Microsoft's Azure revenue growth picks up sequentially in Q1

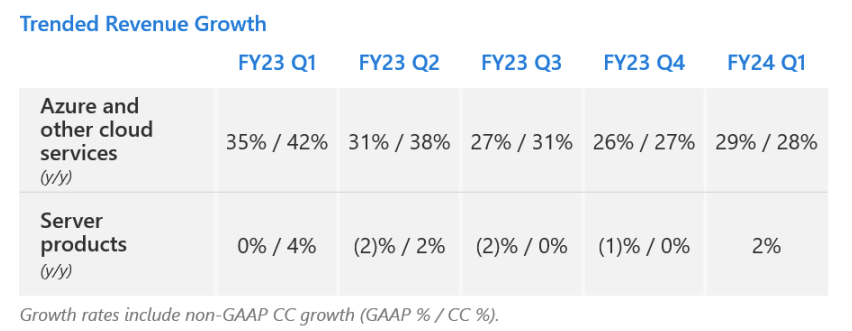

Microsoft reported better-than-expected fiscal first quarter results as its cloud services posted strong growth led by Azure revenue, which was up 29% from a year ago.

The cloud software giant reported first quarter earnings of $22.3 billion, or $2.99 a share, on revenue of $56.5 billion, up 13% from a year ago. Wall Street was expecting Microsoft to report first quarter earnings of $2.65 a share on revenue of $54.50 billion.

In a statement, CEO Satya Nadella said copilots "are making the age of AI real" for consumers and enterprises. CFO Amy Hood said Microsoft Cloud revenue of $31.8 billion, up 24% from a year ago, drove the quarter.

- Microsoft's Copilot enterprise upsell begins Nov. 1, Copilot fatigue will follow

- Microsoft Inspire: Microsoft 365 Copilot pricing, process mining, Meta and Epic partnerships

Those growth rates trumped Google Cloud growth for the September quarter. Microsoft Azure revenue growth accelerated in the first quarter from the fourth quarter.

Speaking on Microsoft's earnings conference call, Nadella said that Azure is gaining share due to OpenAI, model training and new infrastructure. He said:

"Azure again took share as organizations bring their workloads to our cloud. We have the most comprehensive cloud footprint with more than 60 data center regions worldwide, as well as the best AI infrastructure for both training and inference. And we also have our AI services deployed in more regions than any other cloud provider. This quarter, we announced the general availability of our next-generation H100 virtual machines."

Nadella added that 40% of the Fortune 100 is in preview with Microsoft's copilots.

Hood said Microsoft Cloud gross margins will remain flat with a year ago, but the company continues to invest heavily in cloud infrastructure. She gave the following guidance:

- Productivity and Business Processes second quarter revenue will grow between 11% and 12%.

- Office 365 revenue growth will be up 16% in the second quarter.

- Intelligent Cloud revenue in the second quarter will grow between 17% and 18% or $25.1 billion to $25.4 billion. "Revenue will continue to be driven by Azure, which as a reminder can have quarterly variability, primarily from our per-user business and from in-period revenue recognition, depending on the mix of contracts," said Hood. "In Azure, we expect revenue growth to be 26% to 27% in constant currency, with an increasing contribution from AI. Growth continues to be driven by Azure consumption business and we expect the trends from Q1 to continue into Q2. Our per user business should continue to benefit from Microsoft 365 suite momentum, though we expect continued moderation in seat growth rates, given the size of the installed base."

- PC units for Windows appear to have stabilized.

By the numbers:

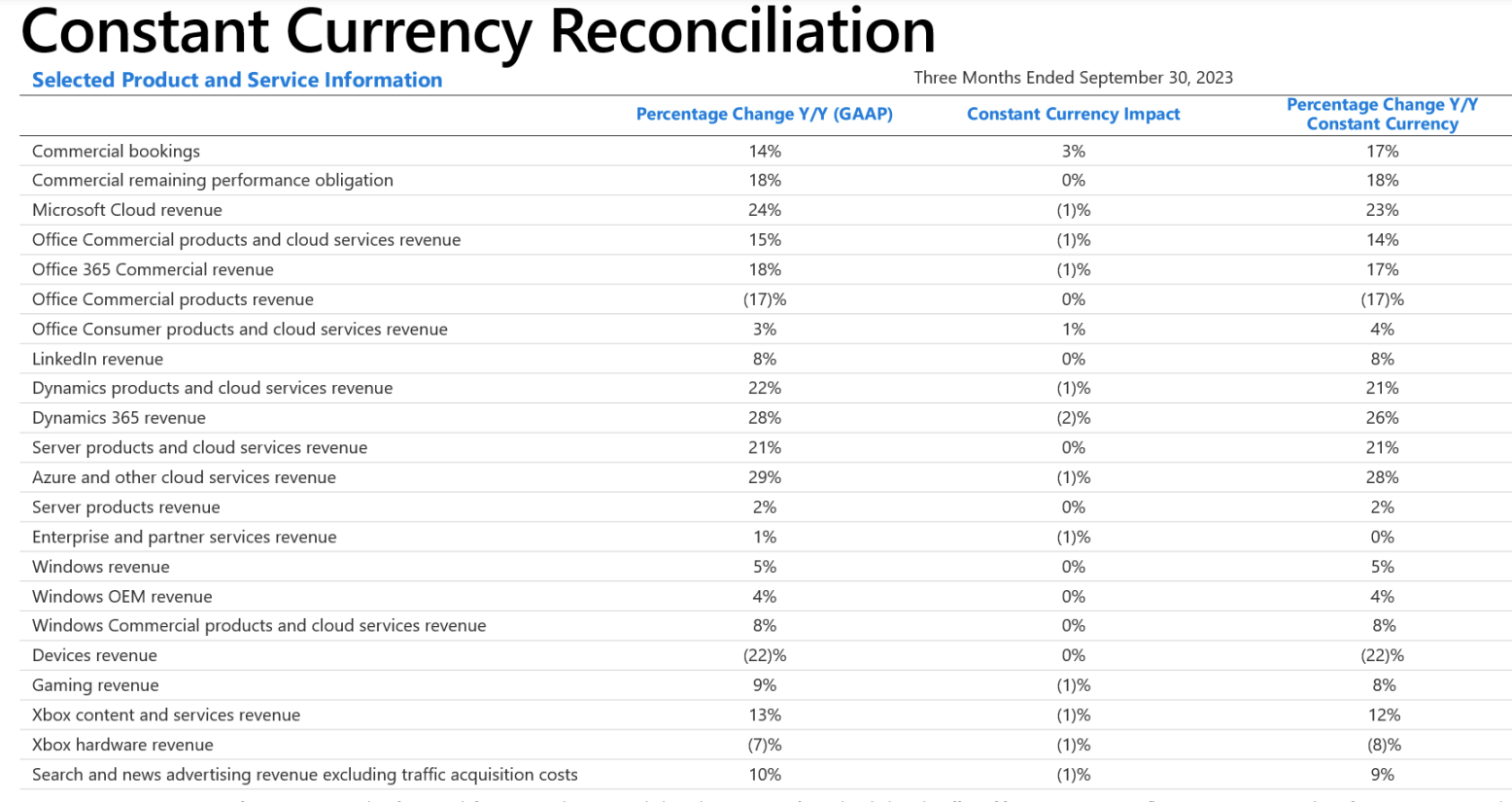

- Office Commercial products and cloud services revenue was up 15% fueled by Office 365. Office Consumer revenue growth in the first quarter was up 3%.

- LinkedIn revenue was up 8% in the first quarter.

- Devices revenue fell 22%.

- Windows revenue was up 5% for the quarter.

Here's the full growth lineup by product line.