Former Vice President and Principal Analyst

Constellation Research

Doug Henschen is former Vice President and Principal Analyst where he focused on data-driven decision making. Henschen’s Data-to-Decisions research examines how organizations employ data analysis to reimagine their business models and gain a deeper understanding of their customers. Henschen's research acknowledges the fact that innovative applications of data analysis requires a multi-disciplinary approach starting with information and orchestration technologies, continuing through business intelligence, data-visualization, and analytics, and moving into NoSQL and big-data analysis, third-party data enrichment, and decision-management technologies.

Insight-driven business models are of interest to the entire C-suite, but most particularly chief executive officers, chief digital officers…

Read more

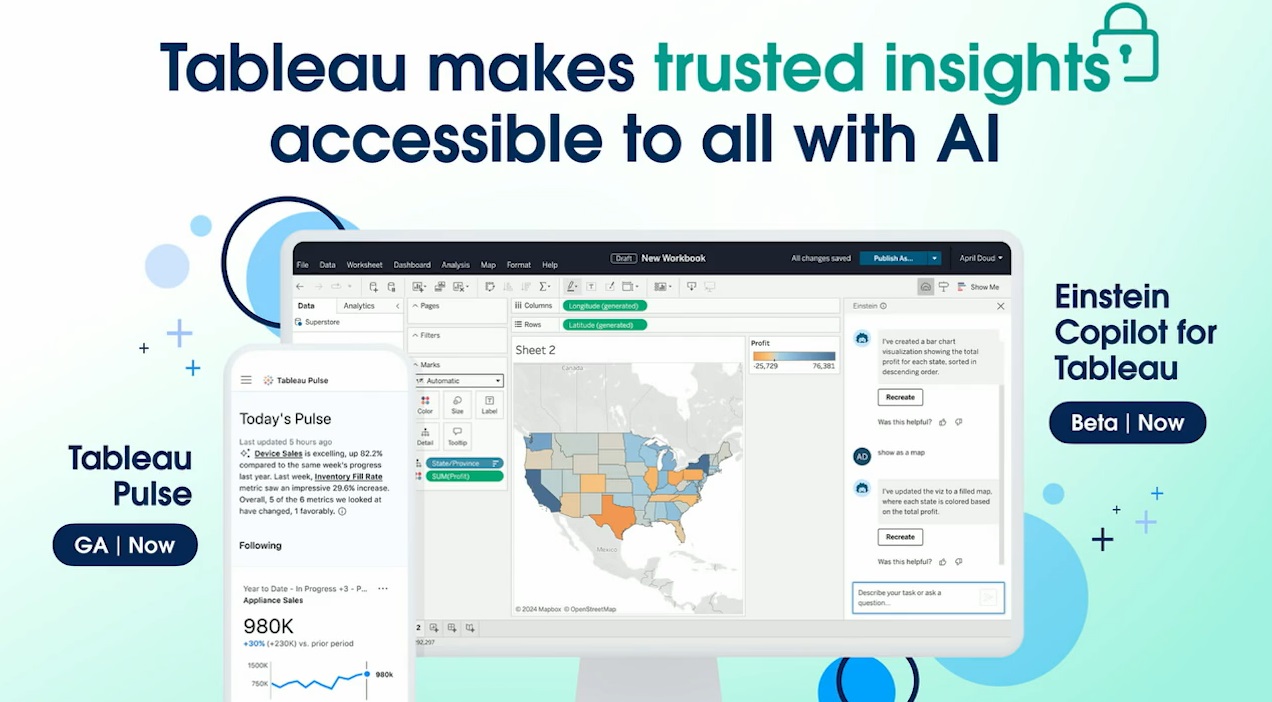

Tableau Conference highlights Pulse and Einstein Copilot. Execs outline 'next wave' advances including cloud-scale data, agile semantics, actionable insights, and composable assets.

What will the next wave of analytics and business intelligence (BI) bring? Tableau used its annual conference 2024, held April 29-May 1 in San Diego, to present its vision and to get feedback from the nearly 9,000 customers in attendance.

Tableau Conference (TC) 2024 was a flashback, in many ways, to annual events from the vendor's independent days. In fact, there was a deliberate effort to tone down the Salesforceification of Tableau. The Salesforce mascots were gone from the keynote stage, and so, too, were prominent signs of Salesforce branding and the overt Salesforce sales pitches shared at last year’s event. Instead, the Tableau brand and “DataFam†took the spotlight, and Tableau Visionaries and Tableau Ambassadors helped to whip up the crowd for annual TC rituals from Devs on Stage to the IronViz competition.

The Announcements

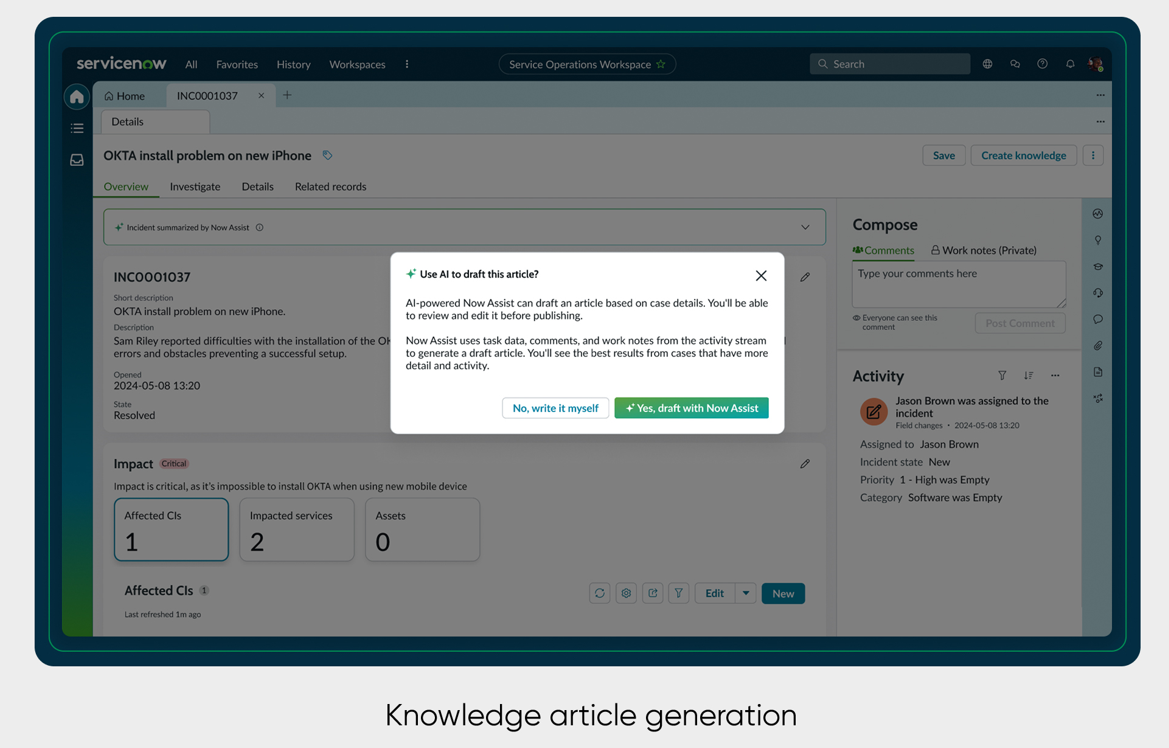

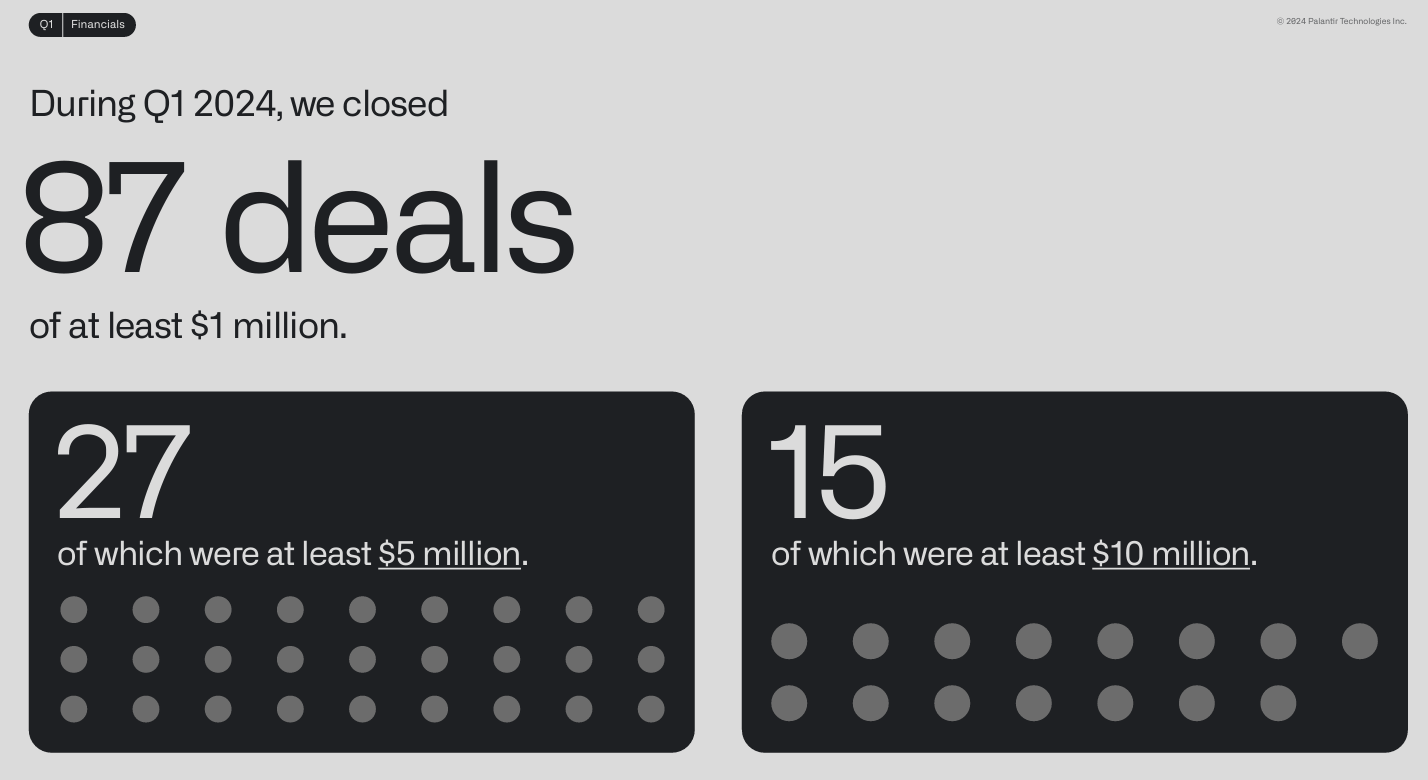

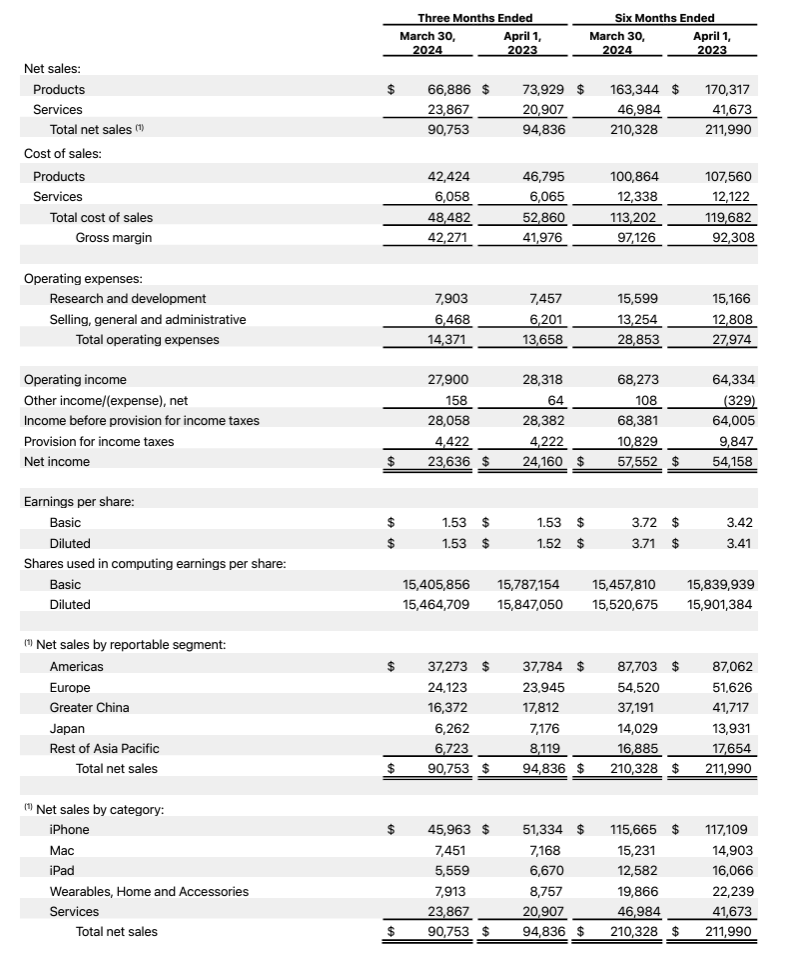

The two biggest headlines from Tableau Conference centered on Tableau Pulse, the concise, business-user-oriented interface that became generally available in February, and Einstein Copilot for Tableau, the vendor’s coming generative AI (GenAI) capability. Pulse stands out in that it's a new and democratizing analytics user experience that's now included with existing Tableau Creator, Explorer and Viewer subscriptions. In contrast to conventional dashboards, Pulse insights present concise, easy-to-consume key performance indicators based on metrics that are curated for specific users and user groups.

Source: Tableau

Tableau Pulse insights are shared through email digests, consumed through the Tableau Mobile app, and added to Slack chats and, soon (as was announced at TC), Microsoft Teams discussions. Barely two months into general availability, Tableau Pulse has been deployed by some 3,000 customer firms with, thus far, 9,000-plus monthly active users, and roughly 1,000 more users being added per week.

One customer exec I spoke to, who is piloting Pulse among finance users and manufacturing plant managers, said that where traditional dashboards are exploratory, Pulse insights are explanatory. These focused, to-the-point insights are better suited to driving action, she said. Coming capabilities for Pulse include real-time alerting, ad hoc Q&A drawing on GenAI vector search capabilities, and metrics layer bootstrapping, which will enable authors and explorers to curate Pulse metrics from existing dashboards and data sets.

Einstein Copilot for Tableau, which saw its beta release at TC, will bring GenAI capabilities to interfaces staring with Web Authoring and, set for beta release next month, Tableau Data Prep and Tableau Catalog. While several vendors have already released GenAI capabilities, Tableau execs said they’re being deliberate about the release in order to gain customer feedback and ensure that the assistants are truly helpful and not prone to hallucination. They also stressed that Tableau’s copilots will be assistants rather than replacements for people.

Other notable feature announcements from the conference included:

- Viz Extensions. Now available in the Tableau Exchange, Viz Extensions are designed to ease the creation of complex visualizations, such as Sankey diagrams, while also supporting a variety of third-party, open-source visualization libraries, such as D3.

- VizQL Data Service This public API enables developers to build custom apps harnessing Tableau services. The API also is a big step toward Tableau supporting headless BI (meaning providing insight services without requiring the Tableau front-end visualization experience).

- Shared dimensions. This option is designed to make it easy to bring fact tables together and to build new data models in an agile way.

- Address Geocoding. This feature makes mapping even easier by automatically converting address fields into geocoded data points.

The Vision

Tableau's Chief Product Officer, Southard Jones, leads a keynote presentation on the next wave of analytics and BI.

Tableau executives weren't just there to celebrate the brand's past. Southard Jones, chief product officer, and Padmashree Koneti, SVP product management, also shared a sober look at analytics and BI challenges that remain, and they solicited customer feedback on a “next wave†vision presentation on how Tableau plans to solve these challenges (with help from Salesforce).

Challenge 1: Data landscape is large and fragmented. The answer to this problem, said Jones, lies in providing a real-time, single source of truth at cloud scale. The solution shown to solve this challenge was Salesforce Data Cloud, but Jones later told analysts that Tableau also will be open to third-party options such as Databricks, Snowflake, Amazon Redshift, and Google BigQuery.

Challenge 2: Users don't trust data or insights. This problem is addressed by "agile semantics for trusted insights." Jones said work is underway on a semantics layer, with details to be announced at Dreamforce. (During analyst sessions, multiple execs had “no comment†on whether the recently rumored Salesforce acquisition of Informatica – a rumor later disavowed by both companies – might have advanced the effort to build a semantic layer.)

Challenge 3: Insights are overlooked or ignored. The answer to this problem is delivering "actionable insights where people work." A keynote demo showed embedding of Pulse insights within third-party apps, such as Workday, as well as analytics being used as triggers for business workflows. Jones later told analysts that Salesforce Flow (workflow) and MuleSoft (integration) can easily be leveraged to make insights actionable within the flow of work and business processes.

Challenge 4: You can't reuse what you build. The answer here, Jones said, lies in providing "reusable and composable assets," with an ability to "package up assets and deploy them in another workspace or even monetize the assets in a marketplace.†Jones later told analysts that Tableau will be able to leverage Salesforce's widely used, declarative Lightning development platform and marketplaces, as well as Flow and the semantic layer, to better package up and reuse assets.

Constellation’s Analysis

Given that some 70% percent of Tableau customers do not use other Salesforce products, Tableau execs struck all the right chords to reestablish the importance of the brand and the DataFam, and to reinforce Tableau’s differentiation as a best-of-bread analytics and BI market leader. At the same time, they also acknowledged that Salesforce, with its deep pockets, its huge ecosystem, and its bevy of existing tech assets, will be indispensable and inseparable in helping Tableau to evolve. For example, Tableau now runs on Salesforce Hyperforce on AWS, and Tableau’s AI and GenAI is being built on Salesforce AI assets and its Einstein Trust Layer.

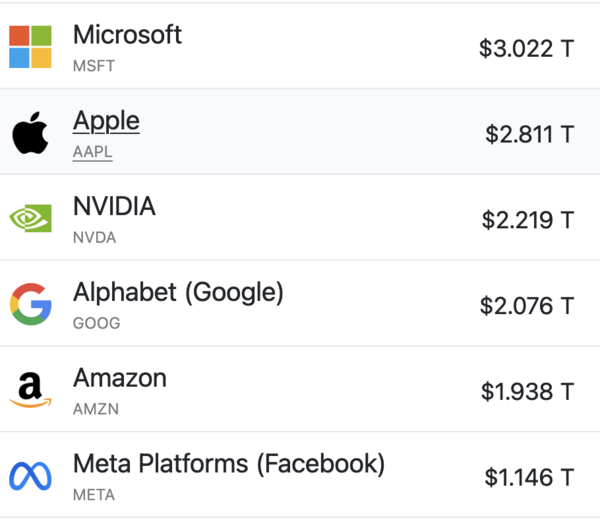

Salesforce and Tableau are far from alone in going after the four data and analytics problems described above. AWS, Google and Microsoft, among others, are all stepping up on the semantic modeling and metadata management fronts, even as astute customers have already embraced independent options, such as dbt Labs. And Salesforce and Tableau are certainly not alone in moving toward actionable and embedded analytics, a trend I've been writing about advocating for years.

The truth is that Salesforce itself needs to address the four problems if it is to better harness data and drive all forms of AI. And Tableau and its customers need Salesforce to succeed if they are to gain cutting-edge AI capabilities. I, for one, got the sense at TC that execs have finally figured out the symbiotic relationship between Salesforce and Tableau. And I, like many customers, am hopeful that it will be possible for Salesforce to let Tableau be Tableau without hard-selling Salesforce products or closing off third-party options.

Success in the next wave will depend on finally reaching all those business users who aren’t interacting with analytics and BI as we know it. But that won’t happen unless the data professionals – the Tableau Creator class – can gain super productivity through AI assistance so they can deliver insights to many more business users in the flow of their work.

Data to Decisions

Tech Optimization

salesforce

Chief Information Officer

Chief Analytics Officer

Chief Data Officer

Chief Technology Officer

hreat Intelligence includes Mandiant intelligence, VirusTotal and visibility tools built on the company's mobile and email scale. The headliner for Google Threat Intelligence is Gemini in Threat Intelligence, a generative AI agent built on Gemini 1.5 Pro that provides insights. Google Cloud also announced

hreat Intelligence includes Mandiant intelligence, VirusTotal and visibility tools built on the company's mobile and email scale. The headliner for Google Threat Intelligence is Gemini in Threat Intelligence, a generative AI agent built on Gemini 1.5 Pro that provides insights. Google Cloud also announced