The big AI, SaaS, transformation themes to watch in 2025’s home stretch

Technology conference season is about to hit overdrive. Enterprises are plotting IT budgets for the year ahead. And the fourth quarter, which is critical, is about to kick off. And the only thing that's scaling into 2026 are open questions that aren't going to be answered quickly (even if vendors tell you otherwise).

Here's a look at the themes I'm watching through the rest of the year.

AI costs and ROI become critical.

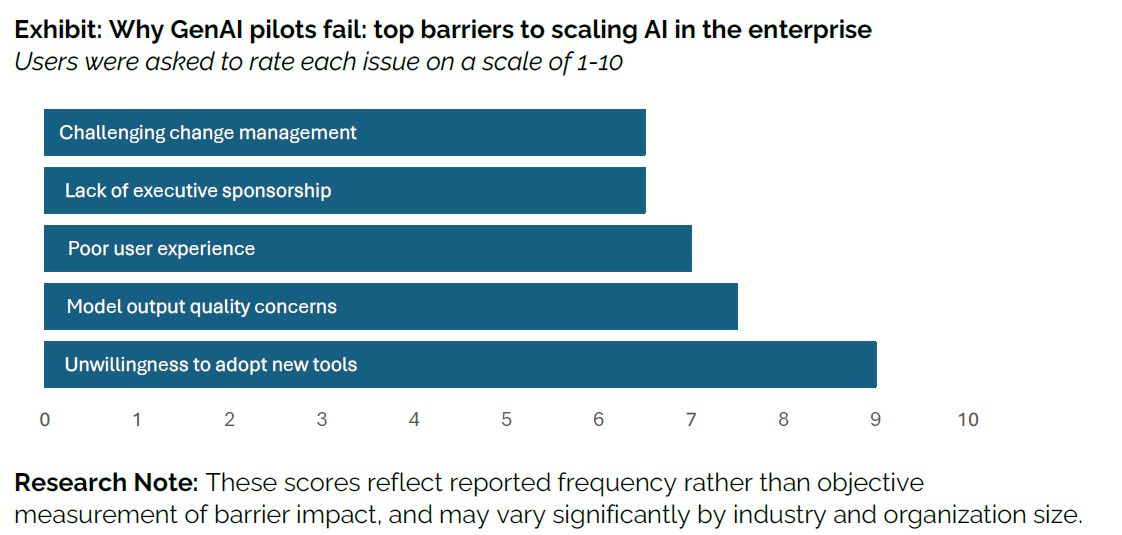

It almost doesn't matter that the MIT Nanda survey that revealed 95% of AI pilots failed relied on anecdotes and murky methodology. That 95% statistic has been cited repeatedly in briefings and keynotes. Given perception is reality, enterprises are disillusioned. At the very least, enterprises are well out of the gee whiz science project stage and well into the show me the money stage.

Get ready for the great vendor pivot and a lot more rationality. Marketing glitz is out as vendors follow the AWS practical approach. ServiceNow, Salesforce and Workday are all talking about internal agentic AI use cases and driving returns.

- Cognizant CEO Kumar: Agentic AI will create a reinforcing flywheel of ROI

- The AWS AI Strategy: Playing the Long Game Infrastructure-Style

Workday Executive Chairman Aneel Bhusri summed the state of enterprise AI today.

"People thought AI was going to solve everything, and vendors were out there marketing way ahead of what they had product wise. People have gotten a lot more realistic about what AI can do and what AI can't do. Vendors have gotten more realistic about delivering solutions to their customers, and, frankly, smarter about what works and what doesn't work,†said Bhusri. “What you'll see from Workday and others over the next 12 to 18 months will be real solutions that really help you run your business better and really leverage the power of AI, not just quick fixes."

Now vendors tell us.

Smaller LLMs solve more problems for enterprises and may get their due.

While we're on the AI cost theme it's worth watching the headlines for smaller more effective models. As HubSpot recently noted, you don't need the latest greatest LLM for many use cases. Simply put, small and cheap LLMs can work well. To that end, watch companies like Writer, which just launched more lightweight Palmyra models designed efficient inferencing.

These smaller models--also championed by IBM, ServiceNow, hyperscale cloud giants and others--will be critical to AI costs given that AI inference will become the most important enterprise workload. Small models will matter even more if LLMs hit the wall on big advances.

Every SaaS vendor wants to be a platform, but many will fail.

Every enterprise software vendor will have a data cloud, agent builder and spiel about being a platform. And why not? Being a platform is a great business. However, customers are only going to tolerate so many platforms.

Workday mentioned the word "platform" 78 times on its investor day at Workday Rising. "The platform becomes the product, maybe for the first time in Workday history," said Workday CTO Peter Bailis.

ServiceNow CEO Bill McDermott said on the company's second quarter earnings call: "We've become the CEO's agentic AI story in enterprise software. And notice I didn't say SaaS. We actually don't live in a SaaS neighborhood. We live in an enterprise AI neighborhood. The big picture is a CEO should want ServiceNow's AI platform for business transformation." ServiceNow executives said the word "platform" 21 times in an hour-long conference call.

Salesforce noted its Agentforce platform 20 times on its second quarter call and said it is expanding beyond CRM into ITSM. "There's no question about that. We've built the software infrastructure for the agentic enterprise, we have our metadata platform unifying our apps, our data and agents into one powerful agentic operating system. We are rebuilding every single one of our products to be agentic. We're delivering almost every single one of those products at Dreamforce," said Benioff.

- Salesforce heads into Dreamforce 2025: A look at the big themes

- Salesforce Q2 solid, outlook light with expansion into ITSM on deck

Agentic AI is the UI and application (maybe).

We've covered this one before and Workday was among the first traditional enterprise software vendors to make a big bet on AI as the new UI with its purchase of Sana for $1.1 billion. In theory, Sana will be the new "front door for work" and leverage Workday's data on people and money. Workday's Data Cloud will dish out critical ERP data to Sana's front end and connectors will bring everything else to the interface.

- Workday spends $1.1 billion on Sana, aims to be front door to work

- LLM giants need to build apps, ecosystems to go with the models

- Pondering the future of enterprise software

- Agentic AI: Is it really just about UX disruption for now?

Gerrit Kazmaier, president, product and technology at Workday, said during Workday's investor day: "We think about Sana like the iOS for enterprise in the future. And we see it being like a power combination with Workday because we have incredible distribution. We have 75 million users already. And you can ask 100% expect us to leverage that to bring Sana as an experience to every one of them."

He added that workers will interact with Sana instead of that SaaS layout that we all know so well. "People engage with Sana today on average 7 times a day in the current form. If we bring this to all of our customers and we open up that AI extensibility for them many things that they are doing today with legacy ticket-based automation, programmed exits, DIY AI systems, they will just naturally fall into this," said Kazmaier.

Build vs buy.

Kazmaier said DIY AI doesn't work in the enterprise and the biggest reason is the data isn't ready. In addition, processes are more complicated. Kazmaier was singing from the same hymn book as Salesforce CEO Marc Benioff.

Benioff noted that most enterprises don't have the talent or money to DIY AI. Even the ones that can build their own are simply creating a rabbit hole. "Customers have gotten very entranced by these ideas should they have their own models. Should they have this? Should they build this themselves? should they DIY their AI?" said Benioff.

Kazmaier argued that you can't simply provide AI Lego blocks and hope they magically optimize enterprise processes. "Business processes are complex. They run organizations, they have systems, whether it's hire to retire on the HR side, whether it's quote to cash, or source to pay. All of these processes are long running and an orchestration of a complex network of actions and systems. And you cannot just superficially slap AI across off that, right, on legacy APIs and have to hope that this would reconfigure transform the process itself," he said.

In other words, AI needs to be brought to the workflows to be useful.

This build vs. buy debate is fascinating and we won't be able to declare a winner for years if not decades. Here's a thought. AI native companies and startups will build and possibly buy later. Midmarket will buy. Large enterprises will do both.

Are we in an AI bubble?

There's a subtle positioning among vendors just in case this AI bubble bursts. It's curious that OpenAI executives seem to be acknowledging the bubble the most. The AI bubble question will common through the fourth quarter, but it's worth remembering a bit of history. In December 1996, then Federal Reserve Chairman Alan Greenspan said there was "irrational exuberance" in the market. The dot-com bubble peaked March 2000 and then crashed.

The signs of a bubble are all there including the return of SPACs, big stock moves on remaining performance obligations (RPO) and valuations that are on par with the dot-com boom.

Oracle Q1 misses, but sees OCI revenue surging over next 4 years

Code transformation may lead us all away from tech debt--or not.

Oracle CTO Larry Ellison said on the company's first quarter conference call: "We're not just building application generators. We're building application generators and then we're building the applications, which gives us insights to make the application generator better. It's a huge advantage to be on both sides of that equation, both being an application builder and a builder of the application generation technology, the underlying AI application code generators. That's a huge advantage."

MongoDB also launched an application modernization program that has AI-driven code transformation as well as the playbooks to work through some of the enterprise nuances.

AWS Transform is built around modernizing everything from mainframes to VMware to .NET.

AI is going to create a lot of new software, but tech debt is funny. As soon as you modernize, the tech debt clock begins again. Tech debt is a bit like the US government's debt that way.