AWS, Microsoft Azure, Google Cloud battle about to get chippy

This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly.

Hyperscalers are getting chippy as they compete for generative AI workloads. It's not that cloud providers were ever exactly collegial, but as growth hits the law of large numbers, enterprises optimize cloud spending and generative AI threatens market share standings you can expect sniping between the big vendors.

This chippy reality was made clear during AWS CEO Adam Selipsky's keynote at re:Invent. He made a handful of not-so-veiled references to Microsoft Azure, its ties to OpenAI and its recent foray into custom silicon.

When Selipsky talked about Graviton4, he noted that "other cloud providers have not delivered on their first server processors." With new versions of Trainium and Inferentia processors he said something similar. The snark revved up when Selipsky was talking about model choices and Amazon Bedrock.

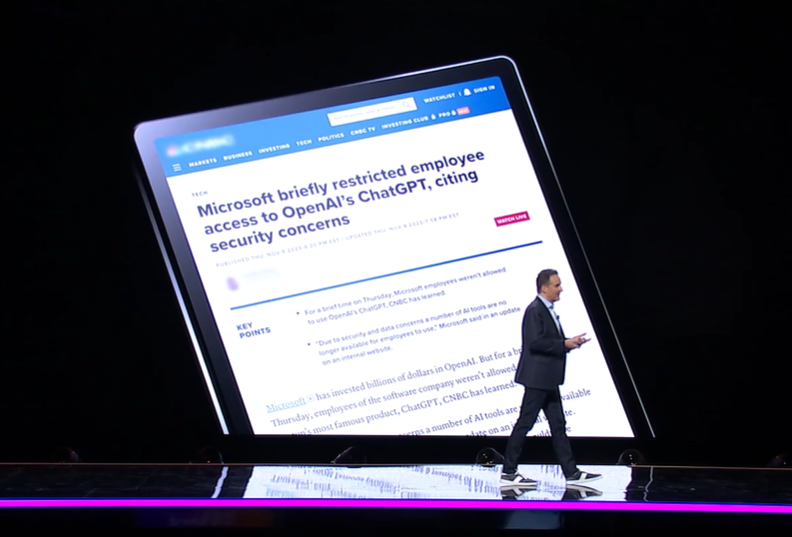

"You don’t want a cloud provider that’s beholden primarily to one model provider, you need a real choice. The events of the past 10 days have made that very clear,†said Selipsky.

When talking security, Selipsky cruised by a headline about Microsoft and OpenAI.

Clearly, the OpenAI fiasco made it clear that you may not want to hitch your generative AI wagon to one model. Microsoft's investment in OpenAI gave the company a head start in generative AI and copilots, but that innovation bet almost backfired when OpenAI CEO Sam Altman was booted, hired by Microsoft and then reinstated at OpenAI. You'd be a fool if you were an OpenAI customer and not thinking about diversification.

However, it's also worth noting that Azure has its own plans for model choice and models as a service. Microsoft CEO Satya Nadella has gone out of his way to say that the company's AI plans go beyond OpenAI and there are multiple models available.

For AWS, which has been the cloud leader from the launch of the industry, the competition from Azure must feel odd. Perhaps Selipsky's swipes work out over time. In my experience talking trash can work, but often doesn't. In technology, the only executive I've seen really pull off the chippy vibe is Oracle CTO Larry Ellison. You can argue that Ellison's version of the truth is sometimes stretched, but he has a knack for punching competitors in the head.

Frankly, I'm a bit surprised that Oracle didn't rent out the Sphere during re:Invent. Or maybe Google Cloud just beat Oracle to it.

Where is all this headed? You already know. It's a return to the fear, uncertainty and doubt age. Here are a few techniques you can use to navigate the new sniping between cloud providers:

Think "The Art of War," arguably the best business book ever written (even though it was technically about war). That Art of War lens gives you insights into the Oracle-Azure partnership. I'm pretty sure Microsoft and Oracle are far from chummy, but they have mutual enemies in AWS and Google Cloud. And Oracle Cloud Infrastructure isn't big enough to threaten Azure yet, so the Satya-Larry bromance is in full bloom.

Fact checks. Cloud providers could go full election mode and that requires that you fact check statements from executives.

Remember how you were treated in the "optimization" phase. The last 18 months have seen enterprises optimize their cloud spending plans. Remember the hyperscalers that worked with you to hit budgets and act accordingly. Trust matters.

Diversify and play cloud giants off each other. All of those enterprise software lessons such as waiting until the last minute of a quarter, evaluating rivals and working discounts will apply to cloud negotiations. You may also consider on-premises options too. Bottom line: You should be able to get a discount.

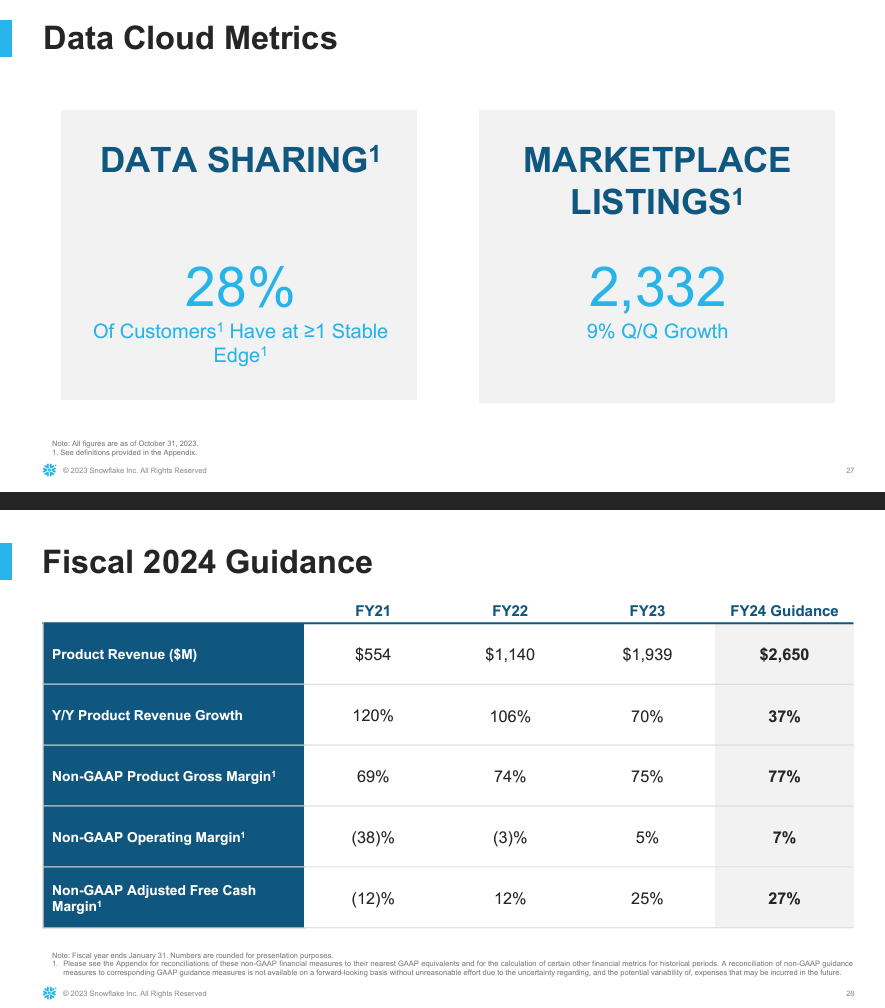

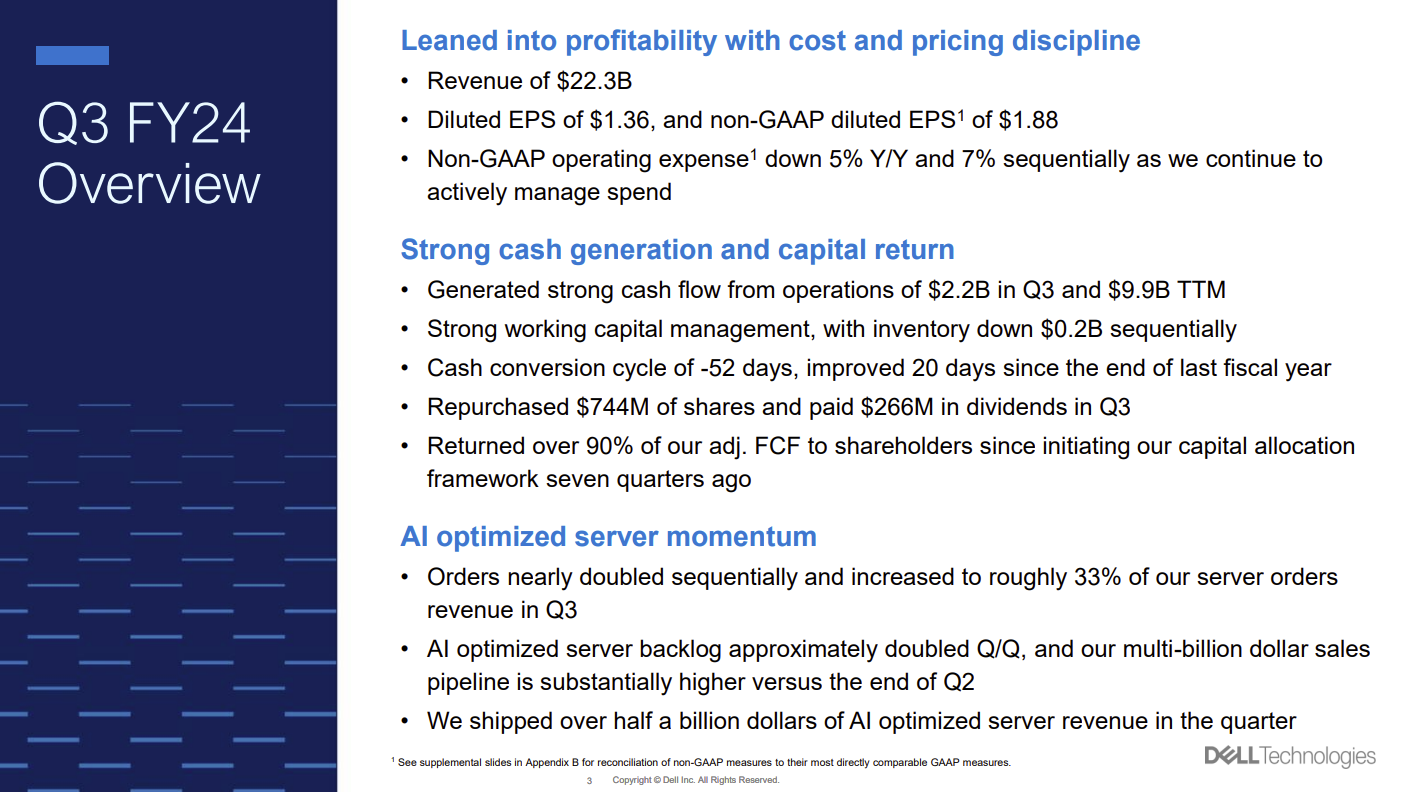

Generative AI has the potential to rewrite the cloud standings and hyperscalers are going to scrap it out accordingly. For the record, here's a look at the hyperscaler growth rates in their most recent quarters:

- Microsoft Cloud fiscal Q1 revenue was $31.8 billion, up 24% from a year ago. Microsoft Cloud includes Azure and other cloud services, Office 365 Commercial, the commercial portion of LinkedIn, Dynamics 365, and other commercial cloud properties.

- AWS Q3 revenue was $23.1 billion, up 12% from a year ago.

- Google Cloud (IaaS and Workspace) Q3 revenue was $8.4 billion, up 22% from a year ago.

- Oracle Cloud (IaaS and SaaS) Q1 revenue was $4.6 billion, up 30% from a year ago.

Here's the week from the Constellation Research team at re:Invent.

- These overlooked AWS re:Invent launches could solve pain points

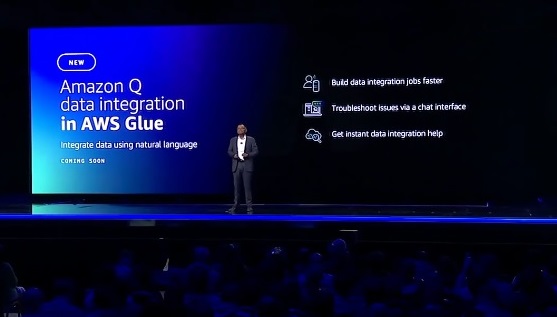

- AWS launches Amazon Q, makes its case to be your generative AI stack

- AWS Expands Zero-ETL Options, Adds AI Recommendations for DataZone

- AWS presses custom silicon edge with Graviton4, Trainium2 and Inferentia2

- AWS bets palm reading will come to an enterprise near you

- AWS Introduces Two Important Database Upgrades at Re:Invent 2023

- AWS launches Braket Direct with dedicated quantum computing instances, access to experts

- AWS re:Invent 2023: Perspectives for the CIO | Live Blog

- AWS, Salesforce expand partnership with Amazon Bedrock, Salesforce Data Cloud, AWS Marketplace integrations

nd pay down technical debt.

nd pay down technical debt.