Constellation Research Ambient Experience: Everything we learned about CX, EX, AI, data

Constellation Research kicked off its Ambient Experience 2024 in Austin and the key theme was the intersection of data, artificial intelligence, digital transformation and employee and customer experiences.

Here's the recap of everything we learned.

Ambient Experience Summit | AX100 2024 | All AX Leaders

AI and data foundations

Generative AI is an immature technology that has put CIOs on the hot seat. Enterprises have to lead with privacy and trust before broad rollouts. "AI should not be used everywhere and some use cases don't apply. You can build it and they won't necessarily come," said Ghalib Kassam, CIO, Los Angeles Times.

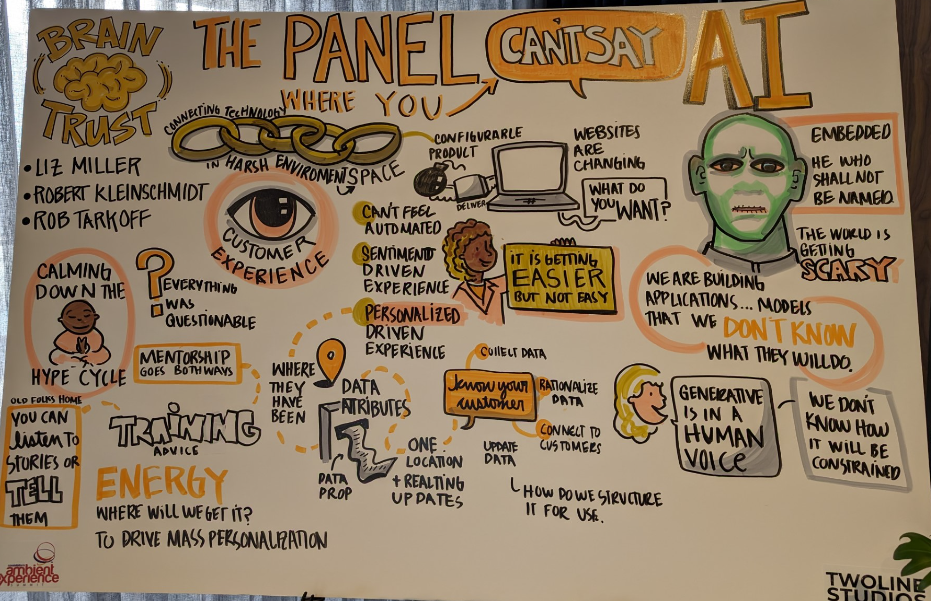

AI will be critical to drive personalized and contextual experiences, said Robert Kleinschmidt, Senior Vice President, Marketing & Mil/Aero SBU AirBorn. AirBorn makes connectors and parts for harsh environments. The company is looking to build experiences focused on personas, context and personalization.

To drive these AI experiences, customers will have to gather data attributes across systems and types. Data will also be needed to focus on teams behind projects instead of individual leads. "In B2B, there are five, 10 or more people involved in a project," said Kleinschmidt. "The lead on a project is not a person. There are different journeys for customers, and you need to see the connections between individuals."

The biggest challenge for AI is convincing CEOs that data is the foundation, and you need to spend time and resources on the grunt work, said Kleinschmidt.

Generative AI could be "scary for enterprises and vendors," said Rob Tarkoff, Executive Vice President & GM, CX Applications at Oracle. Why? "As an industry this is the first time where we've had applications that we don't entirely know what they will do," said Tarkoff. "Incorporating new models creates a whole new frontier of prompt engineering. You test against synthetic data, and you run as many models, and you constrain prompt engineering as much as you can. In an enterprise context, you don't have as much margin for error."

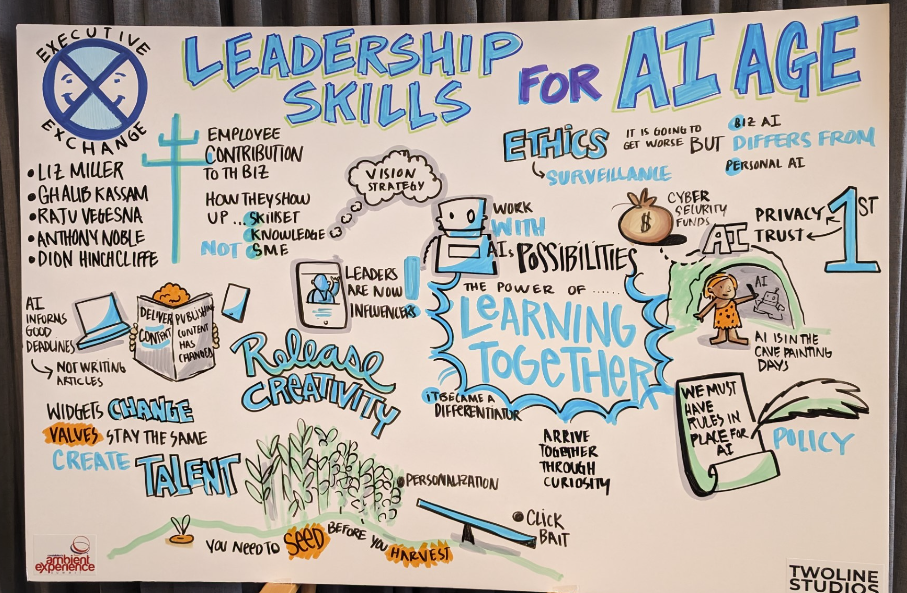

Leadership

Anthony Noble, SVP, Chief Strategy Officer at American Tower Corp., said leadership requires building an understanding on how your colleagues contribute to the business and their knowledge bases. "After that you put together teams with different knowledge bases to solve problems." said Noble. "There's a power in learning together once you're past the scary part and understand the opportunities."

Don't get caught up on technologies because the lifespan of digits is much shorter than inspiring people, said Raju Vegesna, Chief Evangelist at Zoho.

Leaders are more influencers than commanders, said Constellation Research analyst Dion Hinchcliffe. "The biggest trend is that leadership has moved away from command and control," said Hinchcliffe. "Leaders are not order givers but influencers. You need employees to solve local problems at scale with innovation and creativity."

B2B customer experiences

The user journey, experience and interface need more attention in B2B companies. In many B2B companies digital UX has been an afterthought. Kimberlee Sinclair, VP of Digital Customer Experience at H.B. Fuller, said her team enabled transformation by melding technology and digital marketing. "We needed dotted lines between the technology and marketing for it to come together," said Sinclair. "Luckily, our CIO is a businessperson and not a technology wonk."

"Customer experience no longer rests with the sales team," said Trane's Portia Mount, Vice President of Marketing at Trane Commercial Americas, Trane Technologies. "Experience is the integration of product, sales and marketing teams if you want transformation."

Continuous upskilling will be required in the manufacturing sector amid generative AI and productivity gains. "How do we help people get smarter and faster?" asked Mount.

High touch doesn't mean a good experience. Chad Meley, CMO of Kinetica, said experience used to hinge on giving your best customers attention. "There's a pivot toward more self-service and meeting customer preferences to how they want to buy," said Meley.

Employee and customer experiences combine

Does employee experience drive customer experience? April Obersteller, Director of Global Experience: Employee Experience + Customer Experience at Woom Bikes, works at a company that puts employee and customer experiences under one leader. "We believe strongly that the customer is at the center and that has shifted to the employee experience as well," said Obersteller.

Bob DelPonte, Senior Vice President of Customer Success and Global Delivery Services at UKG, said he worked with his HR leaders to correlate customer satisfaction and employee engagement. "My lowest engaged team actually has the worst customer satisfaction systems. And so, when people say happy employees, happy customers, I can correlate directly to productivity, engagement and overall satisfaction," he said.

Employee experience needs to reduce friction. John Bollen, CIO at Blackstone Portfolio Companies, said reducing friction for employees across systems is critical to improving customer experiences. "We never call an employee an employee. They were co-star. Co-stars were part of the experience, and they were part of the show. Everyone was part of the show," said Bollen. "We have all these systems, all these different touch points and getting that data into the cloud so that any employee can look up the customer and understand who they are. It's UX and CX in your hand."

Retention is also a key metric behind employee experience efforts. "We're being very intentional, for the first time ever about the employee experience," said Darla Caughey, Director of Employee Experience at Austin Independent School District. "It's not typical to see an employee experience department in a public school district and it is making a difference with retention." Enterprises will need to have AI strategies and use cases to retain and attract employees.

Employee experience is getting focused on key personas. Christy Punch, Senior Mgr., Product Manager Engineering Experience at Liberty Mutual Insurance, said she's focusing on the developer experience at her company. "I've spent the majority of my career focused on employee experience. And so rather than going broader with customer experience, I've actually started to narrow my focus. And now I am focused on the engineering experience, which is more traditionally known in the industry, the developer experience, and that's actually a very hot topic," she said.

Marketing Transformation Future of Work Next-Generation Customer Experience Data to Decisions Innovation & Product-led Growth Tech Optimization Digital Safety, Privacy & Cybersecurity ML Machine Learning LLMs Agentic AI Generative AI AI Analytics Automation business Marketing SaaS PaaS IaaS Digital Transformation Disruptive Technology Enterprise IT Enterprise Acceleration Enterprise Software Next Gen Apps IoT Blockchain CRM ERP finance Healthcare Customer Service Content Management Collaboration Chief People Officer Chief Information Officer Chief Marketing Officer Chief Digital Officer Chief Data Officer Chief Executive Officer Chief Technology Officer Chief AI Officer Chief Analytics Officer Chief Information Security Officer Chief Product Officer