SAP acquires WalkMe for $1.5 billion

SAP said it will acquire WalkMe in a deal valued at $1.5 billion in a move that could make implementations easier and complement its process and workflow automation efforts.

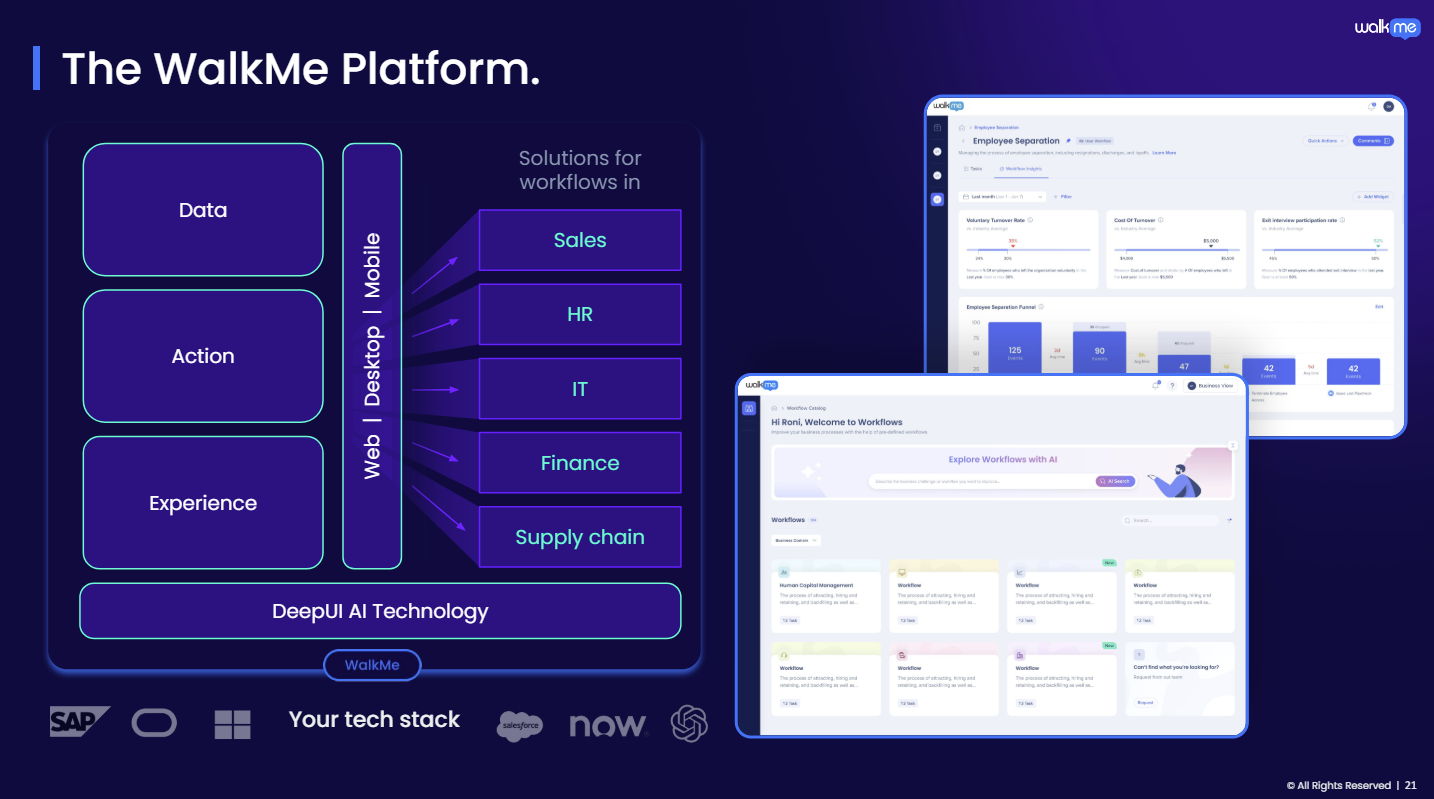

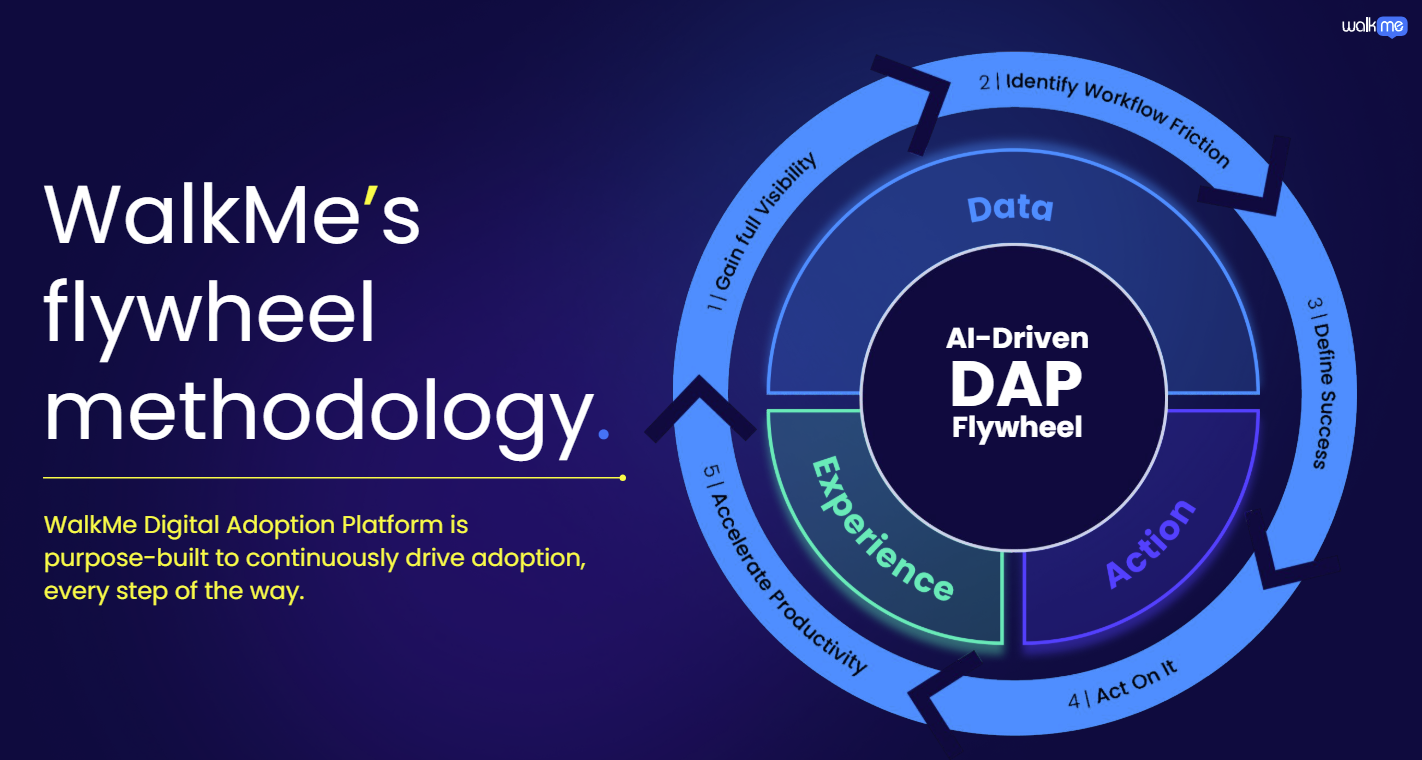

Announced at SAP Sapphire, SAP's purchase of WalkMe gives it a "Digital Adoption Platform," which aims to give employees and customers the ability to navigate applications, websites and apps to accomplish tasks and processes. These autonomous experiences from WalkMe can come in handy as SAP rolls out Joule copilots throughout its stack.

SAP said that it will pay $14 per share in cash to WalkMe shareholders, which will get a 45% premium.

SAP Sapphire 2024: SAP’s Joule everywhere plan: ‘We are not developing AI just for the sake of AIâ€

According to SAP, the plan is to meld WalkMe's technology into SAP's Business Transformation Management portfolio, which includes process mining and automation tools in SAP Signavio and SAP LeanIX. With better process automation, SAP can boost engagement and make its customer implementations smoother.

Christian Klein, CEO of SAP, said "we are doubling down on the support we provide our end users, helping them to quickly adopt new solutions and features to get the maximum value out of their IT investments."

SAP's Q1: Net loss on restructuring, cloud revenue growth of 24% | Constellation ShortListâ„¢ Digital Adoption Platforms | WalkMe in 2023: Adoption as Table Stakes in Digital Experience

SAP will stand to benefit if its customers derive more value. As Constellation Research analyst Holger Mueller noted, SAP only had one customer reference during its keynote at Sapphire. SAP's AI ambitions depend on migrating customers to cloud, S/4HANA

WalkMe CEO Dan Adika said his company can leverage SAP's ecosystem to drive more value. WalkMe will continue to support non-SAP applications. WalkMe launched WalkMeX, a copilot that would bring context and automation to any workflow. That copilot would be integrated with Joule.

The deal is expected to close in the third quarter and be immaterial to SAP's earnings results. WalkMe reported its first quarter revenue of $68.6 million and had 42 customers with $1 million in ARR.

Adika said on WalkMe's first quarter earnings call:

"I'm very proud to introduce WalkMeX. WalkMe’s new Gen AI contextual copilot. It's a completely new experience for the employee in the enterprise. WalkMeX allowed them to use Gen AI capabilities in the flow of work on top of any workflows. We combine the power of general purpose LLMs with our proprietary DPY technology that understand visual interface like a human does, and we created a new kind of copilot, and always on copilot that offers proactive AI assistant contextually in the flow of work. We're basically making AI real for everyone."

WalkMe Chief Revenue Officer Scott Little had noted that the company was seeing strong attach rates with systems integrators that were using the company's technology for change management. Little said:

"Remember, we are attached to their change management, business. That's where we get, that's where we get involved. They come in and do a big change program in support of an SAP, HANA update or an update for Oracle, an update for Workday, then, it's that group that comes in and brings us to the table. So, the more we see those coming down, the more we see those involving an opportunity for us to include WalkMeX. It's just going to accelerate for us."

If successful, WalkMe could make SAP's RISE program more seamless. Constellation Research’s BT150 CXOs have gripes about SAP’s RISE program. Some of the feedback:

- One CIO asked the group for opinions on SAP's RISE program and being forced from on-premises to the cloud. The goal was to have a strategy for SAP in place by the end of the year.

- CXOs weren't thrilled about SAP RISE and items like licensing credits for legacy environments. A CIO wondered what would prevent a customer from moving away from SAP--especially since the enterprise operates in a space that doesn't garner investment from the enterprise software giant.

- SAP's RISE program is viewed as an exercise in financial engineering more than something that benefits customers.

Our BT150 CXOs aren't alone. SAP's German speaking user group takes aim at cloud contracts, BTP and more | SAP user group DSAG rips S/4HANA innovation plans, maintenance increases | SAP retools for generative AI, cuts 8,000 jobs, sets 2024, 2025 ambition

My take

Overall, the WalkMe purchase has a good risk-reward profile for SAP. For starters, the price for WalkMe is a pittance to SAP, which is looking to make it as easy as possible for customers to move to the cloud and S/4HANA. WalkMe also complements SAP's process excellence portfolio.

It's also a safe bet that WalkMe's digital adoption platform could get a big boost from SAP's ecosystem even if all it does is focus on in-house applications. However, WalkMe will continue to support non-SAP applications. The jury is out on how that support will evolve over time.

Nevertheless, it only takes a few slides from WalkMe's investor presentations to see the rationale for SAP's acquisition.

Speaking at SAP Sapphire in Orlando, CEO Christian Klein had a few missions. First, Klein had to convince customers that its Business AI innovations were worth the upgrades and more than hype. Second, Klein wanted to ensure that SAP wasn't just doing AI because everyone else is. And third, Klein had to get its customer base more excited about programs like RISE with SAP and upgrading to S4/HANA and cloud.

Speaking at SAP Sapphire in Orlando, CEO Christian Klein had a few missions. First, Klein had to convince customers that its Business AI innovations were worth the upgrades and more than hype. Second, Klein wanted to ensure that SAP wasn't just doing AI because everyone else is. And third, Klein had to get its customer base more excited about programs like RISE with SAP and upgrading to S4/HANA and cloud.