General Motors needs to fix its software issues quickly

This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

General Motors has software development problems, and the company is facing a brand risk unless it can get its code, user experience and delivery right.

Yes, GM is an automaker and a profitable one, but its future model depends on software prowess. For the fourth quarter, GM reported net income of $2.1 billion on revenue of $43 billion, roughly flat with a year ago. That profit came amid a strike and a reset for its electric vehicle plans.

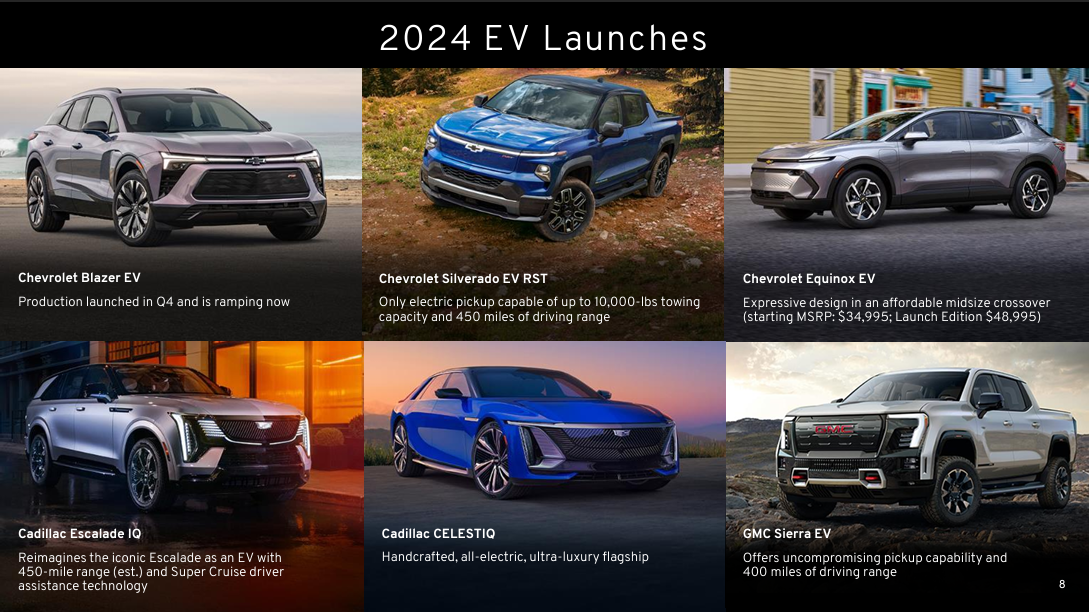

However, GM CEO Mary Barra spent a good chunk of the company's software woes. First, GM had to stop selling its Blazer EV due to software glitches. Edmunds review of the 2024 Blazer EV was brutal with 23 fault codes that didn't turn up on the dashboard. GM plans a software update to fix the issues.

In addition, GM's Cruise autonomous vehicle investment is at risk. GM owns 80% of Cruise. In October, Cruise had to pause driverless operations to "examine our processes, systems, and tools and improve how we operate." In October, Cruise vehicles were involved in two accidents. Cruise issued a voluntary software recall and issued an update that should fix issues.

After two high-profile software failures, Barra had to address the software issues in her shareholder letter and earnings conference call. This won't be the first time an automaker has to talk about software issues. Ford recently recalled F-150 Lightning EV trucks over software issues.

Regarding GM's Blaze software issue, Barra said:

"We disappointed these customers, and we know it. We are determined to get the software right and we will. We have made several organizational and process improvements that will help us deliver the best possible customer experience going forward. Among several important organizational realignments, we established a software quality division within the software and services team that has been performing a retrospective on the Blazer EV and has improved the current software development and test processes across the enterprise. Outcomes of this activity are getting applied to all programs going forward and they include improved standardization of the software development and release process, increased focus on test automation at the vehicle level, and additional quality gates and metrics for software at the vehicle level."

On the Cruise incidents, Barra said the 2024 investment plan revolves around being more deliberate and slowing the cash burn rate as it stabilizes its software efforts.

Barra said:

"We've already begun to implement significant changes to build a better Cruise. We are committed to earning back trust with our regulators and the public through our actions. Our plan for 2024 investment in Cruise reflects our more deliberate and cadence go-to-market strategy and we are developing new financial targets and a new roadmap. Spending will be down considerably this year, but we will continue to invest in the people who are advancing the software, specialized hardware, and AI capabilities. This reflects our commitment to our vision, which is to deliver the safety benefits of self-driving technology and a scalable, profitable business."

Simply put, GM seems to understand that it needs to hone its software game if it's going to transition its business model. As a result, GM will push its investor day until later in the year. "This will give our software team the time to focus on software for our upcoming launches, and we will be able to share more tangible proof points on all four pillars of our strategy, ICE, EV, AV, and software," said Barra. "When we do get together, we will show you what we've done, not just tell you what we're going to do. In the meantime, we've already provided a roadmap for EV profitability in 2025, and we'll share updates on Cruise as we finalize the technology and relaunch plans."

It remains to be seen if GM can fix its software issues before 2024 ends. A few thoughts:

- Automakers are at risk of losing customer experience to Apple and Google with CarPlay and Android Auto, respectively.

- A transition to EVs will mean autos are basically data centers on wheels. Software will be the primary technology driving customer experience.

- However, automakers lack the consumer-facing application development experience. There's a reason a company like Tesla can deliver a better software experience than incumbents and even the EV giant can struggle.

- User expectations for vehicle systems are higher.

- And finally, GM will have to change its culture to improve its application development. It has moved to simplify its offerings, but large companies like GM don't turn on a dime. The pressure is on GM to improve software before the risk to its brand grows.

From our underwriter

Commercial generative AI use cases are promising, but CXOs at the Hitachi Vantara Exchange in New York note there's a lot of work ahead--data management, privacy and training models--to scale. Here's a look at the key takeaways on the use cases that can drive transformation from Hitachi Vantara Exchange in New York.