Microsoft's largest combined event of the year, Microsoft Ignite and Envision, are currently the pre-eminent industry showcases for the sprawling breadth and depth of the technology giant's extensive portfolio of platforms, tools, applications, and other enterprise capabilities.

Making sense of the 1000+ sessions, the evolution of dozens of products, as well as the shifting/maturing of the company's vision for digital transformation, digital workplace, and customer/worker/partner experience is a truly daunting task these days. Yet it's also necessary because the company remains perhaps the single most important overall technology vendor to the enterprise, with its platforms running the end-user computing devices, front office, back office, and cloud/edge infrastructure -- in some combination -- of virtually every organization in the world today.

2017 marks a watershed year for Microsoft, with a continuing sense of renewal in the company's fortunes under CEO Satya Nadella, whose new book Hit Refresh describing the reorientation and rebooting of the entire company during his leadership went on sale this week during Day 2. His keynote on the opening day was perhaps the most succinct strategic overview of what's new in Microsoft's strategic vision, which included some innovative and unexpected ones, as we'll see.

Microsoft's Demonstrates Increasingly Fast Pace for Products

The evidence for this renewal shows: The company's many product lines are evolving faster than they ever have before. For once, enterprises are no longer waiting for the company to innovate (a once common complaint.) Instead, they are now being propelled along by a steady stream of rapid product development by the software giant. This breakneck cadence is one that VP of Office, OneDrive, and SharePoint Jeff Teper has been helping orchestrate for several years now. This has aided the company in catching up in numerous areas, and in many cases pulling ahead, of its competition.

Thus, Microsoft's pace today is one of a fast-moving and nimble startup more than a technology juggernaut: Microsoft's flagship cloud offering, the rapidly growing Azure platform, is doing better than ever, and has arguably become the #1 enterprise cloud platform by some estimates, while wide global adoption of the popular and fast-evolving Office 365 cloud suite and other factors almost certainly makes Microsoft the overall largest cloud vendor in terms of enterprise sales.

Now it's up to organizations to decide how to strategically apply Microsoft's capabilities in their journey towards becoming fully transformed digital businesses. Answers to important questions will be key for momentous decision points of digital leaders over the next few years: Where is Microsoft actually going to take its customers in the next few years? Is the firm genuinely preparing organizations to reach an effective and unique disruptive posture, or are they largely raising every organizations' boat in the same way? More importantly, what are the irreversible business decisions (one way changes that cannot readily be undone) that would be made today by using Microsoft as a primary technology provider, especially with its newest offerings?

In other words, when looking at the strategic emerging technology landscape which IT and business executives simply must navigate successfully -- please see our 2017 Tech AstroChart for The New C-Suite -- and key business trends for digital -- consult our 2017 Business Trends AstroChart for The New C-Suite -- how can Microsoft best help today?

To assist digital leadership (CIO, CDO, CMO, CHRO, CCO, COO, CEO, digital-ready boards, and other IT/LOB executives) in answering these questions via analysis of the enormous volume of information coming out of Ignite and Envision, I've elaborated below on what I believe the key takeaways in a digital leadership context, based on all the news here in Orlando this week:

Seven Strategic Takeaways from Microsoft Ignite and Envision 2017

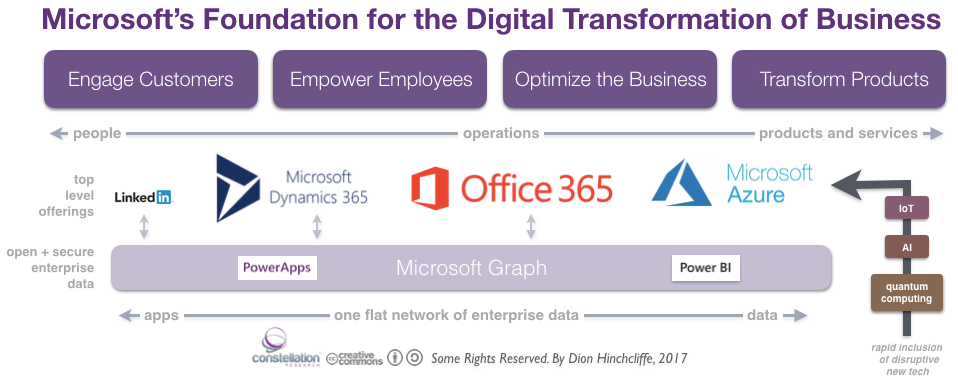

- Microsoft's vision for the front and back office works far better when fully adopted; but enterprises must beware of implication of such commitment. Most digital decision makers prefer to hedge their vendor bets by bringing together multiple providers whenever possible. However, the growing integration between individual applications offers great advantages, but at considerable cost if you have to integrate everything yourself. In an ambitious enterprise data architecture strategy likely to change the status quo, Microsoft's underlying graph model for Office 365, Dynamics, and LinkedIn was showcased prominently in the main keynote at Ignite and Envision, demonstrating a clear path forward for analytics, cognitive technologies, customer experience, and even master data management to be vitally served by bringing together application data onto a single common connected fabric. This has genuine potential to unleash and put to work the entire digital knowledge of an organization to create value for stakeholders and has competitively significant potential. As Nadella pointedly noted during his keynote, every act of using Microsoft apps now enriches the enterprise graph for everyone in the organization continuously. This is the inherent power and advantage of a single deeply integrated cloud platform. Bottom Line: Digital leadership must be aware this value also comes in exchange for the not-inconsequential risk of enterprise cloud lock-in, a major cautionary signpost on this year's New C-Suite Business Trend AstroChart.

- As a digital workplace reality, Microsoft has become the leading player, yet is still making major changes. Workforce experience and even employee engagement can be greatly impacted and improved by digital tools, such as Microsoft's new F1 offering for front line workers. The many different roadmaps shown at the two events for its flagship Office 365 platform show that Microsoft plans to continue a sustained and very fast-paced evolution for the large -- and some would say increasingly bulky -- set of front office digital capabilities, from office productivity to collaboration and engagement. But Microsoft's digital workplace vision tends to be highly tech-centric and focused on producing digital artifacts or enabling communication. Higher order functions like talent management, employee engagement, and orchestrating strategic change programs and change agents are still not well-represented, even as they are priorities of digital leaders today. A little more sobering was perhaps one of the most impactful announcements of either event: The announcement that Microsoft will phase out Skype for Business in favor of the new -- albeit exciting and future-facing -- Microsoft Teams for most unified communications functions (voice, video, chat, etc.) This was a brave move that is likely to be ultimately shown to be the right decision in my analysis, yet it will give headaches to IT teams everywhere as they scramble to deal with the implications, cost, deployment, and mass retraining of workers and support staff. Bottom line: Most organizations can now bet on Microsoft's fast evolving digital workplace as a vision and roadmap with a strong future, but only if they are prepared to deal with significant changes of direction as the company seek to quickly find the right path(s) forward.

- Microsoft has become capable as a full-strength and combined business and technology partner for digital transformation. Citing Maersk, Rolls-Royce, Ford, and a long list of recognizable corporate names, Microsoft is currently enabling some major digital transformations on a global scale. Judson Althoff has been an effective spokesperson on this topic for the company for a while now and had a prominent keynote on Day 1 at Envision, which I attended. I've analyzed Judson's take on this topic before and found it credible, as Microsoft is preparing now to be as much a business partner as a technology company in helping companies lead the reimagining of their business. The Rolls-Royce case example was a good one, and was presented at length. Bottom line: The Microsoft vision and strategy for enabling digital transformation for its customers is broad, compassing, and increasingly proven through case examples, though it appears more bespoke than blueprint based as others are.

- In vital emerging enterprise technologies, such Internet of Things (IoT), blockchain, and artificial intelligence (AI), Microsoft is competent but largely remains tactical. Enterprises usually seek a partner that can stay ahead of where the market is and incorporate new disruptive technologies into the IT platforms that businesses have strategically adopted, as they emerge in the market. In this regard, Microsoft is staying competitive with SAP and IBM with its Azure IoT suite, Azure Cognitive Services (for artificial intelligence), as well as their emerging blockchain capabilities. I also had several conversations at Microsoft Ignite with Microsoft's cognitive product experts and was given a favorable impression that they are heading in the right direction overall. However, they remain focused on more foundational use cases and are only now considering the more strategic enterprise picture. Cognitive services, Internet of Things, and blockchain -- combined with supporting analytics -- all have the potential to remake our businesses in key enterprise activities like strategic decision making, forecasting, risk management, and compliance. However, the company does not yet deliver IoT, AI, or blockchain technologies for these types of functions as yet, though they do appear to be on the radar in my conversations. Bottom line: Though much of the vision is there, Microsoft needs more time to mature and up-level the business capabilities for the current crop of emerging tech that has high disruptive potential. Certainly some startups are well ahead here and will likely remain so for a while. (Please see my enterprise tech to watch in 2017 for a full list of disruptive tech.)

- While big software suites are still the go-to choice for many digital leaders, Microsoft is enabling an increasingly modular, take-what-you-need services-based approach. Time and again in briefings with product managers and experts at Envision and Ignite, PowerApps was cited as a way for end users to shape IT into what they need, often by just taking a fraction of the Microsoft product that they need to solve a given problem. While user-defined IT is a candidate for my yearly tech trends list, the approach has as much to do with the microservices trend that has risen to the level of the C-Suite in many parts of the industry. Why is this important? Because it heralds Microsoft realization that IT must be able to go to the customer in whatever form, mode, and channel is best. To do this, Microsoft is attempting to make its IT solutions as consumable as possible in a multi-vendor and an increasingly federated/hybrid/decentralized IT world. This is actually fairly visionary and makes them a strong partner in many important and future-enabling ecosystem strategies, if they can sustain this as an initiative. Bottom line: Microsoft is becoming a much more digital-savvy and native company -- or least its heading in the right direction for now -- further strengthening it as a strategic business and technology partner.

- As large and extensive as its capabilities are, Microsoft cannot by itself tackle the full set of priorities of The New C-Suite. The extensive announcements and elaborate roadmaps around so many existing products as well as the arrival of new ones at Ignite and Envision still belie the complexity of today's digital world. As rapid as Microsoft appears to be pushing on the accelerator to speed up product development and innovation, the digital world is still evolving faster, and enterprises must find ways (and partners) to manage the change velocity. Even though it's now arguable at the company's pace is one of the fastest overall in the industry, there's simply too much to do today to be satisfied by one vendor, no matter the size. Although there's been a recent wave of large organizations moving to becoming largely Microsoft shops, federated IT landscapes are actually becoming more the norm as apps and Shadow IT (for better or worse) proliferate. Bottom line: Microsoft can serve as the anchor IT provider, but a large and growing constellation of play-nice 3rd parties is required to succeed in digital transformation today.

- Companies looking for a truly disruptive technology partner, can start to look at Microsoft anew. This is perhaps best demonstrated by the unexpected and surprising to many announcement of early quantum computing support in Azure, available later this year. While I'll complete my analysis shortly of why the quantum computing announcement at Ignite was potentially such major news, the fact that no other major enterprise vendor is announcing anything in this area, much less pre-announcing commercial cloud services shows that Microsoft is willing to take significant risks in a real way today, both with products and reputationally. Given the nascent state of the quantum computing market, this is a early and significant move that has the potential to both confuse customers as well as potentially lead them into the future. Bottom line: With this and other bold announcements of late, Microsoft is clearly willing to make significant bets. Digital leaders can certainly opt not to follow, but have more access to the major cutting edge technologies from Microsoft now than in years past.

While the news was largely incremental except for a few big announcements (quantum computing, hybrid Azure, and the shift away from Skype), the amount of house-being-put-in-order, refining, and detailing out of Microsoft's cloud offerings for the enterprise was both tangible and impressive in its own right. There was palpable buzz and excitement at Ignite in particular, as Microsoft exuded a message that it knew what it was about and was delivering on it. That said, Microsoft now has the scope and breadth of a vast product set, along with a vision that may be hard to stick to as a commercial company, especially in terms of modularizing its offerings (good for customers but it can certainly lowers sales potentially) and creating a comprehensive set of APIs that opens up data for integrating and ecosystem use (also good for customers, but is a path for migration away from Microsoft.) If they can keep this direction, and sustain a fast growing business out of it (which every sign shows it the case at the moment), Microsoft and its customers have a solid near future ahead of them given what transpired in Orlando this week.

Additional Reading

Microsoft Ignite & Envision 2017 Announcements and Analysis by Holger Mueller

Microsoft Stresses Choice, From SQL Server 2017 to Azure Machine Learning by Doug Henschen