Financial services firms see genAI use cases leading to efficiency boom

Generative AI use cases are proliferating in financial services to illustrate a trend that's a bit counterintuitive--heavily regulated industries appear to be better set up for artificial intelligence because they have their data and controls in order.

Goldman Sachs CEO David Solomon said he's bullish on generative AI as an investment and financing theme as well as for internal operations. Solomon turned up at Google Cloud Next keynote and then followed up on the bank's first quarter earnings call. Goldman Sachs CIO Marco Argenti outlined the firm’s AI thoughts nearly a year ago. Solomon noted:

"For our own operations, we have a leading team of engineers dedicated to exploring and applying machine learning and artificial intelligence applications. We are focused on enhancing productivity, particularly for our developers, and increasing operating efficiency while maintaining a high bar for quality, security, and controls."

JPMorgan Chase CEO Jamie Dimon also spent a lot of space in his shareholder letter on genAI. The company has more than 400 use cases in production. "We're also exploring the potential that genAI can unlock across a range of domains, most notably in software engineering, customer service and operations, as well as in general employee productivity," said Dimon.

What's interesting about genAI use cases is that the regulated industries can move ahead other industries. Why? Regulated industries already have the data best practices and controls required for generative AI deployments. That case was made by AWS' Matt Wood, VP of AI, in a recent meetup.

This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

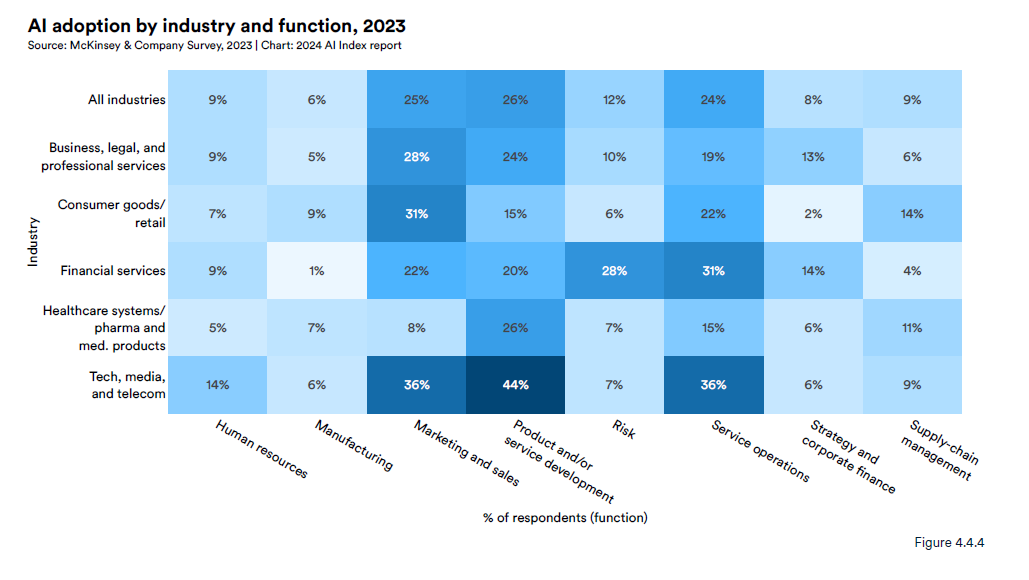

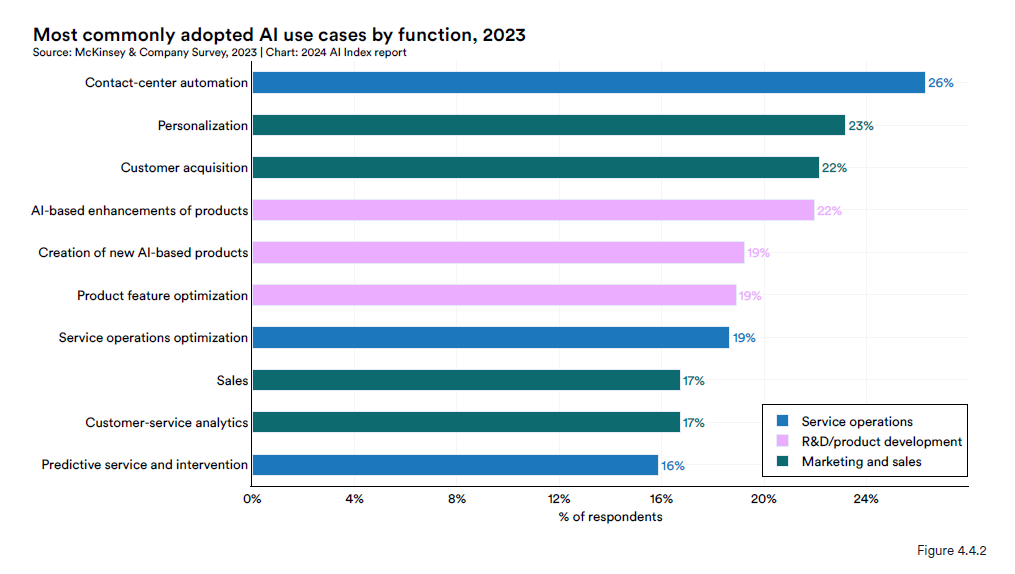

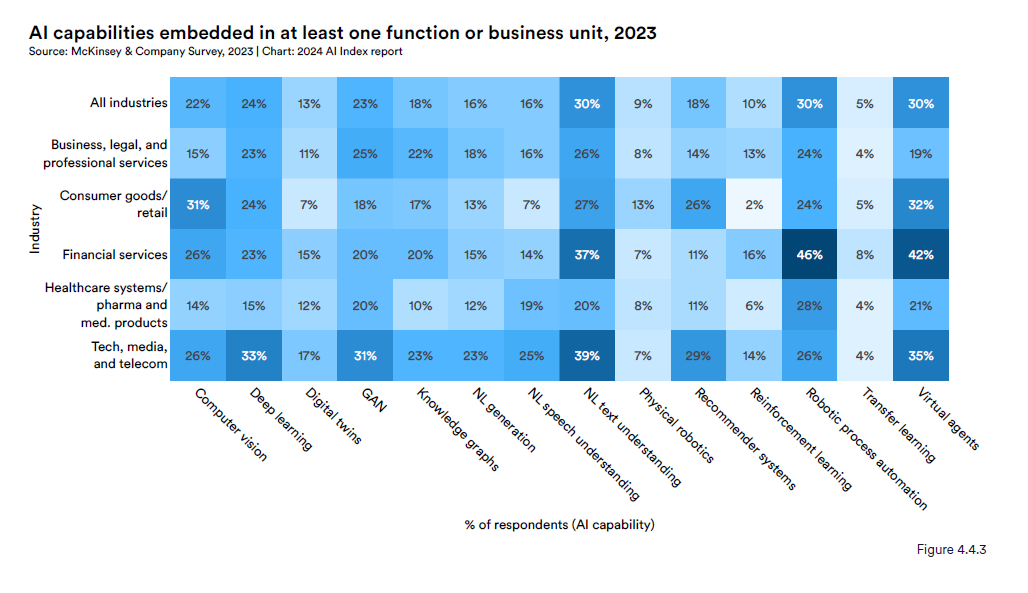

Data from the Stanford University's 2024 AI Index Report highlights how financial services is a standout when it comes to embedding AI into the business. Citing McKinsey data, the AI Index Report highlights how financial services stick out. Here's a few charts to ponder.

At Google Cloud Next, Bernd Leukert, Chief Technology, Data and Innovation Officer at Deutsche Bank, and KeyBank CIO Dean Kontul put a few anecdotes around the use case data. They outlined the use cases being deployed. Kontul noted that 2023 was more about banks navigating interest rates than generative AI. But 2024 features genAI as more of a priority.

Leukert and Kontul said generative AI is a technology where enterprises can't afford to wait because the technology will change business. "I think you have to pick your spot on the hype curve and look at what it can do for operational efficiency," said Kontul. "You have to control for costs, but generative AI use case is going to be real, tangible expense takeouts and eventually remove customer friction so there will be use cases around revenue as well."

Other realities driving use cases for generative AI include:

- High-end sponsorship internally. CEOs want genAI and that top-down support will move proofs of concept to production.

- There's an intersection of process improvement and automation and generative AI.

- GenAI projects will require an ongoing conversation with employees about their roles in the future, how to upskill and reskill and remain with enterprises in different capacities. Leukert said his bank "introduced as a principle that genAI is augmenting human capabilities, not replacing the human."

"There is so much acceleration of movement with generative AI," said Leukert.

Here's a look at some of the use cases highlighted by big banks in recent days.

Document processing to execution workflows. Leukert said generative AI's promise is that it can take thousands of documents coming from customers, process them and then take actions.

Any use case that can be deployed once and then scaled horizontally. Leukert said Deutsche Bank looked at that document processing use case and then noted that it was applicable across multiple services. "We reached out to the business and said let's collect use cases and cluster them into categories and then say if it works in that category for that type of a theme, then we know it is possible to be applicable across multiple application areas across multiple themes in that category," he said.

Business re-engineering. Kontul said genAI will transform business, so it makes sense to think beyond individual use cases. Efficiency is the initial target as genAI can make marketing, software, documentation and code development more efficient. "GenAI will touch every employee in some way at the bank and will do it in a more intuitive way than other technologies in the past," said Kontul.

Risk management. Leukert said generative AI is enabling the bank to be a stronger adviser in times of crisis and better manage risks. For instance, Deutsche Bank has been pouring data into its risk management to better manage liquidity demand during crises (Covid-19, Russia's war with Ukraine) and model next moves. "We think that banks need to manage risks at a much more detailed level than they have in the past to be prepared for the unknown," said Leukert.

Research and data collection. Leukert said content management is a primary use case especially for Deutsche Bank Research, which provides research reports to customers. For analysts, 80% of the work is data collection and 20% is digesting and building the report. Generative AI can now automate much of the data collection and build content to be turned into a report.

Compliance. Kontul said KeyBank has a pilot using genAI to keep apprised of all regulatory changes across states that affect the bank's products.

Engineering productivity. Kontul and Leukert both said their banks were pursuing genAI for coding and engineering productivity. Developer productivity also has the attention of the big players such as Goldman Sachs and JPMorgan Chase.