Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

<br>Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…

Read more

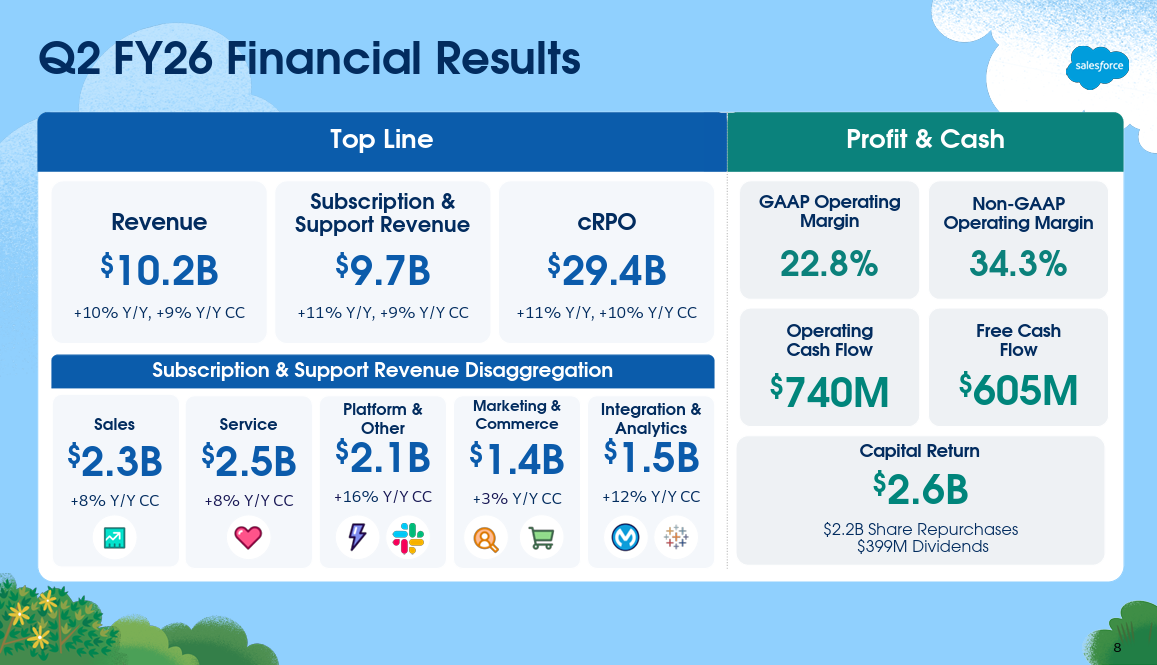

Salesforce is going to launch IT service management at Dreamforce 2025 as well as Agentforce 4, outline its take on the future of enterprise software and lay the groundwork to get from pilot to scale on agentic AI.

On Salesforce's second quarter earnings call, CEO Marc Benioff previewed the big themes that'll emerge at Dreamforce 2025 with a few tangents worth noting on the future of enterprise software. Here's a look:

Agentforce to production and scale with a hefty dose of Agentforce 4.

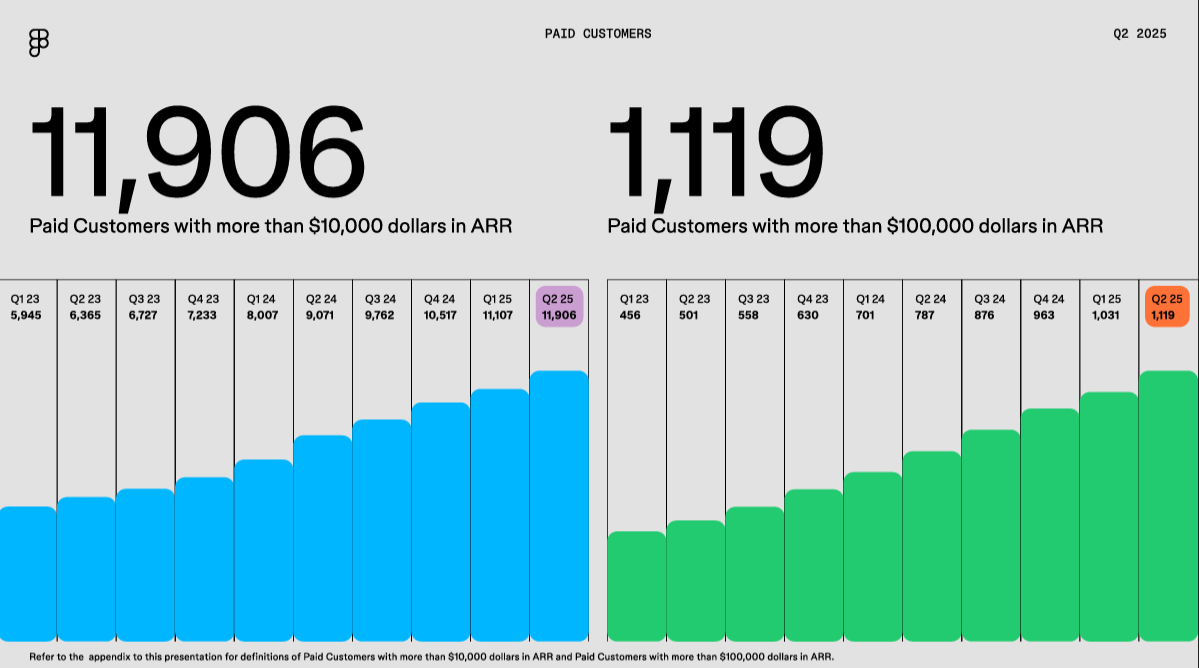

If Dreamforce 2024 was about how easy it is to set up an Agentforce pilot, 2025 will have to be about production and scale. Agentforce launched three quarters ago and it has 6,000 paid deals and 12,500 overall. "We've seen a 60% increase in quarter-over-quarter in customers who've gone from pilot to production and they're expanding use cases and scaling production," said Benioff.

Getting those customers to scale Agentforce and show value will be an overarching theme of Dreamforce sessions.

Srinivas Tallapragada, Salesforce's President, Chief Engineering & Customer Success Officer, said the company has been working with customers using forward deployed engineers to scale pilots. Salesforce is working with customers on "a series of tactical, practical features with a very closed-loop with our customers and hardening, deep integration with our Data Cloud and platform, really increasing the scale, and then just some engineering, customer success, cycle and the product adoption cycle."

My take: If Salesforce's growth is going to accelerate practical tools and features in Agentforce 4 will be needed. Dreamforce sessions will need to get into the weeds of data management, lessons learned so far, engineering value and best practices.

It's worth noting the Agentforce wish list, which was highlighted in a recent interview with Certinia.

Customer zero and beyond.

Salesforce will talk about customer zero a lot at Dreamforce. The idea here is to show Agentforce can scale and provide examples of how customers can implement it. Note the Benioff quotes from the second quarter earnings call:

- "Our Sales Cloud for years has been an app that thousands or millions of salespeople use to manage their sales every single day. But now riding alongside every salesperson is an agentic salesperson. And that agentic salesperson is calling every single person back. And how that relates to Salesforce, well, let me tell you that, well, maybe somewhere between 20 million and 100 million people who have contacted Salesforce in the last 26 years haven't been called back. It's just because we didn't have enough people. But now with our new agentic sales, everybody is getting called back. It's a huge breakthrough and something that every company is going to benefit from."

- "And in service, we've been talking about that now for months, you can see our agents are handling millions of conversations while humans are delivering the empathy and expertise."

- "These agents are operating across apps, departments, silos, all running off of our Data Cloud, all running off of Agentforce. It's an incredible transformation of our product line, but really of our company. Not just of our company, but of our customers, too."

My take: Customer zero case studies can be handy, but lining up enterprises from multiple industries will be more imperative. It would also be good to know how many Agentforce implementations needed integrators, forward deployed engineers and other extras.

Let customers do the talking.

Benioff on the earnings conference call cited DirectTV, Under Armour, Reddit, Pandora, Williams Sonoma and others as customers adopting Agentforce. Benioff also touted a push into US government accounts such as the US Army.

Benioff quipped that his keynote should just be a dozen customers on stage talking Agentforce in his annual "rip up the script" theme. I'd say go for it.

My take: Not surprisingly, Salesforce noted Data Cloud's growth, up 140% from a year ago to become a $7 billion business. What we want to hear from Salesforce customers is whether Agentforce was scaled not using Data Cloud completely or across multiple data stores. After all, your data is never going to be in one place.

Salesforce vs. ServiceNow.

ServiceNow did CRM. Salesforce will launch ITSM at Dreamforce. "We're launching our own agentic IT service platform. A lot of our existing customers have been asking for this. We're bringing a whole new level of capability. It's agent-first and it's Slack-first, that is right inside Slack, you're going to be using our agentic IT service capability," said Benioff. "It's natively embedded where employees already work with zero learning curve. And with agentic IT service, well, every request is becoming a conversation where agents work hand-in-hand with IT teams proactively fixing their problems."

Benioff said Salesforce's ITSM will appeal to multiple enterprises, not just the largest.

My take: It's so easy to fall into the Salesforce vs. ServiceNow storyline. I'm going to refrain. Yes, the two companies are on a collision course to become the AI agent platform of choice. But here's the reality: ServiceNow can expand in CRM and never bump into Salesforce. ServiceNow is going after the "other" part of the CRM pie. ITSM is a similar story. Salesforce's ITSM efforts aren't going to upend ServiceNow as much as be a threat to a vendor like Freshworks.

Overall, the Salesforce vs. ServiceNow theme rhymes with SAP vs. Oracle. Both seem to do fine and neither company really poaches from the other one.

The future of SaaS.

Benioff was asked about the future of SaaS and whether agentic AI would upend the industry. Benioff said AI is "the fundamental extension of SaaS." Here are a few choice quotes:

- "There's this strange narrative that's out there that somehow enterprise SaaS or apps or something are going away. I guess nothing lasts forever. But I just look at how I'm running my own business and the business of our customers, I don't understand what the replacement is."

- "To hear some of this nonsense that's out there in social media or in other places, people say the craziest things, but it's not grounded in any customer truth."

- "You got to separate the forest from the trees or for those of us who are kind of Bible readers, maybe we separate the wheat from the chaff. And I'll just tell you, as we separate the wheat from the chaff, just know there is truth out there, and you have to go out there and really find it. And the truth is always with the customers and also right here at Customer Zero. And I plan to like lay it all out for you at Dreamforce as well on October 14."

Benioff said that the future of software will play out with large enterprises that are "being pitched a lot of different technology right now. And a lot of it is fantasy land."

My take: The debate on the future of enterprise software is only going to pick up. Benioff does have a point that a lot of what's being pitched is fantasy. The divergence to watch is going to be how AI natives scale enterprise software.

SMB and midmarket.

Benioff said AI agents aren't just for large companies. AI may be the enabler to accelerate smaller company growth as well as the midmarket.

On SMBs, Benioff said:

"Those companies need real software, too, but they don't have CIOs. They don't have DIY. They need prepackaged software and they're not really dealing with the hyperscalers or the large-scale SIs. They're dealing with us. We are their hyperscaler. We are their software hyperscaler."

On the midmarket, Benioff said:

"This mid-market and general business is growing super-fast. And when I talk to my friends who run the large SIs, I've been encouraging them to move their business downstream to serve these companies (with) 1,000 to 10,000 employees."

Salesforce President and Chief Revenue Officer Miquel Milano said:

"AI is creating more small and medium companies. So that opportunity is huge and that's why we're investing significantly. We're investing significantly more in the mid and low end of the market."

My take: Enterprise software giants looking for growth always pay homage to smaller enterprises. The issue is that SMBs and midsized companies are forgotten once vendors get their growth game back. That’s why enterprise vendors that actually stay focused on the midmarket have a lot of customer loyalty.

Data to Decisions

Future of Work

Marketing Transformation

Matrix Commerce

New C-Suite

Next-Generation Customer Experience

Innovation & Product-led Growth

Tech Optimization

Digital Safety, Privacy & Cybersecurity

salesforce

ML

Machine Learning

LLMs

Agentic AI

Generative AI

Robotics

AI

Analytics

Automation

Quantum Computing

Cloud

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

Leadership

VR

Chief Information Officer

Chief Executive Officer

Chief Technology Officer

Chief AI Officer

Chief Data Officer

Chief Analytics Officer

Chief Information Security Officer

Chief Product Officer