Nvidia sees Q4 sales of $20 billion, up from $6.05 billion a year ago

Nvidia crushed third quarter estimates on the top and bottom lines as data center revenue was up 279% from a year ago. Nvidia also projected fourth-quarter revenue of $20 billion, up from $6.05 billion a year ago.

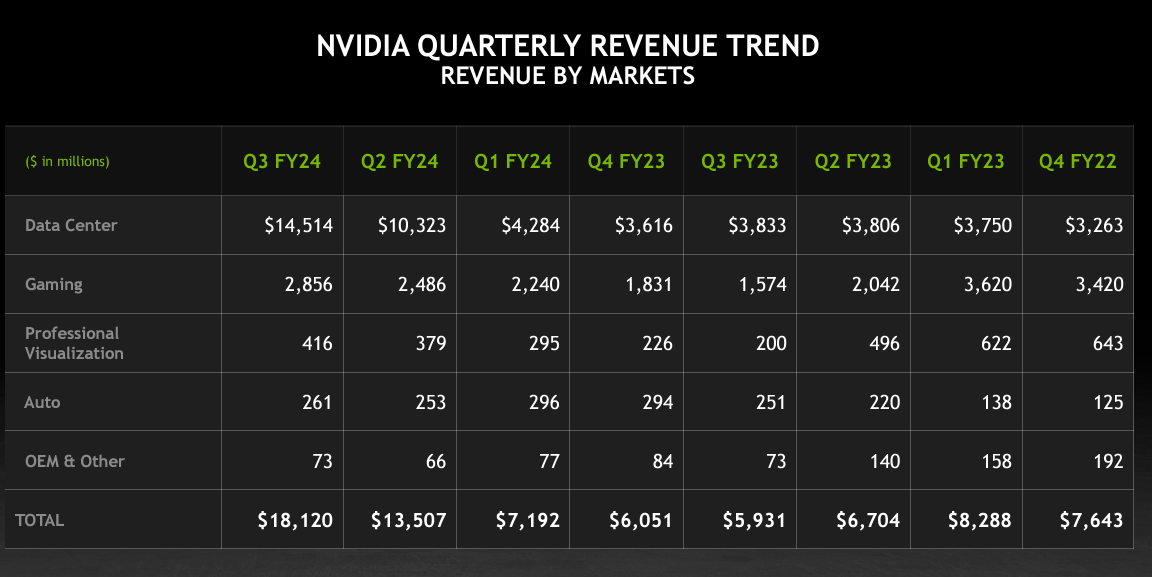

The company reported third quarter net income of $9.24 billion, or $3.71 a share, with revenue of $18.12 billion, up 206% from a year ago. Non-GAAP earnings were $4.02 a share.

Wall Street was expecting fiscal third quarter non-GAAP earnings of $3.37 a share on revenue of $16.18 billion.

In prepared remarks, Nvidia CFO Collette Kress said:

"Data Center revenue was a record, up 279% from a year ago and up 41% sequentially. Strong sales of the NVIDIA HGX platform were driven by global demand for the training and inferencing of large language models, recommendation engines, and generative AI applications.

"Strong sales of the NVIDIA HGX platform were driven by global demand for the training and inferencing of large language models, recommendation engines, and generative AI applications. Data Center compute grew 324% from a year ago and 38% sequentially, largely reflecting the strong ramp of our Hopper GPU architecture-based HGX platform from cloud service providers (CSPs), including GPU-specialized CSPs; consumer internet companies; and enterprises. Our sales of Ampere GPU architecture-based Data Center products were significant but declined sequentially, as we approach the tail end of this architecture."

CEO Jensen Huang said growth reflects the transition "from general-purpose to accelerated computing and generative AI." He said GPU, CPU, networking, and AI software are taking off.

As for the outlook, Nvidia said fourth quarter revenue will be $20 billion with GAAP gross margins of 74.5% (75.5% non-GAAP).

Kress also addressed Nvidia's China business and US trade restrictions on China. Nvidia's A100, A800, H100, H800, and L40S products will take a hit. Kress said:

"Our sales to China and other affected destinations, derived from products that are now subject to licensing requirements, have consistently contributed approximately 20-25% of Data Center revenue over the past few quarters. We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions."

Key recent developments:

- Nvidia launches H200 GPU, shipments Q2 2024

- Enterprises seeing savings, productivity gains from generative AI

- Nvidia, Foxconn aim to build AI factories, collaborate on EVs, robotics

- Nvidia has pricing power: Q2 results surge, projects Q3 revenue of $16 billion

- Why enterprises will want Nvidia competition soon

- Nvidia DGX Cloud now available on Oracle Cloud Infrastructure

- Nvidia fleshes out generative AI vision from PC, workstation to cloud

By the numbers:

- Data center revenue in the third quarter was $14.51 billion, up 279% from a year ago.

- Gaming revenue in the third quarter was $2.86 billion, up 81% from a year ago.

- Professional visualization revenue in the third quarter was $416 million, up 108% from a year ago.

- Automotive revenue in the third quarter was $261 million, up 3% from a year ago.

Constellation Research analyst Holger Mueller said:

"If you wanted to see the demand and growth for AI in a single vendor’s balance sheet – Nvidia is it. Even in the hypergrowth era of other parts of the tech industry, vendors have not seen that balance sheet expansion-- operating income, net income and diluted EPS being around 600% at a double billion revenue run rate that will end up closer to $100B for the FY, than $10B. And for a hardware business, with unseen profitability increases – we have almost double quarterly revenue at Nvidia YoY and cost is only up by 15%. That is an un-hardwarish number, that even software vendors do not deliver. And if you think that a few years ago the concern was that no cloud vendor was using Nvidia now it is 50% of data center revenue. The good news is that inference workloads on Nvidia are growing as well and that AI needs fast networking, so its networking business is on a 10B+ runrate. The concern is only export controls to China but that will not concern investors too much, as Nvidia will find buyers for the slotted chips easily. Except for the software revenue, that is at $1B run rate now, things look good for Jensen Huang an team. No more questions on bitcoin, gaming and automotive for now."

Key takeaways from the Nvidia earnings call:

- Kress said that cloud service providers drove roughly half of data center revenue. "Demand was strong from all hyperscale CSPs, as well as from a broadening set of GPU-specialized CSPs globally that are rapidly growing to address the new market opportunities in AI. We have significantly increased supply every quarter this year to meet strong demand and expect to continue to do so next year," she said.

- Many countries are investing in their own AI infrastructure to support economic growth and industrial policy. Nvidia is working with India, France and other countries in Europe.

- "Inference is contributing significantly to our data center demand, as AI is now in full production for deep learning, recommenders, chatbots, copilots and text to image generation and this is just the beginning," said Kress.

- SAP and Amdocs are the first customers of the NVIDIA AI foundry service on Microsoft Azure.

- Networking now exceeds a $10 billion annualized revenue run rate as data centers adopt InfiniBand.

- Data center growth can continue through 2025. Huang said:

"We believe the Data Center can grow through 2025. And there are, of course, several reasons for that. We are expanding our supply quite significantly. We have already one of the broadest and largest and most capable supply chain in the world. Now, remember, people think that the GPU is a chip. But the HGX H100, the Hopper HGX has 35,000 parts, it weighs 70 pounds. Eight of the chips are Hopper. The other 35,000 are not. It is -- even its passive components are incredible.

High voltage parts. High frequency parts. High current parts. It is a supercomputer, and therefore, the only way to test a supercomputer is with another supercomputer. Even the manufacturing of it is complicated, the testing of it is complicated, the shipping of it complicated and installation is complicated."

More: