Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

<br>Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…

Read more

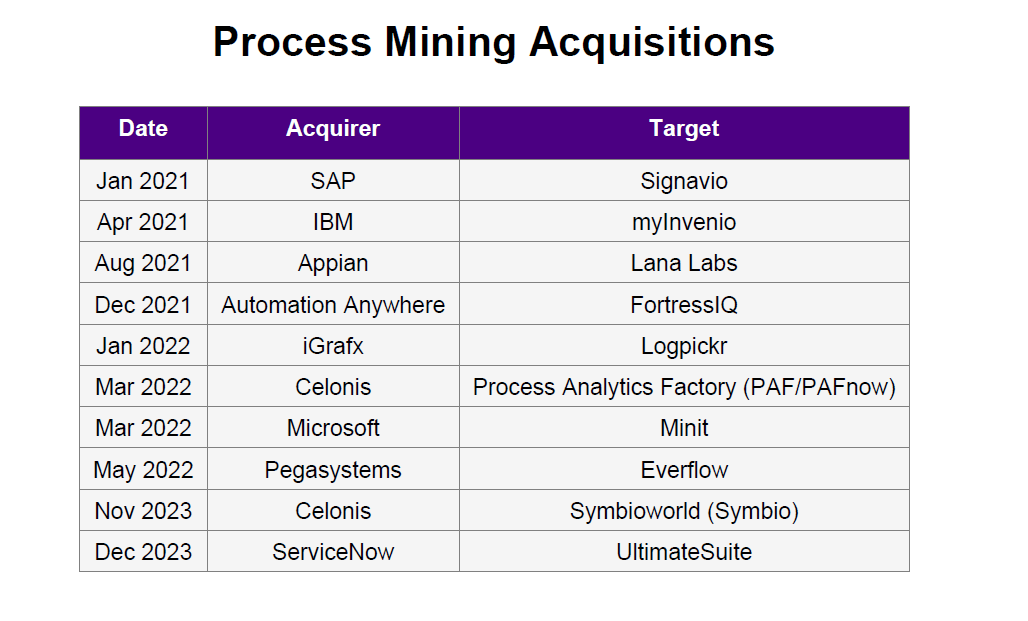

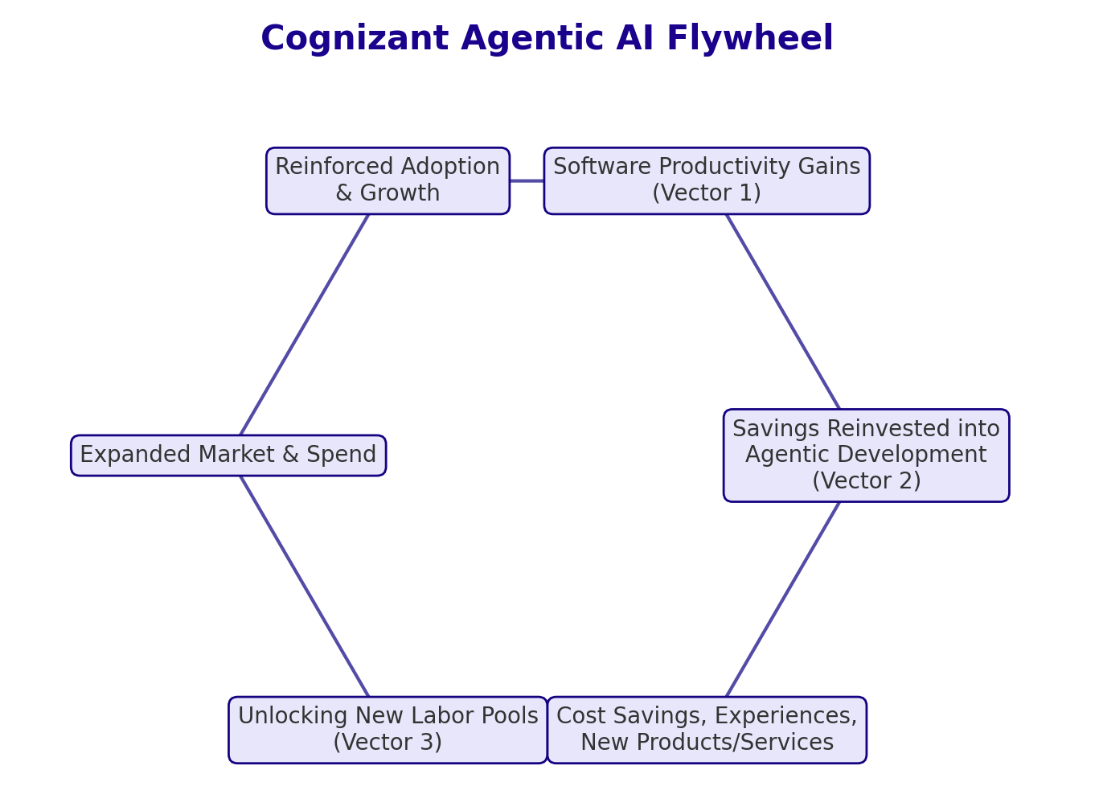

Enterprise software vendors appear to be coalescing around the idea that process mining is an enabler for agentic AI and should be built into platforms.

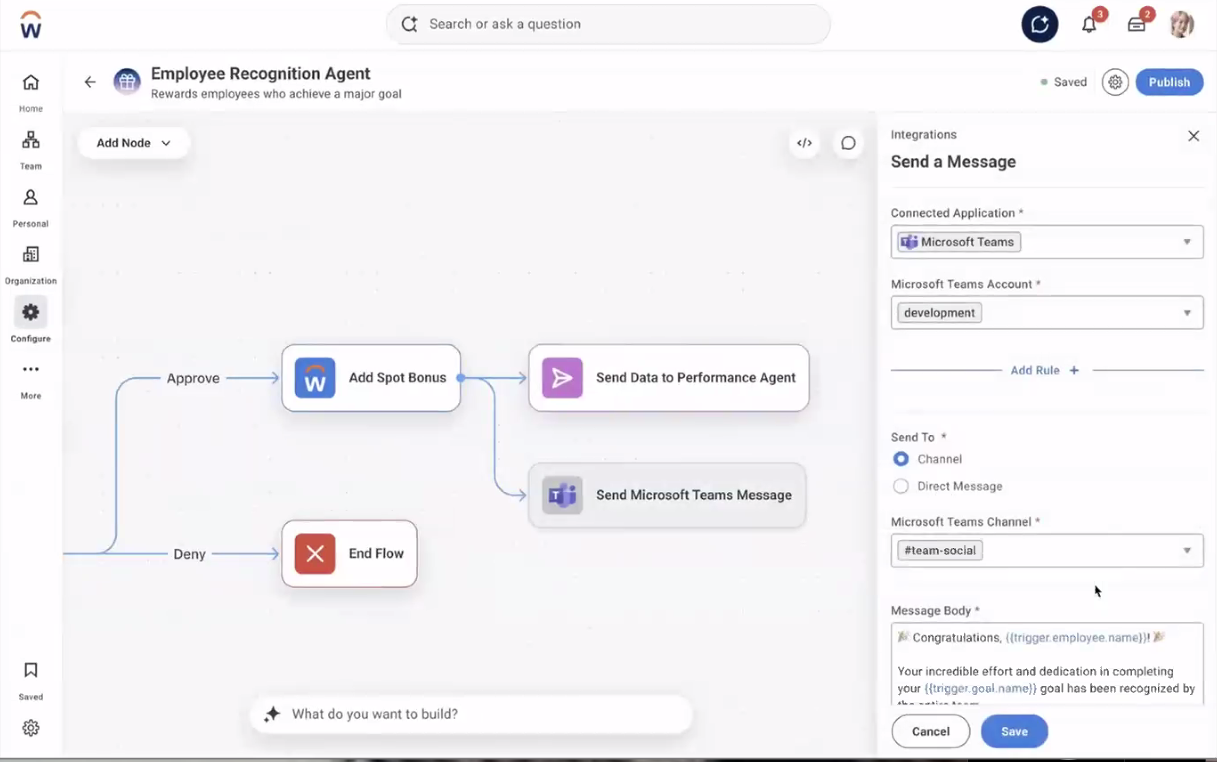

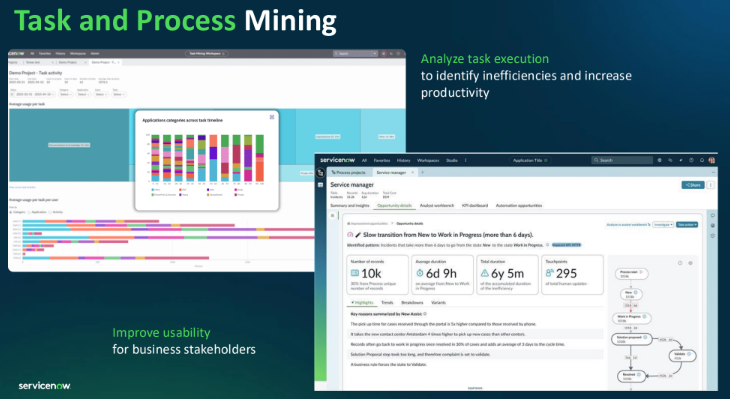

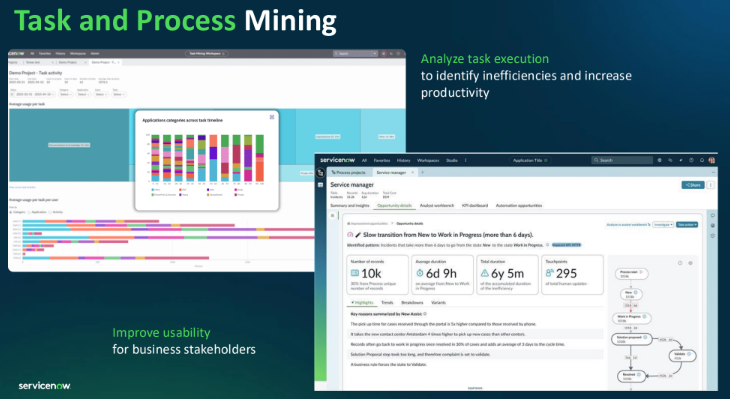

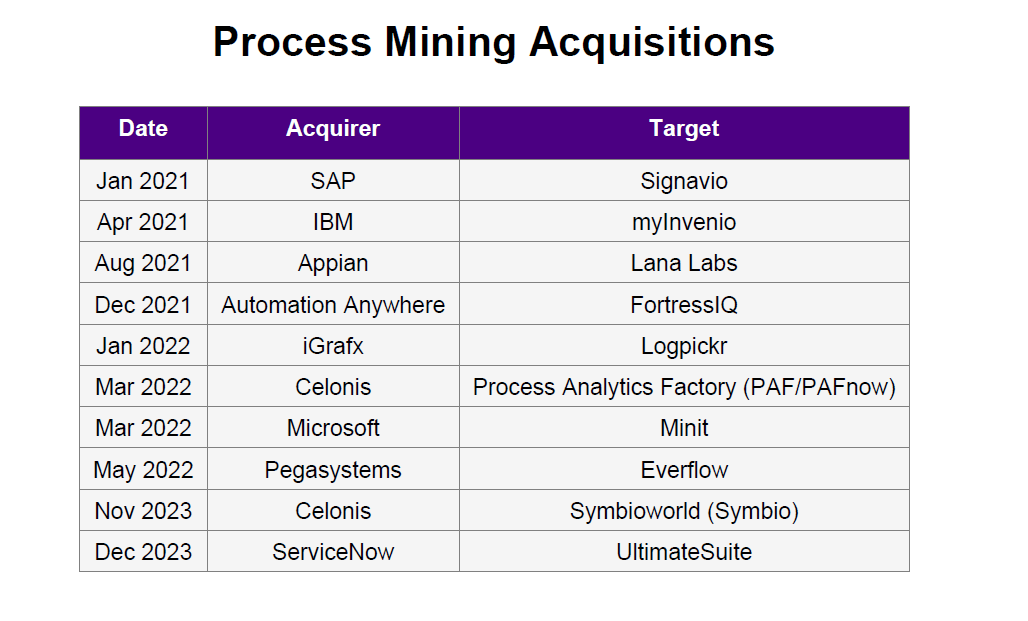

In recent days, process mining, task mining and process automation have all received some play. ServiceNow, which has been acquiring process mining and task mining capabilities as well as partnering with Celonis, has built in more process knowhow into its platform.

ServiceNow acquired UltimateSuite in late 2023 to build out its native process and task mining capabilities. Those capabilities are now included in its Zurich release, which revolves around agentic AI with embedded process automation. Kush Panchbhai, Senior Vice President of AI Platform, Zurich is an effort to give customers the tools to "pivot from legacy automations to proactive automations across all of the workspace" and structured and unstructured data.

The ability to identify inefficiencies via process and task mining is critical because those insights "are then food for our AI agents" to automate with streamlined processes, said Panchbhai. You don’t have to sell me on this process mining meets agentic AI notion. Simply put, I thought agentic AI would just scale process disaster without some kind of optimization in the background.

While ServiceNow’s process efforts are part of the workflow automation continuum, it’s worth noting that other enterprise vendors are onto the idea. Here’s a look at some of the milestones in recent days. Research: Time to Introduce Hi-Fi for Enterprise Processes

Get Constellation Insights newsletter

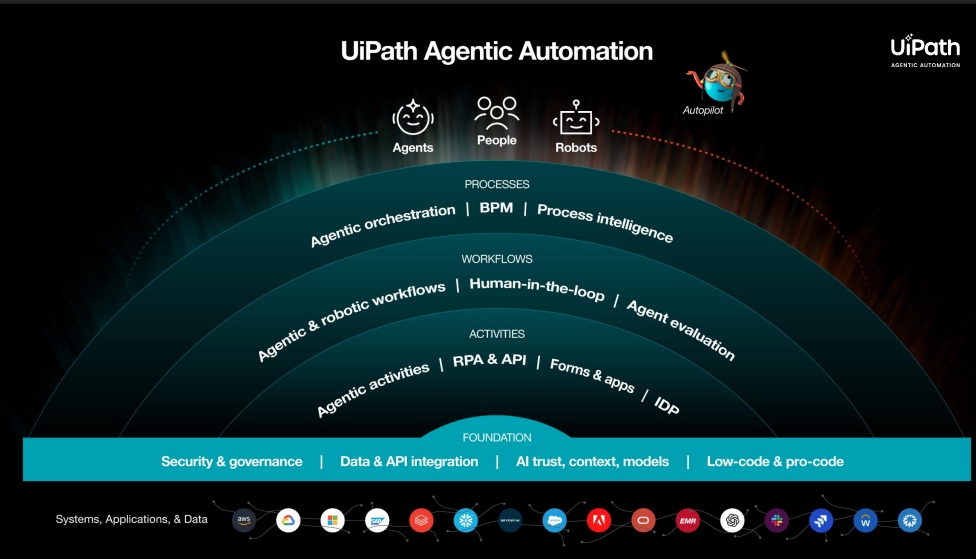

UiPath: Leveraging RPA and process roots with neutrality

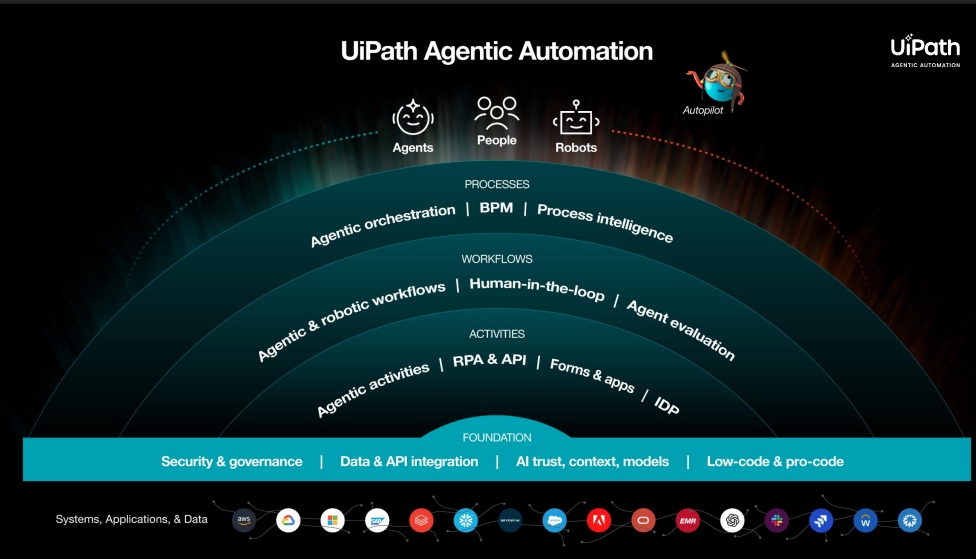

UiPath delivered better-than-expected second quarter results and noted that it is landing larger deals because customers are looking to meld AI, automation, process and orchestration with a neutral vendor.

"With UiPath Maestro, we unify agents, robots and people across systems with governance and transparency so outcomes are measurable and repeatable. This combination is delivering tangible ROI, fueling increasing commercial momentum," said Dines.

Indeed, UiPath's second quarter revenue was $362 million, up 14% from a year ago, and non-GAAP operating income improved to $62 million. It appears that UiPath has emerged from a rough patch. "Since launching our Agentic platform, customers have executed almost 1 million agent runs. Maestro orchestrated over 170,000 process instances, and over 450 customers are actively developing agents," said Dines.

More importantly for UiPath, the company is deepening relationships with customers. Customers with $100,000 or more in ARR increased to 2,432 in the quarter while customers with more than $1 million in ARR came in at 320.

Dines cited Voya Financial a lead customer in the second quarter. Voya automated more than 100 processes and now is targeting more than 40 high-impact use cases in accidental claims with Maestro orchestrating workflows.

Neutrality has its role, according to Dines. "Our key pitch is being really agnostic. I think most of the customers right now are concerned into being completely on one side of a business platform. Because if you look at agentic and orchestration, most of the processes actually spend multiple business systems. You will have to make a choice if you choose an orchestration or an agentic solution that is provided that one of the business systems," he said.

Also see: Hi-Fi process management needs to be foundation for AI | Bloomfilter co-CEO Severinghaus on the intersection of process mining, software development |

Why enterprise, process workflows are the new battleground

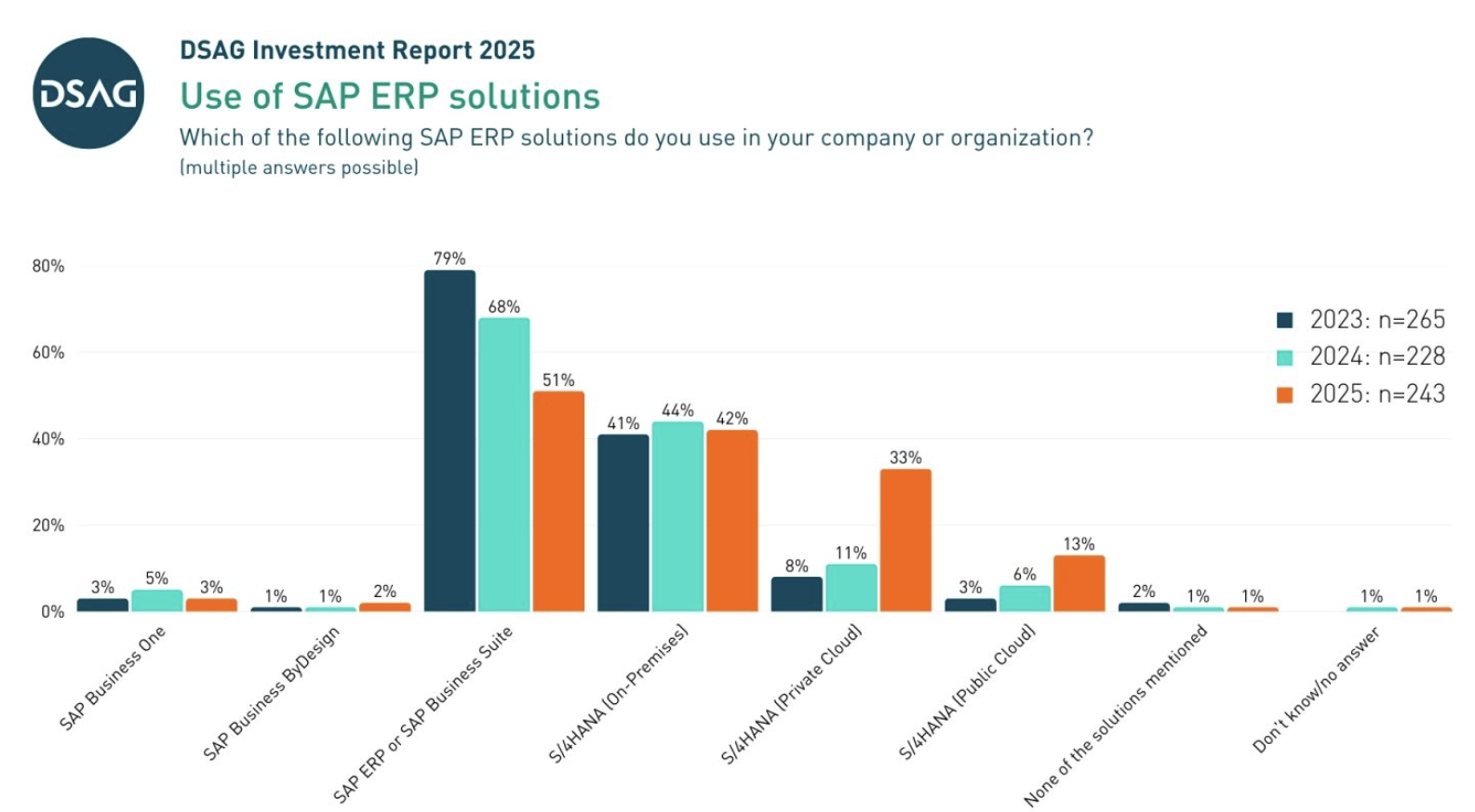

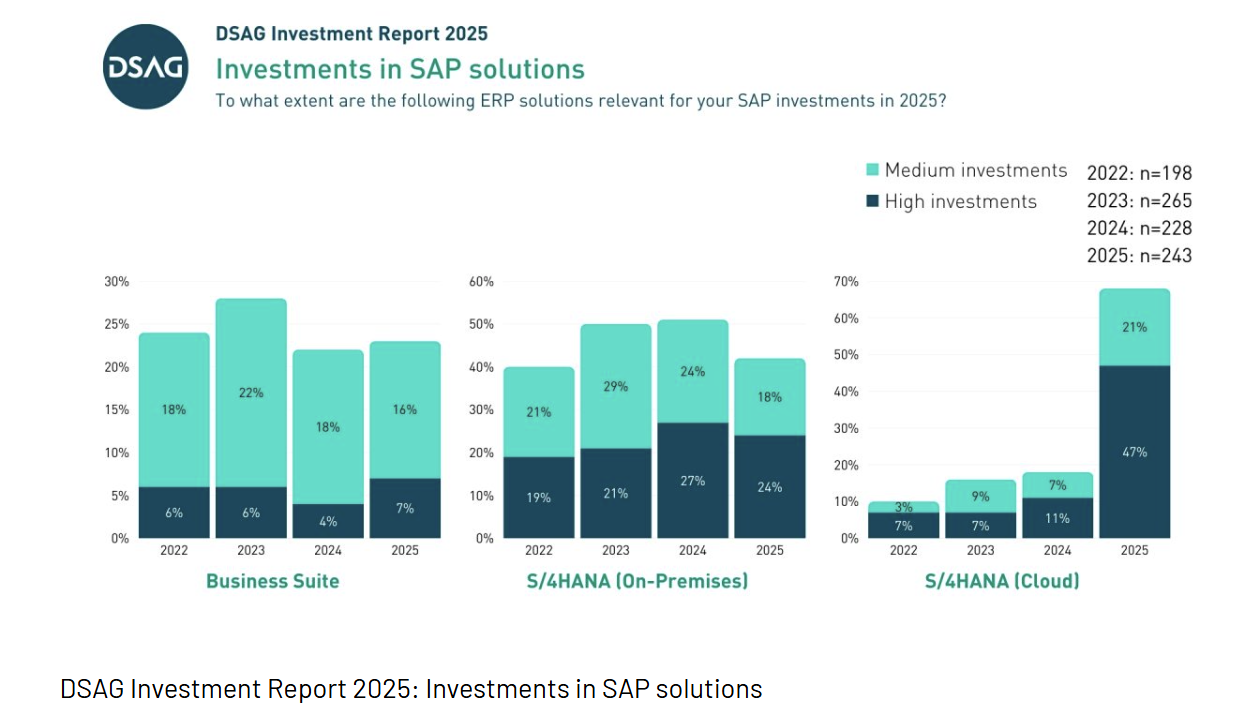

SAP: Process mining is a tool for AI adoption

SAP CFO Dominik Asam said he considers process mining to be part of the tooling for AI adoption in the enterprise.

Asam said at the Goldman Sachs Communacopia + Technology conference that the company is selling software but also transformation and AI automation. That transformation also requires some core building blocks.

"If you want to deploy AI, you have to have all the tooling required like process mining, like the enterprise architecture management, also now the in-app guidance of the user to adopt the tools," said Asam. "SAP has a pretty favorable position that we really sit at the nexus of the processes and the data."

SAP has acquired its way into process mining with Signavio and LeanIX. It also has a partnership with UiPath. SAP and Celonis are mired in a court battle over process mining competition.

C3 AI: Process automation part of a comeback?

C3 AI launched the C3 AI Agentic Process Automation. The company bills the launch as the next generation of robotic process automation.

The company has just hired new CEO Stephen Ehikian, who inherited the launch of C3 AI Agentic Process Automation. Like most process mining and AI agent plays, C3 is selling by the process, value and enterprise pain points. C3’s key points include:

- C3 AI Agentic Process Automation focuses on business processes such as “order-to-cash, customer service, invoice processing, debt collection, supplier onboarding, procurement, and employee onboarding, as well as industrial operations such as equipment troubleshooting, manufacturing operations, production planning, inventory management, and aircraft maintenance.â€

- The C3 offering is looking to address use cases that used to be addressed by robotic process automation (RPA).

- Now C3 AI Agentic Process Automation is a combination of AI models, predetermined steps and controls with an interactive UI.

Although the company billed C3 AI Agentic Process Automation as a breakthrough what’s being offered rhymes with what UiPath has built. It’s unclear whether C3 AI can leverage its process automation suite to better compete with multiple vendors in the enterprise and Palantir in government accounts.

What’s next?

The working theory is that ServiceNow’s move to highlight process mining and task mining in Zurich will lead to more efforts from rivals.

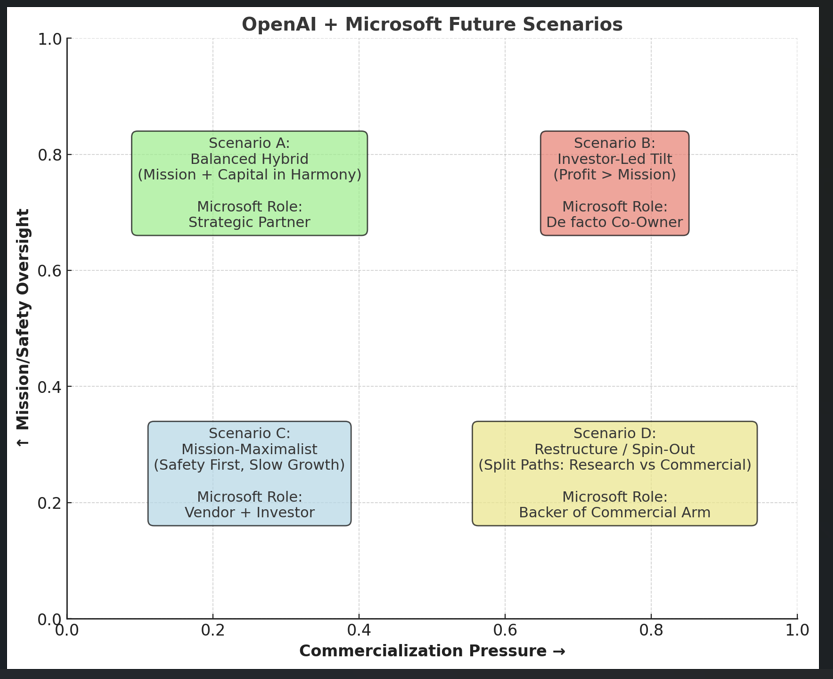

- For instance, Microsoft acquired Minit in 2022 and talked up process mining and automation for a few quarters after the deal closed. It’s unclear what happened to Minit’s technology, but Microsoft wouldn’t need to do much to embed process into its various AI agent platforms.

- Salesforce, which has a bit of ServiceNow envy these days, has enough time to layer in process mining and automation talk into its Agentforce messaging at its annual Dreamforce conference. Salesforce if it truly wants to be seen as a broad platform for agentic AI—beyond its core service, CRM and marketing clouds—may have to buy its way into the process mining game. Salesforce heads into Dreamforce 2025: A look at the big themes

- Celonis, the big dog in process mining and process intelligence, has its Celosphere conference Nov. 3 to Nov. 5 in Munich. The company has repeatedly noted that process intelligence enables agentic AI, but the market hasn’t bought into it. ServiceNow’s moves with Zurich are likely to give the process mining market a lot more play to the benefit of Celonis.

- UiPath is only looking more valuable in this mix. The company has evolved from RPA to process automation to AI agent orchestration. It’s neutral positioning as a vendor is also valuable. The real kicker with UiPath is that its market cap is between $6 billion and $7 billion depending on the day. UiPath could solve some problems for an enterprise software vendor looking to be an agentic AI platform of choice. Or UiPath could go private. UiPath guided toward fiscal 2026 ARR of $1.82 billion to $1.825 billion and has $1.5 billion in cash with no debt.

Data to Decisions

Future of Work

Next-Generation Customer Experience

Tech Optimization

Innovation & Product-led Growth

Revenue & Growth Effectiveness

Digital Safety, Privacy & Cybersecurity

ML

Machine Learning

LLMs

Agentic AI

Generative AI

Robotics

AI

Analytics

Automation

Quantum Computing

Cloud

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

Leadership

VR

Chief Information Officer

Chief Executive Officer

Chief Technology Officer

Chief AI Officer

Chief Data Officer

Chief Analytics Officer

Chief Information Security Officer

Chief Product Officer