Nutanix winning deals vs. VMware, but Broadcom punching back with pricing

Nutanix is learning that larger deals--including the wins from Broadcom's VMware--take longer to nail down and implement due to CXO approvals and Broadcom discounting when business is at stake. Nevertheless, Nutanix appears to have the tools required to win in the trenches vs. VMware.

The company's third quarter financial results and comments from Nutanix CEO Rajiv Ramaswami didn't often address VMware. But it's clear VMware was the elephant in the room. Ramaswami noted that Nutanix won an eight-figure deal with a North American Fortune 50 financial services company. It also won a North American Fortune 500 consumer packaged goods company.

Nutanix product additions, partnerships designed to capitalize on VMware customer angst | What VMware customers are doing through the lens of Nutanix

Ramaswami said:

"This customer, whose data center footprint has historically been split between Nutanix and a competitor was looking to standardize their automation and self-service capabilities on a single platform.

Going forward, this customer plans on swapping out the competitive software in their existing footprint and also utilizing Nutanix cloud platform for all of their expansion needs. We see these wins as a testament to our ability to both land significantly and expand within the largest companies. And we are encouraged by the substantial increase in the number of customers and partners engaging with us, including some of the world's largest companies.

However, these larger opportunities tend to have longer sales cycles, can involve aggressive competitive responses and exhibit great availability with respect to timing and outcome."

Translation: Nutanix is winning VMware customers, but don't expect the wins to be quick or easy.

Nutanix reported a fiscal third quarter net loss of $15.6 million, or 6 cents a share, on revenue of $524.6 million, up 17% from a year ago. Non-GAAP earnings were 28 cents a share. Wall Street was looking for third quarter earnings of 17 cents a share.

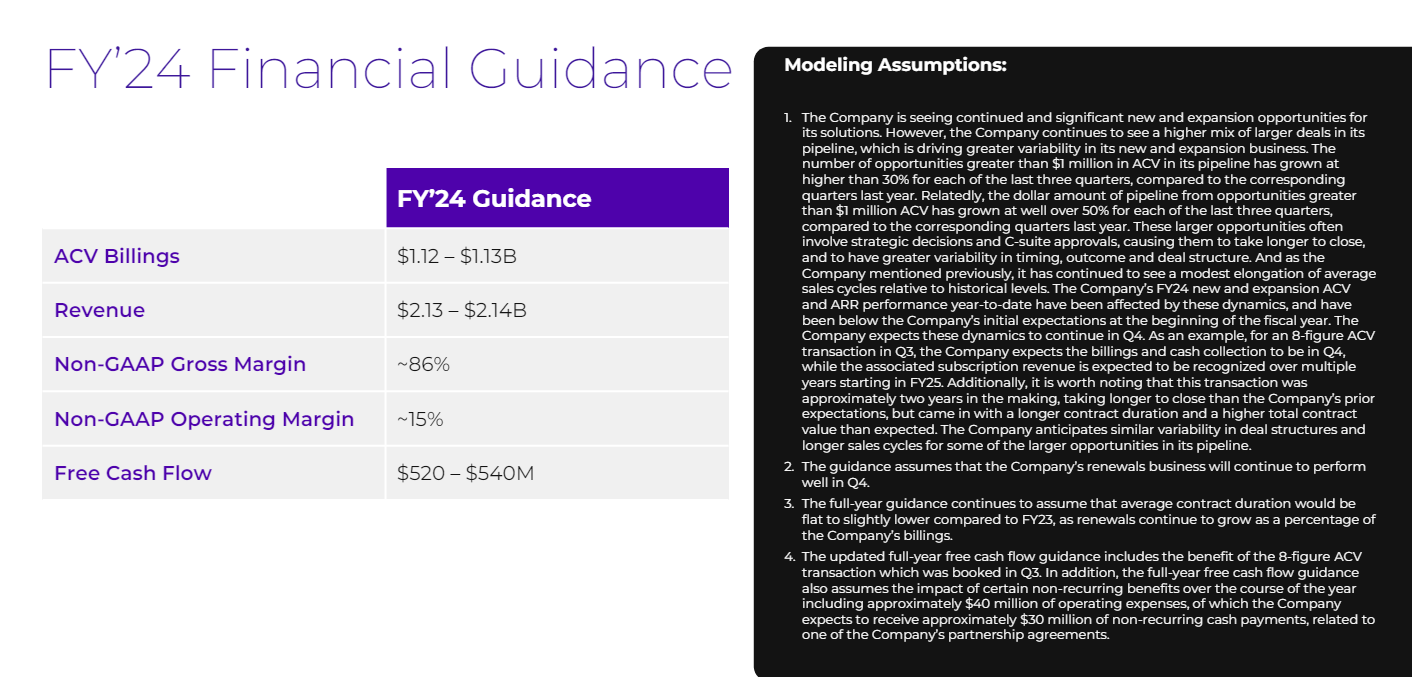

As for the outlook, Nutanix projected fourth-quarter revenue of $540 million to $540 million. For the fourth quarter, analysts were modeling earnings of 16 cents a share on revenue of $548.12 million. For the fiscal year, Nutanix projected revenue of $2.13 billion to $2.14 billion.

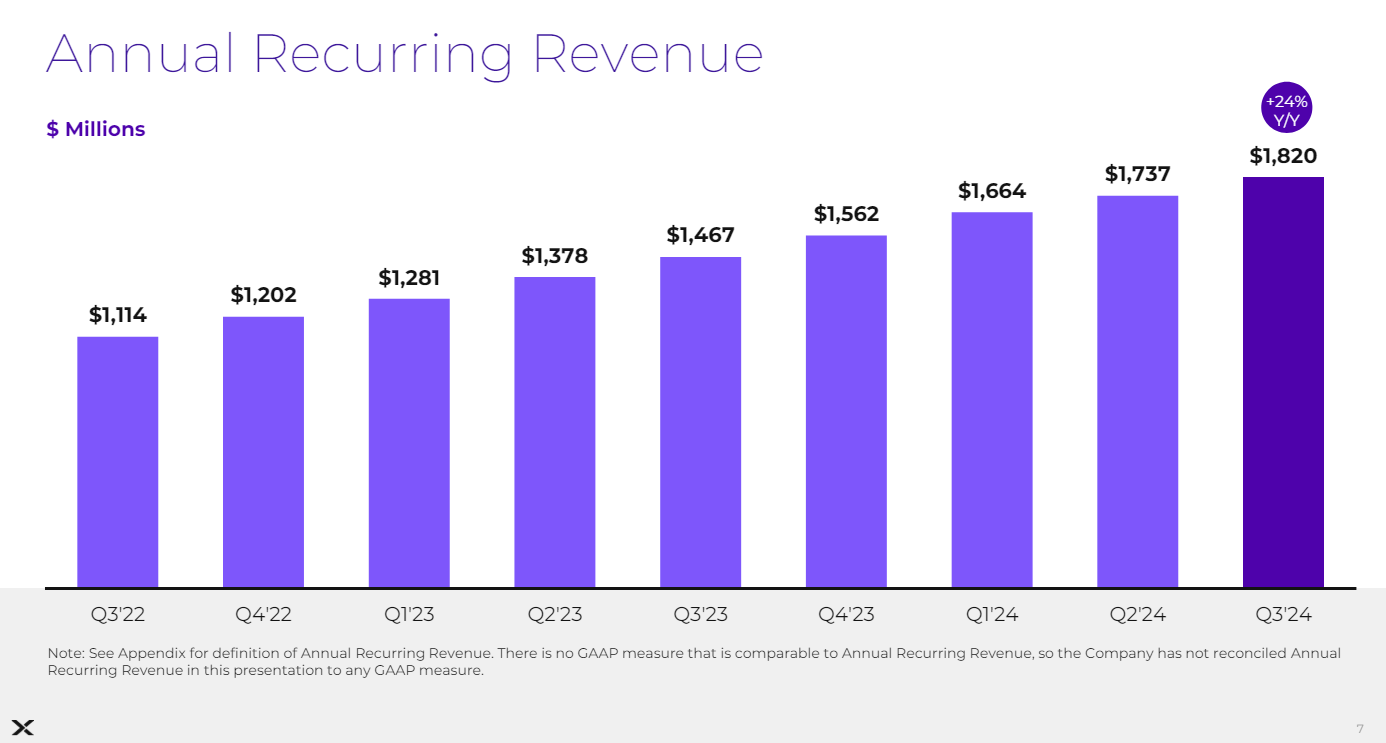

Nutanix said its annual recurring revenue (ARR) in the third quarter was $1.82 billion, up 24% from a year ago.

The results come a week after Nutanix launched a series of products to make it easier for enterprises to adopt generative AI. The most notable announcement from Nutanix .NEXT was a partnership with Dell Technologies. Nutanix will be sold via Dell Technologies hyper-converged systems later this year. Nutanix already has a big partnership with Cisco.

The battle

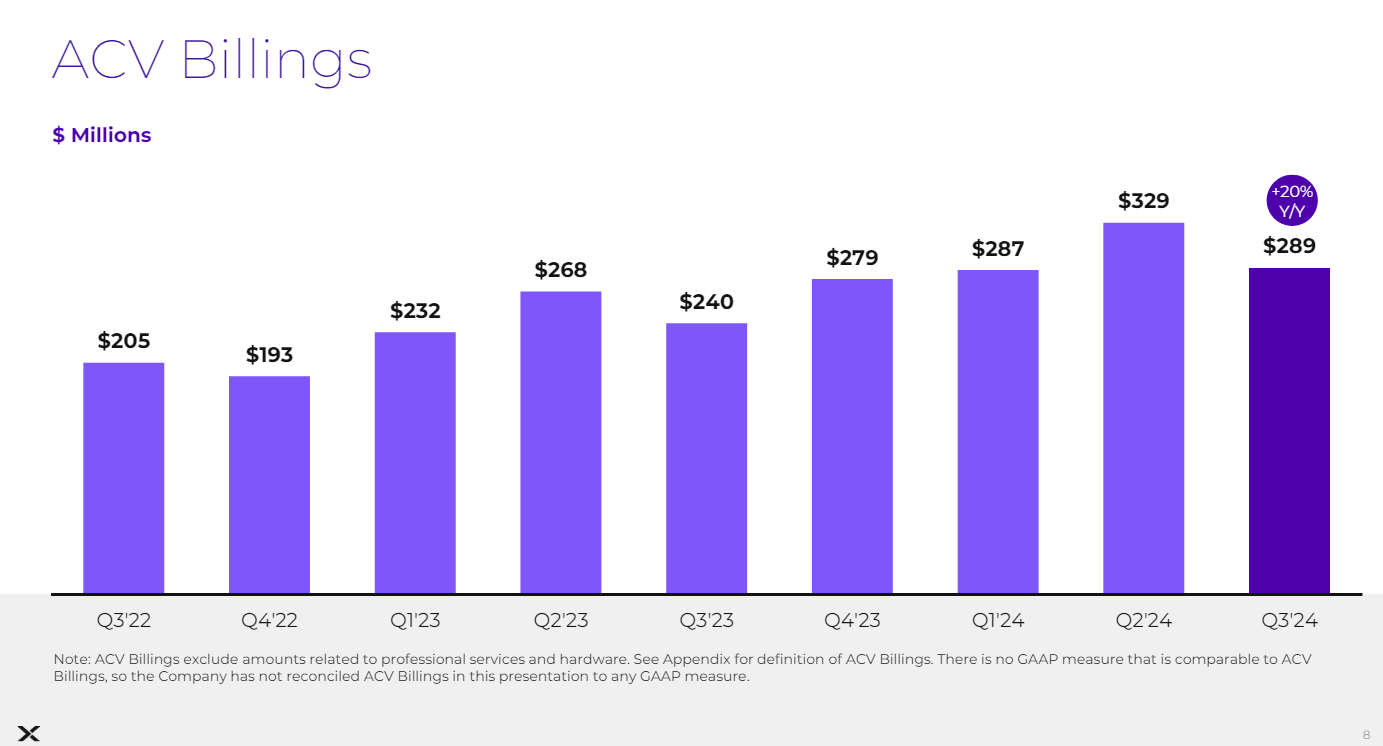

Nutanix CFO Rukmini Sivaraman said the company continues to see "continued and significant new and expansion opportunities" as well as opportunities greater than $1 million in ACV.

The problem? "These larger opportunities often involve strategic decisions and C-suite approvals, causing them to take longer to close and to have greater variability in timing, outcome and deal structure," said Sivaraman. "And as we mentioned previously, we have continued to see a modest elongation of average sales cycles relative to historical levels."

For instance, that eight-figure deal landed in the quarter will have billings and cash collection in the fourth quarter with subscription revenue recognized in fiscal 2025 and beyond. That deal also took two years to land.

Ramaswami said Nutanix has deals that take longer to close, but interest from enterprises and partners is surging. Nutanix is now more strategic as a vendor.

The battle with VMware will take a while. Ramaswami noted that VMware customers have signed multiple year deals before the Broadcom purchase. The installed base also requires a hardware refresh. And VMware will cut prices to keep customers.

Ramaswami noted:

"We've seen Broadcom display a lot of flexibility with respect to their pricing, they are packaging changes, especially when they are faced with the probability of losing some of their larger customers are responding to push back from the market and from the customer base."

The short version: Broadcom has raised VMware's prices in many respects, but will discount heavily if large customers are at risk.

"The situation with respect to what Broadcom is doing is also evolving rapidly. They've tried a bunch of things. They're stepping back on some of the things that they've tried. Of course, for the competitive situation, this is quite dynamic on that front."

The timeline since Broadcom closed its VMware purchase features a good bit of turmoil.

- May 6. Broadcom addresses concerns about VMware Cloud on AWS.

- April 15. Broadcom CEO Tan says VMware customers can get support extensions amid subscription transition.

- March 14. Tan recaps first 100 days of VMware purchase, noted that "this level of change has understandably created some unease among our customers and partners."

- Feb. 14. VMware acknowledges that changes have been rough on customers, but a long blog post could be classified as mansplaining.

- Dec. 11: VMware outlined product rationalization and subscription plan.

My take

This Nutanix vs. VMware battle will go on for years for all of the reasons stated above. The other reality is that migrations take years. If you want a crystal ball into how this will play out for VMware it's worth looking at an example of Broadcom's purchase of CA. CA is a smaller mainframe software provider, but the Broadcom playbook is roughly the same.

I caught up with a CIO this week to chat about a migration away from mainframes. Initially, I thought the migration would be about better access to data, modernization and prepping for generative AI applications. But the migration was really driven by Broadcom’s CA unit squeezing more revenue out of this large enterprise.

In negotiations with CA, it became clear that costs were going to go higher to manage legacy infrastructure. Costs were going to go high enough that it made sense to leave mainframes entirely because there are only so many options to choose from (CA, BMC, IBM).

Sound familiar VMware customers? Today, enterprise buyers are noticing the Broadcom software playbook because VMware is more visible. Turns out all we had to do was look at CA’s approach post Broadcom acquisition to know what would happen.

VMware customers are seeing more options as they evaluate their next moves, but these migrations take time. Rimini Street said it will offer support to VMware customers and Nutanix launched a series of updates that add up to poaching VMware customers.