JPMorgan Chase’s IT, AI bets: Where the returns are

For JPMorgan Chase, the investment in technology and AI will never reach the finish line. Think of transformation as an ongoing project.

JPMorgan Chase has 84 million US customers and $4 trillion in assets under management. The company's approach to data, modernization and artificial intelligence has been worth watching due to the bank's scale, investment in technology and approach to AI.

Recent history:

- Financial services firms: The only certainty is investing in AI transformation

- Enterprises leading with AI plan next genAI, agentic AI phases

- JPMorgan Chase CEO Dimon: AI projects pay for themselves, private cloud buildout critical

- JPMorgan Chase: Why we're the biggest tech spender in banking

- JPMorgan Chase: Digital transformation, AI and data strategy sets up generative AI (PDF)

Jamie Dimon, CEO of JPMorgan Chase, said during the bank’s Investor Day that the transformation work is never finished--and neither is the spending on technology. "It's table stakes. It will be for the rest of eternity. So our tech spend, I think, is, call it, 10% of revenues which is less than most other companies by the way," said Dimon. "In my experience, I think people make a mistake like somehow you're in one transformation and when you get through it, you're done. I've been doing this for a while and I've been through transformation after transformation after transformation, and we're learning. The hardest part is getting data into the form where it can be used properly and where these things belong."

Get the Constellation Insights newsletter

As a result, JPMorgan Chase is spreading its tech bets. "We're building our own cloud-based data centers. We have our virtual servers. We are using all these other folks. We're going to be quite cautious on software-as-a-service, how we deal with cloud providers. I don't mind doing anything ourselves," said Dimon. "I think the mindset should be that whenever management teams meet, you're talking about what you need to do in technology writ large to do a good job for your client. We talk about AI all the time at every different level."

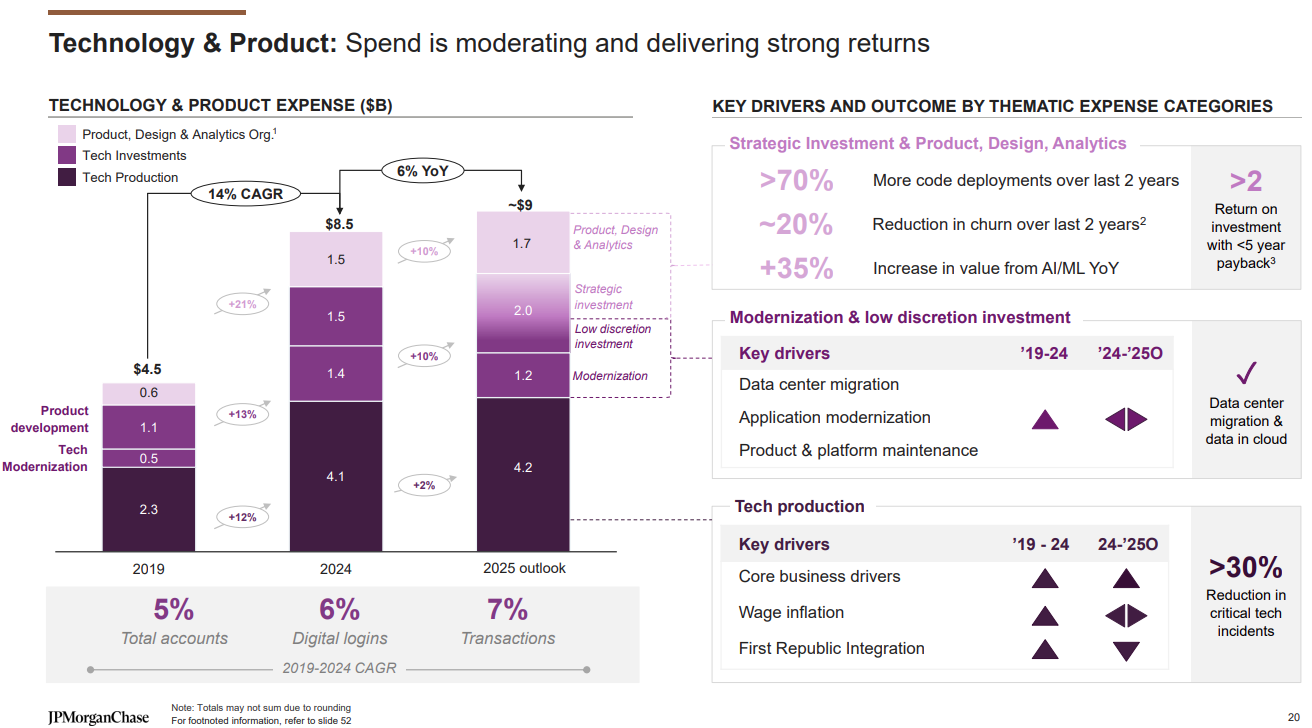

CFO Jeremy Barnum said JPMorgan Chase will spend $18 billion on technology in 2025, up $1 billion from 2024. Barnum did say that the company's modernization investment has peaked.

"We are now probably past the point of peak modernization spend, resulting in a tailwind this year that is funding some of our ongoing investments in products, platforms and futures. And we do continue to see volume growth across the company drive some increased hardware and infrastructure expense. This in turn is partially offset by efficiencies," he said. "The majority is spent on products, platforms and features."

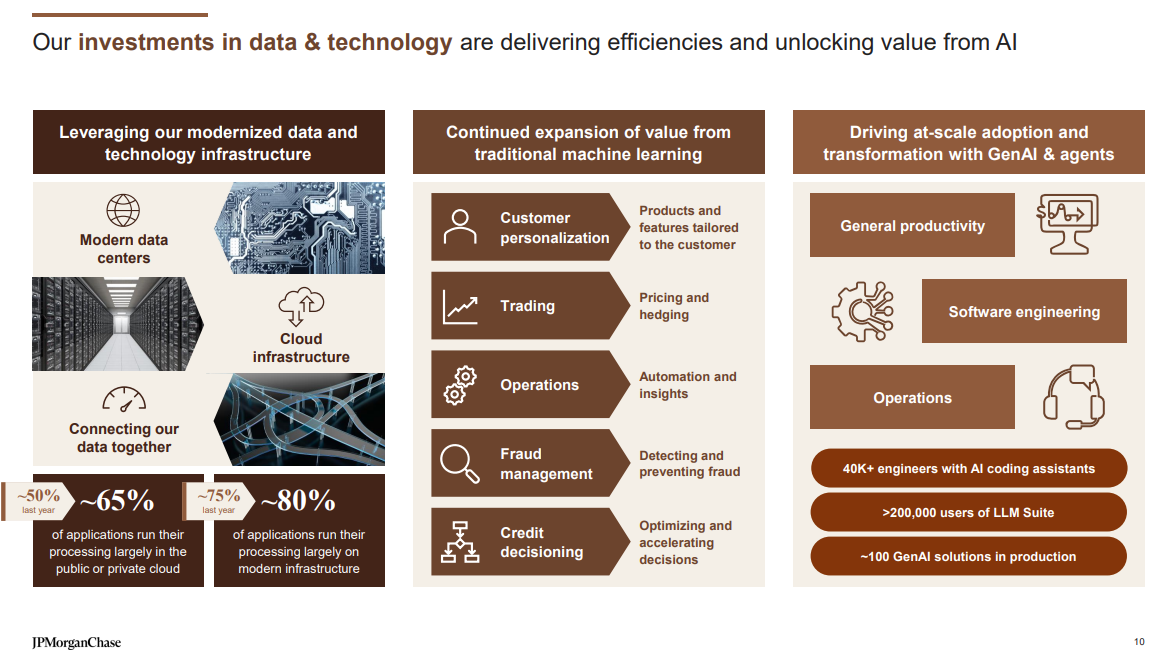

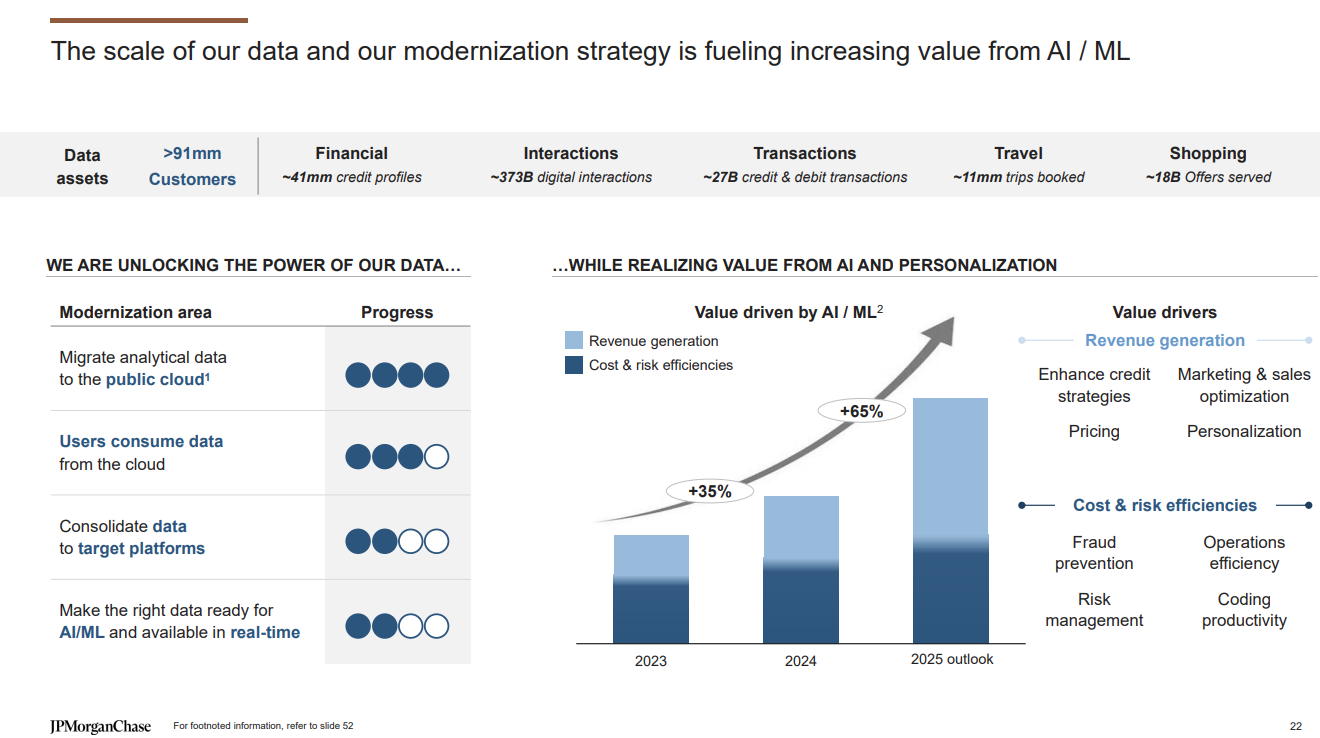

Barnum said this move from retiring technical debt by moving to the cloud and modern infrastructure sets up its AI strategy. JPMorgan Chase has about 65% of its workloads on the public or private cloud, up from 50% a year ago. "If we include the applications that run largely on virtual servers, that number increases to 80%. In addition, we have almost completed the application migrations for our largest legacy data centers and we are in the process of dismantling the physical infrastructure in those sites," said Barnum. "This progress in our modernization efforts continues to deliver significant engineering efficiencies, which we see through ongoing improvement in our speed and agility metrics, but we can't afford to fall behind."

Specifically, JPMorgan can't fall behind in AI and cloud is making it easier to deliver features faster. Here's a look at where JPMorgan Chase is getting the most bang for its AI dollar.

AI coding assistance by software engineers. Barnum said the accelerated adoption of AI coding is promising. "On a personal note here, I'll say that I've recently been indulging in what I've come to learn is known as “vibe coding,†a little bit, and it's actually pretty amazing," he said. "And from what certain of my colleagues tell me who are actually trained, professional computer scientists, it actually helps them quite a bit, too, with their efficiency. It's not just the amateurs who are helped by these tools. It's amazing stuff and we have high hopes for the efficiency gains we might get."

AI for operational efficiencies. Barnum said that a big AI use case is in the call center where algorithms can help agents anticipate and respond to questions faster.

Democratized efficiency. JPMorgan Chase has a generative AI platform that's model agnostic called LLM Suite. More than 200,000 employees globally have access and are gaining several hours per week doing less valuable tasks. "We are starting to see a number of “citizen developer†use cases go into production. While we've made substantial progress over the last decade, we are still in the early stages of our AI journey. We are focused on modernizing data, investing in scalable platforms and being at the forefront of innovation as technology evolves, positioning the company for sustained future success," said Barnum.

Digital engagement. Marianne Lake, CEO of Consumer & Community Banking at JPMorgan Chase, said the unit has been investing in tech, data, and AI to drive customer experience and productivity. "We estimate spend of about $9 billion on tech, product and design this year, moderating to a 6% growth rate year-on-year. $7.4 billion of this is in tech, about 10% of revenue," she said.

Lake added that JPMorgan Chase is also deploying AI to boost card servicing. The company has boosted its product velocity with AI. "We have increased code deployments by more than 70% over the last two years and improved the quality of product delivery over the same period with a 20% reduction in work being replanned. Our investments this year have more than two times return on investment and continue to pay back within five years, and our investments in AI/ML delivered a 35% increase in value last year," said Lake.

Here's a look at Consumer & Community Banking's tech spending plans.

Umar Farooq, Co-Head of J.P. Morgan Global Payments, said: "We are laser focused on providing the absolute best digital experience to every single client segment," he said. "We are really focused on building digital experiences that are targeted to specific segments like technology startups."

Process automation. Lake said improvement in operations have kept expenses flat in her unit over the last five years. Accounts per serviced ops headcount are up 25% due to improving self-service options for companies. Servicing calls per account costs are down nearly 30% per account and processing costs are down 15%. "While AI has definitely contributed here, a lot of this is good old-fashioned process automation and organizational efficiency," said Lake.

Fraud detection and deterrence. Lake noted that JPMorgan Chase is seeing a 12% compound annual growth rate in attacks, but the company has held the cost of fraud flat due to AI tools.

Traditional machine learning and AI. JPMorgan's Lake said the bank expects big productivity gains over the next five years, she said it's worth noting that traditional models are a big reason. She said:

"We have a very rich and valuable tapestry of data. And despite the step change in productivity we expect from new AI capabilities over the next five years, we have been delivering significant value even with more traditional models and the value we're delivering is growing exponentially. I point that out for two reasons; one is that, not every opportunity requires Gen AI to deliver it, and we are “all systems go†already; and second, we are well on our way, modernizing our data to make it more efficiently consumable and machine readable."

Data improvements. Lake said that moving to the cloud has improved storage and compute efficiency, but the bank is spending on improving data management. "Our data needs to be in our target platforms. We're about halfway through that journey, and making data truly fit-for-purpose will include a subset that will need to be streamed real-time, and we've made significant progress here, in particular, for servicing and personalization. There's still a way to go, but we are delivering significant value," said Lake.

Here's a look at the data flywheel Lake highlighted.

Doug Petno, Co-CEO of Commercial & Investment Bank at JPMorgan Chase, said the unit has more than 175 AI use cases in production looking to leverage its data to feed models.

Farooq added that his unit is leveraging its data assets. "We have been building and have completed building a cloud-native data infrastructure and are utilizing AI and machine learning models for everything, from prospect qualification to transaction screening and operations," said Farooq. "The operational efficiencies our data platform has allowed us to capture with AI models are truly impressive. In the last few years, our transaction volumes have gone up by more than 50%. At the same time, our AI models have allowed us to cut manual exceptions by more than 50%, delivering significant operating leverage."

Trading. Mary Callahan Erdoes, CEO of Asset & Wealth Management at JPMorgan Chase, said the company has been "fortifying and using AI on our trading desks for the past eight years." She added that JPMorgan Chase trades about $260 billion in volume daily and hit $500 billion in early April. "AI is not just a tool, it's reimagining workflows and it's changing the loading capacities for thousands of people on the frontline and in the back," said Erdoes.

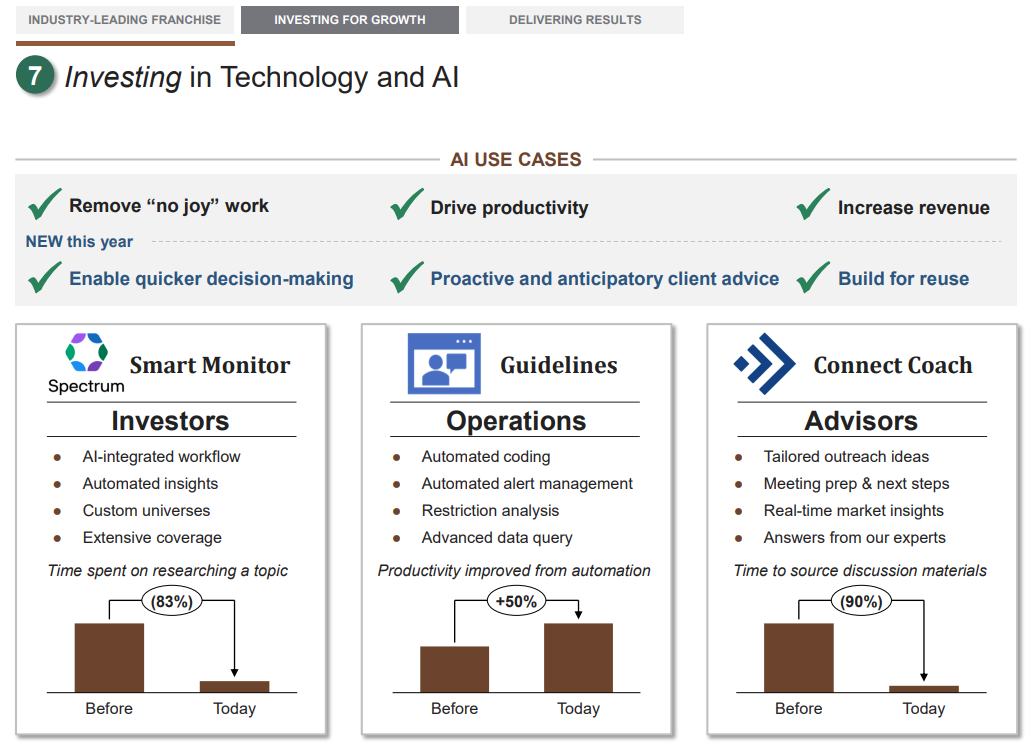

She pointed out Smart Monitor is a tool that uses AI to find stocks, absorbs call reports, stock moves and ratios to highlight trades. Connect Coach is another feature that anticipates next best action for trades.