Teradata Disrupts Self With Cloud Push

Teradata is responding to change with a new architecture, more apps and IP, and, most importantly, a more urgent move to the cloud. Here’s a look at the priorities.

At the June 13-15 Teradata Influencers Summit in San Diego, executives vowed that the company is moving into the cloud more aggressively and embracing a “post-relational” era in which conventional databases must co-exist with schema-on-read platforms.

Such pronouncements would have been unthinkable just a few years ago, but Teradata, like many vendors, is adapting to a changed technology landscape. After a series of disappointing quarters, Teradata’s board ousted CEO Michael Koehler in March and tapped board member Victor Lund to replace him. Introduced at the Summit, Lund was frank about Teradata’s past and its future.

“We got into Hadoop and open source late and we got insular in our focus,” Lund admitted. “We know that our customers want to buy and consume technologies in new ways, so we have to deliver on that.”

Teradata executives went on to detail the strategy and roadmap ahead. I see highlights in three areas:

- A new IntelliFlex data fabric architecture and MAPS database feature will separate storage and compute decisions for more flexible deployment, configuration, scaling and purchasing.

- New apps and “business solutions” are expected to drive more software and services revenue.

- A more aggressive move into the cloud is expected to accelerate the evolution toward a balance of on-premises infrastructure and cloud-based services sales.

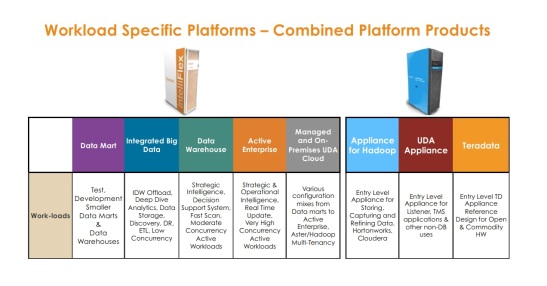

Teradata previously had at least four separate platforms to handle different workloads, but a new

IntelliFlex architecture will eventually narrow that to one platform while giving customers flexibility

to support diverse workloads simultaneously.

IntelliFlex and MAPS: Built For Change

On-premises systems sales (with related services) still account for the lion’s share of Teradata’s business, and the company isn’t taking it for granted. Where on-prem infrastructure is concerned, customers are looking for many of the same attributes they’re seeking in the cloud: flexibility, easy scalability, and the ability to add resources as needed. Teradata’s response is IntelliFlex, a new data-fabric architecture announced in April and expected to be generally available in the third quarter.

Where Teradata currently has four dedicated systems, including its Enterprise Data Warehouse and Warehouse and Mart appliances, IntelliFlex will eventually replace all these products with just one platform. A MAPS feature of the Teradata database will enable customers to configure (and endlessly reconfigure) IntelliFlex storage and compute capacity to handle multiple workloads, ranging from archival retrieval to the ultimate in in-memory query performance.

IntelliFlex separates storage and compute capacity decisions so customers can scale independently and in smaller increments. Customers will be able to add different types of storage and compute nodes, including managed-cloud nodes and storage capacity, as required. Separate MAPS enable customers to support multiple workloads simultaneously, so customers can mix, match and reconfigure system utilization as required.

MyPOV on IntelliFlex and Maps: Teradata isn’t the first to decouple storage and compute (Snowflake, for one, has taken that step), but it’s a huge step for a company with a big installed base and a hybrid cloud strategy. IntelliFlex and MAPS will obviously also be available through Teradata’s managed, private-cloud services, and it will support combined on-premises and managed-cloud deployments. IntelliFlex will not be part of the public cloud offerings, where Teradata runs on AWS and (by early next year) Microsoft Azure hardware. But these public cloud options have rapid, elastic scaling on their side.

Teradata Cloud services will surely cannibalize on-premises system sales, but Teradata has no choice but give customers flexible options. IntelliFlex looks like a reinvention of the infrastructure that will benefit both Teradata and its customers by streamlining the product lineup while giving customers more flexibility and choice. Whether it will counteract and compensate for declining hardware sales is another question, but the company is clearly doing something far more radical than just bringing out the next box and expecting customers to go for business-as-usual floor-sweep upgrade.

Teradata Apps & Services Grow

More than half of Teradata’s revenue is tied to services, and that extends well beyond system deployment. Teradata has more than 5,000 consultants, including more than 250 in its Think Big Analytics unit. A key takeaway from the Summit is that revenue tied to content — intellectual property (IP) in the form of industry specific analytic frameworks, solutions and applications – is destined to grow.

At the Summit, Teradata went over the entire consulting portfolio, including Innovation Analytics (think data science), Proven Analytics (think vertical industries), and Analytic Optimization (think automated modeling, scoring and model optimization). In most cases the consulting starts with methodologies and best-practice frameworks, but there’s also IP, such as prebuilt analytic packages for customer journey analysis, product recommendation, customer satisfaction tracking, email compliance or insider threat detection.

Teradata champions Multi Genre Advanced Analytics: the idea being that no one analytic method can address all needs. It’s one reason the consulting group works with a who’s who list of analytic partners and why the Teradata Unified Data Architecture (UDA) integrates with myriad sources and technologies (see test results below). Multi-genre is also the core appeal of Teradata Aster, which supports graph, text, path, statistical, machine learning and SQL analysis all through SQL and SQL-like expressions. Here, too, IP is growing. The Aster AppCenter introduced last year now has more than 40 prebuilt applications. Combining platforms and techniques can obviously get complicated, so all the better if the steps are knitted together in an analytical application.

MyPOV on Teradata Apps & Services: Deployment agility is the name of the game, so I believe customers will welcome the growing portfolio of apps, use-case templates, analytic packages and so on. I was also glad to see multi-genre talk and initiatives outside of the context of Aster, which was long a tough sell for Teradata when it was an appliance-only option. Now that Aster is available as a cloud service and, since March, as a software-only solution running on Hadoop, adoption should grow. But many customers will have their own ideas about how to pursue multi-genre, with Spark grabbing a lot of attention over the last two years.

At this year’s Summit, execs seemed less inclined than in years past to insist that Teradata has all the answers. They’re showing more solid lines, dotted lines and arrows to technologies that are not in the Teradata portfolio, and that’s a good thing.

Teradata’s Cloud Push

Teradata Cloud has been in the works for years, but the message at the Summit was that company is going to move more aggressively, particularly on public cloud services. Thus, the Teradata Database on AWS service, which debuted earlier this year, will graduate from single-node to multi-node support in Q3. What’s more, a similar service on Microsoft Azure will follow by early next year. It’s not yet clear how scalable these services will be at the outset, but Teradata execs made it clear they ultimately expect to support instances with hundreds and, eventually, thousands of nodes.

Underscoring Teradata’s differentiation in the cloud, Oliver Ratzesberger, president of Teradata Labs, ran a live test during the Summit simultaneously running the same TPC-based query workload on two-node Teradata instances on Azure and AWS and on two-node and eight-node instances of Amazon Redshift on AWS. The number of queries completed in this 39-minute test (shown below) demonstrated that costs per query were much lower for Teradata even though its cost per hour of service was 40% to 80% higher than the costs for Redshift.

In a Teradata test, the same queries were run on two-node instances of Teradata on AWS and Azure and

on two-node and eight-node instances of Redshift on AWS. After 39 minutes, Teradata had completed

tens of thousands of queries while Redshift configurations completed 53 queries and 310 queries.

I’ve seen this throughput-versus-cost comparison applied first hand by a customer comparing Amazon Elastic MapReduce to a high-performance alternative. Here, too, AWS was not the winner from a performance or cost perspective.

MyPOV on Teradata Cloud:

It’s easy enough to do your own tests with cloud-based services, but the real differentiator for Teradata is having hybrid and multi-cloud deployment options – capabilities Amazon obviously can’t offer. I profiled one Teradata customer who says he may never use Teradata public cloud services, but he’s using Teradata’s (private cloud) Database as a Service for disaster recovery and dev-test work. Another customer I profiled said that he may never buy another rack; he’s running on the Teradata Database as a Service today and is looking forward to the day when he can move backup and test-dev instances to AWS or Azure.

There’s no one offering that will fit all customers, so Teradata’s hybrid approach is compelling. It’s my hope that the pace of execution increases and that customers get multi-node support on both AWS and Azure by the end of the year.

MyPOV Overall: Huge forces have disrupted business as usual across IT. The companies that flourished in the on-premises era have to adapt. As CEO Lund put it at the outset of the Summit, Teradata has great technology, smart people and an awesome customer base. Now that distractions — such as the divested Aprimo marketing business — are out of the way, Teradata has clearly refocused on its core competency. Now it’s a matter of execution and delivering great technology in smarter, more flexible and easier-to-consume ways.