Constellation Research Offers a Fresh Take on the Analytics and Business Intelligence Market

Your top choice in analytics and BI should not come down to a one-size-fits-all assessment. Constellation’s 2023 Analytics and BI Market Overview report helps buyers identify a short list that fits their organization.

Analytics and business intelligence (BI) products have long helped companies become more data driven. The market is mature in many respects, but these days analytics and BI platforms are evolving in three important ways:

Cloud deployment. Supporting organizations as they move data and workloads into the cloud or multiple clouds to gain agility.

Embedding. Delivering insights where people work (not just in reports or dashboards) so more users can harness data and insights to drive better outcomes.

AI/ML augmentation. Getting more predictive and automated, taking advantage of ML, natural language (NL), and emerging forms of AI such as generative AI and large language models (LLMs). These features help organizations be more proactive, uncover insights, and eliminate manual tasks.

The Constellation Research 2023 Analytics and BI Market Overview Report, published on May 1, focuses on how well vendors are responding to these trends. Are they leading or lagging? The report also details what vendors offer in terms of more mature and expected functionality, including:

- Data integration and preparation.

- Data cataloging, data modeling and data management.

- Security, access control, and governance

- Dashboarding and reporting

- Data storytelling

Unlike other reports that deliver a one-size-fits-all, top-right ranking, Constellation Research takes a different approach focused on helping customers to develop a short list of candidates that are right for their organization. As we note in the report, “no single offering is in the proverbial top-right corner for all customers. Just as there is a huge variety of vehicles—from sedans and SUVs to pickup trucks and convertible coups, all of which have four wheels and get you from point A to point B—there is great variety among the 17 analytics and BI offerings covered in the report. The coverage includes: Amazon QuickSight, Domo, Google Looker, IBM Cognos Analytics, Infor Birst, Microsoft Power BI, MicroStrategy, Oracle Analytics, Qlik Sense, Salesforce CRM Analytics, SAP Analytics Cloud, SAS Visual Analytics, Sisense, Tableau from Salesforce, ThoughtSpot, TIBCO Spotfire, and Zoho Analytics.

Which vendor should be on your short list? Consider that the product that most reports put in a top-right corner is available on only one cloud. Can an analytics and BI system realistically be your enterprise standard if it’s not available on the cloud where all or your data or a majority of your data resides? We think not.

There are other considerations that break one-size-fits-all, top-right analysis. For example, Constellation believes that organizations that are deeply invested in an enterprise applications portfolio from the likes of Infor, Microsoft, Oracle, Salesforce, SAP or Zoho should naturally have Infor Birst, Microsoft Power BI, Oracle Analytics Cloud, Salesforce CRM Analytics, SAP Analytics Cloud or Zoho Analytics, respectively, on their shortlist. The availability of pre-built analytic content, built-in data integration, and data model consistency tied to these applications makes these offerings very compelling.

Budget is another consideration, and organizations that want truly broad deployments will want to consider the low-cost deployment options available with Amazon Quicksight (assuming they’re running mostly on AWS), Microsoft Power BI (assuming they’re running mostly on Azure) or Zoho Analytics (assuming they’re using Zoho Cloud or are willing to self-manage the deployment on another cloud).

In addition to the points made above, the Constellation Research 2023 Analytics and BI Market Overview report is complemented by the publication of two related Constellation Research ShortListsTM based on the market overview research:

- The Constellation Research 2023 “Multicloud Analytics and Business Intelligence Platforms†ShortList (which updates and replaces the 2022 ShortList on Cloud-Based BI). As the name change suggests, the bar has been raised. Now that every vendor included in the market overview offers a SaaS service on at least one cloud, the bar has been raised. Sure, many organizations still prefer to deploy and manage software themselves, yet every vendor tells us their vendor-managed services are their fastest-growing products. The updated ShortList recognizes eight vendors who offer their analytics and BI platforms on multiple clouds.

- Our first-ever Constellation Research “Embedded Analytics†ShortList recognizes vendors that are going well beyond traditional embedding approaches aimed strictly at software and SaaS vendors. The nine leaders on this new list are also providing embedding options for third-party productivity and collaboration apps, enterprise apps, custom apps (including low-code/no-code development options), and event architecture/triggers/alerts and, in some cases, workflow capabilities for driving business processes based on analytics.

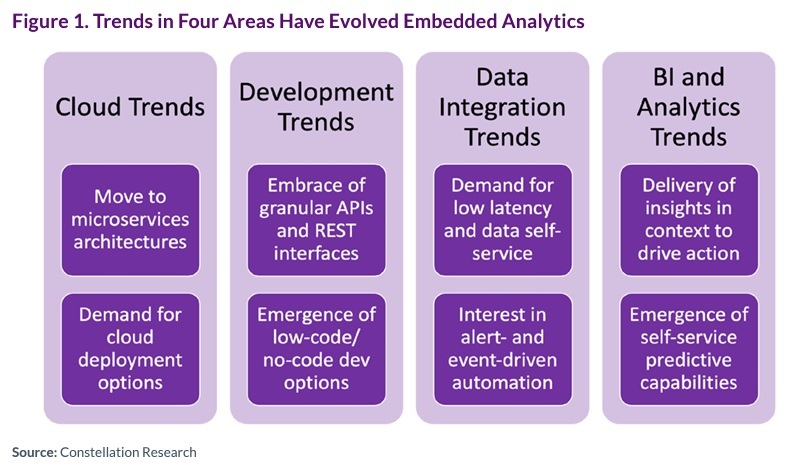

Figure 1. from the report details trends evolving embedded analytics and shaping our new Embedded Analytics ShortList.

As for our third ShortList in this category, the most recent “Augmented Business Intelligence and Analytics†ShortList, published in August 2022, did not merit an interim update. Constellation is reviewing multiple generative AI features and functions that are in private preview or in limited public preview at this writing. Constellation’s regularly scheduled ShortList update, due in Q3 2023, will consider generative AI and other augmented advances that are generally available by that time.

To better understand which product might be the best fit for your organization, the market overview provides in-depth analyses of each of the 17 vendors listed, including their presence on our Cloud, Embedded and Augmented Shortlists. Ten of the 17 vendors are on two of these shortlists. One vendor, ThoughtSpot, an upstart innovator pursuing the latest trends, is on all three shortlists, but the report does not put any one vendor in a top-right corner.

As is the case for all 17 products covered in our market overview, customers should read the report and consider the fit with their organization, their deployment footprint, their use cases, and their long-term plans before placing any product on their short list for request-for-proposals and follow-up pilot testing.