Broadcom pitches VMware Cloud Foundation 9 as the future, but rivals eye disgruntled customers

Broadcom CEO Hock Tan said enterprises can bet on VMware's platform for on-premises AI workloads as well as private cloud. But the competition is only going to increase as rivals aim to poach VMware customers.

Tan's talk landed as VMware held its Explore conference. Given Broadcom's business is being driven by custom AI processors it's easy to overlook the VMware acquisition. Despite intense competition from Microsoft, HPE, hyperscalers and Nutanix to name a few, Broadcom has delivered on what it said it would do with VMware.

Broadcom's plan was to simplify pricing, focus on VMware Cloud Foundation (VCF) and large enterprises.

Tan said:

"Most of you continue to be weighed down by your legacy infrastructure, and you're afraid to move forward. How do you let go of your IT path so you can build for the future?

Well, I can tell you for sure, the answer is not to run straight to public cloud as you did 5, 10 years ago. If you're going to do cloud, do it right, embrace VCF 9.0 and stay on-prem. That VCF 9.0 is the culmination of 25 years of VMware technology and innovation. And this is the platform for the future."

At VMware Explore, the company announced the following:

- The company said Walmart selected Broadcom's VMware as a strategic vendor for virtualization software. VMware Cloud Foundation (VCF) will be the platform that unifies Walmart's distributed operations.

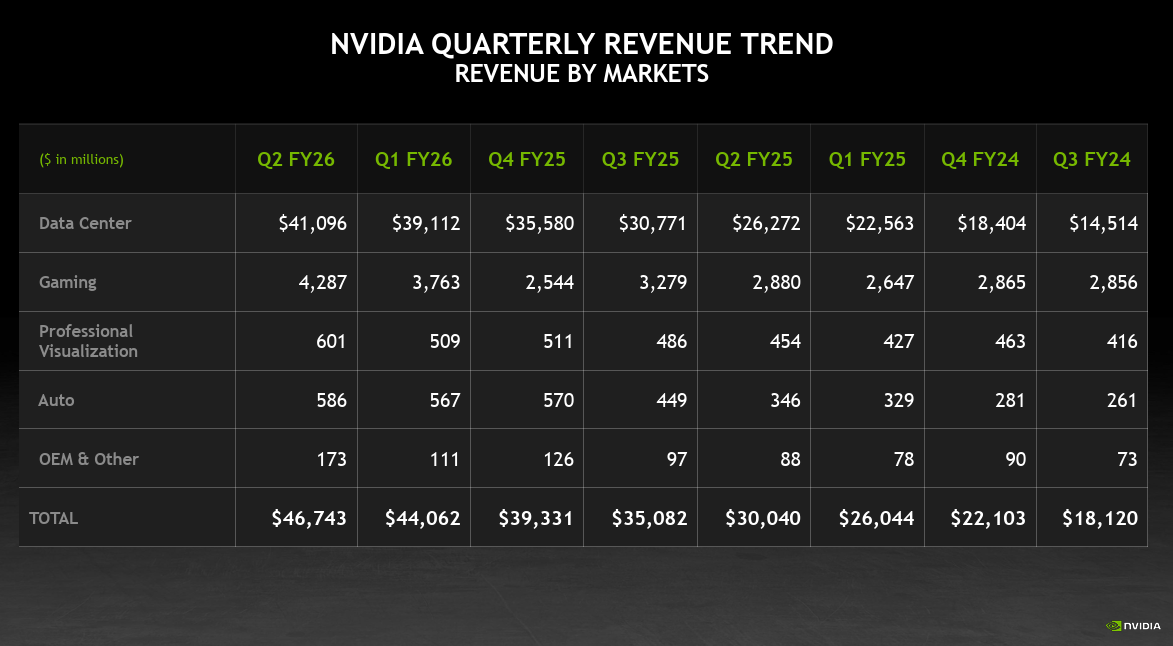

- Broadcom said VCF will get VMware Private AI Services as a standard component in VCF 9.0, which is generally available. VMware argued that VCF is futureproof for AI workloads. Model Context Protocol (MCP) support, runtimes for multiple AI accelerators from Nvidia and AMD, and multiple models will be added to VCF.

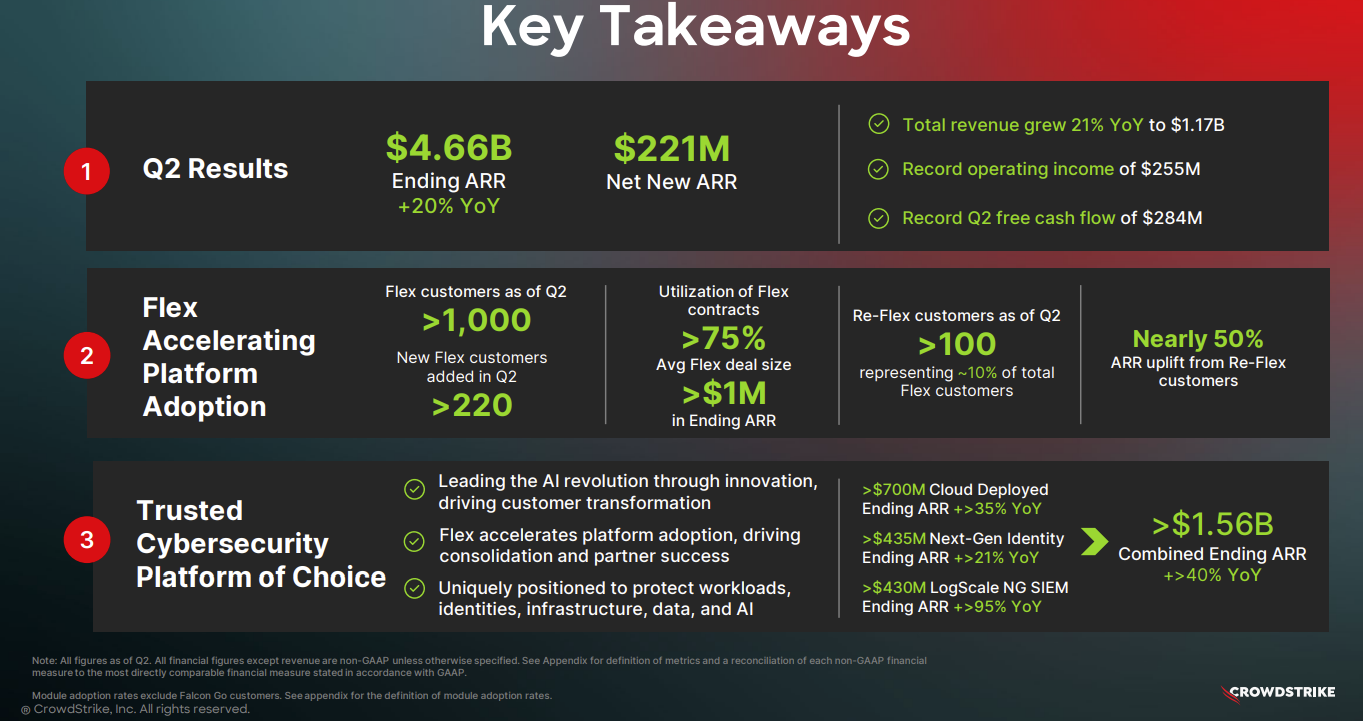

- VCF has new services for cybersecurity including continuous compliance enforcement, automated cyber and data recovery and incident response tools.

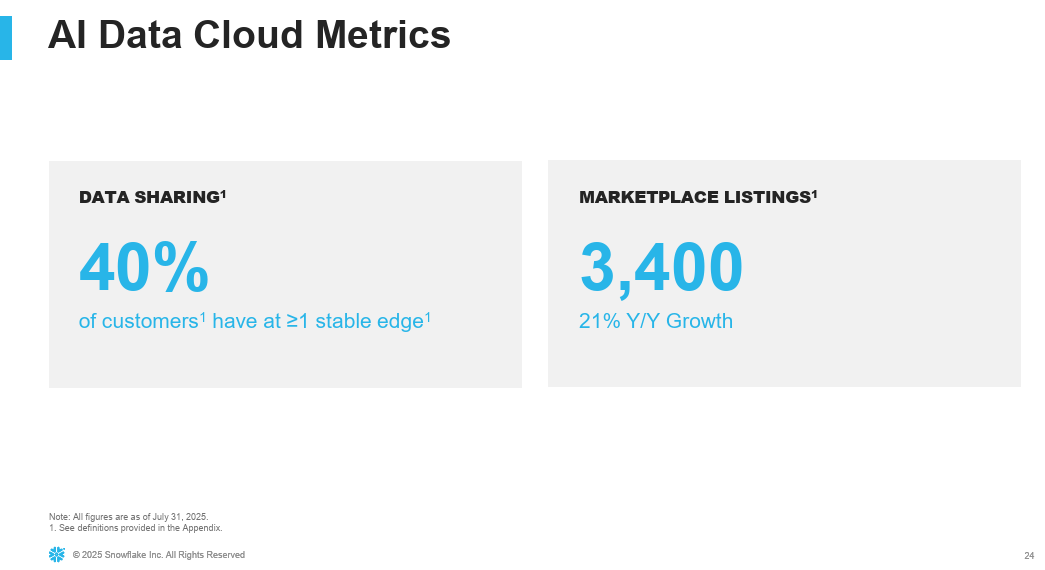

- A partnership with Nvidia to integrated the GPU giant's latest technologies into VCF.

- An expanded alliance with Canonical to ship container-based AI applications faster. VCF and Ubuntu Pro will be available with enterprise support.

It remains to see if Tan's wooing of enterprises will pay off. It does appear that VMware has battled back vs. the competition either by favorable pricing or technology roadmap. Tan's biggest argument is that Broadcom has delivered on its promises.

"Since the acquisition two years ago, we rolled up our sleeves, did the tough engineering work and the result today is VMware Cloud Foundation 9.0, a real software-defined platform to run all your application workloads with compute, networking and storage tightly integrated," he said. "We deliver VCF as a single SKU. We made it plug and play. And with VCF 9.0, just want you to know, private cloud now outperforms public cloud."

The Explore keynote also featured a heavy dose of customers including Barclays and Grinnell Mutual that modernized on VCF. "With VCF, it's really allowing my small team to extract maximum value from a really cohesive set of tools. And that unifying software, it extends to that pain point that exists between infrastructure and developers," said Jeremy Wright, Director of IT Infrastructure, Grinnell Mutual.

Not so fast, say rivals

Tan's argument that VCF 9.0 is your future isn't going to give pause to rivals. Just ahead of the Explore keynote, Microsoft launched a VM Conversion tool that makes it easy to convert VMware to Windows Server and Hyper-V.

Before that Microsoft announcement, Platform9 launched a tool to migrate entire VMware vSphere clusters.

In May, AWS launched AWS Transform for VMware all designed to migrate VMware customers. Now generally available, AWS Transform for VMware is just getting traction.

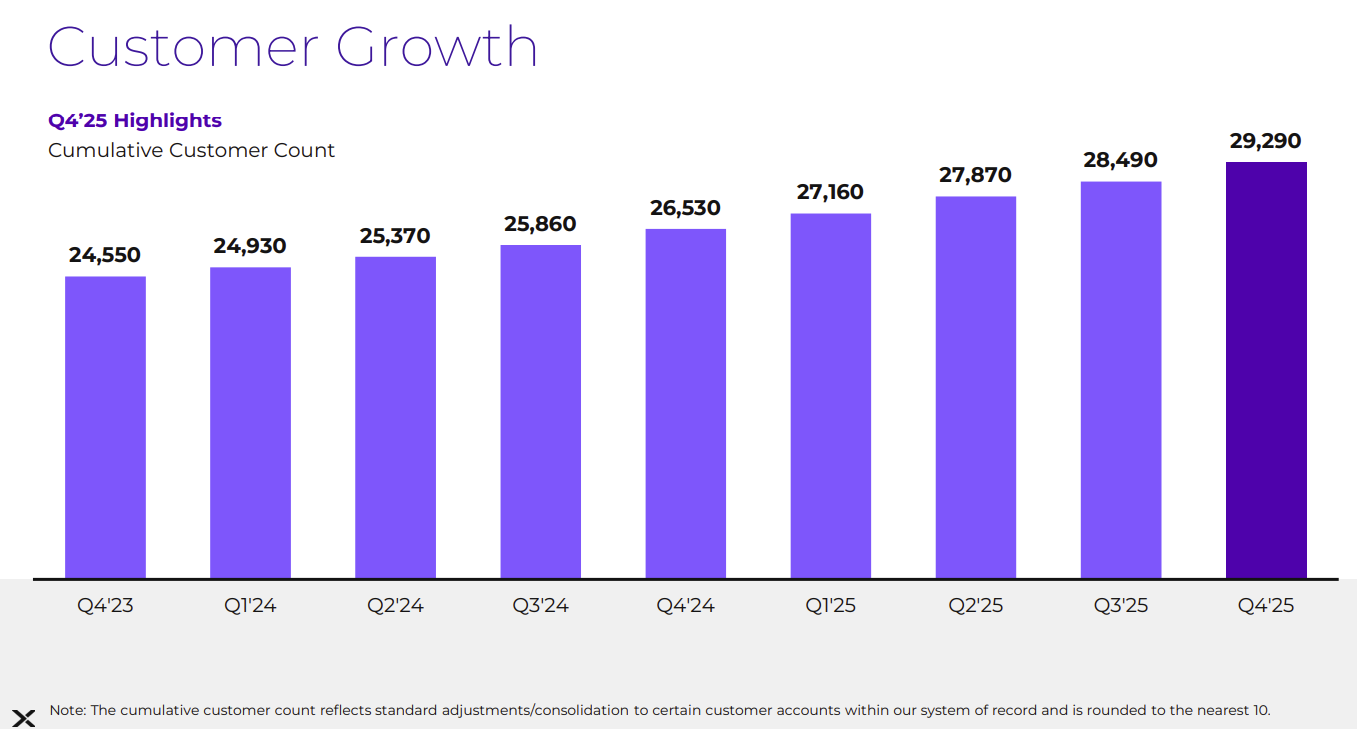

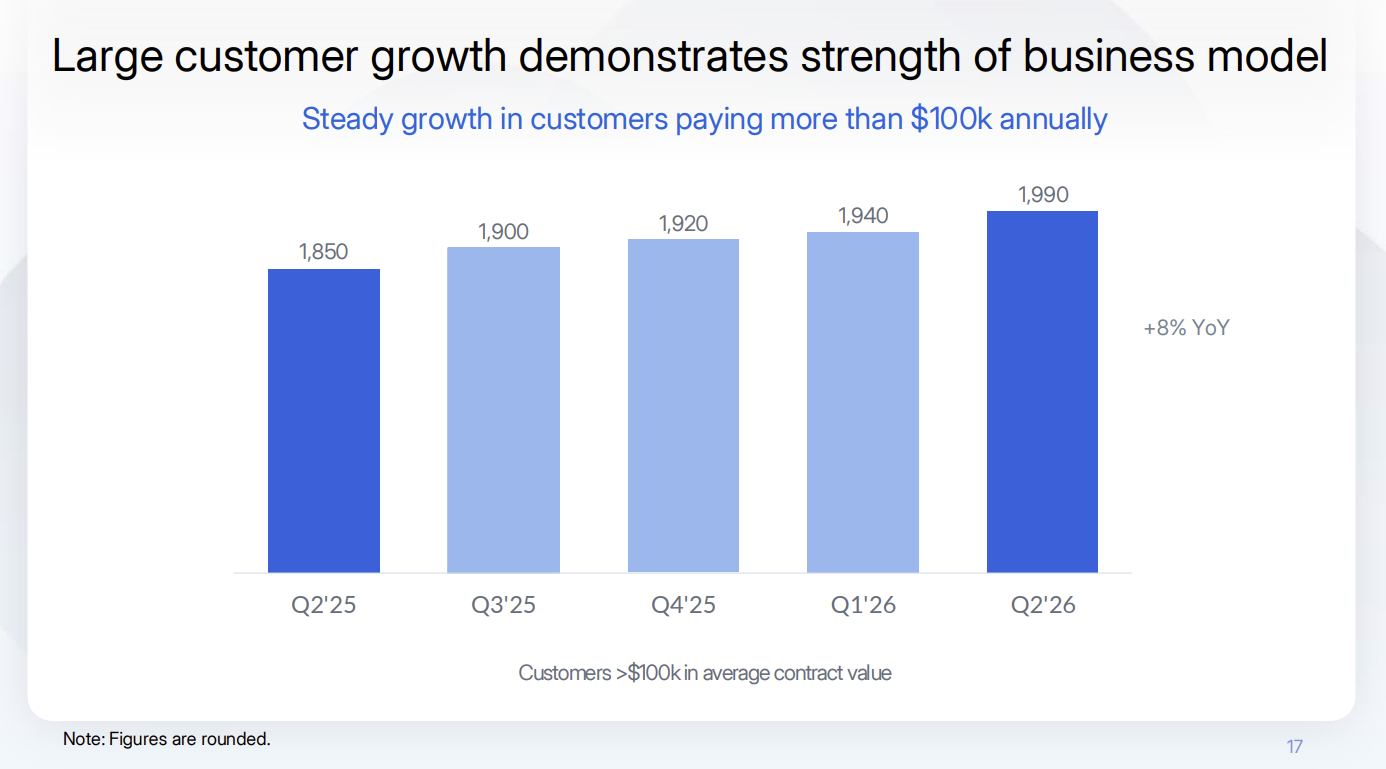

And Nutanix's second quarter earnings call featured its usual batch of VMware questions. CEO Rajiv Ramaswami said Nutanix is taking workloads from VMware, but it's a long game. He said:

"I think the vast majority of the opportunity is still in front of us. And if you were to characterize this as a multi- inning baseball game, I'd probably say we're in the second inning at this point. The fact we've added 2,700 customers over the last year is a good sign that there are people moving. But there's 200,000 customers out there for VMware.

It's going to take time. And for the bigger customers, it's going to take even longer. The real big ones out there will take a long time to migrate. The smaller you are, the faster it is to migrate. The longer you are -- the bigger you are, the longer it's going to take."