AGI may be far away, but 'jagged AI' will still take jobs

The enterprise AI market appears to be embracing a little nuance and CxOs would be wise to avoid banter about artificial general intelligence and think about systems that drive returns in the real world. Those returns will likely be generated with fewer workers.

Microsoft CEO Satya Nadella had an interesting exchange with a Wall Street analyst who asked about AGI, Microsoft's deal with OpenAI and the never-ending rise in capital expenditures. The exchange followed Microsoft’s strong first quarter results.

Nadella said: "How are these AI systems going to truly be deployed in the real world, make a real difference and make a return for both the customers who are deploying them and then obviously, the providers of these systems? Even as the intelligence capability increases, the problem is it's always going to still be jagged. You may even have a capability that's fantastic at a particular task, but it may not uniformly grow. So, what is required is in fact, these systems, whether it is GitHub Agent HQ or the M365 Copilot system. Don't think of this as a product. Think of it as a system that in some sense smooths out those jagged edges and really helps the capability."

As for AGI, Nadella said it's not coming anytime soon. "I think we will be in this jagged intelligence phase for a long time," said Nadella. "We feel very good about building these systems as organizing layers for agents to help customers. I feel pretty good about the progress in AI, but I don't think AGI as defined by us in our (OpenAI) contract is every going to be achieved anytime soon. I do believe we can drive value for customers with advances in AI models by building these systems."

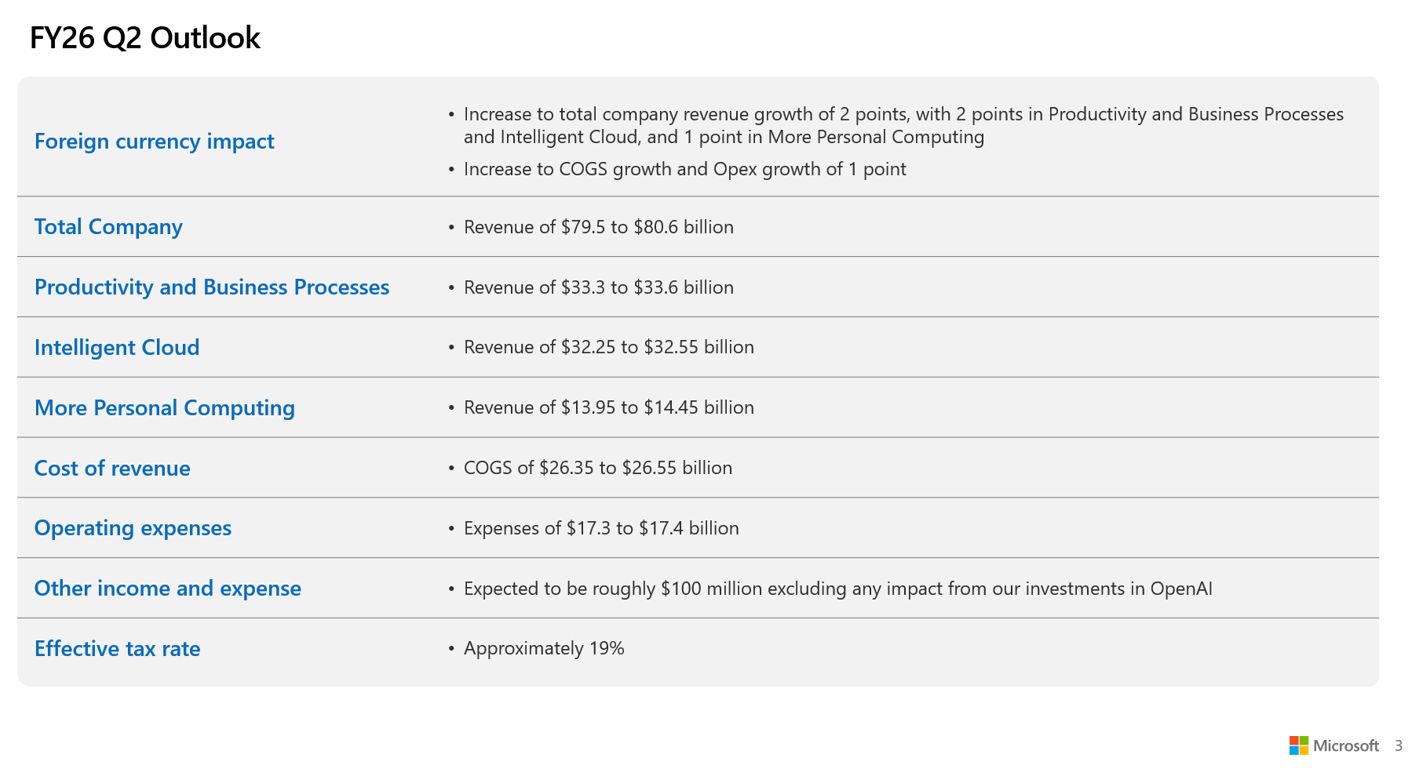

What about returns for Microsoft? Don't sweat that one. Microsoft generated first quarter free cash flow of $25.7 billion, up 33% from a year ago, even as it stepped up capital expenditures to $34.9 billion with half of that sum going to GPUs and CPUs. CFO Amy Hood said Microsoft is capacity constrained through the fiscal year but is seeing strong demand signals for AI and returns ahead.

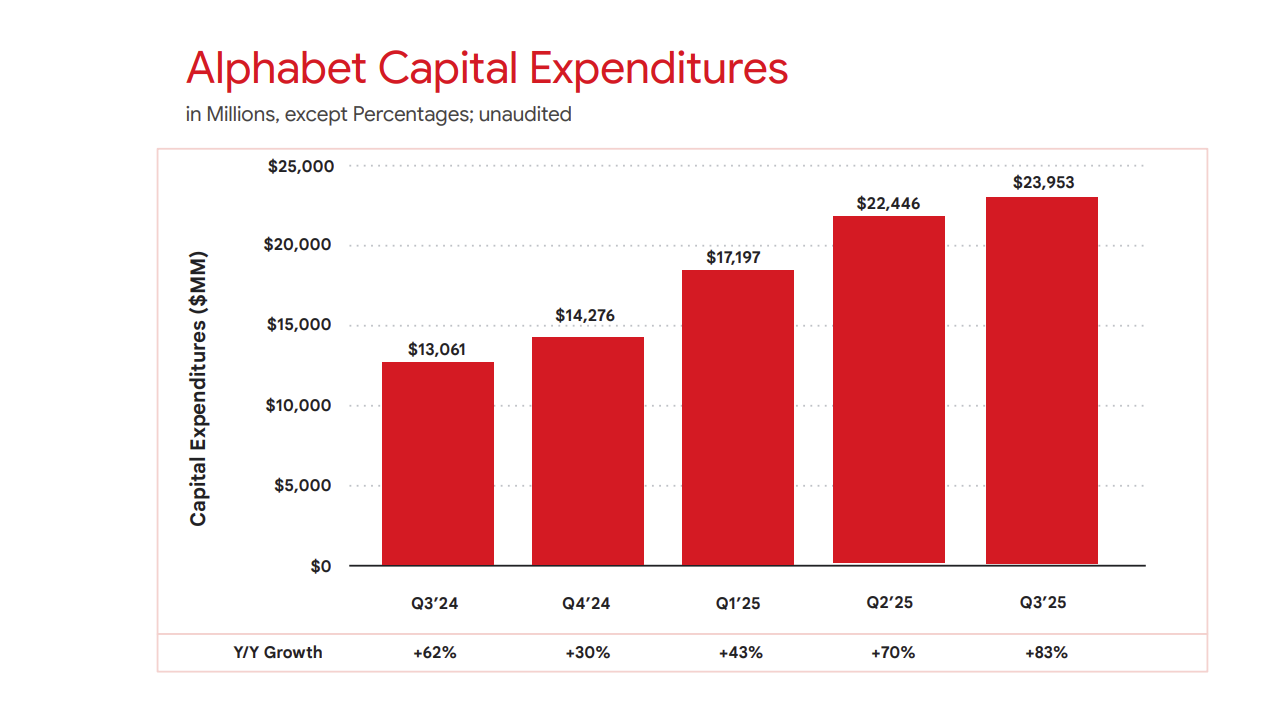

In other words, Microsoft doesn't have to chase AGI. Neither does Alphabet, which said it will spend $91 billion to $93 billion in 2025 capital expenditures. Alphabet is seeing strong demand for its TPU instances as well as its Google Cloud AI services and Nvidia-based offerings.

Alphabet CEO Sundar Pichai said the company is seeing extensive productivity gains from AI and monetizing advanced in multiple ways--advertising, YouTube and Google Cloud. The pace of LLM big bang developments be more spaced out, but returns are there.

In addition, enterprises are taking a more systems-based approach to AI and focusing on multiple models and agents. "Our packaged enterprise agents in Gemini Enterprise are optimized for a variety of domains, are highly differentiated and offer significant out-of-box value to customers. We have already crossed 2 million subscribers across 700 companies," said Pichai.

At the Google Public Sector Summit, a few panels noted that "2026 will be the year of AI ROI."

- Google Public Sector: AI agents and the future of government

- Google Public Sector, Lockheed Martin pair up for on-premises AI

- Old Dominion, Google Public Sector create AI incubator

- City of Los Angeles bets on Google Workspace with Gemini as it preps for big events

This systems-based approach to AI, agent layers and governance is why ServiceNow CEO Bill McDermott could hardly contain himself on the company's third quarter earnings call.

One product that's resonating with customers is ServiceNow's AI Control Tower. That interest highlights how agentic AI, various models and governance is more the story than AGI or whatever OpenAI's Sam Altman is cooking up this week.

ServiceNow's Amit Zavery, Chief Product and Operating Officer, said: "What we have done is we have integrated all the different systems out there to give you full visibility and control. It resonates instantly."

All of these comments sound very pragmatic. But there are already signs that this productivity is going to lead to fewer jobs. The job market may not be fire as much as it is no hire.

You don't need AGI for a white collar recession

First, let's start with the obvious. This week was where a lot of folks seemed to realize at once that we're in a white collar recession. To be realistic, the white collar job losses have been mounting for two years (you only need to ask someone who lost a gig and can't find one). And now the recent data points are adding up and it appears AI is taking jobs.

UPS cut 14,000 corporate jobs and 35,000 total. The disclosure, which was made on UPS's third quarter earnings call, boils down to AI and automation and the need to align headcount with volume declines.

Brian Dykes, CFO of UPS, said "we finished down nearly 34,000 positions year-over-year, which includes a reduction from our driver voluntary separation program. Nearly 1/3 of the reductions occurred in September."

UPS CEO Carol Tome noted that UPS is automating everything it can.

Amazon did its part to ding white collar jobs when it announced that it was cutting 14,000 corporate jobs. The rationale? AI requires less layers of management. Yes, most companies talk about augmenting human workers, but the reality is you just don't need as many people. Also see: AWS fires up Project Rainier, Trainium2 cluster for Anthropic

Other companies are either cutting white collar jobs (Target, GM) or holding the line on hiring (JPMorgan Chase). Alphabet said it is holding the line on headcount.

Alphabet CFO Anat Ashkenazi said generative AI is enabling the company to become more efficient across multiple fronts including headcount and infrastructure. "This is not a onetime effort but an ongoing way in which we operate the business," he said.

And this isn't just corporate America. At the Google Public Sector Summit in Washington DC, it was a common belief that AI agents were going to take on more work.

Ed Van Buren, an applied AI strategic growth offering leader at Deloitte, said upskilling will be critical. "Most federal agencies are smaller than they were last year. But still government has critical work that has to get done. It's going to be important for industry to help out a smaller government workforce. The Trump Administration is saying very directly that AI and emerging technologies are going to augment the existing remaining Federal workforce," said Van Buren.

A few thoughts:

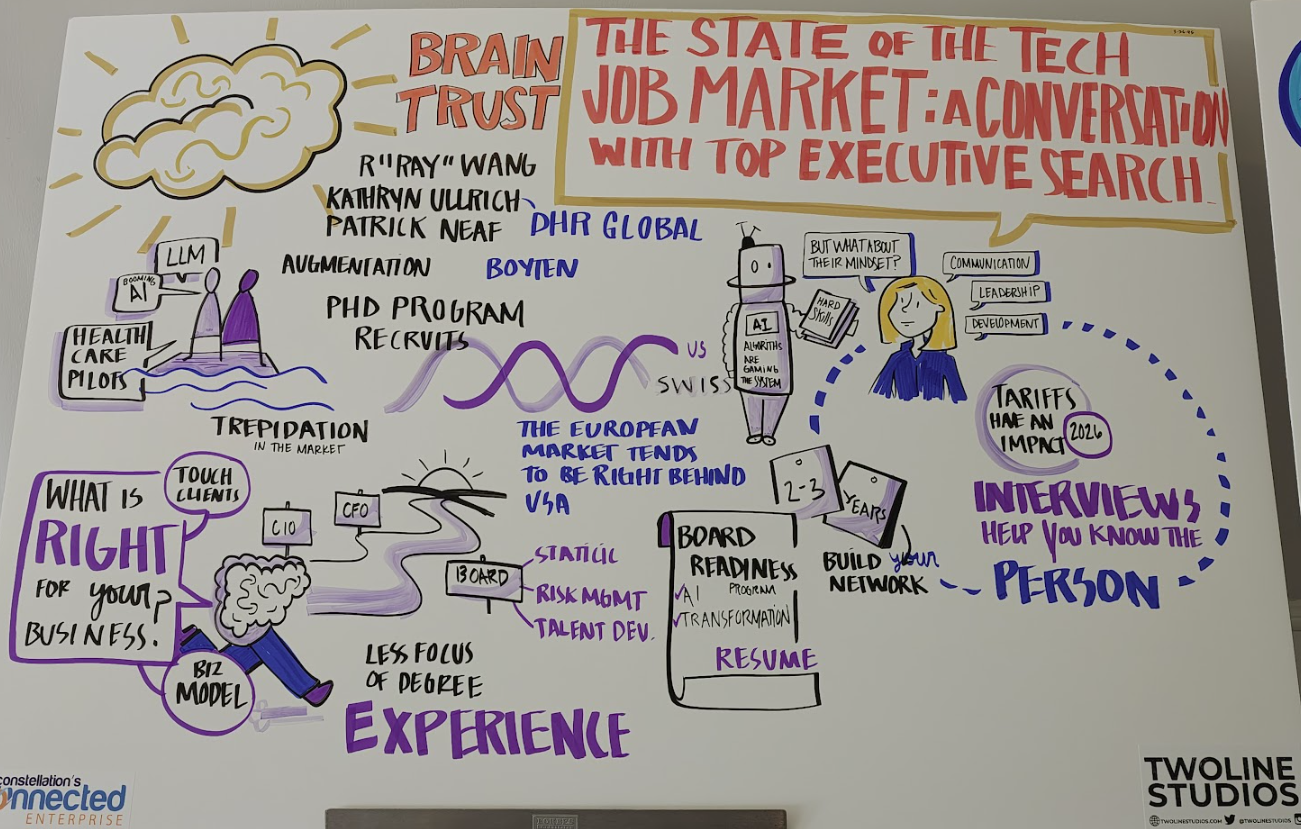

- Coming out of Constellation Research's Connected Enterprise agentic AI discussions, I was more optimistic about humans and their ability to find work. This week, I'm back to thinking we're going to need a lot less people to get work done. The point? The AI vs. human employment reality is going to ebb and flow as will your emotions. See: CCE 2025: AI agents: Dreams, reality and what's next

- No government has an answer or even rough plan for these job losses. Something that stuck with me from both Constellation Research's AI Forum in Washington DC and Google Public Sector is that more will be done with less due to AI. Aside from vague talk of upskilling, retooling work and retraining humans there's no plan for dealing with the labor losses. AI is one reason why the economy is being revamped with a manufacturing spin, but once the construction on AI factories is done where's the work? Should manufacturing come back to the US, there will still be fewer people and more robots.

- Ultimately, we get to a place where AI-enabled entrepreneurship will be rewarded. However, it's unclear whether everyone is suited to be an entrepreneur.

- With any luck AI will be like previous technology shifts where humans adapt and new roles are created. The disruption in between will take years to play out.