AWS annual revenue run rate hits $100 billion as growth accelerates

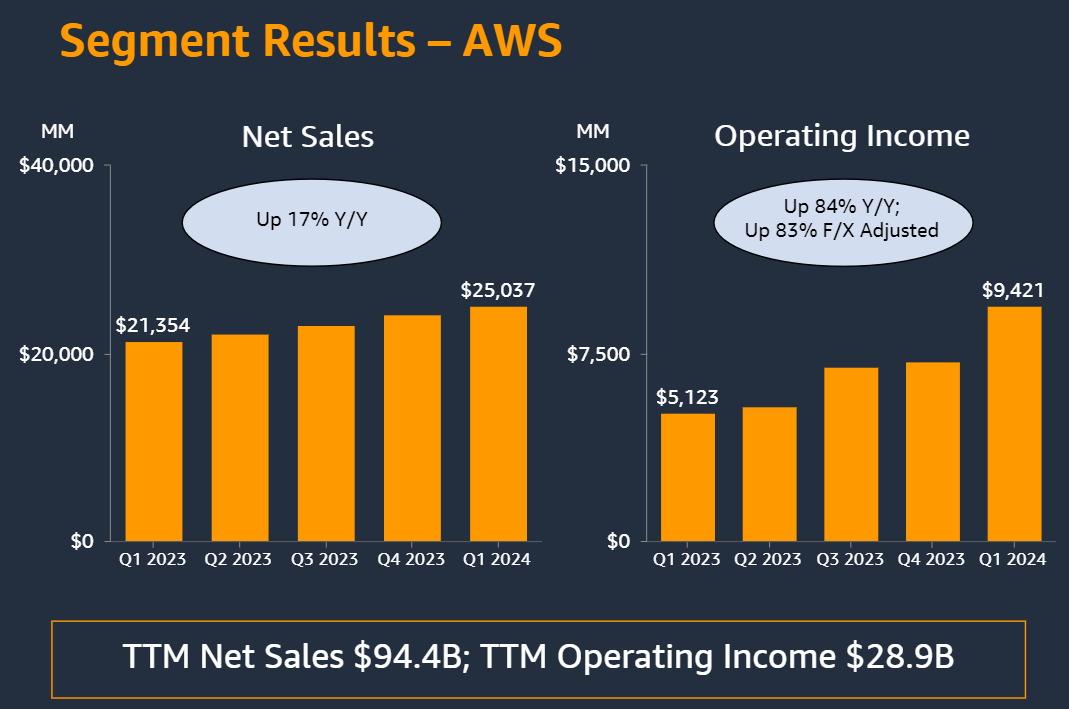

Amazon Web Services revenue growth accelerated in the first quarter as the cloud giant reported sales of $25 billion.

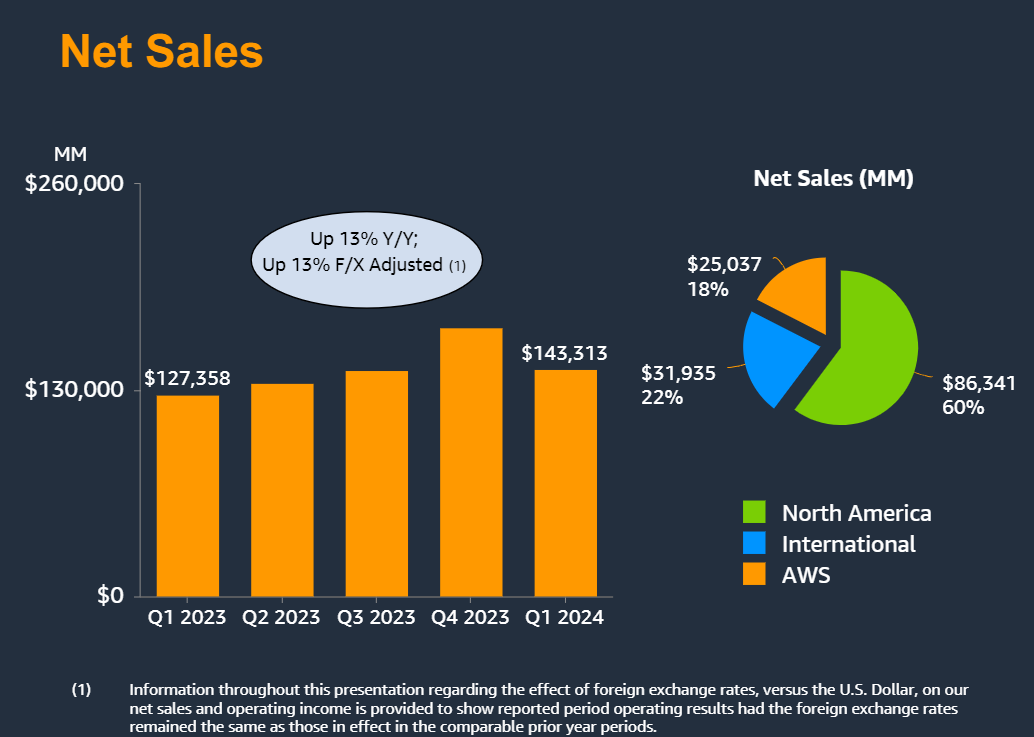

Amazon reported overall first quarter net income of $10.4 billion, or 98 cents a share, on revenue of $143.3 billion, up 13%. Wall Street was expecting Amazon to report earnings of 83 cents a share on revenue of $142.56 billion.

With the Amazon and AWS results, it's clear that hyperscale cloud providers are landing AI workloads. Microsoft Azure revenue in Q3 up 31% | Alphabet shows Q1 strength in Google Cloud, initiates dividend

AWS delivered first quarter operating income of $9.4 billion on revenue of $25 billion, up 17% from a year ago. Fourth quarter revenue growth for AWS was 13%. Wedbush was expecting AWS first quarter revenue of $24.6 billion. AWS announced the general availability of Amazon Q earlier in the day.

By the numbers:

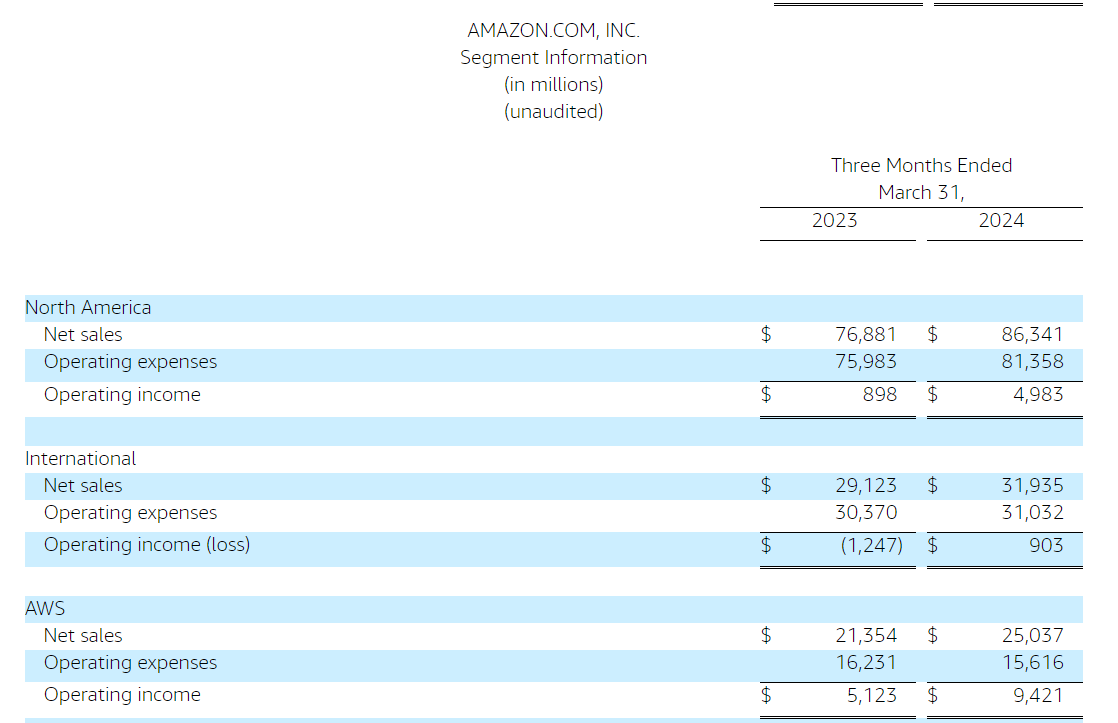

- Amazon's North America commerce unit had first quarter revenue of $86.3 billion with operating income of $5 billion.

- International commerce sales in the first quarter were $31.9 billion, up 10% from a year ago, with operating income of $900 million.

- Amazon's first quarter net income includes a $2 billion non-operating loss from the company's investment in Rivian.

- Amazon advertising revenue in the first quarter was $11.8 billion, up 24% from a year ago.

CEO Andy Jassy said AWS was benefiting from "the combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate (now at a $100 billion annual revenue run rate)."

Speaking on an analyst conference call, CEO Jassy talked up cloud demand, Amazon Bedrock and the company's approach to generative AI. He said:

"Companies have largely completed the lion's share of their cost optimization and have turned their attention to newer initiatives. We see considerable momentum on the AI front where we've accumulated a multi billion dollar revenue run rate already."

Jassy touted Bedrock and said enterprises are increasingly looking at generative AI strategies that revolve around model selection and customization ability. He said Bedrock's recent launch of custom model import was "a sneaky launch as it satisfies a customer request that has not been met yet." Amazon Bedrock gets custom model import, evaluation tools, new Titan models

- Amazon CEO Jassy's shareholder letter talks AWS' approach to generative AI

- AWS' Matt Wood on model choice, orchestration, Q and evaluating LLMs

- AWS ups its investment in Anthropic as giants form spheres of LLM influence

"The prospect of these two linchpin services in SageMaker and Bedrock working well together is quite appealing the top of the stack for the Gen AI applications being built," said Jassy, who added that Q is off to a good start with enterprises.

He said capital spending will be up as AWS builds out data centers to meet demand.

"The more demand AWS has, the more we have to procure new data centers power and hardware. And as a reminder, we spend most of the capital upfront. As you've seen over the last several years, we make that up an operating margin and free cash flow down the road as demand scales out. We don't spend the capital without very clear signals that we can monetize it. We remain very bullish in AWS. We're at $100 billion dollar annualized revenue run right now and 85% or more of the global IT spend remains on premises. And this is before you even calculate genAI. There's a very large opportunity in front of us."

As for the outlook, Amazon projected second quarter sales of $144 billion to $149 billion, up 7% to 11% from the previous year.

More:

- AWS Q4 revenue growth 13% as Amazon's results shine

- Amazon Generative AI Stack Offering Overview

- Amazon's Vogels says 'cost awareness is a lost art' as AWS launches optimization tools

- These overlooked AWS re:Invent launches could solve pain points

- AWS launches Amazon Q, makes its case to be your generative AI stack