Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

<br>Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…

Read more

Cloud hell may have just frozen over as Oracle and Google Cloud outlined a partnership that gives enterprises an option to combine Oracle Cloud Infrastructure and Google Cloud.

For any enterprise technology veteran who remembers Oracle and Google duking it out in court over Android and Java, the partnership is almost like a trip through bizarro world. Oracle also has a similar partnership with Microsoft Azure. To that end, OpenAI is also now buying capacity from Oracle via the OCI and Azure tie-up.

Simply put, Oracle Cloud has nailed being an efficient cost-effective infrastructure and has aligned up with all the large players not named Amazon Web Services (AWS). Should a similar deal be cut with AWS and OCI hell will really freeze over. Oracle CTO Larry Ellison jabs at AWS as much as he did SAP back in the day.

Nevertheless, Ellison wouldn't rule out a AWS partnership either.

"Customers are using multiple clouds not only infrastructure clouds, but they might have Salesforce applications or Workday applications or they use multiple cloud clouds in their in their business right now. We think that these are all the clouds become interconnected. We are thrilled we have that connection with Microsoft and the same thing with Google Cloud. We'd love to do the same thing with AWS.

We think we should be interconnected to everybody. And that's what we're attempting to do within our multi cloud strategy. I think that's what customers want. I'm optimistic that that's the way the world will settle out. We'll get rid of these fees for moving data from cloud, the cloud. And all the clouds will be interconnected."

Here are the details of the Oracle and Google Cloud tie-up followed by the OpenAI deal and the not-too-surprising strong cloud results.

Google Cloud and OCI

Google Cloud's Cross-Cloud Interconnect will be initially available in 11 global regions so customers can deploy general purpose workloads without data transfer charges. Later in 2024, the companies said Oracle Database @ Google Cloud will be available with the database, network, feature and pricing at OCI.

Ellison said the deal with Google Cloud is good for joint customers. Sundar Pichai, CEO of Google and Alphabet said the partnership will combine Oracle's database and applications with its AI layer.

Oracle Database @ Google Cloud would give customers direct access to OCI database services deployed in Google Cloud data centers. That combination would enable Vertex AI and Gemini from Google Cloud to be leveraged without latency. For Google Cloud, the Oracle partnership can embed its AI services into more enterprises. Customer references cited by Google Cloud for AI adoption include Bayer, Best Buy, Discover Financial and TD Bank to name a few. Also see what Equifax and Wayfair have done with Google Cloud.

Google Cloud Next 2024: Google Cloud aims to be data, AI platform of choice | Google Cloud Next: The role of genAI agents, enterprise use cases

The two companies said they will jointly sell Oracle Database @ Google, provide support and a unified experience and then provide a bevy of services to mix and match.

Australia East (Sydney), Australia Southeast (Melbourne), Brazil East (São Paulo), Canada Southeast (Montreal), Germany Central (Frankfurt), India West (Mumbai), Japan East (Tokyo), Singapore, Spain Central (Madrid), UK South (London), and US East (Ashburn) are the regions that will initially launch.

Constellation Research analyst Holger Mueller said the Google Cloud and Oracle partnership makes sense.

"When something works, tech vendors copy the playbook: In this case it is the Oracle / Microsoft partnership that allows to run OracleDB @ Azure from the Azure console. Now the same gets repeated for Google Cloud. This is great news for enterprises, and good for Google Cloud and Oracle. And it makes it harder for cloud databases to compete with Oracle for building Next Generation Applications."

Other details about the Google Cloud and OCI partnership include:

- In 11 regions, customers can move data across Google Cloud and Oracle.

- Joint customers will be able to access and deploy Exadata and Autonomous Database later this year through Google Cloud.

- Customers can bring their licenses and get access to support.

- If you use your GCP commitment to consume extra data, OCI will credit you toward support costs.

- Field teams are aligned.

- Oracle services across the board will be used in Google Cloud including Oracle apps.

- The two clouds will be available in one console.

- Interconnects will be up to 100 gigabit per second.

- Google customers can take their license and deploy on Google Cloud if self managed.

- Pricing parity will be available on both clouds.

Oracle CEO Safra Catz said the Google Cloud deal highlights broader traction and the ability to integrate applications as well as cloud infrastructure.

"A very large enterprise tech company signed a contract in Q4 for over $600 million where we will be helping them transform their operations with Fusion to enable them to become more agile, faster, growing and more profitable. We will replace out many of our competitors products."

OpenAI buys OCI capacity

OpenAI will use OCI for additional capacity in a partnership with Microsoft Azure and Oracle. Microsoft is already using OCI for additional workloads.

"We are delighted to be working with Microsoft and Oracle. OCI will extend Azure's platform and enable OpenAI to continue to scale," said Sam Altman, OpenAI CEO, in a statement.

OpenAI needs all the capacity it can get. The company is scaling fast, constant training models and needs to serve 100 million monthly users with its ChatGPT services.

Ellison said Oracle ramped up the Azure partnership in the fourth quarter with 11 of the 23 planned OCI datacenters inside Azure going live.

Ellison outlined some of the OpenAI partnership details.

"We're building a very large data center with lots of Nvidia chips. The new Nvidia chips and new Nvidia interconnect liquid cooled. These are primarily for training. The training goes beyond languages because they're neural networks trained with not just language but math and masses of images as well. That's a very different problem than answering a question posed by someone. Everyone that's big is going to be training their models on imaging. That's a huge amount of additional data and training and we're right in the middle of it."

The Google Cloud, OpenAI deal trump earnings miss

Oracle also reported fourth-quarter earnings that missed expectations. The company reported fourth-quarter earnings of $1.11 a share on revenue of $14.3 billion, up 3% from a year ago. Non-GAAP earnings were $1.63 a share.

Wall Street expected fourth quarter earnings of $1.65 a share on revenue of $14.57 billion.

Cloud revenue in the fourth quarter was $5.3 billion, which missed estimates of $5.45 billion. Nevertheless, cloud infrastructure revenue in the fourth quarter was up 42% from a year ago. Cloud application revenue was $3.3 billion, up 10%.

For fiscal 2024, Oracle delivered net income of $10.5 billion, or $3.71 a share on revenue of $53 billion.

Oracle CEO Catz said the company "signed the largest sales contracts in our history—driven by enormous demand for training AI large language models in the Oracle Cloud." Remaining performance obligations exiting the fourth quarter was $98 billion, up 44% from a year ago. She did note that currency fluctuation continues to be a wild card to results.

In fiscal 2025, Catz said Oracle will continue to gain workloads. "I also expect that each successive quarter should grow faster than the previous quarter—as OCI capacity begins to catch up with demand," said Catz. "In Q4 alone, Oracle signed over 30 AI sales contracts totaling more than $12.5 billion—including one with Open AI to train ChatGPT in the Oracle Cloud."

AWS, Microsoft Azure, Google Cloud battle about to get chippy

"Customer conversations are now absolutely only focused on our cloud services," said Catz. "It is all about our comprehensive, highly differentiated and secure cloud offering. Customers have progressed from their initial curiosity about Oracle Cloud into full blown rollout."

Catz said that OCI consumption revenue would have been higher if it weren't for supply side constraints.

"As on-premise databases migrate to the cloud, either to OCI directly or using database Azure or Google Cloud. we expect these cloud database services will be that third leg of revenue growth alongside OCI," she said.

Other items:

- Oracle won't break out Cerner's impact. Catz would typically give guidance that excluded Cerner.

- As for the outlook, Catz said OCI capacity will meet demand and boost revenue each quarter in fiscal 2025.

- OCI will grow faster in fiscal 2025 than the 50% this year.

- Capital expenditures will double in fiscal 2025.

- Oracle will hone its outlook going forward in October at Oracle World.

- Revenue in the first quarter will grow 6% to 8%.

- Total cloud revenue will be 21% to 23% in the first quarter.

- Non-GAAP EPS is expected to grow between 11% to 15% and be between $1.33 and $1.37.

What's next? Bigger and smaller OCI data centers

Ellison said OCI's integrated stack is uniquely suited for AI. "When you charge by the minute, faster also means less expensive. OCI trains large language models several times faster and at a fraction of the cost of other clouds," he said. "The operating system and the database are fully autonomous."

Ellison said Oracle also occupies less space with OCI and that's why it can park infrastructure in Azure and Google Cloud facilities. He said:

"We talked for a while about our ability to build very small data centers when needed. Virtually any one of our customers could choose to have the full Oracle Cloud in their data center. We can start very small."

Ellison, however, noted that Oracle will also go big. He said:

"We're now bringing 200 megawatt data centers online. We are literally building the smallest most portable, most affordable cloud data centers, all the way up to 200 megawatt data centers, ideal for training very large language model and keeping them up to date. This AI race is gonna go on for a long time. It's not a matter of getting ahead in AI, but you also have to keep your model current. And that's going to take larger and larger data centers. Some of the data centers we have that we're planning are absolutely even bigger."

More on genAI dynamics:

Data to Decisions

Tech Optimization

Innovation & Product-led Growth

Future of Work

Next-Generation Customer Experience

Digital Safety, Privacy & Cybersecurity

Oracle

Big Data

SaaS

PaaS

IaaS

Cloud

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

CCaaS

UCaaS

Collaboration

Enterprise Service

AI

GenerativeAI

ML

Machine Learning

LLMs

Agentic AI

Analytics

Automation

Chief Information Officer

Chief Technology Officer

Chief Information Security Officer

Chief Data Officer

Chief Executive Officer

Chief AI Officer

Chief Analytics Officer

Chief Product Officer

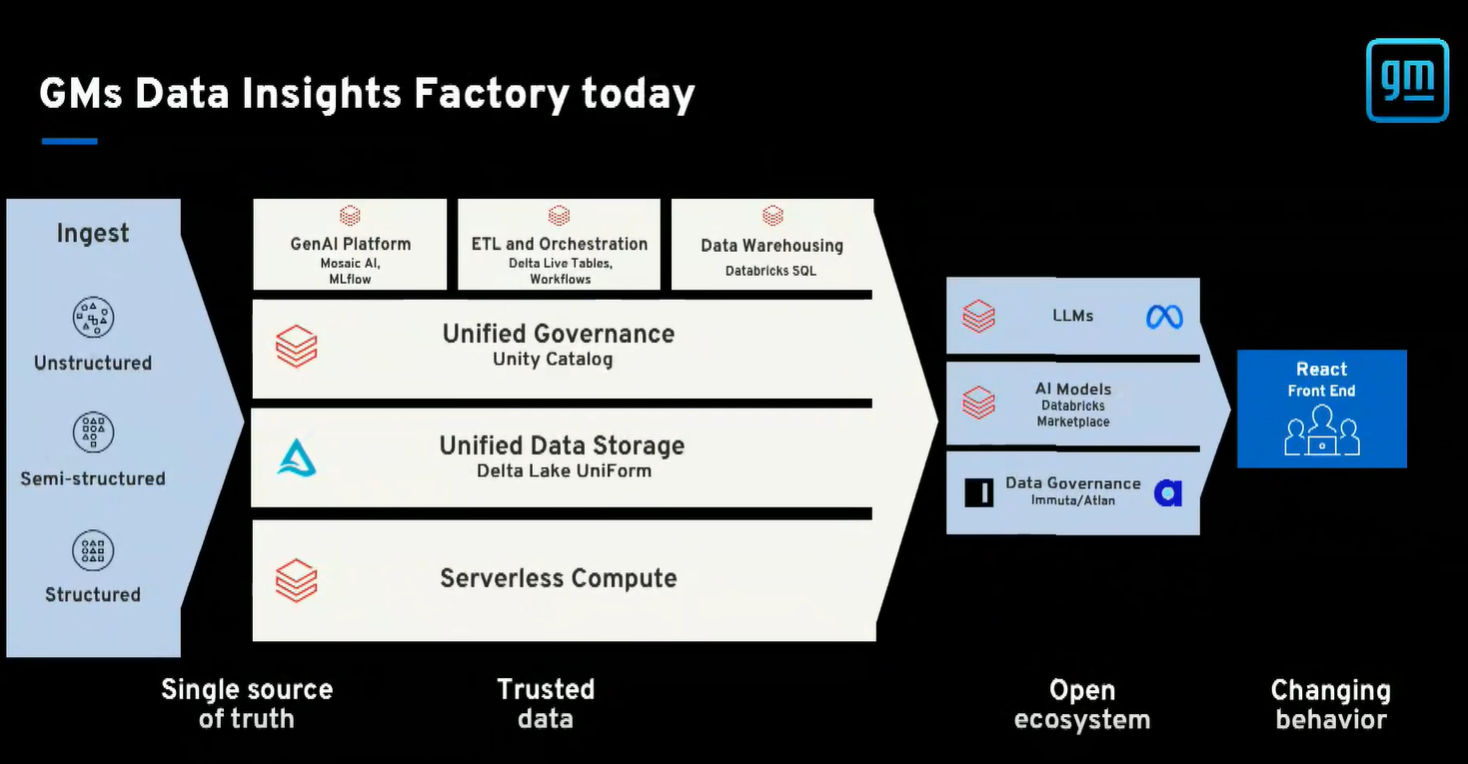

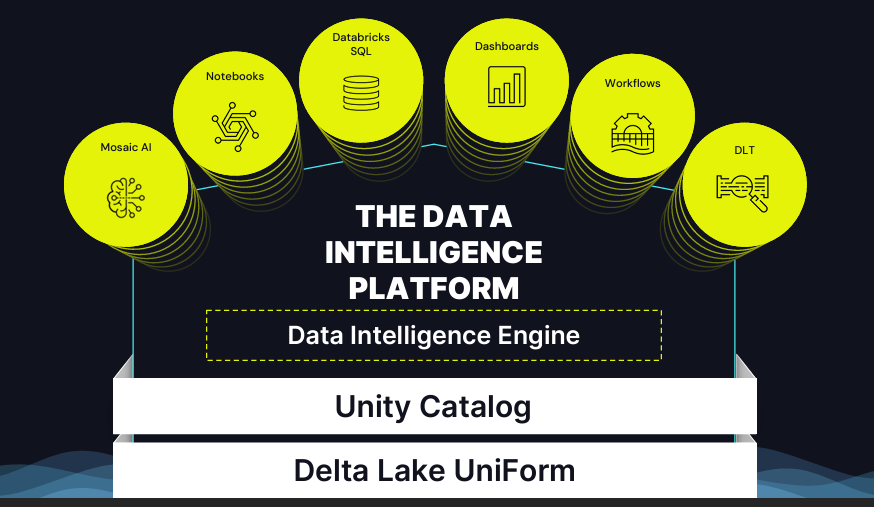

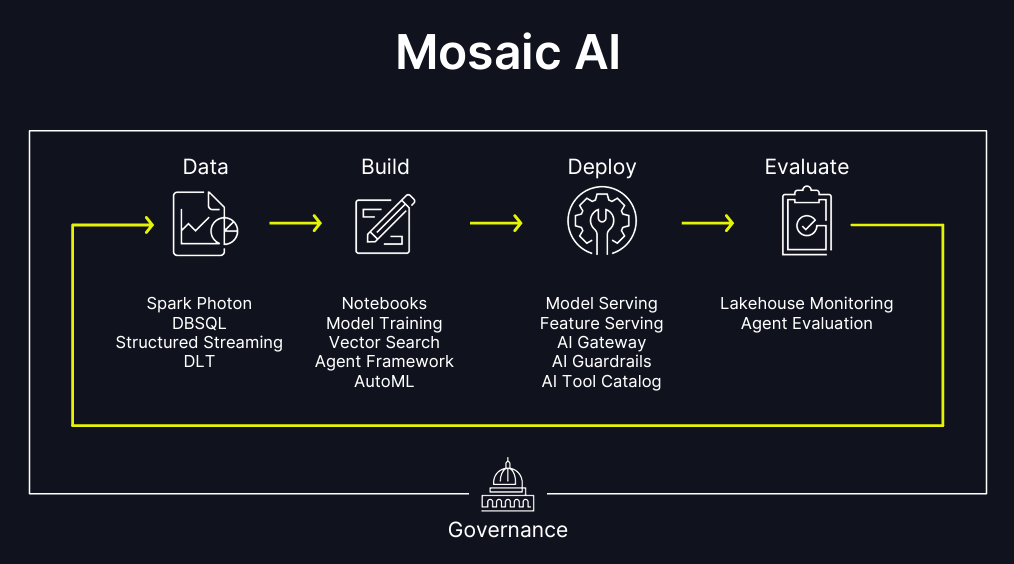

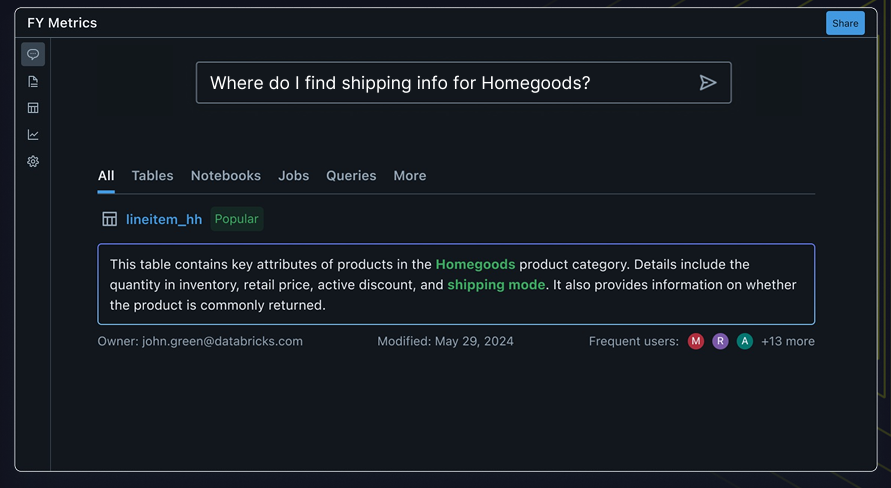

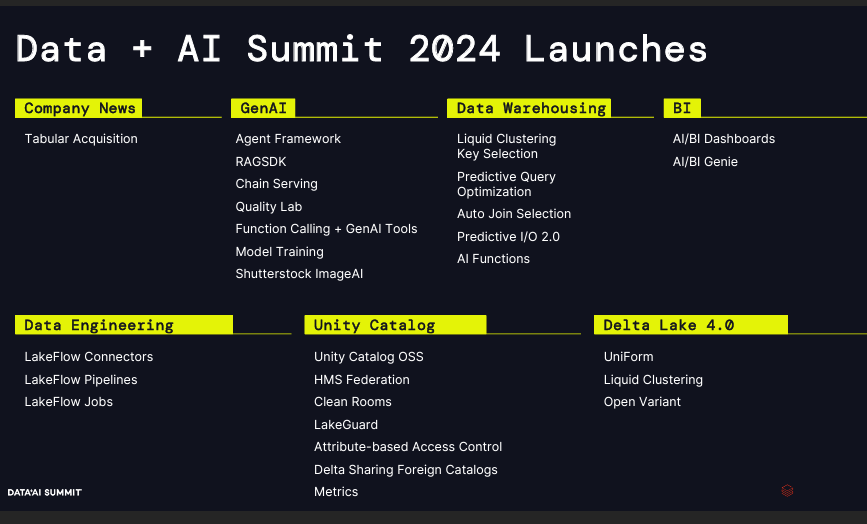

During a keynote, Databricks CEO Ali Ghodsi said data and AI is converging. "In the last 18 months, every CEO from a Fortune 500 company or small company I've talked with thinks that data and AI is going to be super strategic for them over the next five years. They think that that's how they're going to win," said Ghodsi. "That's going to be the main differentiating factor whether it's the financial sector, retail, media, healthcare or in the public sector. Doesn't matter, all of it. It's going to be data and AI."

During a keynote, Databricks CEO Ali Ghodsi said data and AI is converging. "In the last 18 months, every CEO from a Fortune 500 company or small company I've talked with thinks that data and AI is going to be super strategic for them over the next five years. They think that that's how they're going to win," said Ghodsi. "That's going to be the main differentiating factor whether it's the financial sector, retail, media, healthcare or in the public sector. Doesn't matter, all of it. It's going to be data and AI."

Access Bank is a Nigerian multinational commercial bank that started in corporate banking before expanding into personal and business banking in 2012. The company, which has more than 28,000 employees, features more than 700 branches and service outlets across 21 countries and serves more than 65 million customers. The bank is one of Africa's largest retail banks.

Access Bank is a Nigerian multinational commercial bank that started in corporate banking before expanding into personal and business banking in 2012. The company, which has more than 28,000 employees, features more than 700 branches and service outlets across 21 countries and serves more than 65 million customers. The bank is one of Africa's largest retail banks. Voice Biometrics, Conversational IVR, Video Banking, Call Back assist, Auto QM, Real time Speech Analytics, Microsoft Dynamics CRM integration with Avaya as Agent Interface, Enhanced Reporting, Dashboards and Gamification. The stack was chosen to revamp IVR to make it easier to use, and to give agents real-time information and speech analytics for context on customer issues.

Voice Biometrics, Conversational IVR, Video Banking, Call Back assist, Auto QM, Real time Speech Analytics, Microsoft Dynamics CRM integration with Avaya as Agent Interface, Enhanced Reporting, Dashboards and Gamification. The stack was chosen to revamp IVR to make it easier to use, and to give agents real-time information and speech analytics for context on customer issues.