Neptune Insurance highlights AI exponential, data, build vs. buy trends

Neptune Insurance Holdings has successfully completed its initial public offering with a business model that revolves around applying data science, machine learning and artificial intelligence to provide flood insurance. The company may be well on its way to being an AI exponential.

To the uninitiated, flood insurance is a bit of a disaster in the US. According to FEMA, flooding is the most common and costly natural disaster with damages topping $40 billion annually according to the Congressional Budget Office. Flood maps are outdated, many building owners in flood zones forgo insurance and most policies are provided by the National Flood Insurance Program (NFIP).

In high-risk states such as Florida, Texas and Louisiana residential flood insurance penetration is below 13% combined. The federal insurance typically has high premiums and low coverage limits that fail to address rebuilding costs. NFIP has a cover limit of $250,000 compared to Neptune's $7 million.

Insurers stay away from flood insurance due to the risk and potential costs. Neptune Insurance is betting that it can apply AI to manage risk, provide a good customer experience and insure more homes with more affordable coverage.

In its SEC filing, Neptune Insurance, which has 60 employees, said: "We believe the NFIP’s legacy pricing model, cumbersome processes, and limited coverage have created significant market dislocation and inefficiencies, resulting in a compelling opportunity for private flood insurers like Neptune to capture market share."

Why would Neptune want to play ball in the flood insurance market? AI, machine learning and data science. Neptune may be among the first of the AI-native industry-focused enterprises to go public, but it certainly won't be the last.

- The road to AI Exponential will be bumpy

- AI Exponentials Will Rule the World

- Radically Rethink Old Models To Enable the Power of AI

- Enterprise AI: It's all about the proprietary data

- Get Insights Newsletter

Neptune's AI stack, which runs on the cloud but appears to be mostly custom built (or a very well-kept secret), enables the company to carry out underwriting risk selection and pricing, aggregation and carrier assignment in less than two seconds via its Triton underwriting engine. Neptune has no human underwriters.

The Triton underwriting engine has a lifetime written loss ratio of 24.7% from 2016 inception through June 30. From 2018 to 2024, NFIP has a written loss ratio of 86% according to FEMA. The broader property and casualty industry has a written loss ratio of 54%, according to NAIC data.

Key points about Neptune's underwriting approach:

- The company leverages its own claims data as well as industry wide signals. "With over a quarter billion dollars in paid claims across our portfolio since inception, and our extensive analysis of industry claims and performance data, we have developed deep insights into identifying and managing properties with the highest probability of flood losses," said the company.

- Neptune has proprietary models focused on the characteristics and factors leading to large-scale losses. Neptune has a unit called Neptune Data Science Group that creates the models and predictive analytics that fuel the company.

- Models are continually optimized.

- Pricing models are driven by models that account for flood risk data, customer behavior and market dynamics. The company doesn't use manual adjustments or broad risk groupings to price insurance. "Behavioral economics plays a crucial role in determining how customers perceive and value coverage, and incorporating customer behavioral factors into our methodology enables us to tailor pricing to increase adoption while maintaining underwriting integrity. By understanding not only the risk, but also the behavior of customers, we believe we can optimize premium structures to drive growth and retention," said Neptune in regulatory filings.

- Neptune disaggregates policies across geographic boundaries to manage risks. In addition, Neptune doesn't have balance sheet insurance risk or claims handling responsibility because it uses a network of 26 reinsurance providers.

The data stack

We reached out to Neptune for an interview, but didn't get a reply. It's unclear what cloud Neptune uses and checks with the hyperscalers resulted in no comment.

Mike Dezube, Chief Data Science Officer at Neptune, co-founded Charles River Data, which was a data science consulting firm acquired by Neptune in May 2024. Dezube worked at Google on search, machine learning and healthcare and has focused on AI, GIS data and decision engines.

CTO Brad Schulz has experience in insurance technology platforms, flood insurance and behavioral marketing.

While Neptune's stack appears to be build over buy it does leverage a few key providers focused on geospatial data and automated workflows.

Here’s a quick look at Neptune’s data stack:

- Neptune Triton incorporates KatRisk APIs to overlay flood footprint data into exposure post natural disaster. The modeling tools bolstered Neptune's ability to manage risk.

- Neptune has used Ecopia AI for its building-based geocoding to price based on granular location.

- Neptune used ICEYE, a data provider on flood hazards.

- Customer experience and self-service operations are powered by Ada, which provides a front end to insurance buying. Ada's bots provide answers to customer questions about policy payments, endorsements and documents. Neptune uses an internal customer success team that uses Zendesk and Zoom to handle more complicated queries.

Neptune isn’t likely to turn up into a big enterprise software keynote, but there are lessons to be learned from its data and model as differentiator strategy.

Disruptor-like results

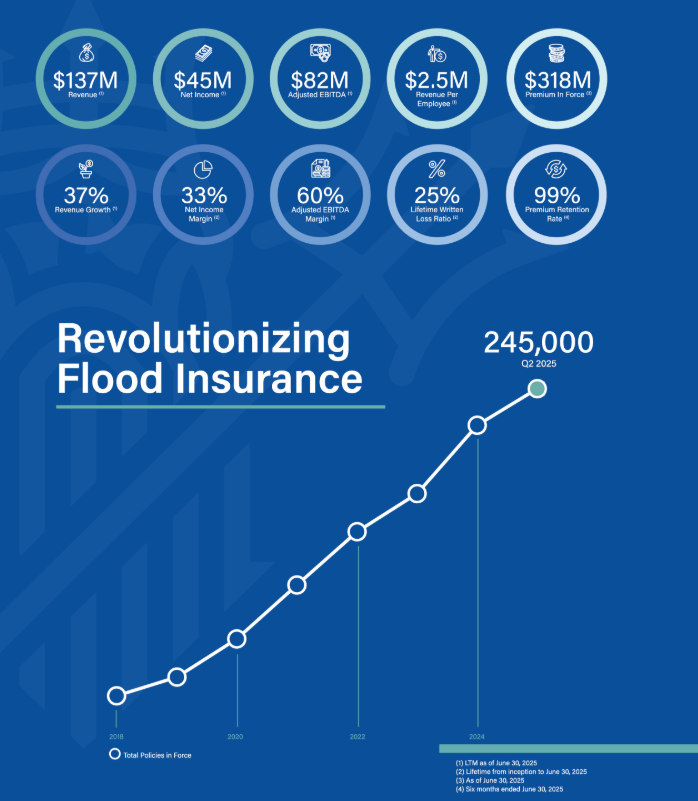

Neptune said it has surpassed 250,000 policies in force, but what stuck out about the company was its results and levels of automation.

The company's net profit per employee checks in at $750,000 and revenue per employee is $2.5 million from inception to date.

For the six months ended June 30, Neptune reported net income of $21.56 million on revenue of $71.42 million, up more than 32% from a year ago. In 2024, Neptune reported net income of $34.6 million on revenue of $119.3 million.

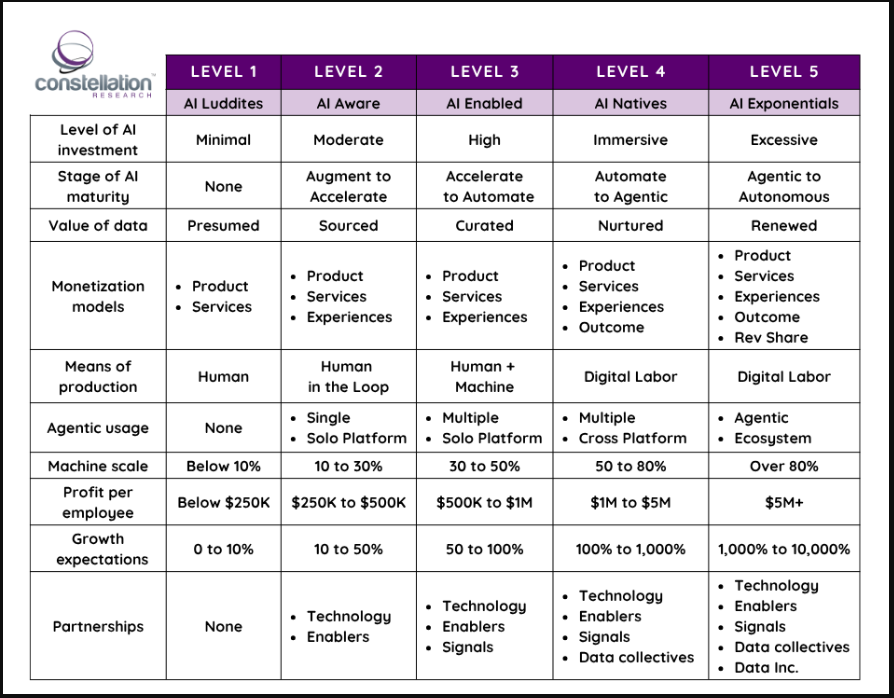

Those figures put Neptune into the AI native camp in Constellation Research's framework.

Now there are risks with Neptune's business. The company has weathered multiple hurricanes already, but natural disasters are always a risk. In addition, Neptune could take a hit from a fading housing market--especially in flood prone areas that boomed during the Covid pandemic.

But so far, Neptune appears to be a disruptor worth watching. The company priced its IPO Sept. 30 at $20 and hit a high of $33.23 Oct. 3 before settling into a range between $25 and $30.