Vice President and Principal Analyst

Constellation Research

Title: About Dion Hinchcliffe

Dion Hinchcliffe is an internationally recognized business strategist, bestselling author, enterprise architect, industry analyst, and noted keynote speaker. He is widely regarded as one of the most influential figures in digital strategy, the future of work, and enterprise IT. He works with the leadership teams of large enterprises as well as software vendors to raise the bar for the art-of-the-possible in their digital capabilities.

He is currently Vice President and Principal Analyst at Constellation Research. Dion is also currently an executive fellow at the Tuck School of Business Center for Digital Strategies. He is a globally recognized industry expert on the topics of digital transformation, digital workplace, enterprise collaboration, API…...

Read more

In London last week, WalkMe Analyst Day 2023 — an exploration of their progress so far with their digital adoption platform — began in the morning with a company overview by their CMO, Adriel Sanchez. Digital adoption is a vital new digital experience category that makes it significantly easier to increase impactful results for users with existing and new IT systems. WalkMe is arguably the leading player in the category and has long been an 'anchor tenant' on my digital adoption platform ShortList.

Adriel began the day by highlighting the paradox of digital transformation, noting that there will be $3.4 trillion in investment in this strategic activity by 2026, which WalkMe very much seeks to be a major part of. The paradox: Despite the abundance of technology, most projects fail and productivity often decreases. It's an unfortunate stat that hasn't changed much in 30 years, I'd note. This, he argues, is due to the ever-increasing complexity of workflows, tech overload, and the need for more effective change management. And really, he noted, there are three major obstacles:

- Tech overload

- Resistance to change

- Risk and compliance regimes are growing

Adriel also explores generative AI, a powerful new technology that has the potential to revolutionize the way organizations work. However, he cautions that generative AI also requires careful change management to ensure its safe and responsible adoption.

WalkMe CMO, Adriel Sanchez, starts of WalkMe Analyst Day 2023 in London. Photo Credit: Dion Hinchcliffe

WalkMe's approach to digital adoption and change management is based on three key principles:

- Data visibility: WalkMe provides organizations with insights into their friction points, allowing them to identify where and how to improve the user experience.

- Personalized user experiences: WalkMe delivers personalized guidance to users in the context of their daily workflow, helping them to navigate new applications and processes more effectively.

- AI-powered guidance: WalkMe leverages AI to understand user intent and provide contextually relevant assistance, reducing the need for manual support.

Adriel wrapped up by noting that WalkMe's actually has deep roots in AI and its ability to help organizations navigate the tsunami of change that is coming with the advent of generative AI.

WalkMe's approach to digital adoption and change management offers a powerful solution to the challenges faced by organizations in today's complex technology landscape. By providing organizations with visibility, personalization, and AI-powered guidance, WalkMe seeks to help them achieve the full potential of their digital transformation initiatives.

Then Leon Ashley provided a demo of the state of the art of WalkMe as a product. He also very cogenty summarizes the value proposition of digital adoption platforms like WalkMe, namely that they "allow you as an organization to take these massive platforms that have been built for global implementation and customize them not only to your organization's requirements, but your department requirements, your user requirements and really make it work for you."

Now digital adoption platforms typically provide real time guidance in-app, but it has traditionallly required that the user has launched the app. Leon notes that WalkMe Workstation can provide notifications on the desktop and even search the available guidance tree. Leon also provided a demo that shows how much WalkMe actually does for the user: "Let's remove the wasted clicks. Let's remove the waste of navigation. Let's remove training users how to use the application and just get the job done." He shows an expense request being almost completely filled out by WalkMe, with very little work done by the user, which merely directed it to happen. This is what digital adoption can do to systematically reduce friction, overcome usability hurdles, and eliminate training shortfalls.

Leon then switched over to generative AI, talking about how WalkMe can form a powerful front end for AI marketing tools like Jasper or software development AI tools, GitHub Copilot. They actually rolled out WalkMe internally on their own engineering team which had low adoption of Copilot.

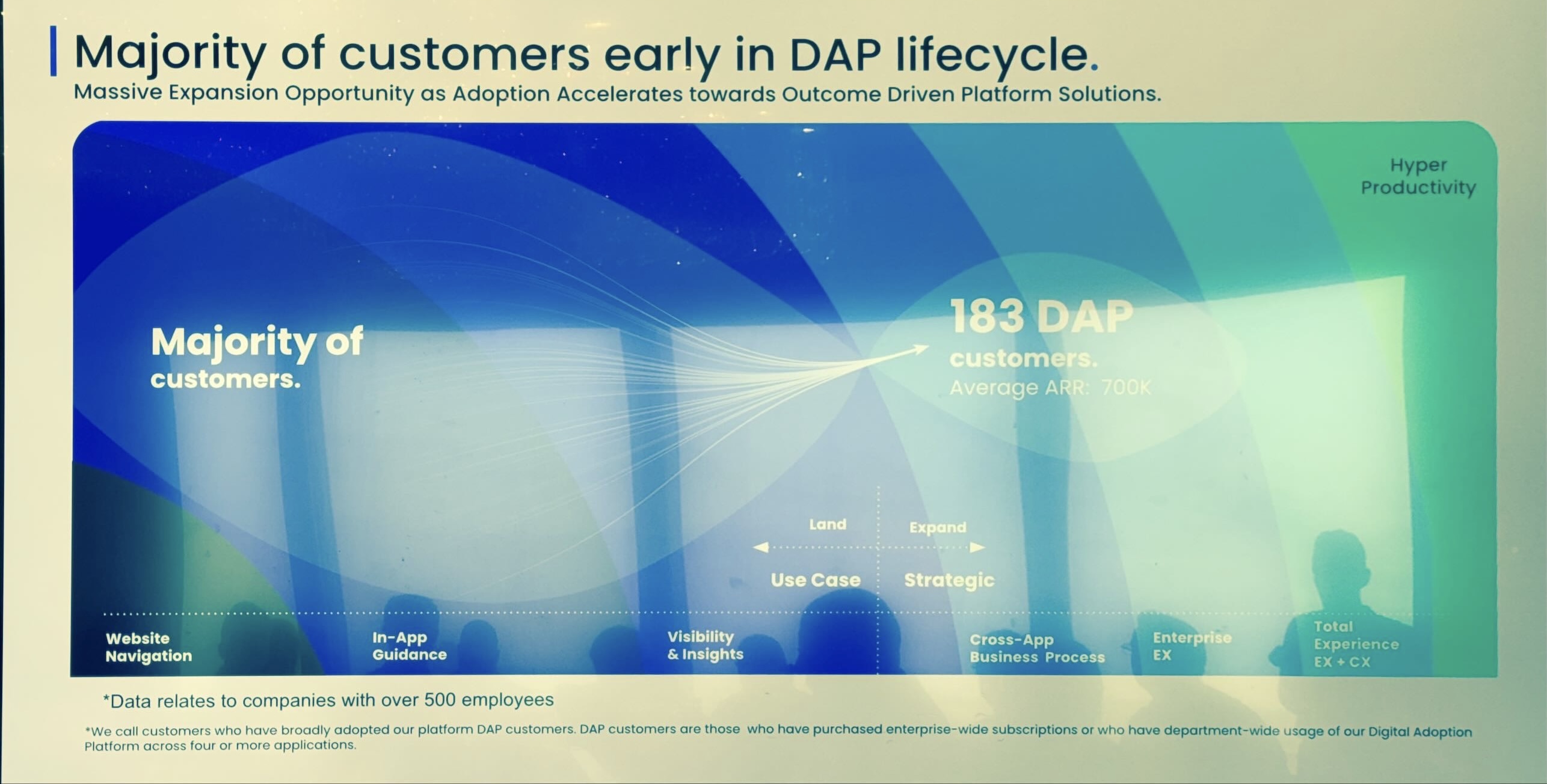

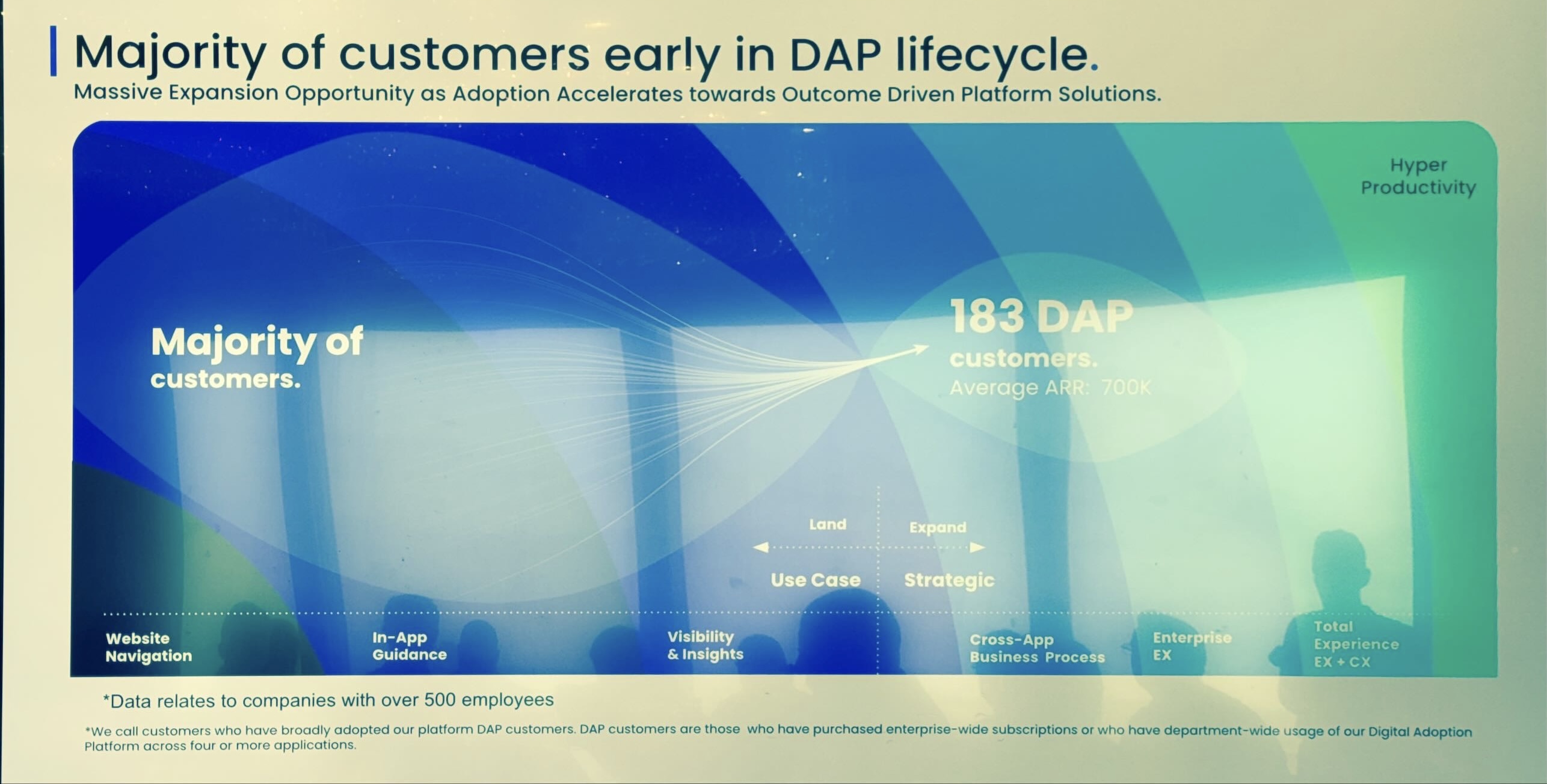

Adrien returned and talks about the WalkMe business, noting that the company is now profitable and has over 1,000 employees. They are also working on getting customers to more systematically adoption the product, a profile they call a "DAP customer." He says, "This is how we define a digital adoption or adapt customer, as someone who has deployed us on four or more applications. to us, that is the bar that we've set that shows that organization has a commitment to digital adoption as a methodology for implementing technology through managing the change that's required at these technologies. Walkme has over 180 of this more strategic DAP customers, with the majority being earlier in the adoption curve.

So, where do digital adoption platforms get used the most?

“The two most popular departments that we're solving problems for HR and sales, by far, like there's no not even like a distant second distant third†said Adriel. He also noted that WalkMe is used both for legacy applications as well as new software deployment, as it can help just as much with both application profiles. Big system integrators also are large users of WalkMe in their own or customers projects, to speed deployment. "Deloitte deployed on hundreds of applications across over 100,000 employees."

Then Adriel talked about what it takes for AI transformation, which WalkMe is positioning its product as directly enabling:

- Data: Train LLMs to work for your business

- Training and education: Educate employees and drive adoption of AI in the flow of work

- Guardrails: Mitigate risk by deflecting certain behaviors

- Utilization: Monitor utilization of embedded and native AI tools

Next up comes Ofir Bloch, a long-time executive at WalkMe who has been there since early in the company's journey through digital adoption. He reviews the latest State of DIgital Adoption report, which will be out in a couple of weeks.

Ofir Bloch, VP of Corporate Marketing, WalkMe explores the State of Digital Adoption 2024. Image Credit: Dion Hinchcliffe

He noted that "digital adoption is becoming a KPI in its own right." Not just the DAP software category.

“It’s becoming a priority for companies as they understand that they can no longer go buy technology and just hope that it works.â€

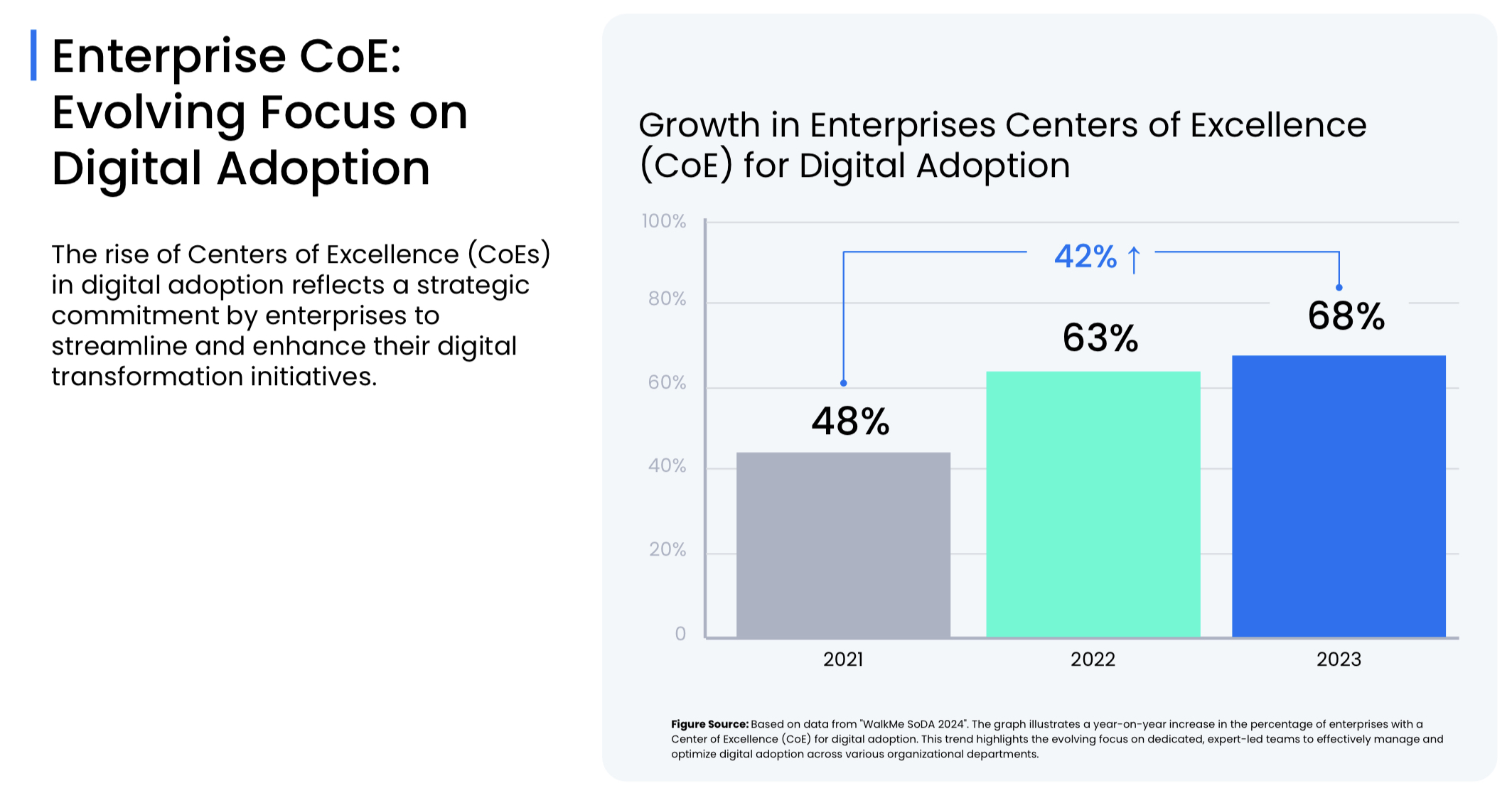

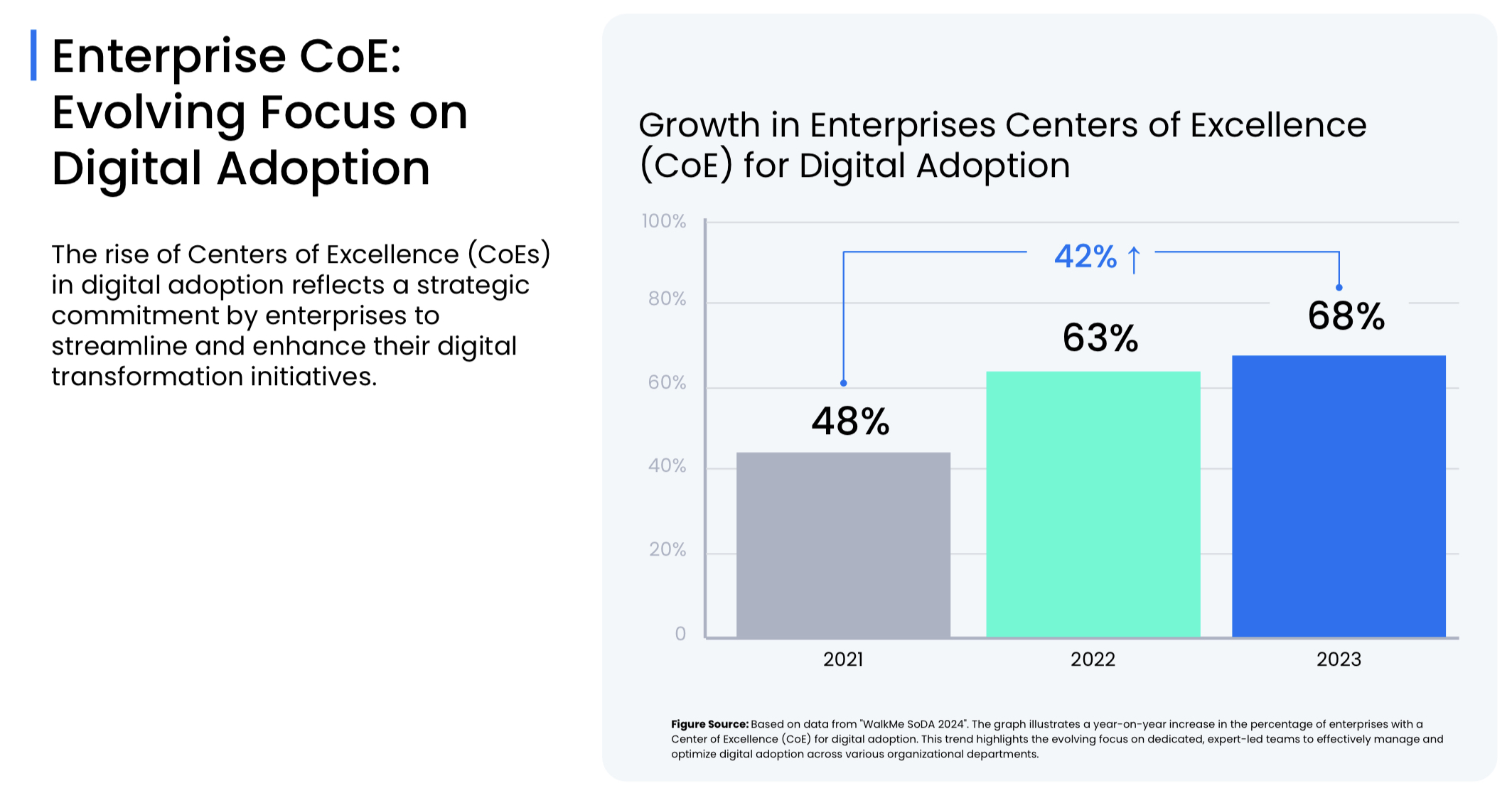

On the adoption of WalkMe itself, Ofir explored fascinating hard data on the growth of Centers of Excellence for digital adoption, presenting data, a 42% growth in the number of digital adoption CoEs in the last two years.

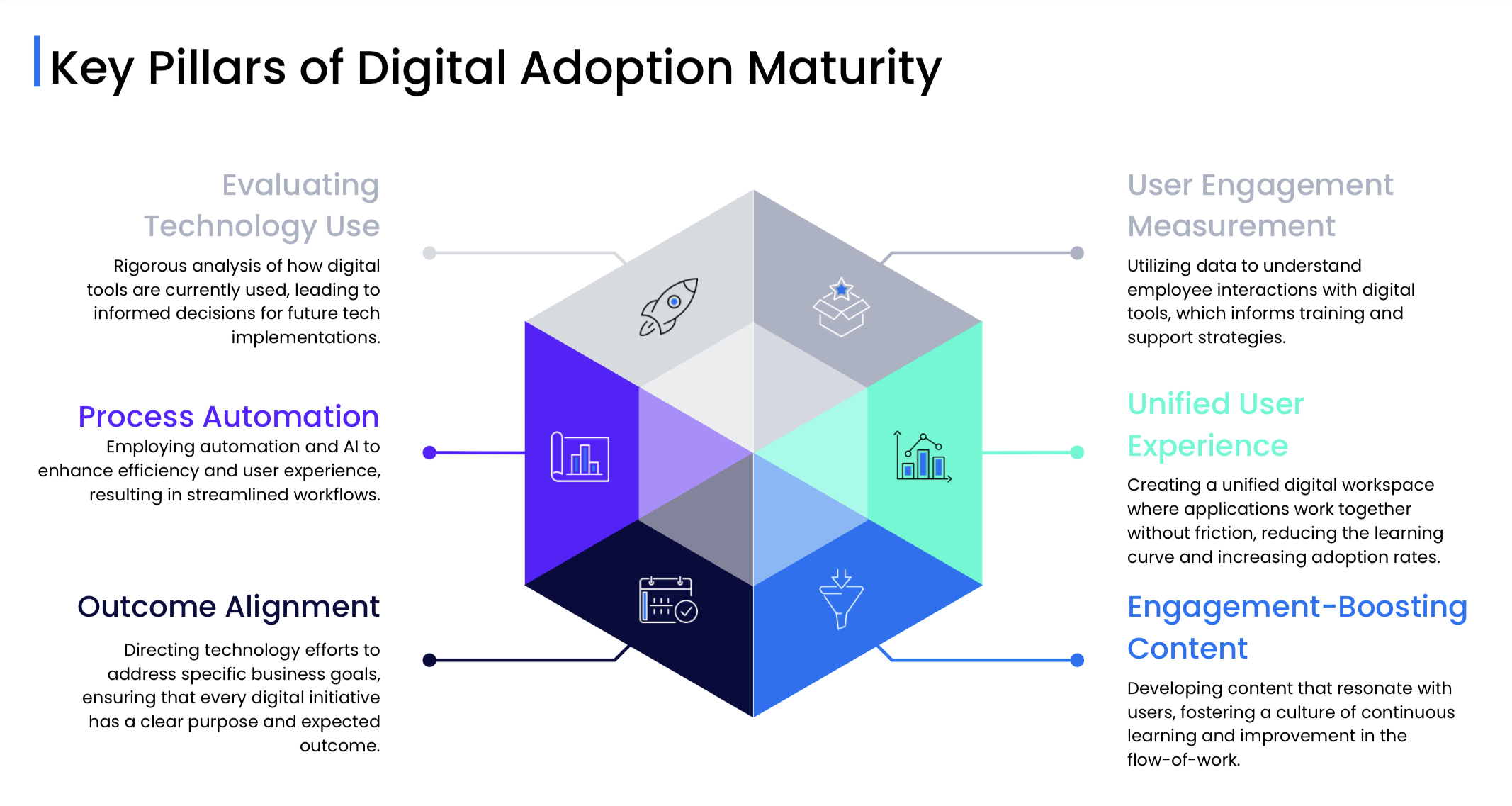

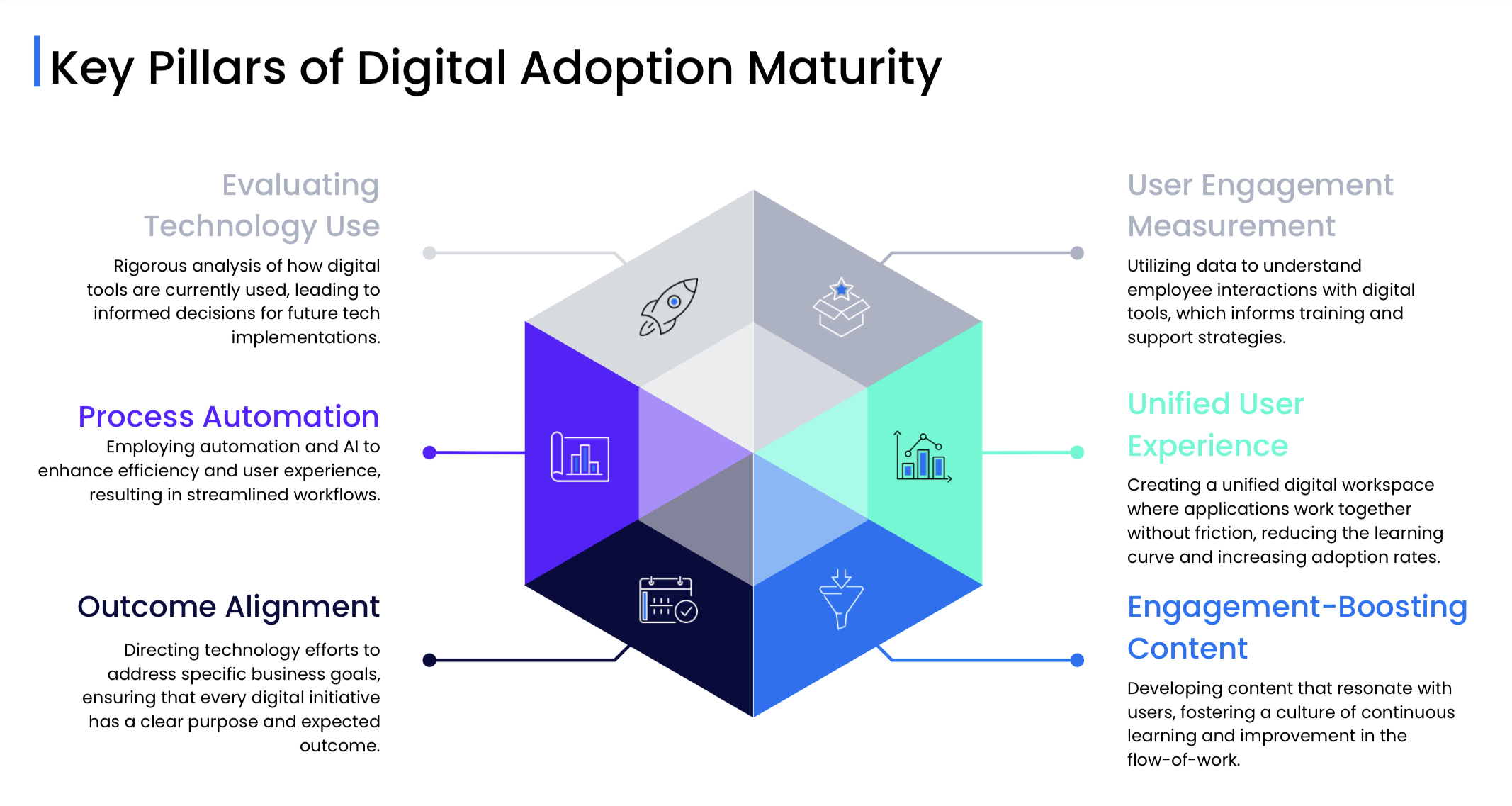

He also explores what the data shows are the key pillars of digital ddoption maturity:

- Evaluating tech use

- Process automation

- Outcome alignment

- User engagement measurement

- Unified user experience

- Engagement-boosting content

This is one of the first detailed views of maturity of digital adoption in the industry and is worthy of study, as the productivity boosts and cost savings represented by focusing on these are very considerable for the average organization that seeks them.

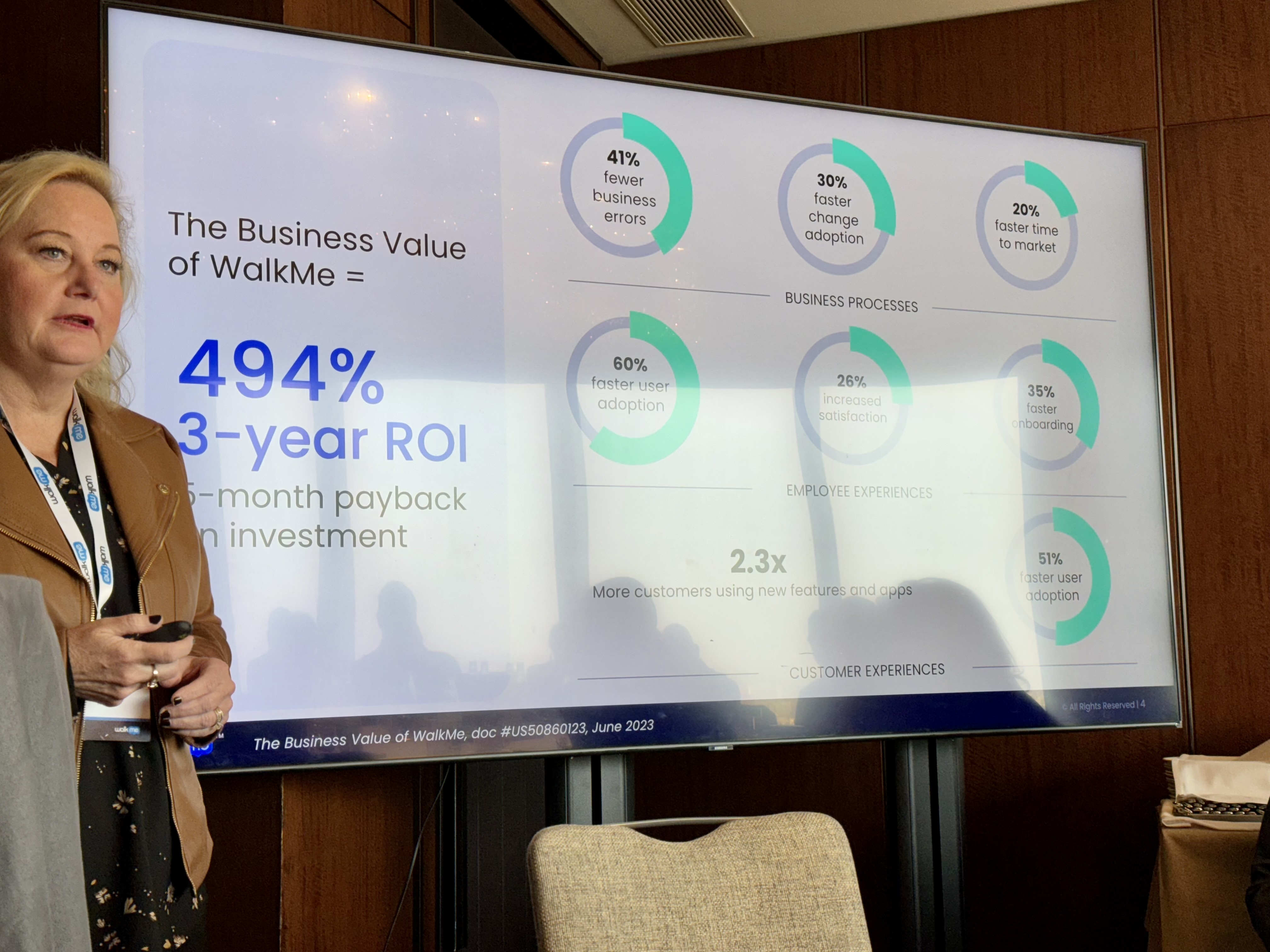

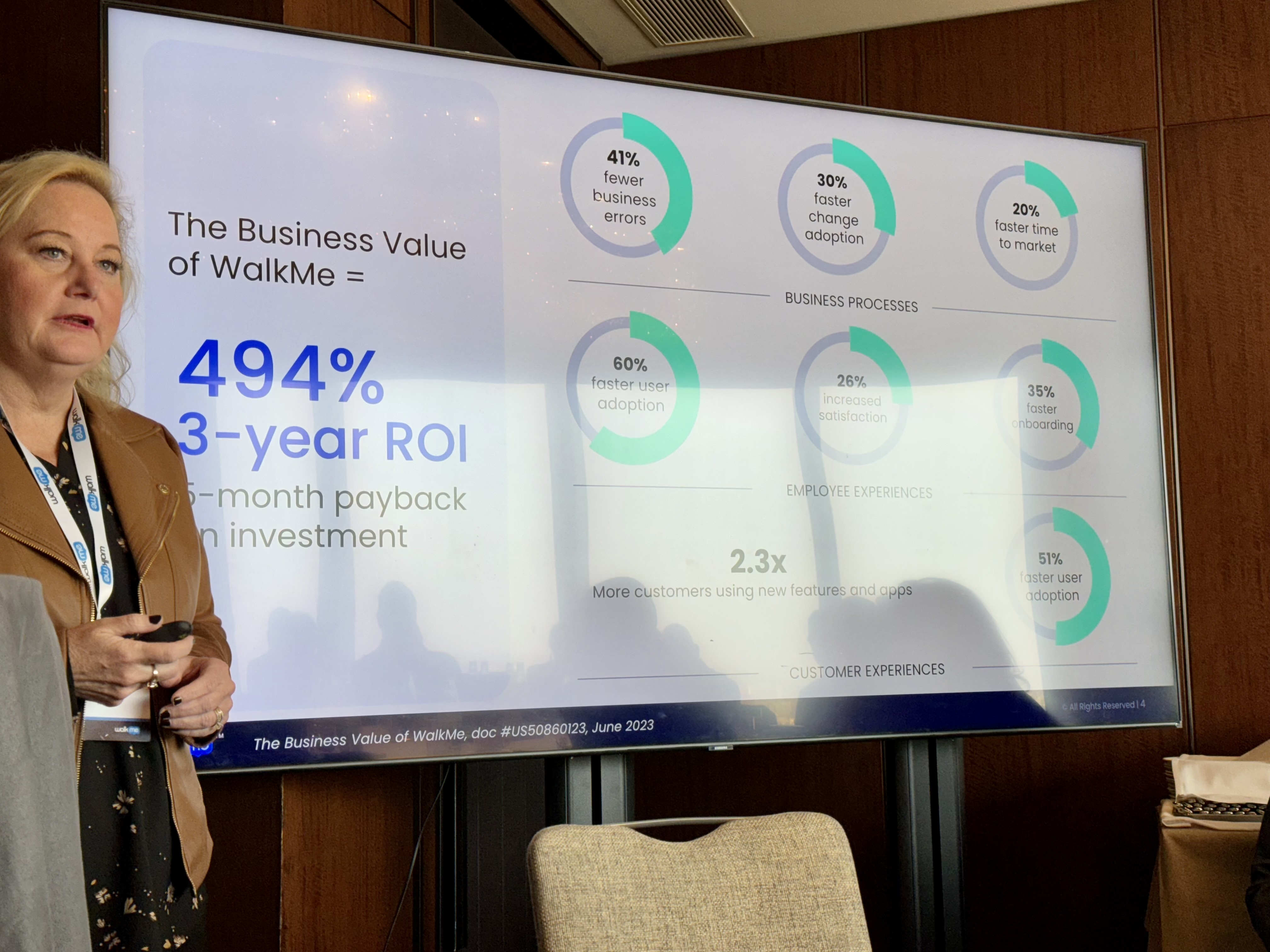

Then KJ Kusch came up to explore their updated strategy and and value framework. As part of this, she has some very insightful data on the benchmarks for digital adoption, specifically:

- 41% fewer business errors

- 30% faster change adoption

- 20% faster time to market

- 60% faster user adoption

- 25% increased user satisfaction

- 35% faster onboarding

- 51% faster user adoption

WalkMe says this results in an average 494% 3 year ROI and 6 month payback in initial investment. These are remarkable numbers, and because WalkMe can actually measure all this in the platform based on how its customers actually behave, these numbers are relatively rigorous collective analytics.

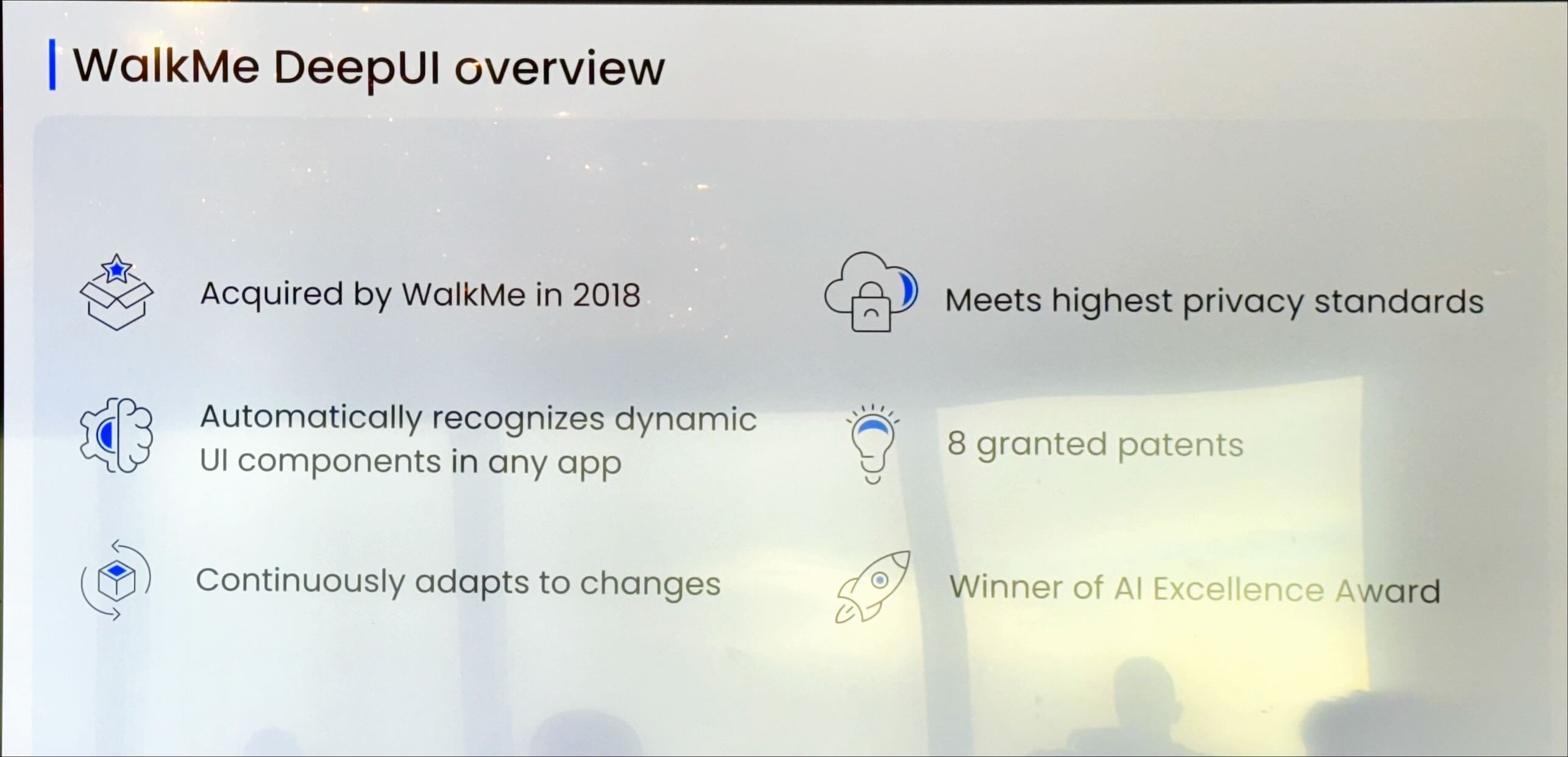

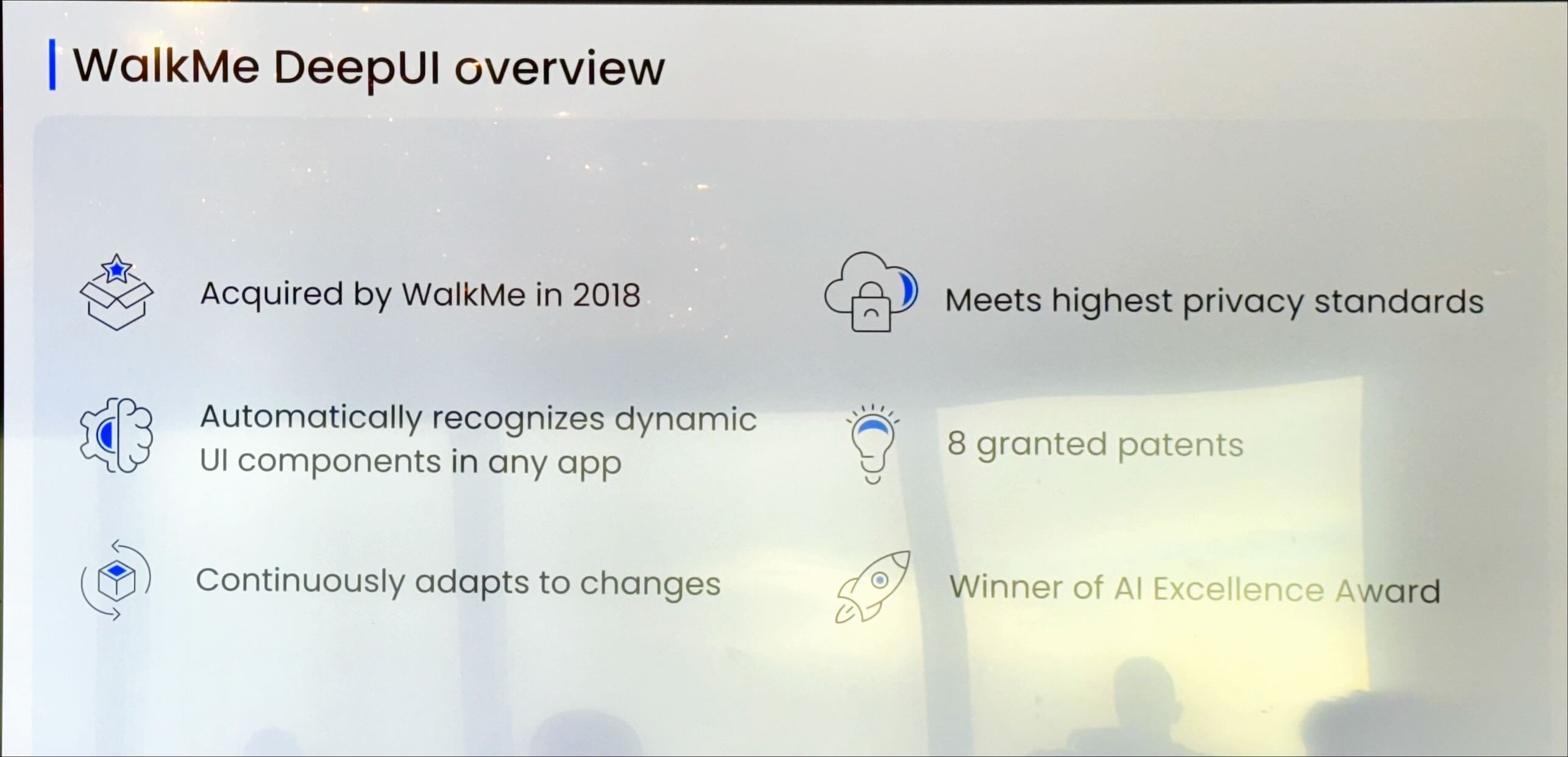

DeepUI: Adapting to the Continuous Change of Apps

Liya Spiegel, Director of Product Experience, then took us through the DeepUI technology that they use to map content to the fields and control fo underlying applications. Acquired in 2018, DeepUI is instrumental in keep WalkMe content matched with the fields in the apps, including high Web responsive applications and even localized apps with fields in entirely different languages. Based an underlying AI technology, DeepUI ensures when applications like Salesforce or Workday change across releases, the WalkMe digital adoption content continues to function as expected. It has 8 granted patents and is a key competitive differentiator for their digital adoption platform.

Customer Success at WalkMe

Next up was Sunil Nagdev, the new Chief Customer Officer of WalkMe, talked about improving customer success. "It's an important piece for me and when I came to WalkMe, it was really important for me was to understand how we do our land and expand because that's the most critical piece of our business itself" in terms of strong organic growth.

Sunil summarized the main areas of challenge in doing this:

- Implementation cycles

- Responsiveness

- Scale and sustain

- Underutilization

I also sat with Sunil at the dinner the night before analyst day and he came across to me as quite thoughtful and very much concerned about growing deeper customer intimacy while turning the relationship with them into one where WalkMe becomes a trusted advisor.

Time to value is also a area Sunil is focused on, getting WalkMe implementations down to 4-6 weeks, at least for initial deployment. My analysis is that Sunil is going to be instrumental growing customer lifetime value and increasing the average number of apps per customer that are accelerated by the WalkMe platform.

He is also bringing the concept of what he calls "scaled adoption" to the table at WalkMe, so that just-in-time microlearning and a revamped certification program will ensure customers are able to "hold their weight" in helping deliver the success of the solution. He will round this out with a customer advocacy program as well.

WalkMe's Trajectory Heading into 2024

Here's my analysis of where the company sits today and where it's going next year:

- The company's growth and financials are strong and the firm is healthy, with revenue up year-over-year, including net income up an impressive 62%.

- WalkMe's technologies, such as Deep, UI and various digital adoption patents ensure it has very good competitive differentiation for the time being.

- The company is poised to move much more from single-app, single use case deployments to multiple-app, multiple use case rollouts next year with their new customer success focus.

- This is vital for WalkMe to grow as it gains size, given that most customer organizations are still leaving considerable productivity and value creation on the table due to limited digital adoption deployments, the data presented at analyst day clearly showed.

- Where the company remains challenged is systematically moving beyond departments like sales and HR, and their new partner program, the Propel program may be instrumental in making that happen. I also think the company has to not just sell to the CIO, but also to executives in charge of employee experience overall, which have a vested interest in long-term post-rollout success.

- The company has also assembled new frameworks, education, tools, and a more strategic advisory approach that should foster broader deployments across more apps and departments within customers in 2024 and beyond.

- Digital adoption stubbornly remains a category with limited industry awareness, but this is changing, and the data showing the double digit rise of centers of excellence for digital adoption is a very good sign for the company.

- Enabling AI transformation directly as a digital adoption strategy as generative AI rolls out across enterprises around the world should add to the growth story as WalkMe matures their offerings for this in 2024 and beyond.

- Digital adoption as a category is getting closer to breaking out, and WalkMe still stands to be the company that leads this given their product and go-to-market maturity, but will like be 2-3 more year still before it becomes a "household name" in IT.

Additional Reading

How Leading Digital Workplace Vendors Are Enabling Hybrid Work

WalkMe in 2022: An Update on the Digital Adoption Journey

How Generative AI Has Supercharged the Future of Work

Future of Work

Tech Optimization

Chief Customer Officer

Chief Information Officer

Chief Digital Officer

Chief Technology Officer

experiences. Here are the takeaways from our conversation.

experiences. Here are the takeaways from our conversation.