Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

<br>Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…

Read more

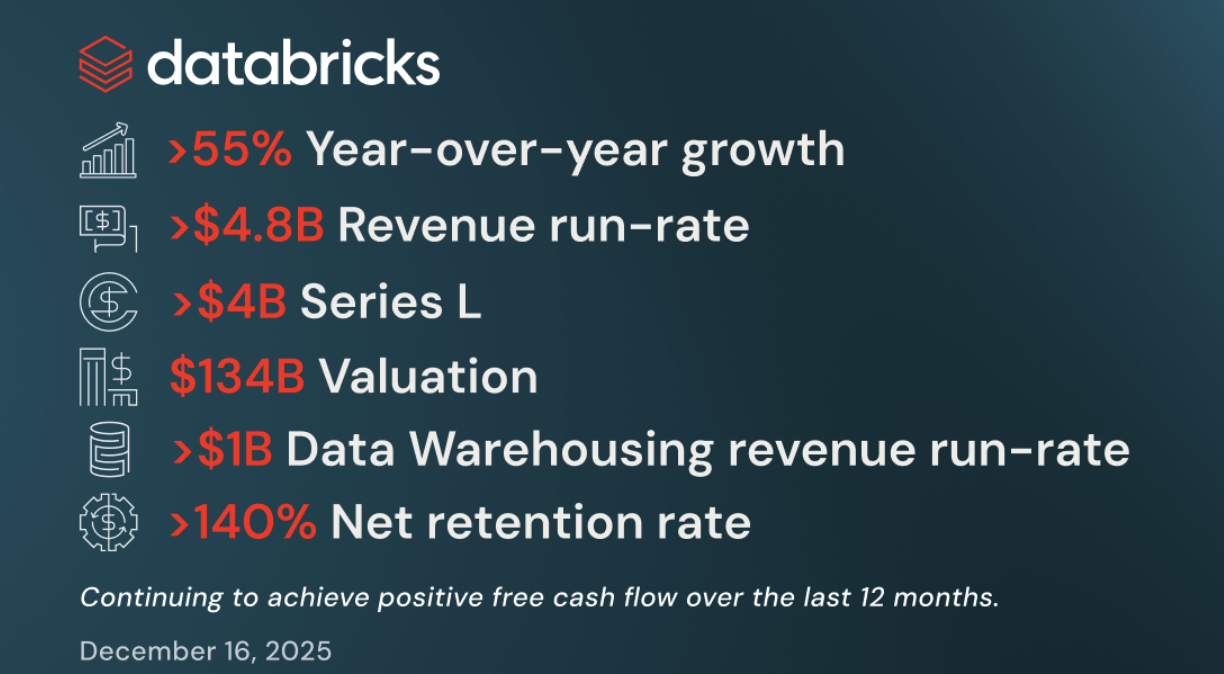

Rimini Street's first act took 20 years, but the second one will move much faster as the company aims to layer agentic AI over legacy enterprise resource planning systems. The strategy: Enable enterprises to accelerate their automation and AI plans while relegating reliable yet legacy systems to plumbing.

At its Dec. 3 Analyst and Investor Day, Rimini Street held what could be called a long overdue roadshow. Rimini Street was founded in 2005 with the mission of providing maintenance and support services to ERP customers of Oracle and SAP. The win for customers: Rimini Street could offer maintenance at a lower cost and enable enterprises to put off ERP upgrades.

As you can imagine, Rimini Street’s value prop didn’t go over well with ERP vendors. Oracle and Rimini Street legal battle started in 2010 and ended July 7 in a settlement. During that 15-year legal battle, Rimini Street went public via a special purpose acquisition company (SPAC) merger in 2017. Yes, Rimini Street SPACed well before it became trendy.

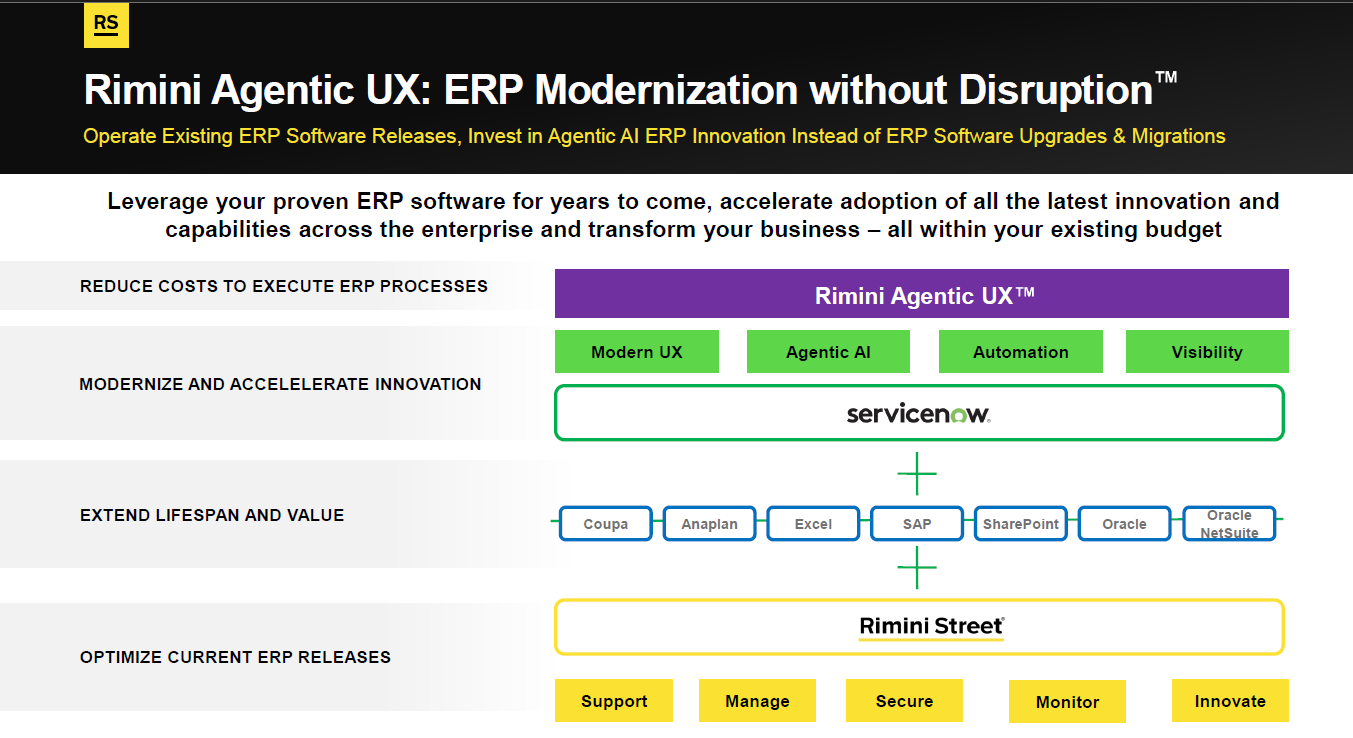

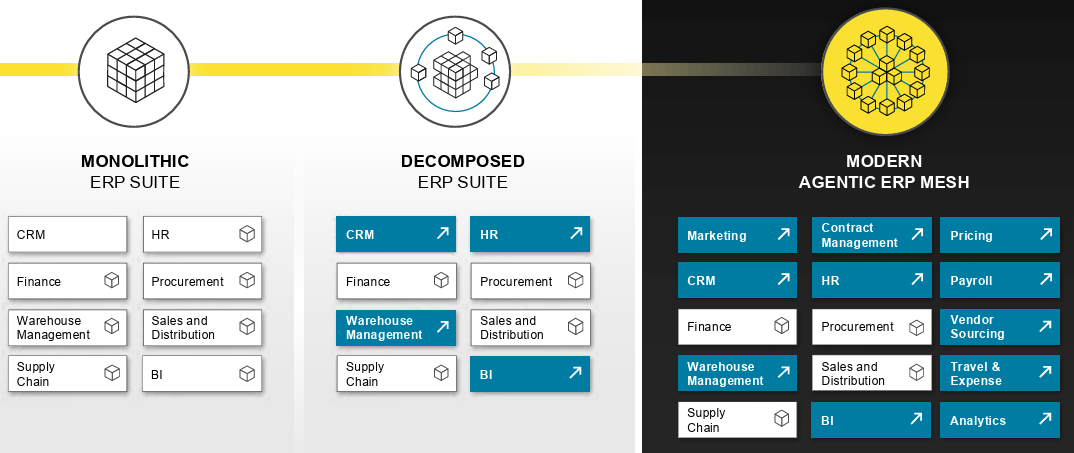

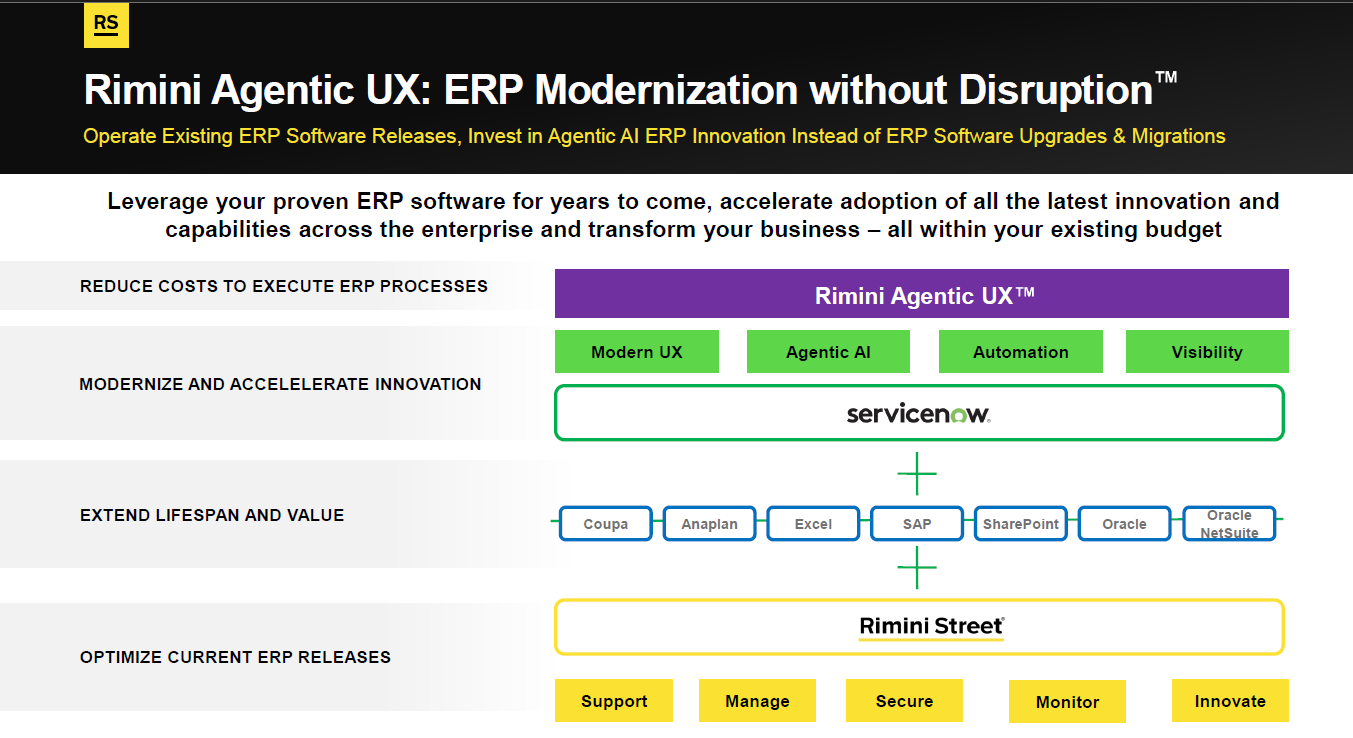

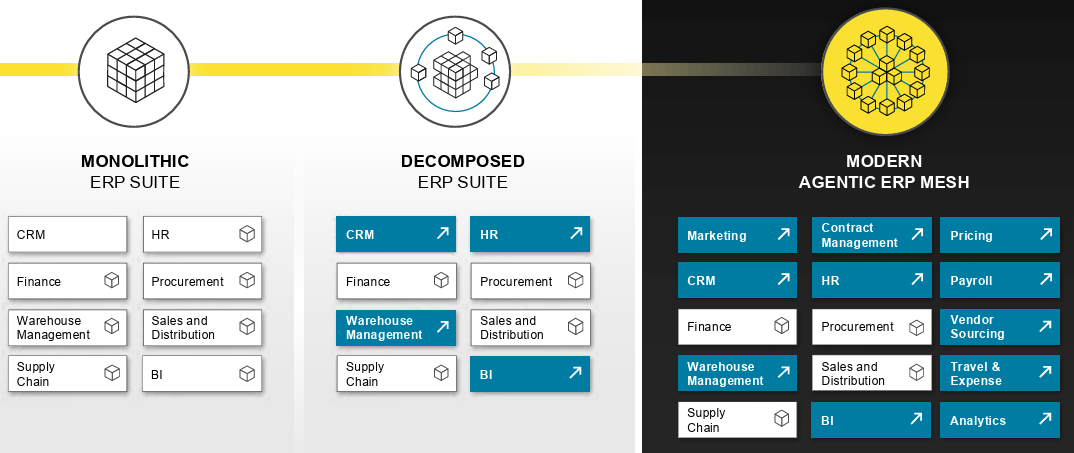

Rimini Street's second act, which will run from 2026 to 2030, includes an AI spin to its traditional ERP services. The company plans to maintain ERP systems, give customers the ability to put off costly upgrades and relegate them to systems of record plumbing. The new UI for these legacy systems will be agentic AI. The company launched Rimini Street Agentic UX, which has been deployed across multiple customers, in a move that aims to abstract away ERP systems by focusing on AI workflows and processes.

In many ways, Rimini Street Agentic UX is the product of a year-old partnership with ServiceNow. Rimini Street and ServiceNow have a broad partnership to use the Now Platform to enable AI agents to run on legacy infrastructure. ServiceNow and Rimini Street formed a partnership in late 2024 designed to move processes forward with AI and now the two companies have 26 joint pilots underway.

Rimini Street CEO Seth Ravin laid out the company's strategy. Rimini Street generates more than $400 million in recurring revenue, serves clients with two-minute response times or less and has a diverse customer base that's more than 50% international.

Ravin's case for Rimini Street revolves around evolving from providing maintenance and support for various enterprise systems to enabling AI. Rimini Street today supports legacy systems such as SAP, Oracle, Dayforce and VMware as well as SaaS applications including Salesforce, Workday, ServiceNow and multiple open-source databases. Going forward, Rimini Street is looking to build on that support and make enterprise AI deliver returns.

"Think of us as AI for the real world. We're the guys who are helping to drive down costs. We're helping to automate processes, streamline businesses and drive #1 problem of every single company we work with, profits," said Ravin.

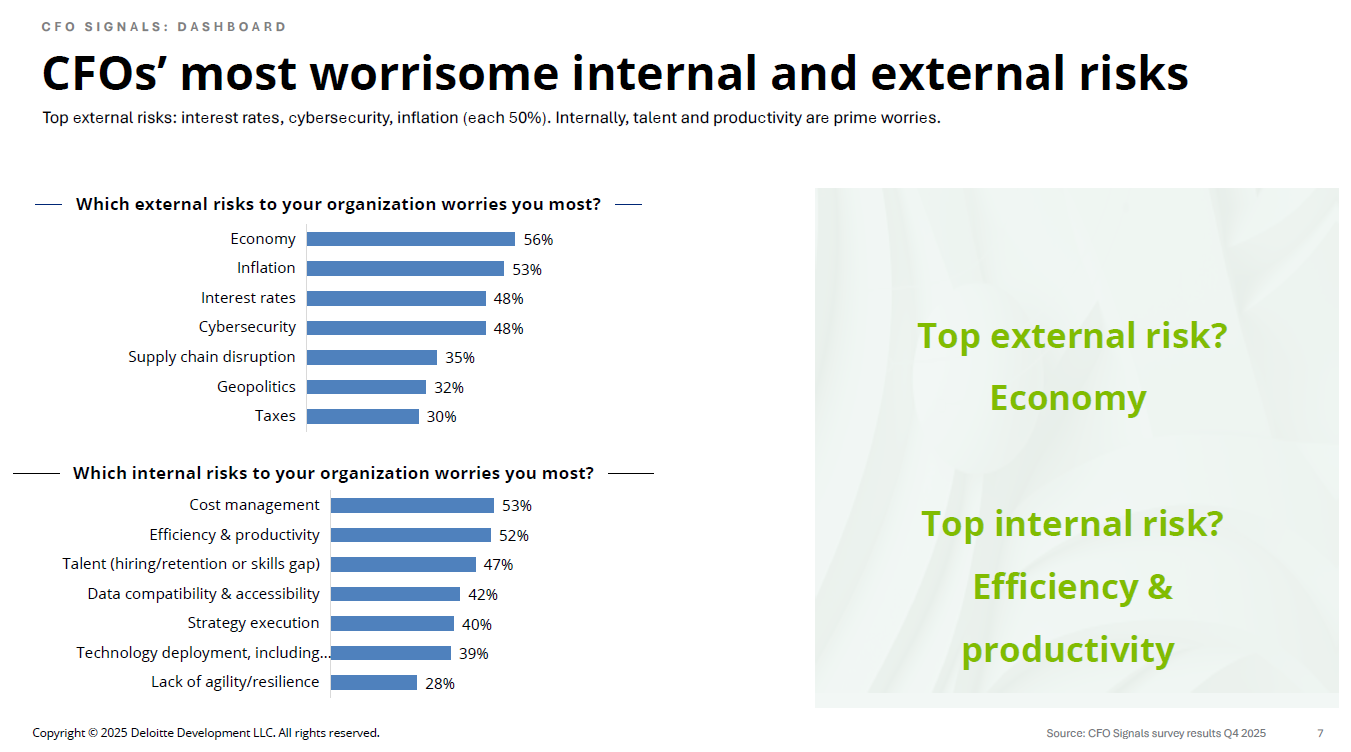

Ravin argued that boards of directors globally are mandating AI and transformation but also cutting budgets. "How do I make ends meet?" asked Ravin. "CIOs wander out of these meetings punch drunk."

The needle CIOs need to thread is innovation vs. cost cutting. Integration of systems is also a big issue. "We have all these great systems now. The problem is they really don't work together. You've probably heard they're all integrated and there's all these integration tools. It's just not the case. In most organizations, these systems are still very separate," said Ravin, who said every vendor wants customers on the latest release and "CIOs literally cannot do it all."

Ravin estimated that about 9% of the average budget is spent on innovation. "This is a formula for disaster in the long term," he said.

ERP at its technical limits

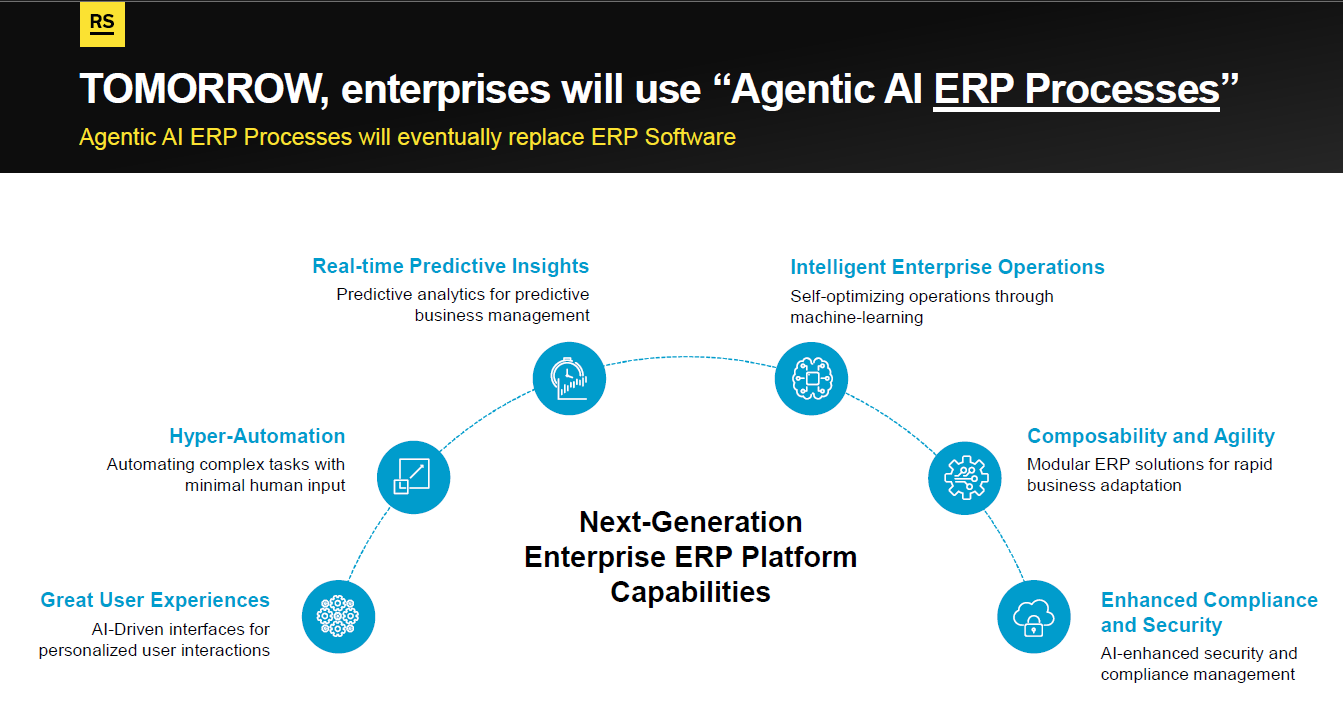

Rimini Street's Ravin said "we believe that ERP software is reaching its technical limitation."

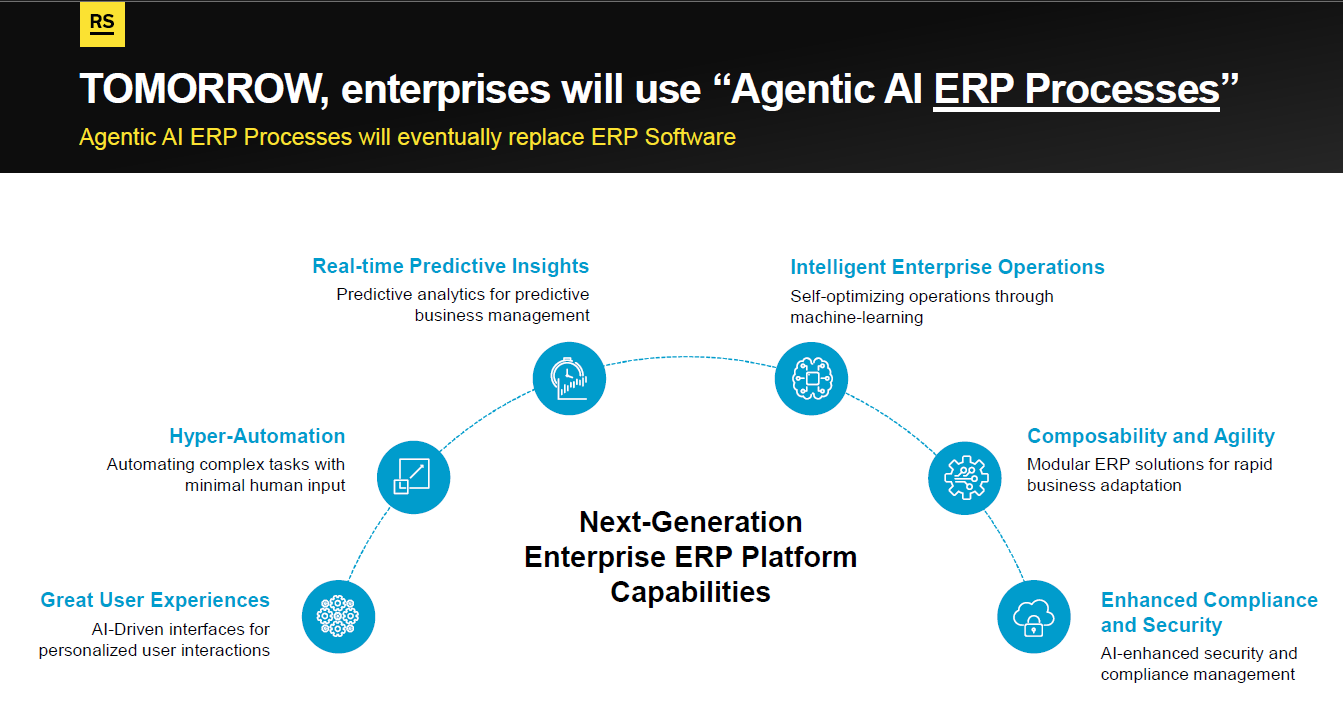

The company will support ERP for years and decades, but a transition to an AI paradigm is coming. "We believe agentic AI is going to be the downfall of the software we see in the world today and it's happening fast," said Ravin.

Rimini Street Agentic UX is designed to be a simplified window into ERP systems.

And Rimini Street certainly has the installed base to prove its Agentic UX approach will work. Rimini Street manages the ERP systems across automaker Hyundai. The company also serves companies such as Catalyst Brands, which has rolled up companies such Aeropostale, JCPenney, Eddie Bauer, Lucky, Nautica and Brooks Brothers, and KnitWell, a private company that owns eight apparel brands including Ann Taylor, LOFT, Talbots and Chicos. Catalyst and KnitWell each have a handful of ERP systems to roll up. Agentic UX could give these companies an exit ramp to ERP consolidation and upgrades.

Todd Treonze, VP Integration and Corporate Systems at Catalyst Brands, said his company launched a year ago with multiple brands on their own ERP systems. Catalyst Brands consolidated support and maintenance and now plans to build on top of them as systems of records. "I think that there's a really big future opportunity for us here, to reinvest some of the savings we're seeing at the support level and put into the innovation side of the business," said Treonze.

It's a similar story for KnitWell.

"An ERP platform is almost the perfect platform to put agentic AI on top of it. It is well structured. The data underneath is also well structured. And it's all around business rules. There is no easier use case to automate with Agentic AI," said Jaap van Riel, CTO of KnitWell "I really hope I never have to upgrade an ERP in my life again. It's not good for my sleep, and it's not good for kind of the P&L either."

Now this phase out of ERP software as the work interface will take time. Ravin said the reality is that transitions in the enterprise must be orderly and there are processes to consider.

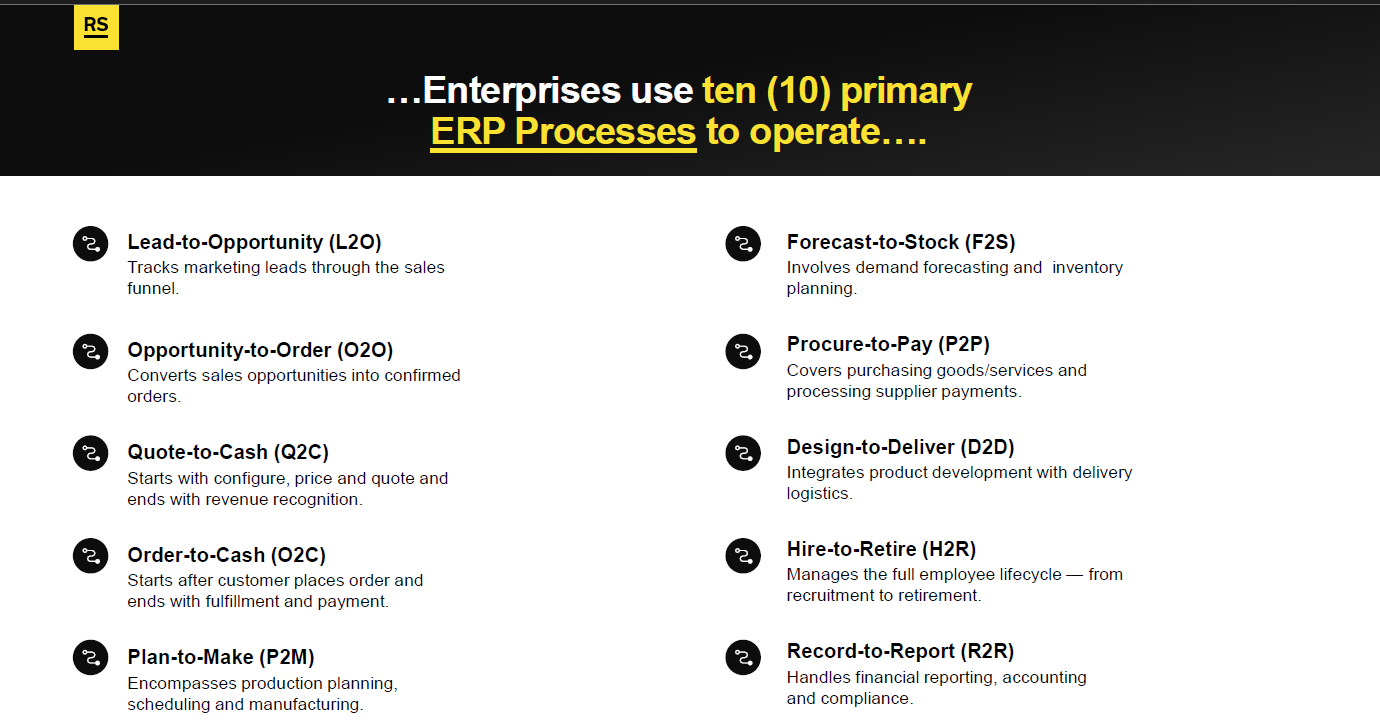

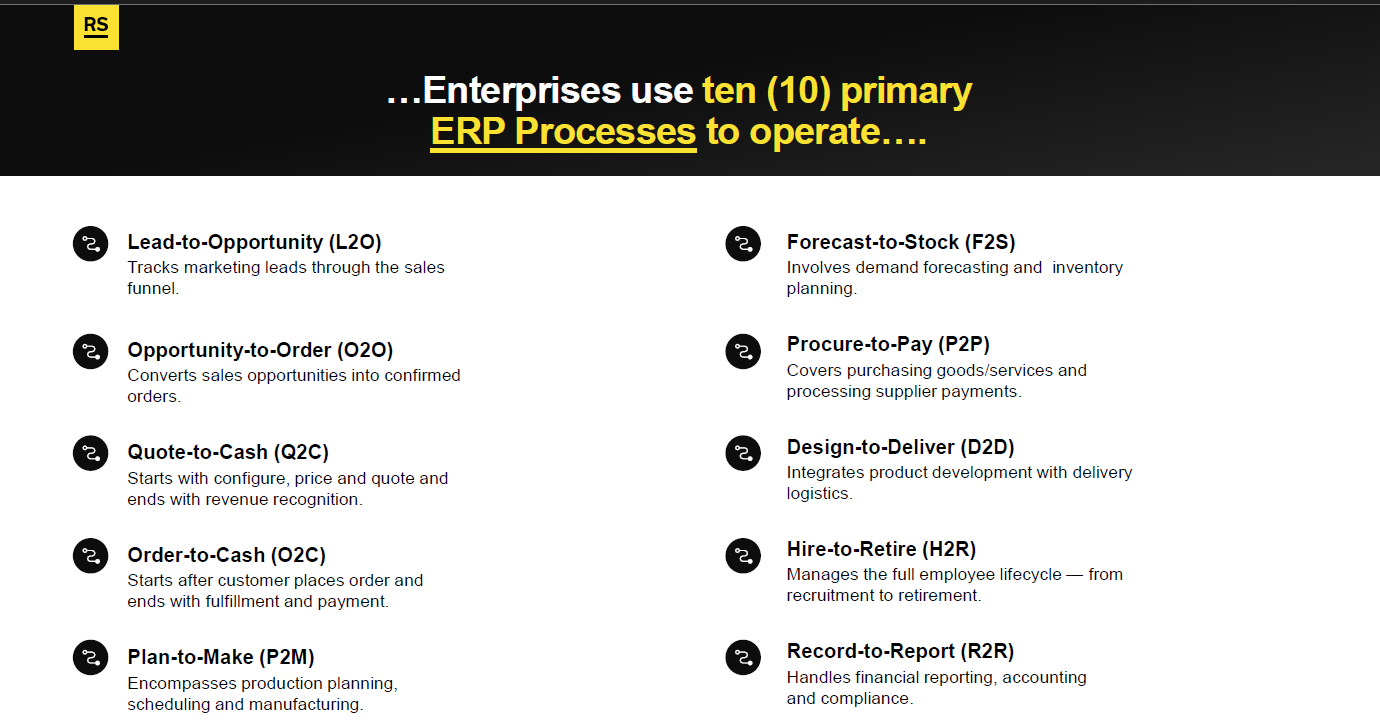

For enterprises to find money for innovation, they'll need to run those ERP processes well. However, don't confuse ERP processes for ERP software.

"We believe we could take 40% of the labor cost out of running the processes that run a business or government agency. That is monumental in terms of driving bottom line profits, streamlining operations and leapfrogging over the competitors with technology. This is what AI can do in the real world, in ERP and transactions," said Ravin.

Ravin's pitch is something we're hearing anecdotally from customers and vendors. The reality is that AI is changing the enterprise technology cycle to one that revolves around more efficient processes and use cases. The software matters, but optimized processes matter more.

The game will revolve around abstracting ERP software away so you can focus on the process.

The long AI game (sped up)

CIOs will need to realize it's a long game. AI agents will require governance, protocols and orchestration. Processes will be retooled.

"There are a lot of questions. We still have a lot of things to do. This is not all baked yet," said Ravin. "You have to recognize we're in the middle part of this inning in getting the technology figured out and then deployed in the real world. That's why we keep focusing on process, not the software."

To Ravin, enterprises will need to focus on process over software because "we don't have years to change."

Enterprises will need to think through the 10 processes that run businesses. Rimini Street's plan is to help enterprises extract the processes out of the ERP software.

"We are going to extract these processes out of the ERP software and move them up into the Agentic AI ERP like it's surgery. And eventually, eventually, there won't be a need for the underlying software anymore. Because we will have moved piece by piece over time, from one paradigm of technology to another," said Ravin. "Their tools, our know-how, our knowledge, our ability to go to market with credibility because we know these processes. We'll just put the new technology right over the top. We won't take the risk of ripping and replacing your massive global system. We then will move pieces one at a time."

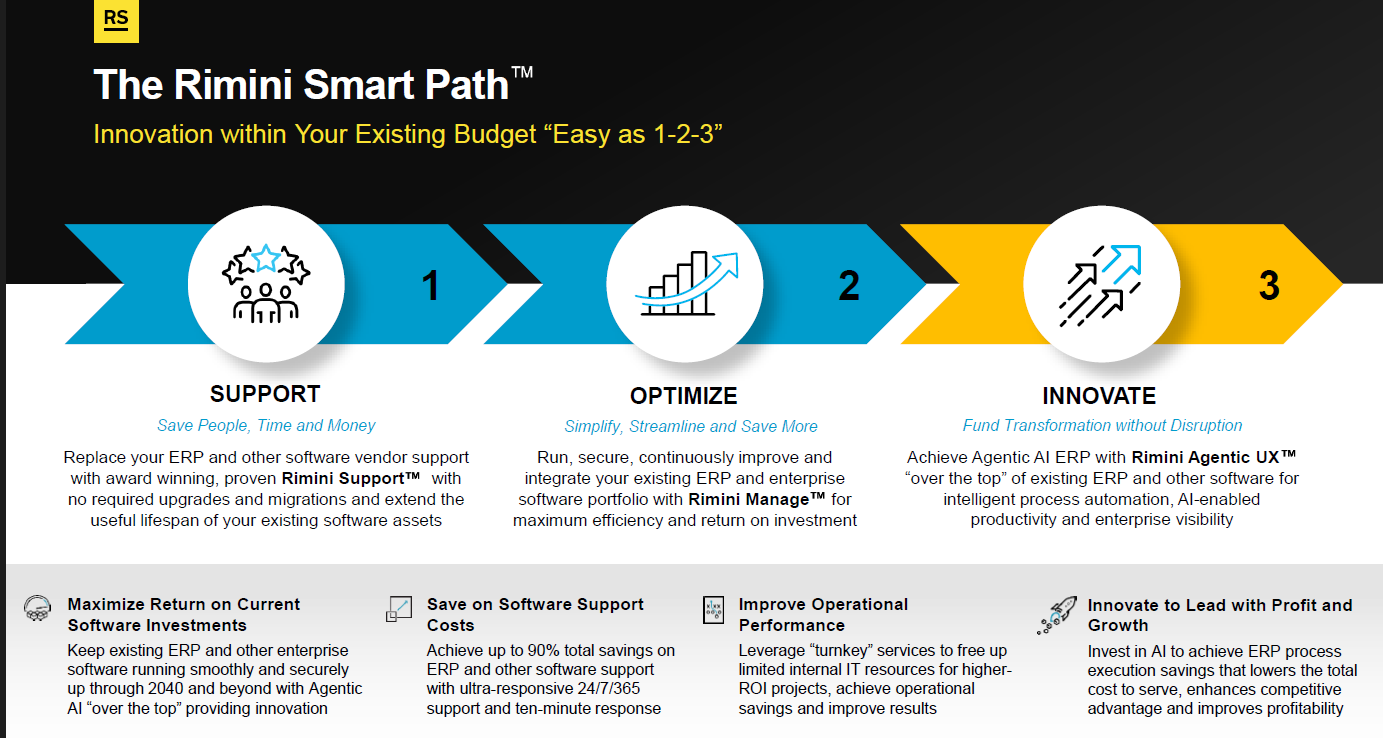

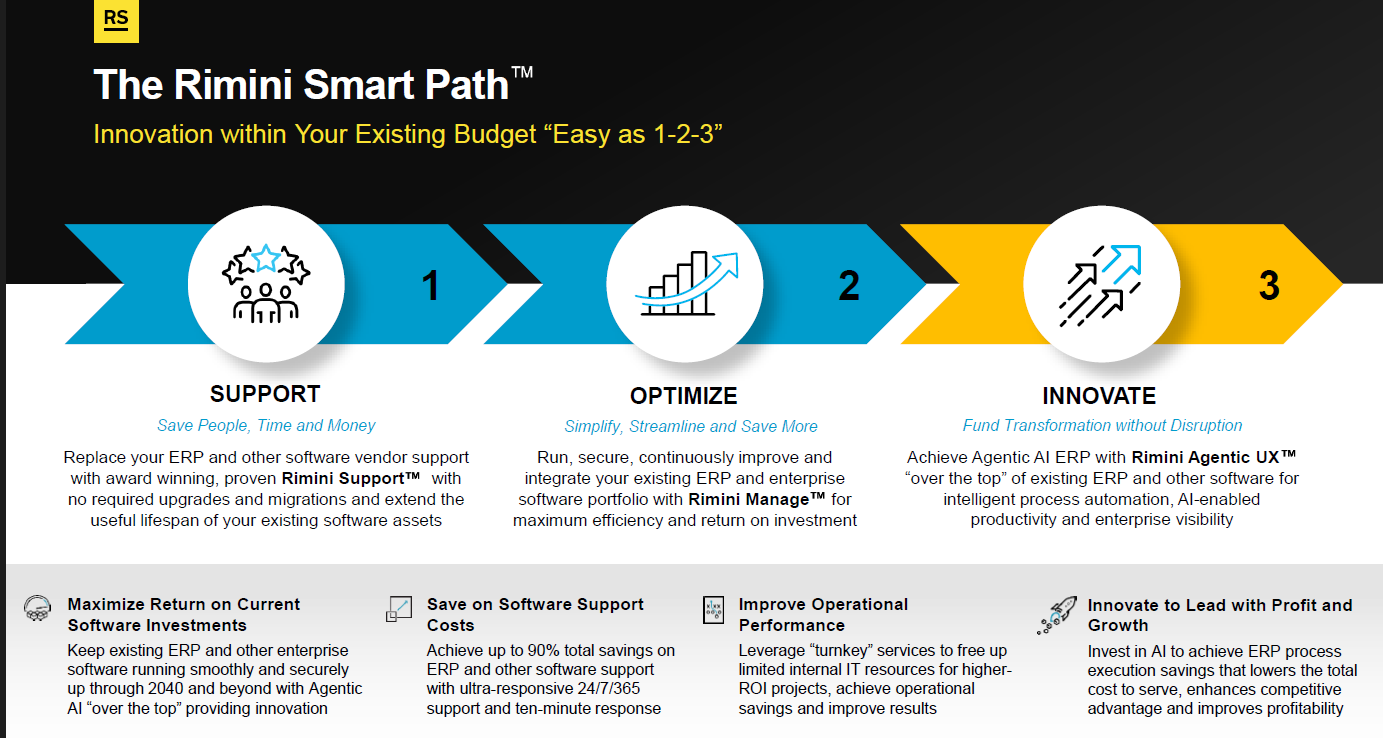

Rimini Street's portfolio includes methodology called Smart Path, which revolves around a gradual move to a process-driven system and out of the ERP software game.

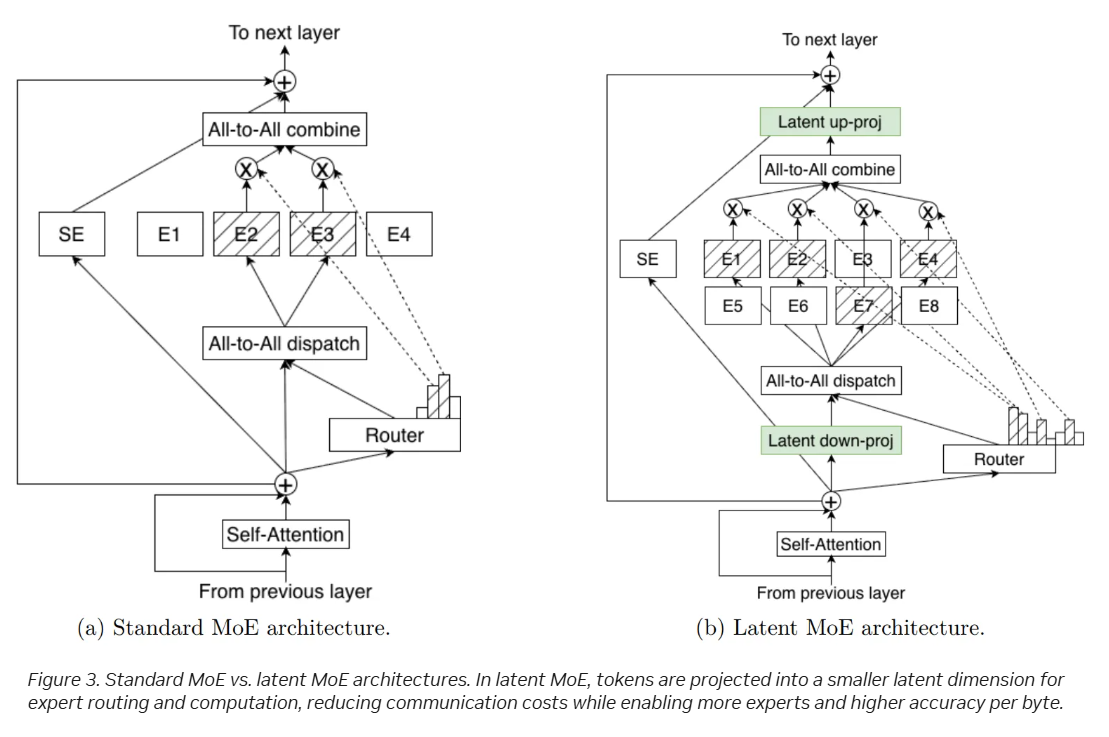

Vijay Kumar, Chief Innovation Officer at Rimini Street, Smart Path revolves around providing a foundation and roadmap to move to agentic AI ERP. Core tenents include:

- Use legacy ERP systems for what they're good at: Data.

- Layer a framework on top of it with Agentic UX.

- Leverage an architecture that is headless. "We're going to keep the SAP systems the way they are. We're going to preserve the data, the customizations and a lot of the work that customers have done," said Kumar. "What we're doing is really modernizing the front end of it, adding AI agents, which is absolutely critical, improving the UX, and finally being able to automate."

- Be prepared to evolve architecture since it's early in the AI game.

Rimini Street reckons it can get enterprises to a pilot in 30 days. Kumar said the ideal customer is one that has complex workflows, manual workflows and things that are hard to automate. The end state may feature agentic AI ERP apps to handle processes and use cases. "Once we start building credibility app by app, use case by use case, we're going to layer agentic AI across the enterprise," said Kumar.

Data to Decisions

Future of Work

Next-Generation Customer Experience

Tech Optimization

Innovation & Product-led Growth

Digital Safety, Privacy & Cybersecurity

rimini street

ML

Machine Learning

LLMs

Agentic AI

Generative AI

Robotics

AI

Analytics

Automation

Quantum Computing

Cloud

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

Leadership

VR

Chief Information Officer

CEO

Chief Executive Officer

CIO

CTO

Chief Technology Officer

CAIO

Chief AI Officer

CDAO

Chief Data Officer

CAO

Chief Analytics Officer

CISO

Chief Information Security Officer

CPO

Chief Product Officer