2025 in review: AI trends from the buy side and sell side

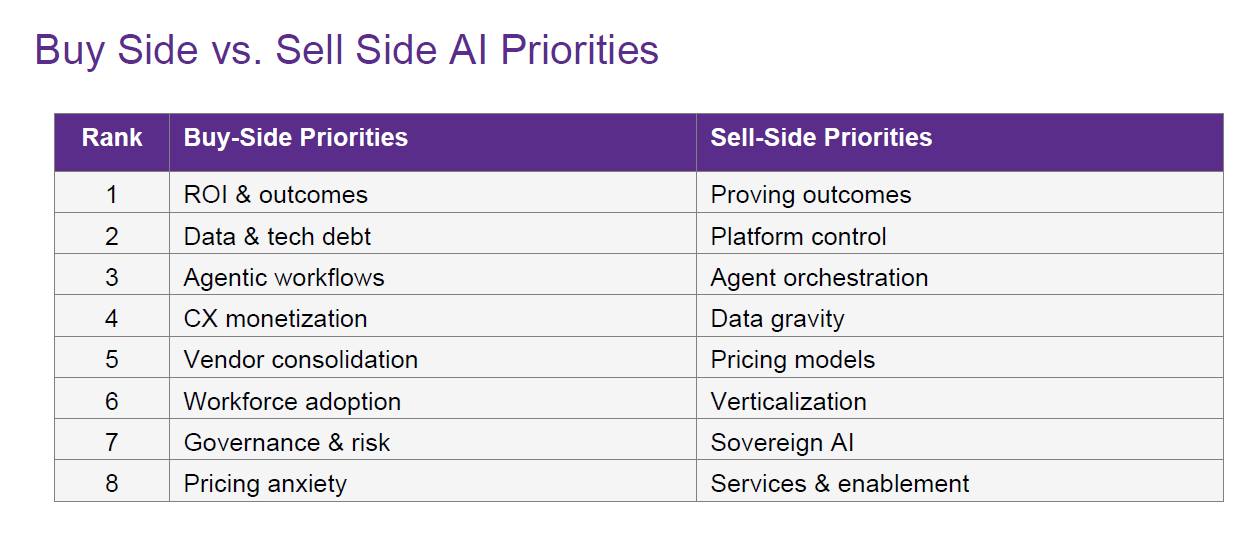

As CxOs zoom out on 2025, it's clear that the year was characterized by AI building blocks and the need for real returns. Agentic AI platforms aren't quite mature, but the industry standards and connections are making deployments more realistic.

If you're an enterprise technology buyer the onus is on the vendors for showing value and more than proof of concepts. The game for both the buy side and the sell side revolves around use cases that show returns and can scale across the enterprise.

For vendors, the appeal of this use-case-by-use-case motion is selling a platform that can create, manage and orchestrate AI agents. For CxOs, the chase is the autonomous enterprise and efficiency and productivity gains that can fund more AI efforts.

In many respects, 2025 was a tale of two halves. The first half was dominated by economic volatility and skepticism about what vendors were pitching.

In the second half, the vendor platforms matured and proofs of concepts began to move to production. There also seems to be consensus that AI, automation and process are comingled.

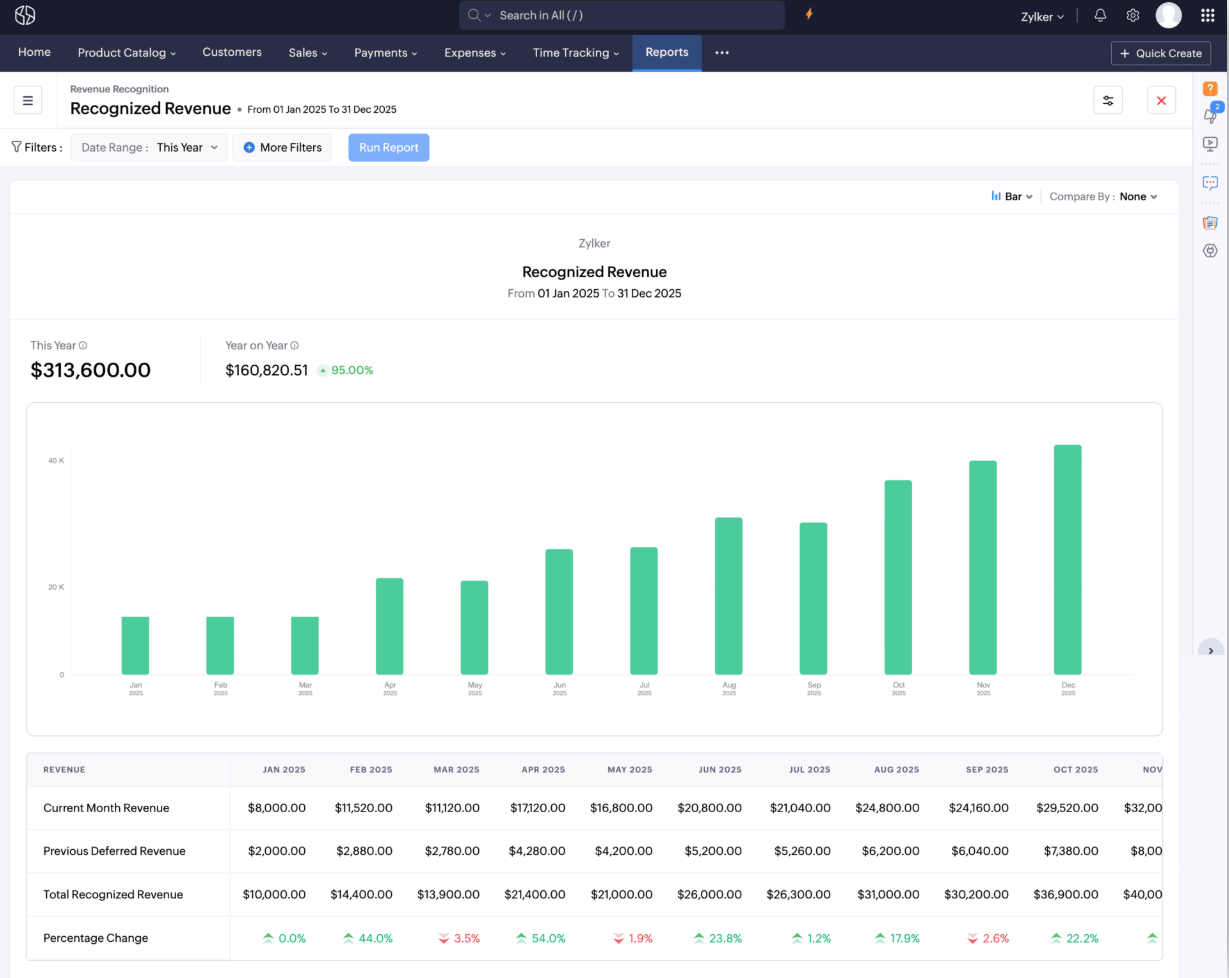

For the 2025 analysis, I homed in on all the Constellation Insights articles posted throughout the year and analyzed the broad themes in enterprise technology, the buy side and the sell-side vendors.

Common themes in 2025

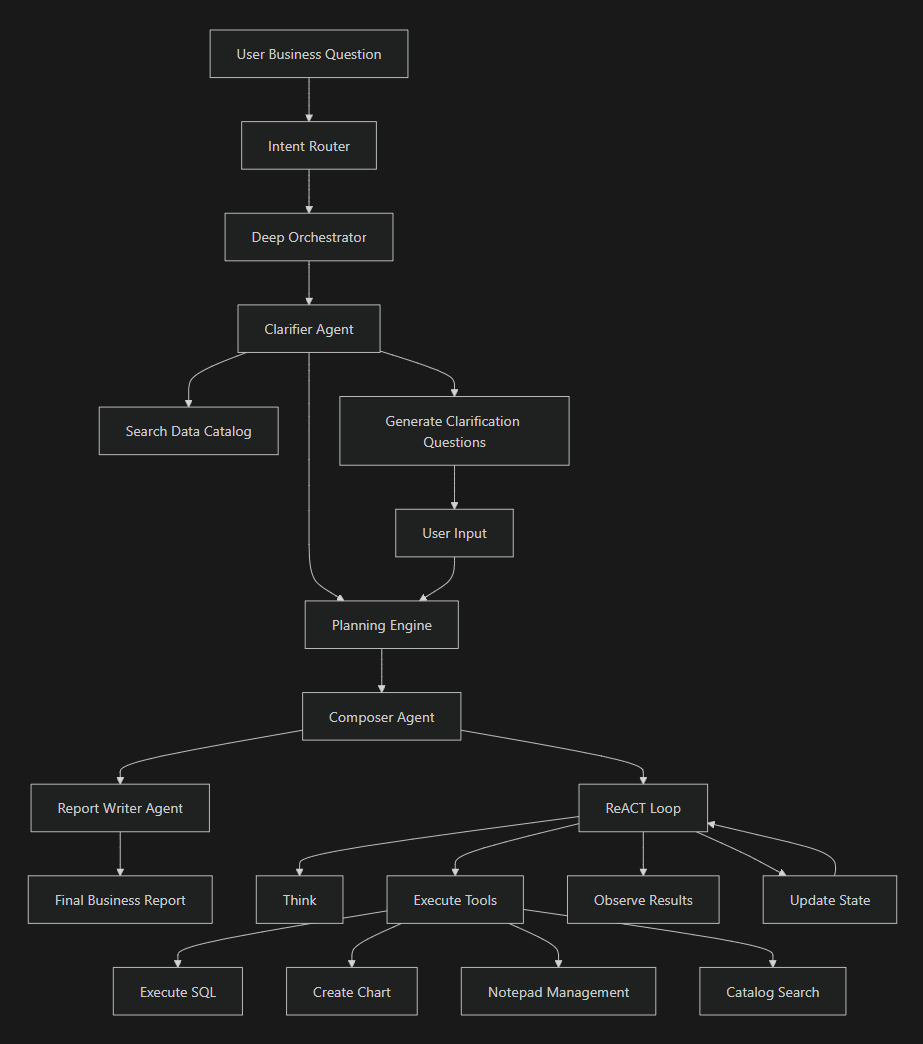

Agentic AI grew up, but still isn't what any reasonable executive would call mature. Agentic AI is a heavy lift that includes forward-deployed engineers, an enterprise data strategy that works, services and use case refinement. Simply put, it's easy to build an AI agent. Scaling them with guardrails and building enough trust to let these models run your company is another matter entirely.

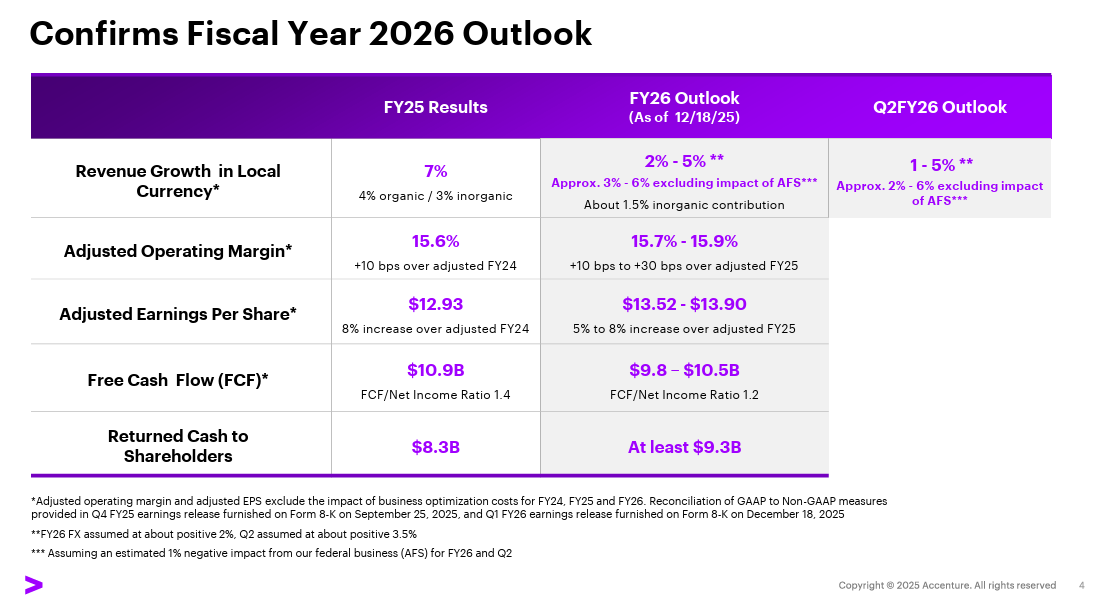

AI economics in flux. Salesforce's recent move to offer an agentic enterprise license agreement is notable because it gives enterprises predictability. The consumption approach from SaaS didn't work out for many buyers. Vendors want to monetize the value they're creating, but enterprises are tired of bills continuing to rise. A consensus emerged that there will be multiple models that are combined to optimize for price performance. Hyperscalers are working custom silicon to commoditize compute and models will be rightsized for the task at hand.

Everything is a platform. SaaS providers are branching out beyond their core markets to become broader AI agent platforms. There isn't a vendor that doesn't have a horse in the AI agent platform race.

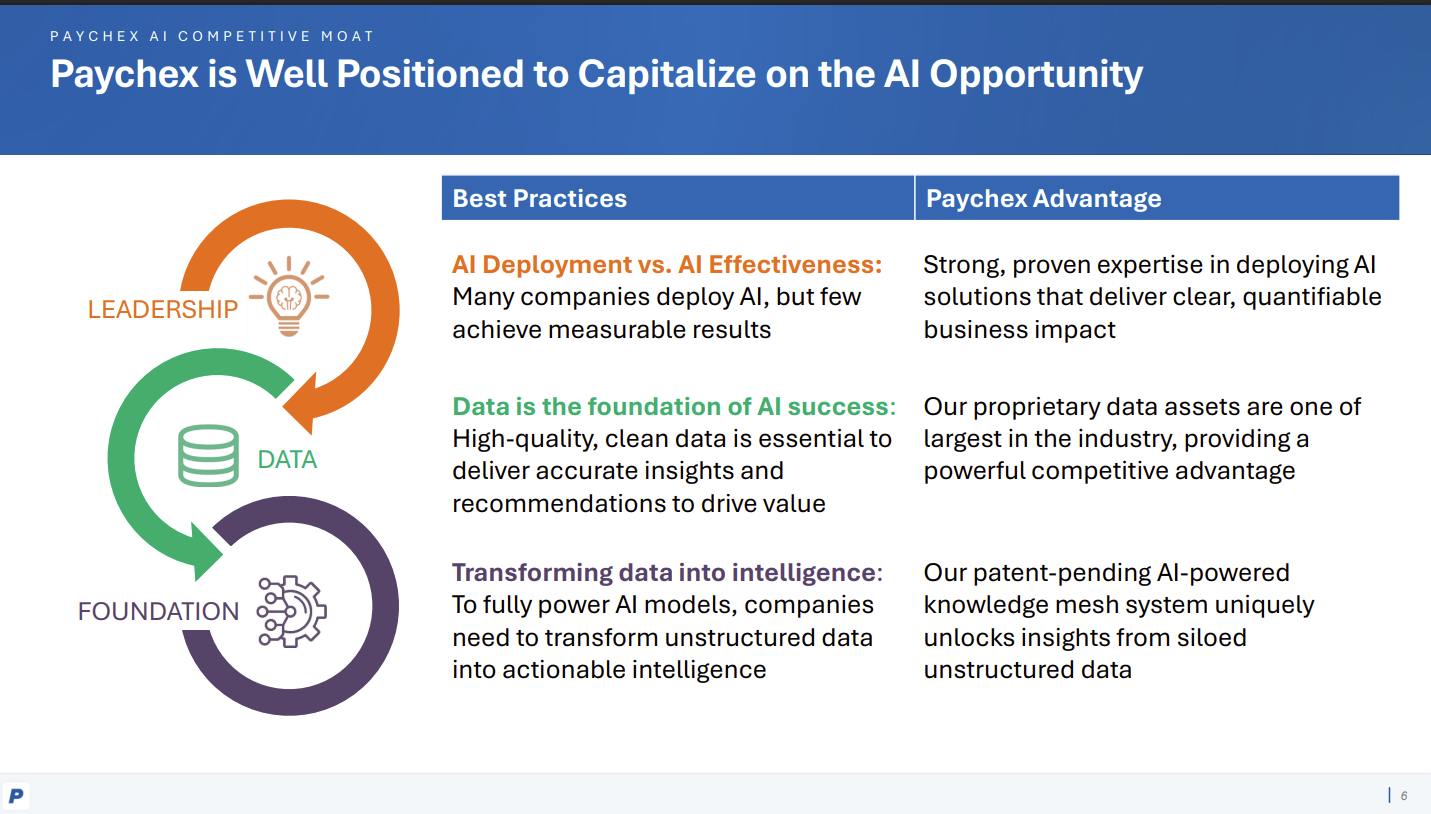

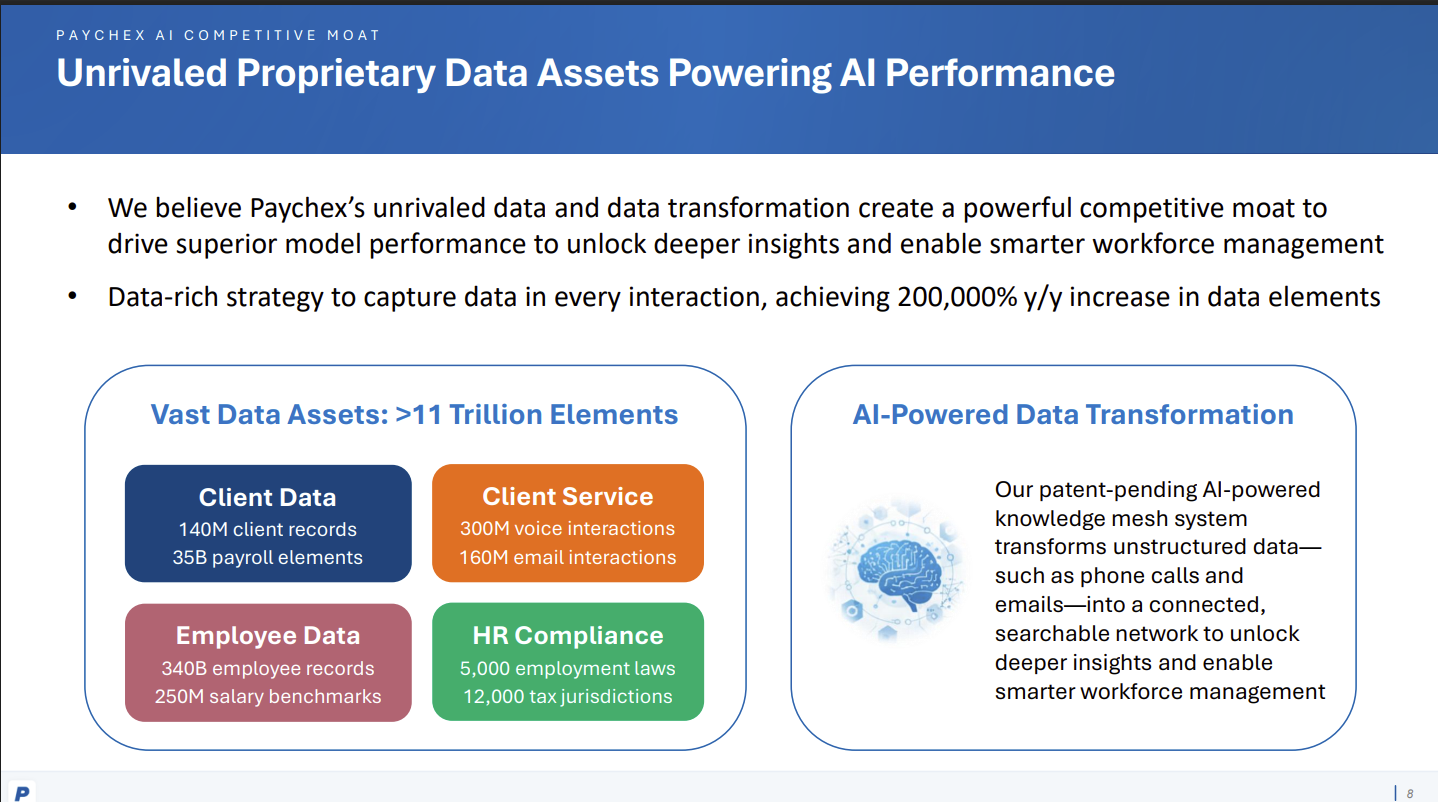

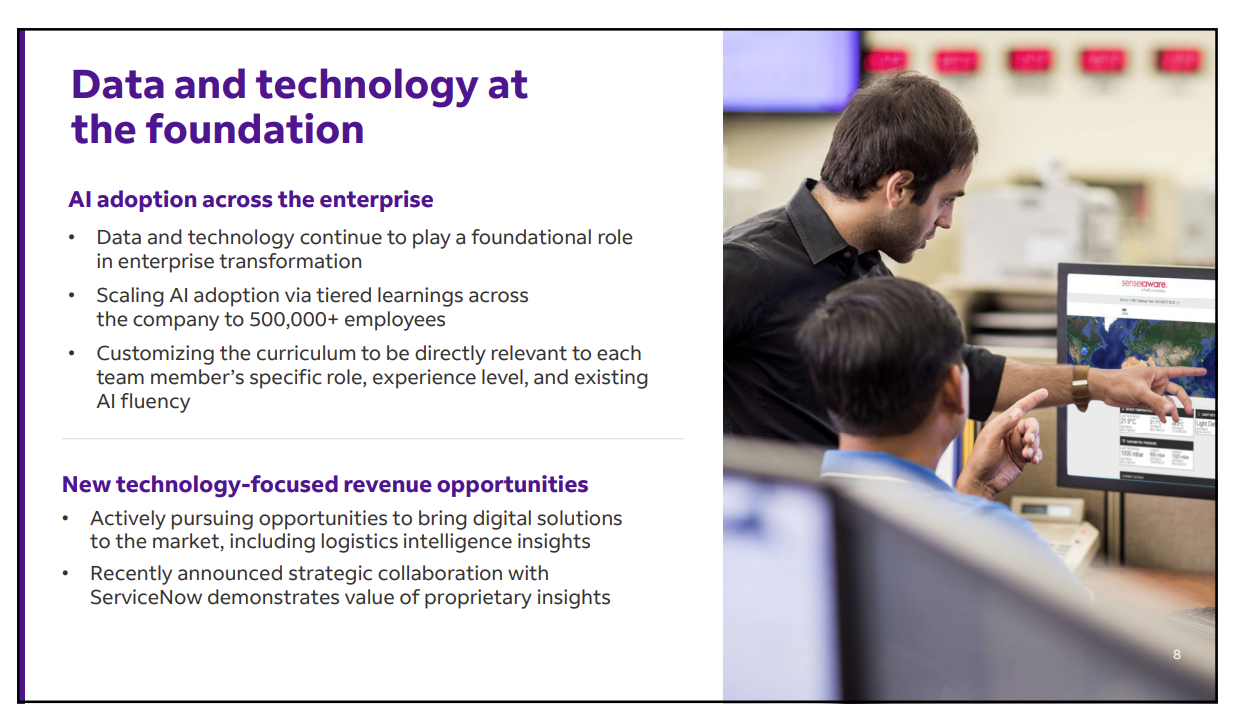

The real wins will revolve around industry-specific use cases and first-party data. Enterprises are beginning to leverage their unique data to train models and optimize use case by use case and industry by industry. Context is everything. Again, it's easier said than done.

The buy side

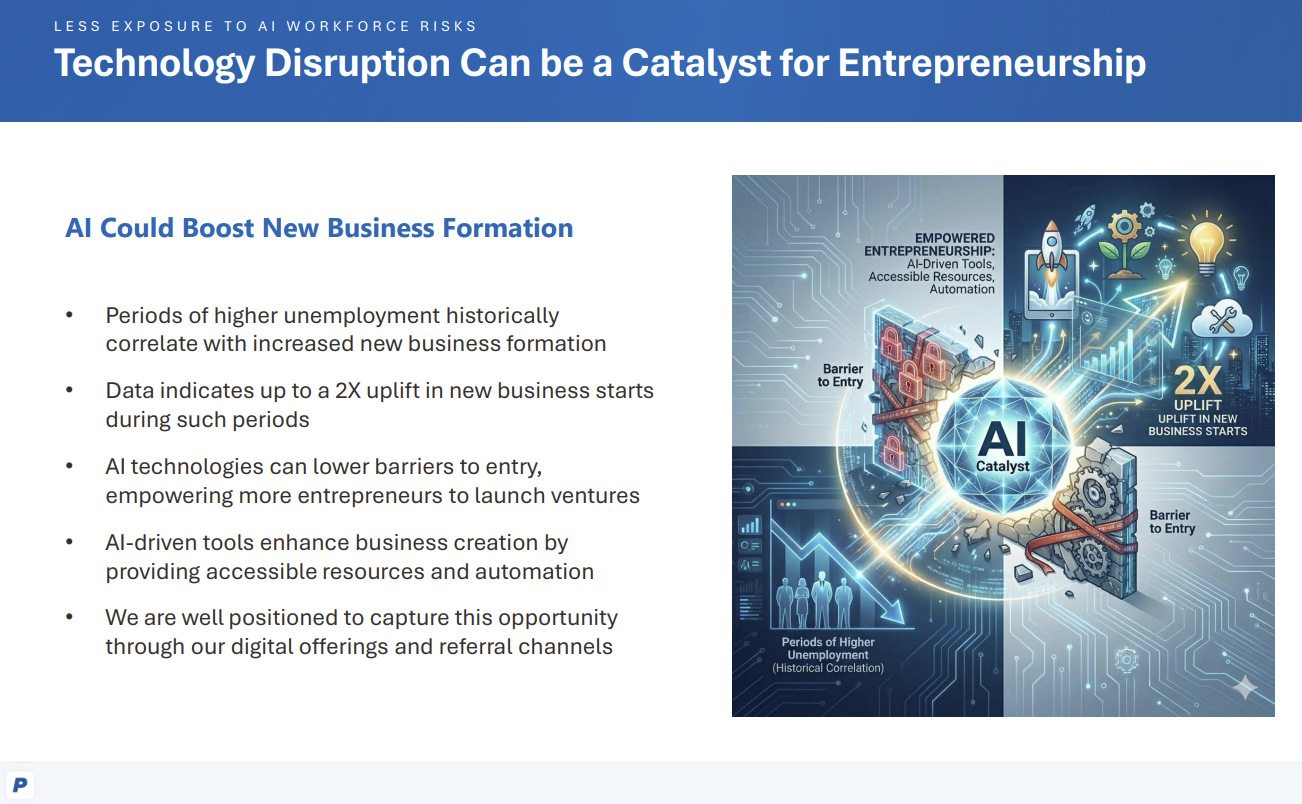

AI is an excuse to change operating models. Enterprises are beginning to use the agentic AI push as a way to optimize operations across all processes and use cases. These efforts would take longer under yesterday's transformation projects, but AI is giving smart companies air cover to accelerate plans.

- Costco approaching AI in ‘very Costco way’

- Rivian’s AI strategy: Four takeaways

- CVS Health outlines AI-driven ‘engagement as a service’ plan

- Warby Parker's third act revolves around AI

- JPMorgan Chase’s IT, AI bets: Where the returns are

Models are a commodity. Enterprises are no longer wowed by the latest and greatest models. China's DeepSeek and Qwen from Alibaba changed that proprietary model thinking in early 2025. Now enterprises are just as likely to use Nova models from AWS or open source as they are the big three models. That said models are a key ingredient of buying decisions of broader platforms.

- Target cuts deal with OpenAI as it plans customer experience overhaul

- Google Cloud, KPMG outline lessons learned from Gemini Enterprise deployments

- Virgin Voyages: Lessons learned from scaling Google Gemini Enterprise AI agents

- A look at the intersection of AI and customer experience

Multi-cloud, multi-model, multi-everything. Enterprises have always been wary of lock-in (and still do it anyway), but AI is advancing so quickly that CxOs want neutrality and options. Interoperability is a requirement and AWS, Google Cloud and Microsoft Azure are beginning to connect. AI sprawl isn't a concern yet, but will be soon.

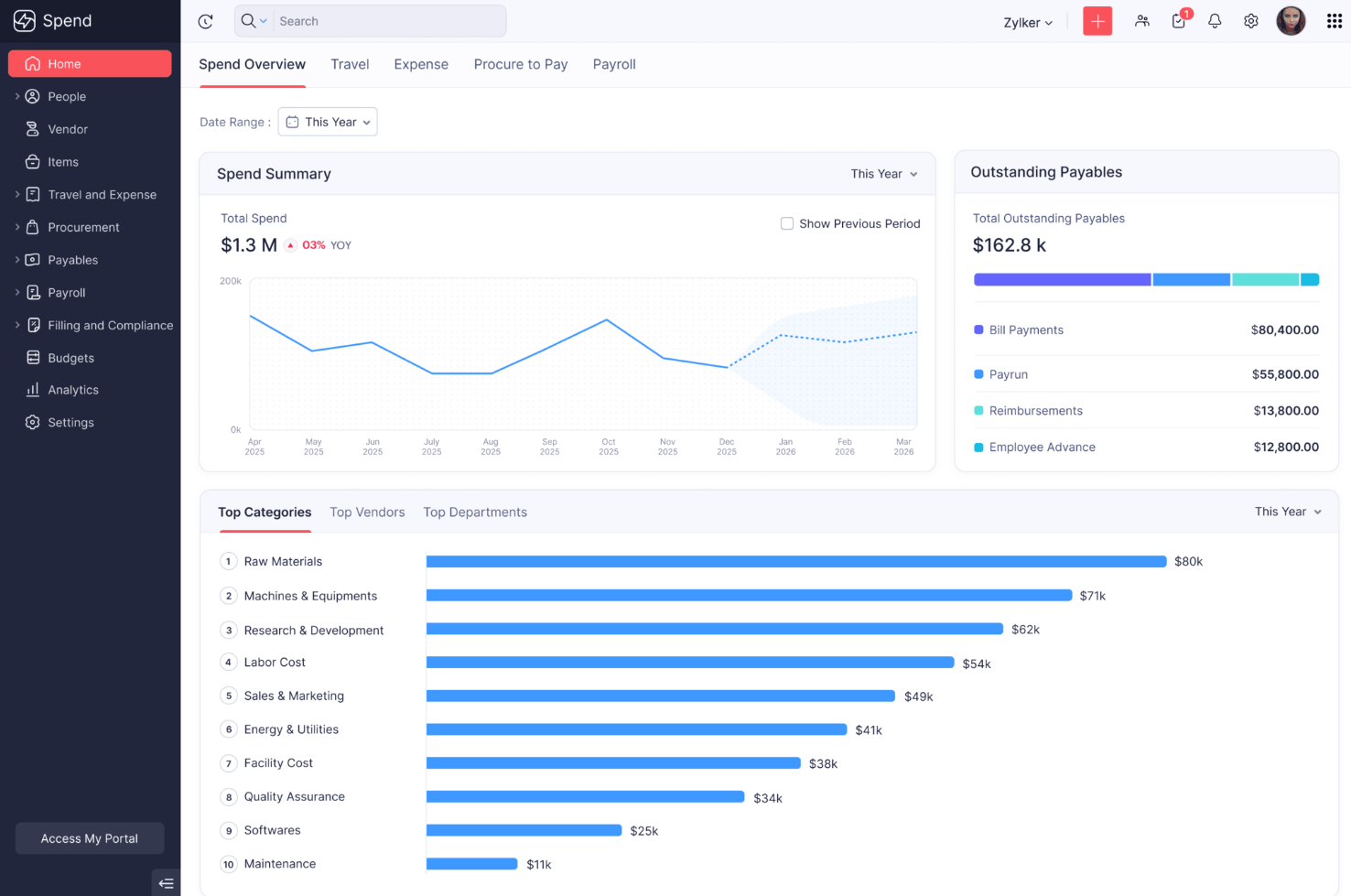

Technology strategy and business strategy merge. Spend on infrastructure, applications, models and ecosystems are driven by margins, agility and resilience of all types. Enterprises will look to AI as a way to abstract away technical debt.

- TD SYNNEX CIO Kristie Grinnell on adopting AI, tech debt and change management

- Google Public Sector Summit 2025: Takeaways on data, AI, ROI from 7 technology leaders

- How Wayfair's replatforming sets it up for agentic AI commerce

- Airbnb: A look at its AI strategy

- Citigroup AI agent pilot underway for 5,000 workers

- Goldman Sachs eyes next AI transformation from position of strength

- Delta starting to scale its AI-driven dynamic pricing system

Value over vision. Enterprises are shrinking budget cycles and demanding measurable impact. Enterprises care about efficiency, productivity, customer experiences and revenue gains. Vanity pilots are kaput. Practical AI is in.

- CCE 2025: AI agents: Dreams, reality and what's next

- CCE 2025: What the CxOs are saying about CX, AI, process

- For AI agents to work, focus on business outcomes, ROI not technology

- AI Forum Washington, DC 2025: Everything we learned

It's still all about data. The enterprises that have a coherent data strategy, data quality and modern pipelines and platforms can win in the AI age. Too few enterprises have their data game down.

The sell side

Every vendor wants to be your sole platform. A tenured CxO would chuckle at these AI vendor developments. Why? Vendors have always wanted to consolidate all of your spending with them. Picking a vendor that can be your one go-to agentic AI platform isn't easy.

The value sales pitch. Vendors increasingly talked enterprise value, use cases and process optimization. They're certainly talking a good game. By mid-2025, this value-based sales pitch became the norm. Enterprise vendors and even OpenAI and Anthropic are all using the industry and use case playbook with partners or via direct sales.

LLM giants build ecosystems. OpenAI and Anthropic, not to mention Google's Gemini, are building ecosystems and applications that can leverage their models. What's unclear is whether these LLM giants can be the overarching interface that relegates enterprise software to plumbing. Also keep an eye on Databricks and Snowflake, which could leverage their data platforms to be the overarching enterprise layers.

- The enterprise LLM questions you should be asking

- LLM giants need to build apps, ecosystems to go with the models

Orchestration is the big thing. Vendors are pitching themselves as your go-to AI orchestration layer. For a vendor, agent orchestration will drive stickiness and revenue and lock-in. It's also possible that orchestration and data gravity will go together and drive vendor revenue.

Hyperscalers gain clout. Aside from ServiceNow, hyperscalers and integrators are the most natural fit to be that overarching AI platform, abstraction and orchestration layer. The big three cloud players are horizontal, touch every part of the enterprise and have pricing models that naturally go together with AI agents. Add it up and AWS, Microsoft Azure and Google Cloud all gained clout in 2025.

The year in Insights

- Rimini Street’s second act will include heavy dose of agentic AI, UX

- AWS re:Invent 2025: This one was different

- The enterprise LLM questions you should be asking

- Frontline workers get their AI moment

- A look at the intersection of AI and customer experience

- AGI may be far away, but 'jagged AI' will still take jobs

- CCE 2025: AI agents: Dreams, reality and what's next

- OpenAI, Anthropic increasingly diverge as strategies evolve

- Welcome to the context chorus: There’s no AI without context

- Big bank CEOs, CFOs riff on state of AI exuberance

- Neptune Insurance highlights AI exponential, data, build vs. buy trends

- AI Forum Washington, DC 2025: Everything we learned

- Enterprise AI: It's all about the proprietary data

- The big AI, SaaS, transformation themes to watch in 2025’s home stretch

- AI agents, automation, process mining starting to converge

- LLM giants need to build apps, ecosystems to go with the models

- Pondering the future of enterprise software

- Secure browsers will matter more with AI agents

- Watercooler debate: Are we in an AI bubble?

- LLMs on sale: What happens when OpenAI, Anthropic offer Feds value meal pricing?

- Watercooler debate: Is it the data or the infrastructure?

- The road to AI Exponential will be bumpy

- Enterprise technology customers look to AI, efficiency to combat uncertainty

- The rise of good enough LLMs

- The disconnect between tech euphoria, CFOs is jarring

- What we learned from enterprise tech buyers in first half of 2025

- AWS re:Inforce 2025: GenAI, AI agents and common sense security

- A tour of enterprise tech inflection points

- RPA and those older technologies aren’t dead yet

- JPMorgan Chase’s IT, AI bets: Where the returns are

- Agentic AI: Is it really just about UX disruption for now?

- AI infrastructure matures, GPU supply and demand may even out

- Lessons from early AI agent efforts so far

- Every vendor wants to be your AI agent orchestrator: Here's how you pick

- Resilience is the key enterprise theme and it favors the large

- Agentic AI: Everything that’s still missing to scale

- Financial services firms: The only certainty is investing in AI transformation

- AI strategies and projects: The hope, the fear and everything in between

- After volatile first quarter, these 10 questions loom over enterprise technology, CxOs

- Humanoid robots near inflection point courtesy of AI

- The data wars are just starting and agentic AI may be a trigger

- AI? Whatever. It's all about the first party data

- Enterprise AI: Here are the trends to know right now

- The year of quantum computing (already)

- Will CX suffer from an overreliance on AI?

- Hershey finishes SAP S/4HANA implementation: Is it sweet or suite?

- AI agents bring consumption models to SaaS: Goldilocks or headache?

- DeepSeek's real legacy: Shifting the AI conversation to returns, value, edge

- Here’s what technology buyers say about AI, technology, transformation

- GenAI prices to tank: Here’s why

- Delta Air Lines completes cloud migration, eyes data, AI-driven customer experiences

- Physical AI, world foundation models will move to forefront

- 2025 in preview: 10 themes in enterprise technology to watch