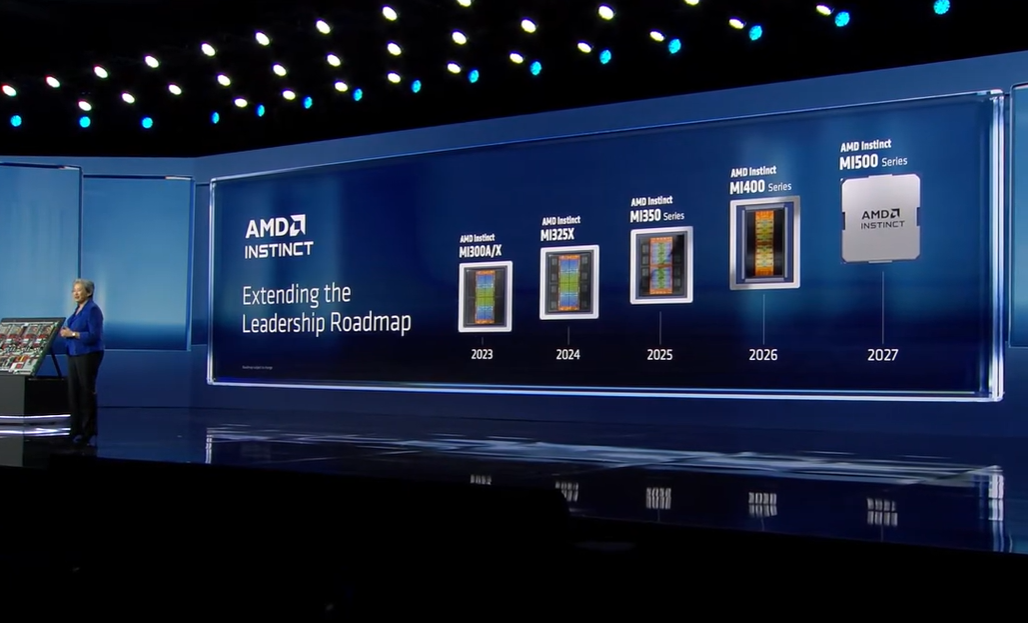

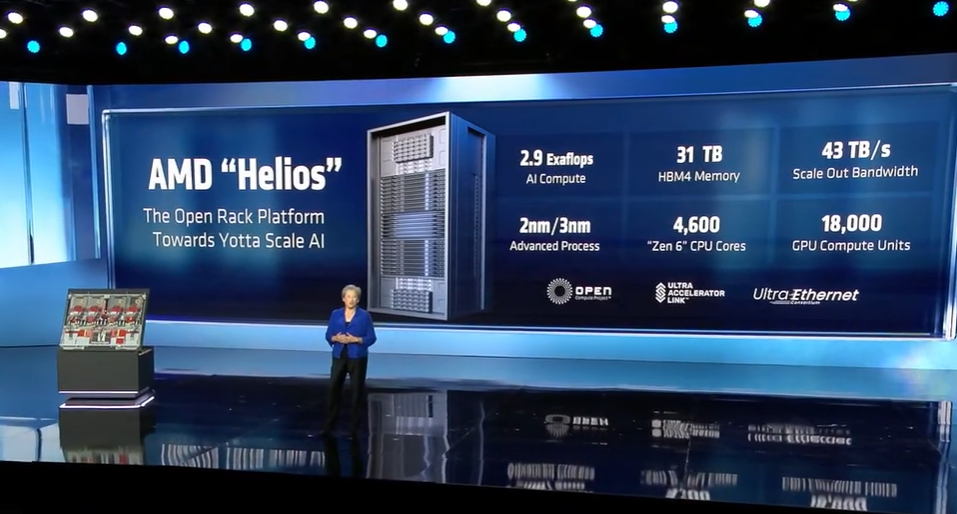

AMD teased its Instinct MI500 GPUs, which will launch in 2027, gave an early look of its Helios rack scale platform and touted the need for yotta-scale infrastructure.

Yotta-scale represents an expansion from today's 100 zettaflops of global compute capacity to more than 10 yottaflops. Think 24 zeroes and 10,000 more compute available than 2022.

AMD CEO Lisa Su during her CES 2026 keynote aimed to position the company as an effective counterweight to Nvidia with reach into AI infrastructure, physical AI and robotics and edge use cases including AI PCs. Su featured a host of customers including OpenAI, Blue Origin, Generative Bionics and AstraZeneca to name a few.

The news that got the most attention was the Instinct MI500 GPUs as AMD needs to keep up with Nvidia's annual cadence. The Instinct MI500 GPUs provide 1000x more AI performance than the MI300x GPUs built in 2023. AMD's Instinct MI500 GPUs are built on AMD's next-gen CDNA 6 architecture and 2nm process technology.

"The MI400 series was a major inflection point in terms of delivering leadership training across all workloads, inference, scientific computing," said Su. "But we are not stopping there. Development of our next-gen MI500 series is already well underway."

- AMD sees big growth over next 3 to 5 years, AI boom continuing

- AMD's data center, PC units shine in Q3

- OpenAI, AMD ink big GPU deal: What it means for the rest of us

- IBM, AMD eye hybrid quantum computing, supercomputer architectures

AMD also positioned itself as a full-stack AI provider with the early look of Helios, which includes 3 exaflops in a single rack. Helios, the product of the ZT Systems acquisition, features MD Instinct MI455X accelerators, AMD EPYC "Venice" CPUs and AMD Pensando "Vulcano" NICs for scale-out networking. The processors are integrated with AMD's open ROCm software.

The company highlighted AMD Instinct MI440X GPU, which is designed for on-premises enterprise AI deployments used for training, fine-tuning and inference in an eight-GPU system.

Su's keynote at CES 2026 did what it had to do--position AMD as a viable alternative to Nvidia's dominance. Here's a look at the key news from AMD at CES 2026.

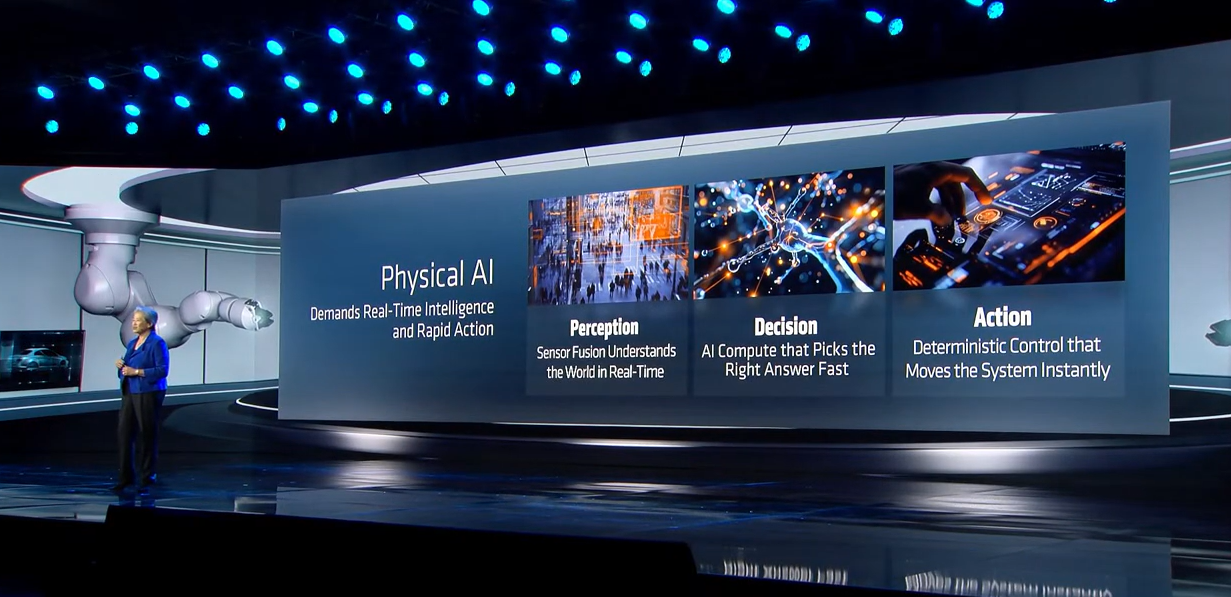

AMD outlined Ryzen AI Embedded processors, a portfolio of embedded x86 processors for AI edge applications. The portfolio, including AMD's new P100 and X100 Series processors, is designed for everything from automotive cockpits, healthcare and physical AI and robots. Su aimed to position AMD well for physical AI and robotics, which are the main theme at CES 2026. She said:

"At AMD, we spent more than two decades building the foundation of physical AI today. We're doing it together with a broad ecosystem of partners. Physical AI is one of the toughest challenges in technology. It requires building machines that seamlessly integrate multiple types of processing to understand their environment, make real time decisions and take precise action without any human input, and all of this is happening with no margin for error. Delivering that kind of intelligence takes a full stack approach."

The company expanded its AI PC portfolio including AMD Ryzen AI 400 Series and Ryzen AI PRO 400 Series processors.

Ryzen AI Max+ 392 and Ryzen AI Max+ 388 are processors designed for on-device AI compute with the ability to support models up to 128-billion parameters and 128GB unified memory.

AMD also launched the Ryzen AI Halo Developer Platform, available in the second quarter, to bring AI development to a desktop PC. The developer platform is AMD's first branded effort for AI developers.

AMD announced AMD ROCm 7.2 software for Windows and Linux.

Constellation Research's take

R "Ray" Wang, founder and CEO of Constellation Research, speaking to Bloomberg outlined significance of physical AI as the next trillion-dollar market opportunity. He said Nvidia's early release of Vera Rubin chips is a game-changer that accelerates timelines.

Wang views Nvidia as more than a GPU player, but a full-stack ecosystem vendor that includes chips, software, and device partnerships.

- Nvidia touts Rubin platform production, hardware advances

- Nvidia highlights its robotics momentum as Qualcomm makes its platform case

- A look at how Mercedes Benz, Nvidia collaborated on autonomous vehicles

When comparing rivals:

- Nvidia is currently dominating the GPU market.

- AMD is positioned as a competitor launching new GPUs and looking to provide more efficient chips with wider availability. Wang expects AMD to showcase partnerships in the data center space as an alternative to Nvidia.

- Intel is seen as a more state-sponsored approach, focusing on manufacturing in the US.