AMD sees big growth over next 3 to 5 years, AI boom continuing

AMD projected compound annual revenue growth rates of 35% over the next three- to five years and said demand for AI infrastructure and its chip portfolio is strong.

CEO Lisa Su said during AMD's investor day that the pace of AI infrastructure spending and pace of change is higher than she's ever seen before. "We see a tremendous opportunity ahead to deliver sustainable, industry-leading growth," said Su.

Su in a question and answer session noted that that compound annual growth rate may be front loaded over the three- to five-year time horizon. "We're giving a three to five year TAM and the outer years have a little bit less visibility than the near term years," said Su. "We would expect the near term years to grow faster than 80%."

- AMD's data center, PC units shine in Q3

- OpenAI, AMD ink big GPU deal: What it means for the rest of us

- IBM, AMD eye hybrid quantum computing, supercomputer architectures

AMD is seeing strong interest in its AI accelerators. "There is a desire for significant amount of compute. We are working with the supply chain today to make sure that we have the broad ability to support all the compute that's required," said Su.

Here's a look at long-term growth targets over the next three to five years.

- AMD sees non-GAAP earnings topping $20 a share with non-GAAP operating margins of more than 35%.

- AMD's data center business will grow at a 60% compound annual growth (CAGR) rate with 10% for its PC and gaming and embedded units.

- The company sees its EPYC CPU server chip portfolio gaining more than 50% market share. In data center AI, AMD sees CAGR of more than 80%.

- PC market share will top 40%.

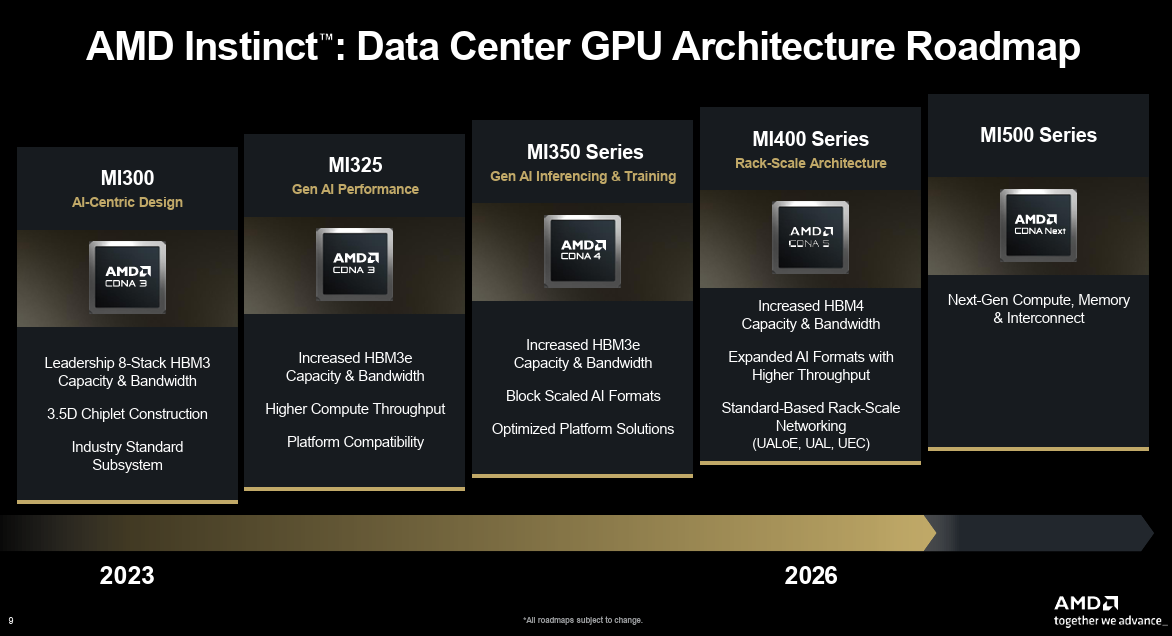

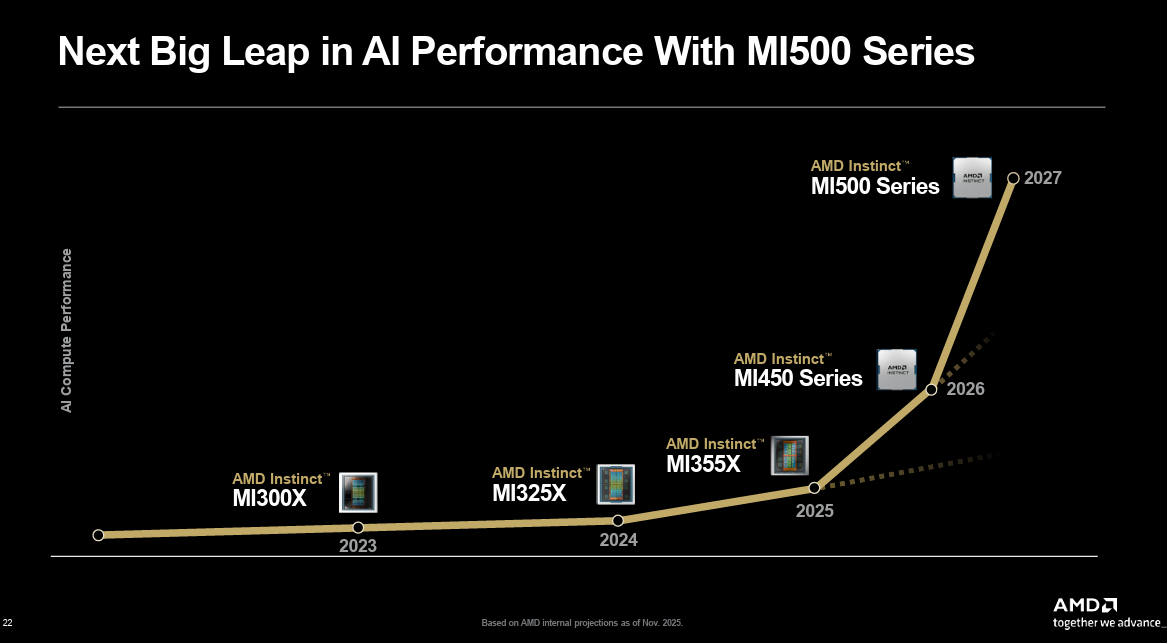

On the product front, AMD executives outlined the AMD Instinct roadmap including Helios systems with AMD Instinct MI450 Series GPUs followed by the MI500 in 2027.

The company also touted its next-gen Venice CPUs and AI networking offering for scale-up and scale-out workloads.

Su was asked about the risk to AI infrastructure spending, notably how much of it has to be funded by OpenAI. Su said AMD "is quite disciplined how we plan these things" and that the company is "comfortable that we know how to do it."

She added that the companies that are funding AI infrastructure such as Google, Microsoft and AWS are well funded. There's also sovereign nations spending heavily. Su said:

"All of the other large hyperscalers who are talking about raising their forecasts are extremely well funded. Their balance sheets are really strong, and the fact that they are choosing to invest more in AI should be a good indicator to the audience that they see value in it."

Regarding OpenAI, AMD's Su said:

"The reason that we are so forward leaning on this is it is great for us in terms of just the amount of learning that we get from engaging at gigawatt scale with a customer that's on the bleeding edge of foundational models. We're doing this in a very structured way. This is a very unique moment in AI and we shouldn't be short sighted. If the AI usage grows as much as we expect there's going to be plenty of financing."