Apple Q2 better than expected, China sales lower but better than feared

Apple's second quarter results were better-than-expected, but revenue fell 4% from a year ago. The company said it plans to buy back an additional $110 billion in shares.

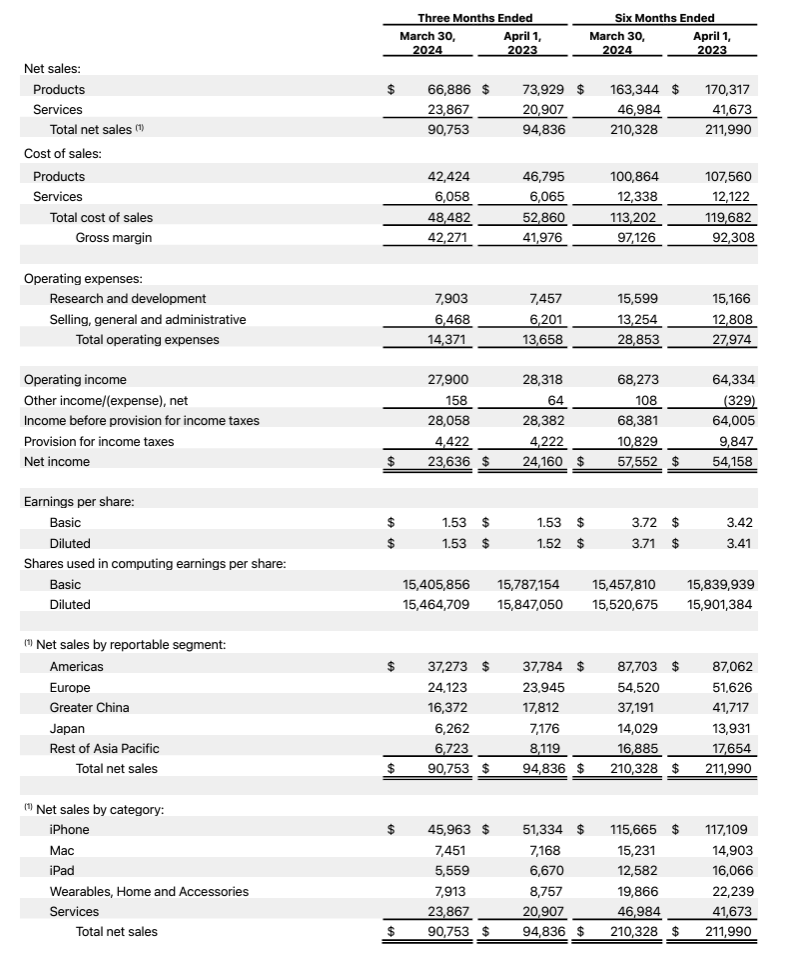

The company reported second quarter earnings of $1.53 a share on revenue of $90.8 billion. Wall Street was looking for Apple to report second quarter earnings of $1.51 a share on revenue of $90.61 billion.

In a statement, Apple CEO Tim Cook touted the launch of the Apple Vision Pro and plugged the company's upcoming iPad event and Worldwide Developers Conference (WWDC).

- Apple Vision Pro could rev hybrid work, video collaboration

- Apple Vision Pro available Feb. 2: Will Enterprises, developers rev expense accounts?

By the numbers:

- iPhone sales in the second quarter were $45.96 billion, down from $51.33 billion a year ago.

- Mac sales in the second quarter were $7.45 billion, up from $7.17 billion a year ago.

- iPad sales in the second quarter were $5.56 billion, down from $6.67 billion a year ago

- Wearables revenue was $7.9 billion down from $8.76 billion a year ago.

- Services revenue in the second quarter was $90.75 billion, down from $94.84 billion a year ago.

China revenue was a big worry going into the results. Sales were down in the second quarter but not as bad as feared. Apple's second quarter China revenue was $16.37 billion, down from $17.8 billion a year ago.

Apple's iPhone's market share in China fell to 15.7% in the first quarter from 19.7% a year ago as Huawei gained share, according to CounterPoint Research.

As for the outlook, Apple projected June quarter total revenue growth of low single digits including foreign exchange headwinds. Gross margins will be between 45.5% and 46.5%.

Here's a look at the takeaways from the Apple second quarter conference call:

Generative AI and WWDC. Cook said AI and generative AI are "a big opportunity across our products." He said:

"We continue to feel very bullish about our opportunity and generative AI we are making significant investments and we're looking forward to sharing some very exciting things with our customers soon. We believe in the transformative power and promise of AI and we believe we have advantages that will differentiate us in this new era, including Apple's unique combination of seamless hardware, software and services integration, groundbreaking Apple silicon, with our industry leading neural engines, and our unwavering focus on privacy, which underpins everything we create."

"I do see a key opportunity, as I've mentioned before, with generative AI across the vast majority of our devices."

China. "People have such a great affinity for Apple and it's one of the many reasons I'm so optimistic about the future," said Cook. He said:

"If you look at the top selling smartphones iPhones are the top two in urban China. We opened a new store in Shanghai and the reception was very highly energetic. I maintain great view of China in the long term."

Enterprise. Apple said enterprises are interested in Vision Pro and the company is seeing "many compelling use cases." Enterprise interest in Apple remains strong across products, added Cook.

Constellation Research analyst Holger Mueller said that Apple needs to rev the innovation engine and its generative AI story can't come soon enough. He said:

"Apple thrives and dives with the iPhone. The quarter shows that a drop $5.5B of iPhone revenue cannot be made up by increases in product revenue (but only Mac sales were up) and services revenue (even though it was a record breaking quarter in services). The lack of innovation that hits the top line is also clear, with the launch of the Apple Vision Pro falling in the quarter and wearables were down by other $800M. The only bright spot on the geography side was Europe. Apple trimmed its cost of sales over $4B – so it managed to show constant EPS but on almost 400,000 less (basic) shares. The $110B stock repurchase program will help to make the EPS KPI more favorable. At the end of the day, it is only innovation around the iPhone that can maintain – or even grow – Apple as we knew it."