AMD's data center, PC units shine in Q3

AMD reported better-than-expected third quarter results as its data center unit delivered revenue growth of 22% and its PC sales grew 46% from a year ago.

The chipmaker reported third quarter earnings of $1.24 billion, or 75 cents a share, on revenue of $9.246 billion, up 36% from a year ago. Non-GAAP earnings in the quarter were $1.20 a share.

Wall Street was expecting AMD to report non-GAAP earnings of $1.17 a share on revenue of $8.75 billion.

AMD CEO Lisa Su said the quarter was fueled by "broad based demand for our high-performance EPYC and Ryzen processors and Instinct AI accelerators."

By the numbers:

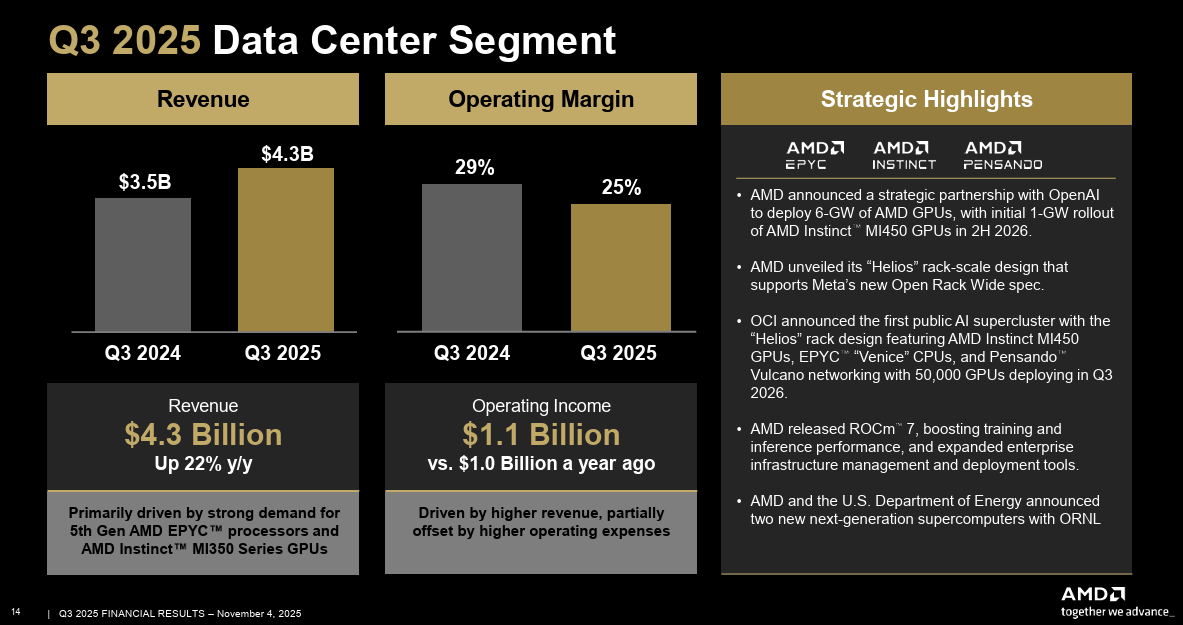

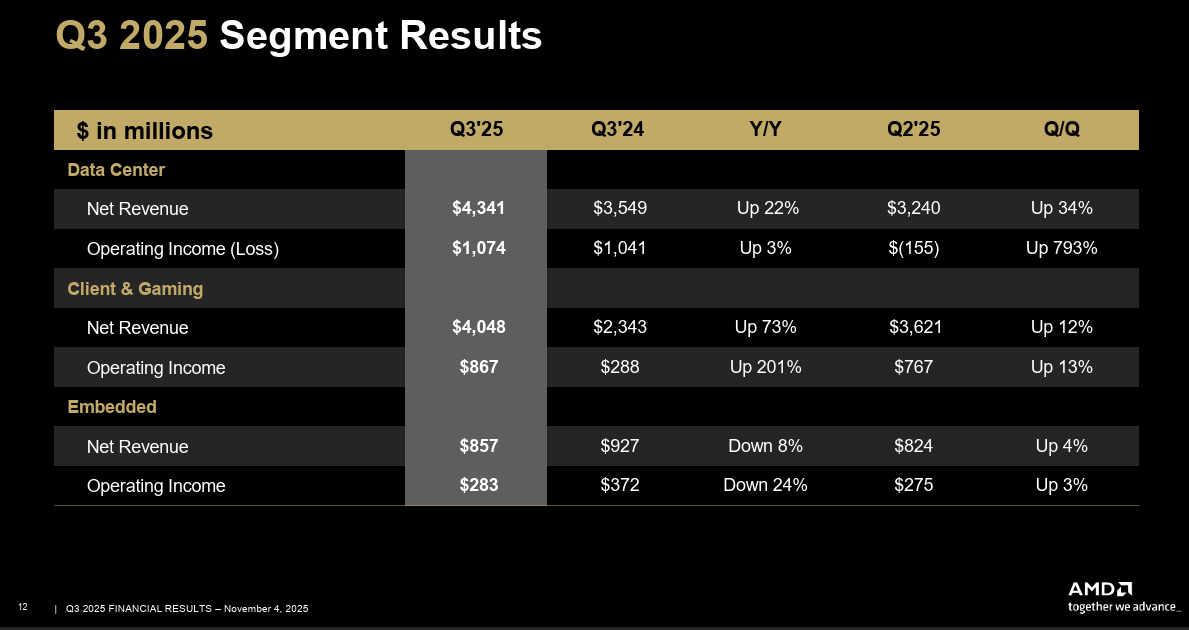

- Data center sales in the third quarter were $4.3 billion, up 22% from a year ago, with strong demand for 5th Gen AMD EPYC processors and AMD Instinct MI350 Series GPUs. Data center operating income was $1.07 billion.

- Client and gaming revenue was $4 billion in the third quarter, which was up 73% from a year ago. Client revenue was $2.8 billion, up 46% and gaming revenue was $1.3 billion, up 181% from a year ago. AMD said sales of Ryzen processors and Radeon gaming GPUs were strong. Operating income was $867 million.

- Embedded revenue was $857 million, down 8% from a year ago, with operating income of $283 million.

During the quarter, AMD inked deals with multiple hyperscalers as well as OpenAI.

As for the outlook, AMD said fourth quarter revenue will be about $9.6 billion, give or take $300 million, or revenue growth of 25% compared to a year ago. The outlook doesn't include revenue from AMD Instinct MI308 shipments to China.

The company will hold an investor day next week with more details on AMD's straetgy. AMD's Su said the following on the earnings call.

- "It's a pretty unique time for AI right now. There's just so much compute demand across all of the workloads. With OpenAI, we are planning multiple quarters out, ensuring that the power is available, and that the supply chain is available. The key point is the first gigawatt we will start deploying in the second half of '26 and you know that work is well underway," said Su.

- Interest is strong for AMD's Helios designs and MI450 AI accelerators. "I think the interest in Helios has just expanded over the last number of weeks, certainly with some of the announcements that we've made with OpenAI and OCI," said Su.

- "Given what we see today, we see a very good demand environment into 2026," said Su.

- "AMD commercial PC momentum accelerated in the quarter with rising PC sell through up more than 30% year over year, as enterprise adoption grew sharply, driven by large wins with Fortune 500 companies across healthcare, financial services, manufacturing, automotive and pharmaceuticals."