Big Idea: ESG Solutions Address the Impending ESG Imperative

Managing the Shift From Shareholder Capitalism to Stakeholder Capitalism

In 2015 all 193 United Nations (UN) member states adopted the 2030 Agenda for Sustainable Development—a framework that “provides a shared blueprint for peace and prosperity for people and the planet, now and into the future.” One milestone was a collection of 17 Sustainable Development Goals (SDGs) designed to fight and end all forms of poverty, inequality, and climate change. The intent was for all countries—from the poorest to the richest—to take action, protect the planet, and promote economic prosperity while ending poverty. Each country was expected to participate, with national frameworks and review at the global level. Although these SDGs are not legally binding, many activist investors have decided to incorporate the goals in their reporting requirements, and many organizations have begun efforts to shift corporate social responsibility (CSR) programs into ESG programs.

With the 193 UN member states all creating their own frameworks and thousands of asset managers and investors applying their own unique approach, the overall ESG efforts require a level of standards definition, data collection, data harmonization, and reporting. This, in turn, has created massive opportunities for technology providers and system integrators able to develop solutions to address these challenges.

An onslaught of massive regulations expected by governments around the world has added to this complexity, creating two massive markets—one for ESG metrics reporting and a bigger one for ESG enablement and solutions.

Constellation forecasts that the market size for ESG metrics reporting will be 1.425 billion by 2026, with a compound annual growth rate (CAGR) of 17.3%. Constellation expects that the ESG enablement and solutions market for the same period will reach well over $2.216 trillion. Constellation breaks down these software offerings and solutions into the three ESG buckets: environment, social, and governance.

Environment

Social

Governance

Twenty Business Trends Prioritized By Business Impact And Organizational Adoption

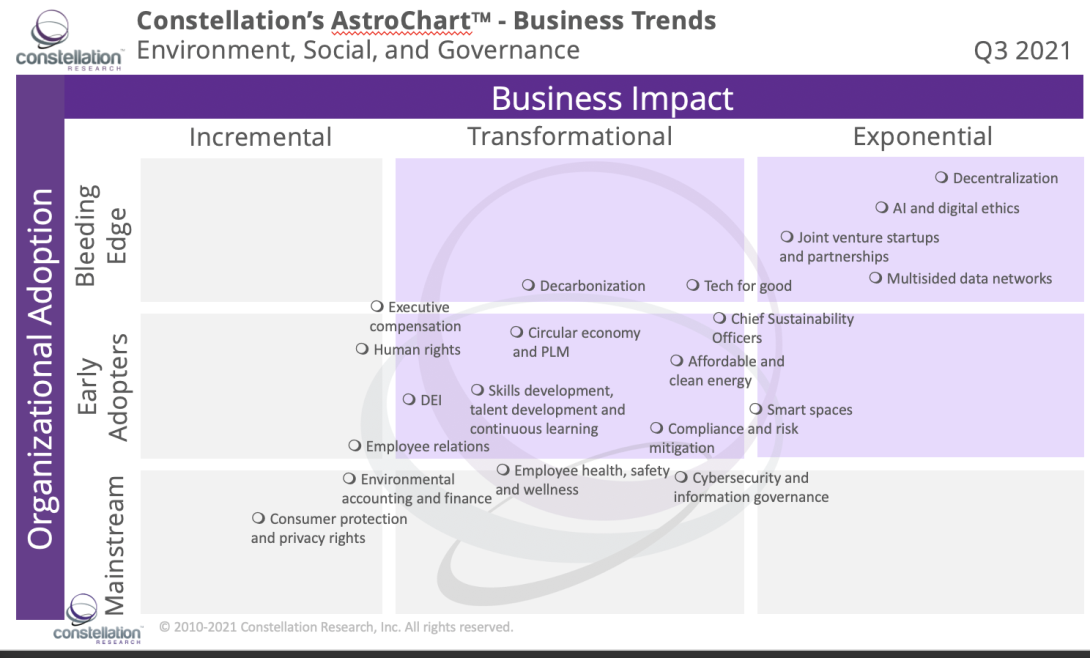

From extreme weather to privacy, cybersecurity threats to regulatory pressure, and demographic shifts to changing social norms, the ESG market has never been so dynamic or so volatile. Board-level members must navigate rising pressure from investors and asset managers along with the hodgepodge of complexity from a deluge of regulatory requirements. Consequently, new initiatives for achieving ESGs present an opportunity for improving regulatory compliance, operational efficiency, revenue growth, market differentiation, and impact on the organization’s brand.

The latest Constellation AstroChartä identifies 20 significant business trends and ranks them by business impact and organizational adoption (see Figure 1)

Figure 1. . Constellation’s AstroChart: Trends in ESGs Show Business Impact and Organizational Adoption

Source: Constellation Research, Inc.

The full report can be found on the Constellation Research website.