Adobe sets outlook for fiscal 2024, outlines FTC inquiry

Adobe reported better-than-expected fourth quarter earnings as revenue was up 12% from a year ago.

The company reported fourth-quarter earnings of $1.48 billion, or $3.23 a share, on revenue of $5.05 billion. Non-GAAP earnings for the fourth quarter were $4.27 a share.

Wall Street was expecting fourth-quarter earnings of $4.14 a share on revenue of $5.02 billion.

Adobe CEO Shantanu Narayen, Constellation Research's CEO of 2023, said the company saw strength across its Creative, Document and Experience Clouds. "We believe that every massive technology shift offers generational opportunities to deliver new products and solutions to an ever-expanding set of customers. AI and generative AI is one such opportunity and we have articulated how we intend to invest and differentiate across data, models and interfaces," said Narayen.

Here's Adobe's fourth quarter sales by unit:

- Digital Media revenue was $3.72 billion, up 13% from a year ago.

- Digital Experience revenue was $1.27 billion, up 10% from a year ago.

- Document Cloud revenue was $721 million, up 16% from a year ago.

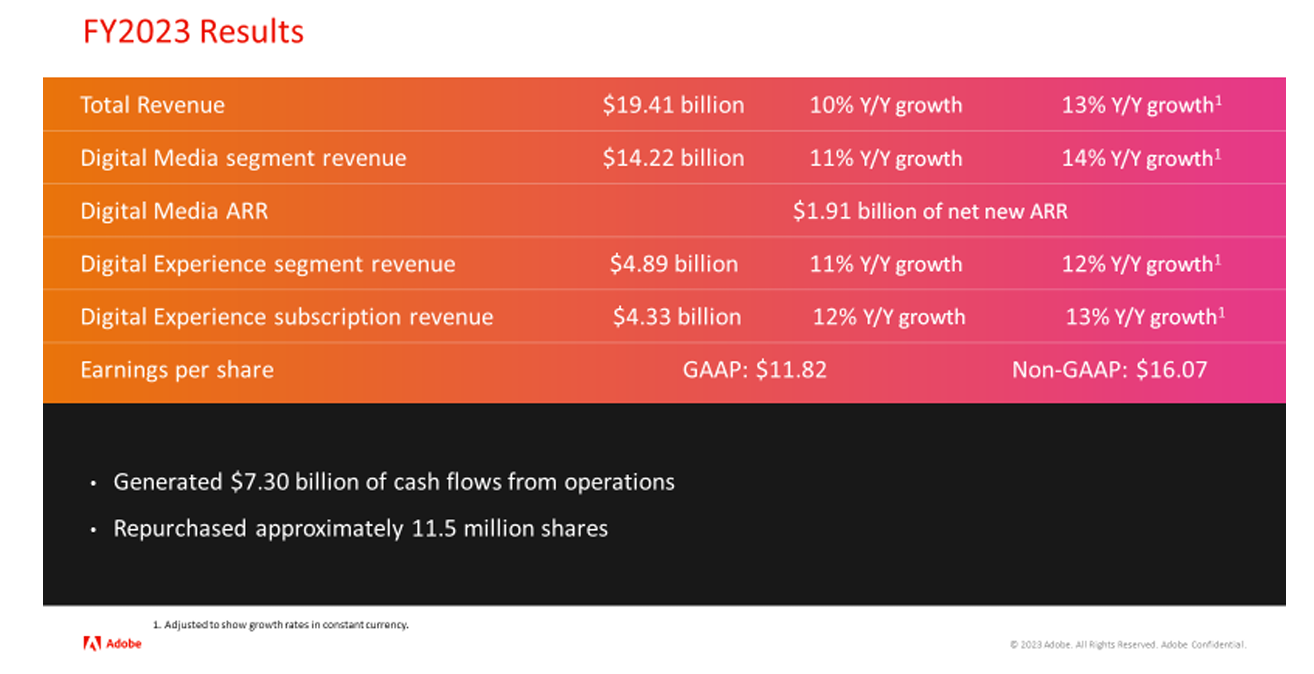

For fiscal 2023, Adobe reported revenue of $19.41 billion, up 10% from a year ago with net income of $5.43 billion, or $11.82 a share.

As for the outlook, Adobe is projecting fiscal 2024 revenue between $21.3 billion to $21.5 billion with non-GAAP earnings of $17.60 to $18 a share. For the first quarter, Adobe is projecting revenue of $5.1 billion to $5.15 billion with non-GAAP earnings of $4.35 a share to $4.40 a share.

Separately, Adobe said in an SEC filing that it could see "significant monetary costs or penalties" from a potential Federal Trade Commission resolution or defense. Here's what Adobe said in its filing:

"Since June 2022, we have been cooperating with the Federal Trade Commission (“FTCâ€) staff in response to a Civil Investigative Demand seeking information regarding our disclosure and subscription cancellation practices relative to the Restore Online Shoppers’ Confidence Act. In November 2023, the FTC staff asserted that they had the authority to enter into consent negotiations to determine if a settlement regarding their investigation of these issues could be reached. We believe our practices comply with the law and are currently engaging in discussion with FTC staff. The defense or resolution of this matter could involve significant monetary costs or penalties and could have a material impact on our financial results and operations."