Oracle Q1 misses, but sees OCI revenue surging over next 4 years

Oracle's first quarter earnings and revenue fell short of expectations, but remaining performance obligations growth of 359% overshadowed the results.

The company delivered first quarter earnings of $1.01 a share on revenue of $14.9 billion, up 12% from a year ago. Non-GAAP earnings in the quarter were $1.47 a share.

Wall Street was expecting Oracle to report first quarter non-GAAP earnings of $1.48 a share on revenue of $15.04 billion.

Oracle said cloud revenue overall was $7.2 billion, up 28% from a year ago. Oracle's infrastructure as a service business was $3.3 billion in the first quarter, up 55% from a year ago. Cloud application revenue (SaaS) was $3.8 billion, up 11% from a year ago.

- Oracle adds OpenAI's GPT-5 to its database, cloud applications

- Oracle Cloud Infrastructure to add Google Cloud Gemini models

Although the most recent quarter was mixed, Oracle's future demand looks strong. Oracle said remaining performance obligations (RPO) in the first quarter was $455 billion, up 359% from a year ago. In its SEC filing for the quarter Oracle said:

"Remaining performance obligations were $455.3 billion as of August 31, 2025, of which we expect to recognize approximately 10% as revenues over the next twelve months, 25% over the subsequent month 13 to month 36, 34% over the subsequent month 37 to month 60 and the remainder thereafter."

CEO Safra Catz said Oracle signed "four multi-billion-dollar contracts with three different customers in Q1." She added:

"It was an astonishing quarter—and demand for Oracle Cloud Infrastructure continues to build. Over the next few months, we expect to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars. The scale of our recent RPO growth enables us to make a large upward revision to the Cloud Infrastructure portion of Oracle's overall financial plan which we will be presenting in detail next month at the Financial Analyst Meeting."

Catz said Oracle is expecting Oracle Cloud Infrastructure revenue to be $18 billion this fiscal year, up 77%, and then increase to $32 billion, $73 billion, $114 billion and $144 billion over the next four years. "Most of the revenue in this 5-year forecast is already booked in our reported RPO," said Catz.

Today, Oracle's cloud revenue run rate is pushing $29 billion. For comparison, AWS has an annual revenue run rate of $124 billion compared to $50 billion for Google Cloud and $75 billion in annual sales for Microsoft Azure.

CTO Larry Ellison said multicloud database revenue from Amazon, Google and Microsoft grew 1,529% in the first quarter compared to a year ago. "We expect multicloud revenue to grow substantially every quarter for several years as we deliver another 37 datacenters to our three hyperscaler partners, for a total of 71," said Ellison.

Ellison said the company will introduce the following at Oracle AI World: Oracle AI Database, which will allow customers to use any LLM including Google Gemini, OpenAI ChatGPT, xAI's Grok and others--on top of Oracle Database.

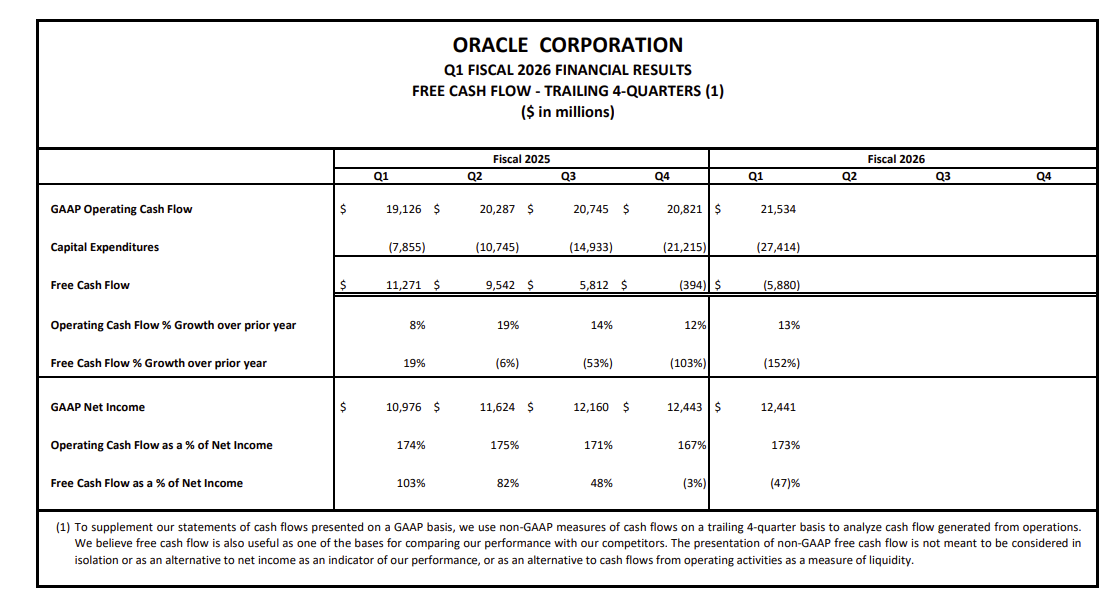

While Oracle's future demand seems secure, it's worth noting that the company's free cash flow is taking a hit as it spends heavily to expand. In the first quarter, Oracle operating cash flow of $21.53 billion was surpassed by $27.4 billion in capital expenditures. Oracle's free cash flow was negative for the last two quarters.

Constellation Research analyst Holger Mueller said:

"Oracle finds itself with the interesting challenge that it needs to invest to deliver on the revenue it has under contract for the future. Capex is up $20 billion year over year with negative free cash flow. As long as the data center build out does not hit any snags, Oracle gets the committed spend. There will be great quarters for Oracle investors to come. The interesting aspect is that none of the Oracle competitors have gone cash flow negative in a quarter. This fiscal year will be huge for Oracle and capacity gone live will be the quarterly KPI."

As for the outlook, Catz said second quarter revenue growth will be between 14% to 16% with non-GAAP earnings between $1.61 a share to $1.65 a share. Fiscal 2026 capital expenditures will be about $35 billion.

Catz added that Oracle doesn't own buildings or land, but the equipment. "It's much cheaper than our competitors. We only put that equipment in when it's time, and we're generating revenue right away," she said. "It's asset pretty light. Some of our competitors like to own buildings. That's not really our specialty."

Here's what Ellison said on the conference call:

- "There's a huge amount of demand for inferencing. All this money we're spending on training is going to have to be translated into products that are sold, which is all inferencing. And the inferencing market, again, is much larger than the training market."

- "A lot of companies are saying we're big into AI because we're writing agents. Well, guess what? We're writing a bunch of agents too."

- "AI is going to generate the computer programs called AI agents that will automate your sales and marketing processes. Let me repeat that. AI is going to automatically write the computer program that will then automate your sales processes and your legal processes and everything else."

- "We have gotten the entire Oracle Cloud, the whole thing, every feature, every function of the Oracle Cloud, down to something we can put into a handful of racks. We call it butterfly. It costs $6 million. So we can give you the we can give you a private version of the Oracle Cloud with every feature, every security feature, every function, everything we do, for $6 million."

- "We're an application company and a cloud infrastructure company, and therefore we build applications, and we'd like to be more efficient. And the way to be more efficient is to build AI application generators. And we have been doing that, and we the latest applications that we are building. We're not building them, they're being generated by AI."