Adobe's AI strategy, monetization 'feels really good right now'

Adobe said its various AI offerings are driving usage and monetization as the company delivered better-than-expected second quarter results.

CEO Shantanu Narayen said AI is becoming a "nice tailwind" for the business and adoption as customers either pay for higher-tier plans for AI or buy individual features.

Narayen breaks down the AI effect as "AI influence revenue"--innovation that drives usage and higher subscription revenue in products like DX, Acrobat and Creative Cloud--and direct revenue from a standalone Firefly app, Creative Cloud Pro and GenStudio.

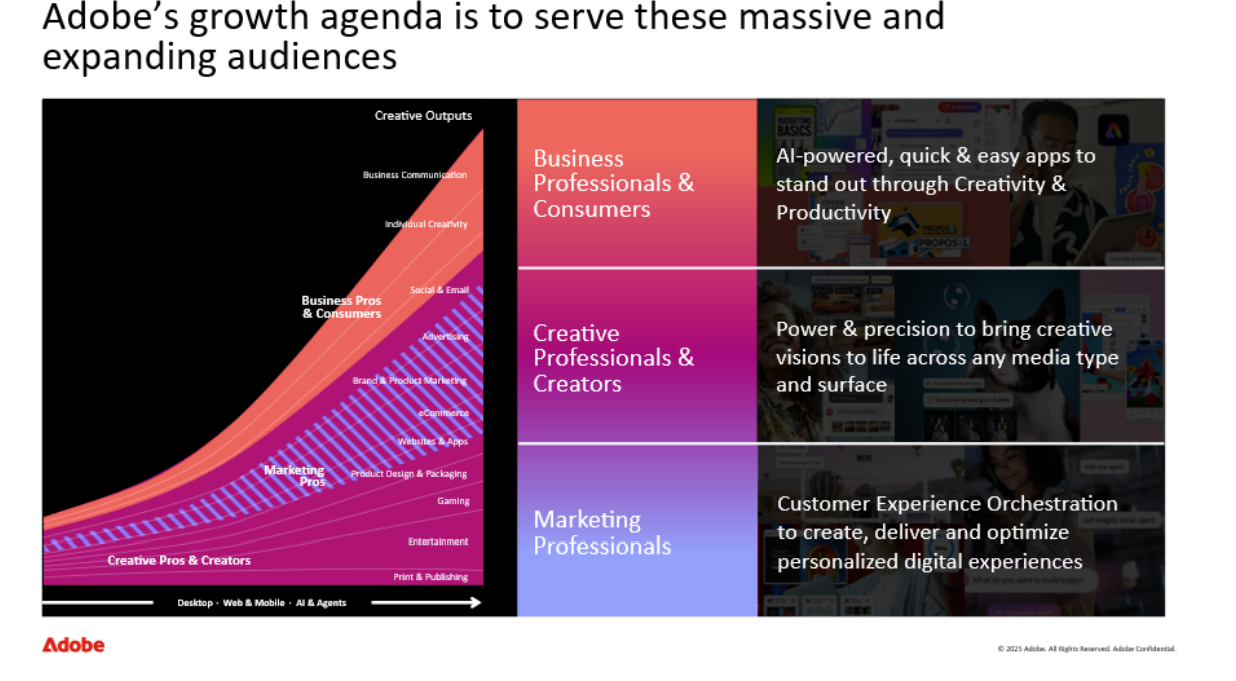

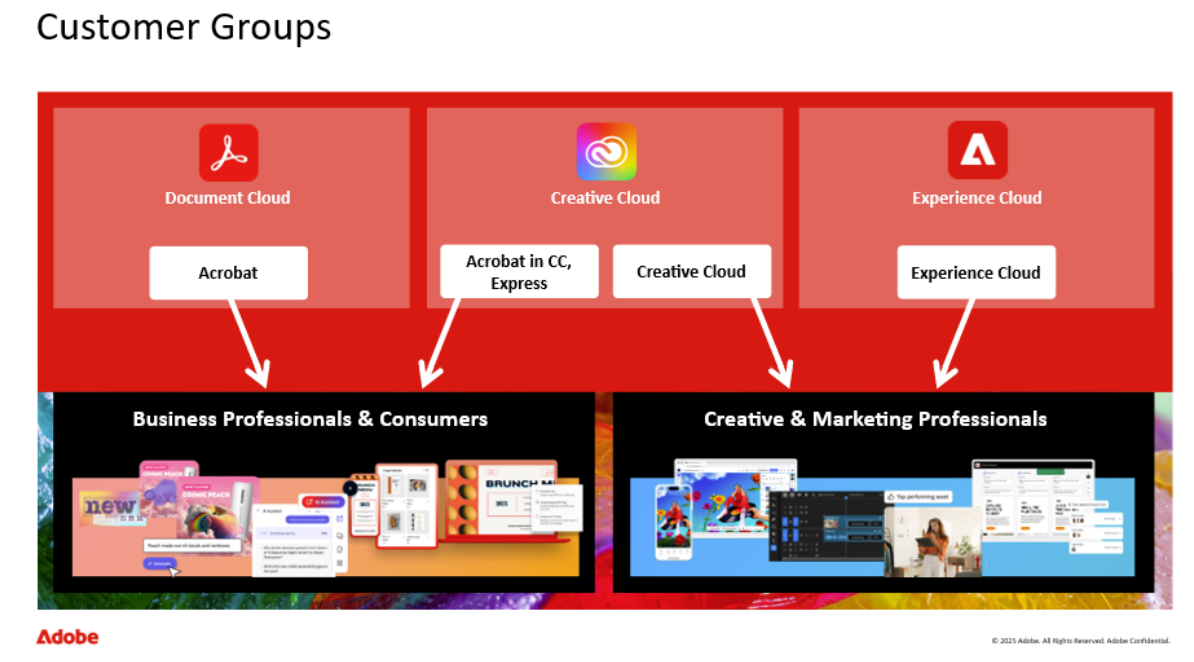

Adobe has laid out a strategy where it is targeting business professionals and consumers as well as creative and marketing pros. The approach gives Adobe a well-diversified customer base.

Narayen explained:

"The AI influence revenue is already in the billions because that speaks to the value that people are getting across both our DX products, Acrobat products as well as the Creative products. So across the board, there's no question that AI is a nice tailwind as it relates to adoption. And we also said we're tracking ahead of the $250 million of ARR."

The immense opportunity is all ahead of us. And as we get this entire offering that we keep talking about, which is Acrobat; Express; Firefly single app; Creative Cloud Pro, which includes Firefly; GenStudio; and the AEP and apps, each one of them, we think, has a tremendous opportunity ahead of us. So it's very early in terms of the AI monetization, but we're very advanced in terms of how much innovation we've delivered. And so it feels really good right now."

That AI effect is showing up in Adobe's earnings report, which appears to have satisfied Wall Street. In most quarters, Adobe reports strong financials and gets walloped afterward due to monetization worries or fears about trailing in AI.

Rest assured those worries are still there. Adobe executives were repeatedly asked about competition from Meta and other model disruptors to Creative Cloud, Adobe Express and the rest of the portfolio.

David Wadhwani, general manager of Adobe's Digital Media business, said the company is moving key apps like Firefly to mobile and it is driving its model based on data and the web journey optimization it offers enterprise. The lessons from Acrobat's AI upsell are being applied elsewhere. "We onboarded into 8,000 new businesses in the quarter with Express," he said.

Narayen said the Adobe strategy has been to drive adoption of key AI tools like Firefly and Acrobat AI Assistant and then drive monetization. Ultimately, Creative Cloud Pro will have the bundle of Adobe's best AI features. The Adobe CEO also said Adobe is seeing strength in its marketing offerings too and is automating workflows. "The North Star is the combination of creativity and productivity driving growth for us," he said.

The numbers

Adobe reported second quarter earnings of $1.69 billion, or $3.94 a share, on revenue of $5.87 billion, up 11% from a year ago. Non-GAAP earnings were $5.06 a share. The results and outlook topped Wall Street estimates.

- Digital Media revenue was up 11%.

- Digital Experience revenue was up 10%.

- Business professional and consumer group subscription revenue was up 15%.

- Creative and marketing professional group revenue was up 10%.

As for the outlook, Adobe said third quarter revenue will be between $5.87 billion and $5.92 billion with non-GAAP earnings of $5.15 a share to $5.20 a share.

For fiscal 2025, Adobe projected revenue of $23.5 billion to $23.6 billion with non-GAAP earnings of $20.50 a share to $20.70 a share.