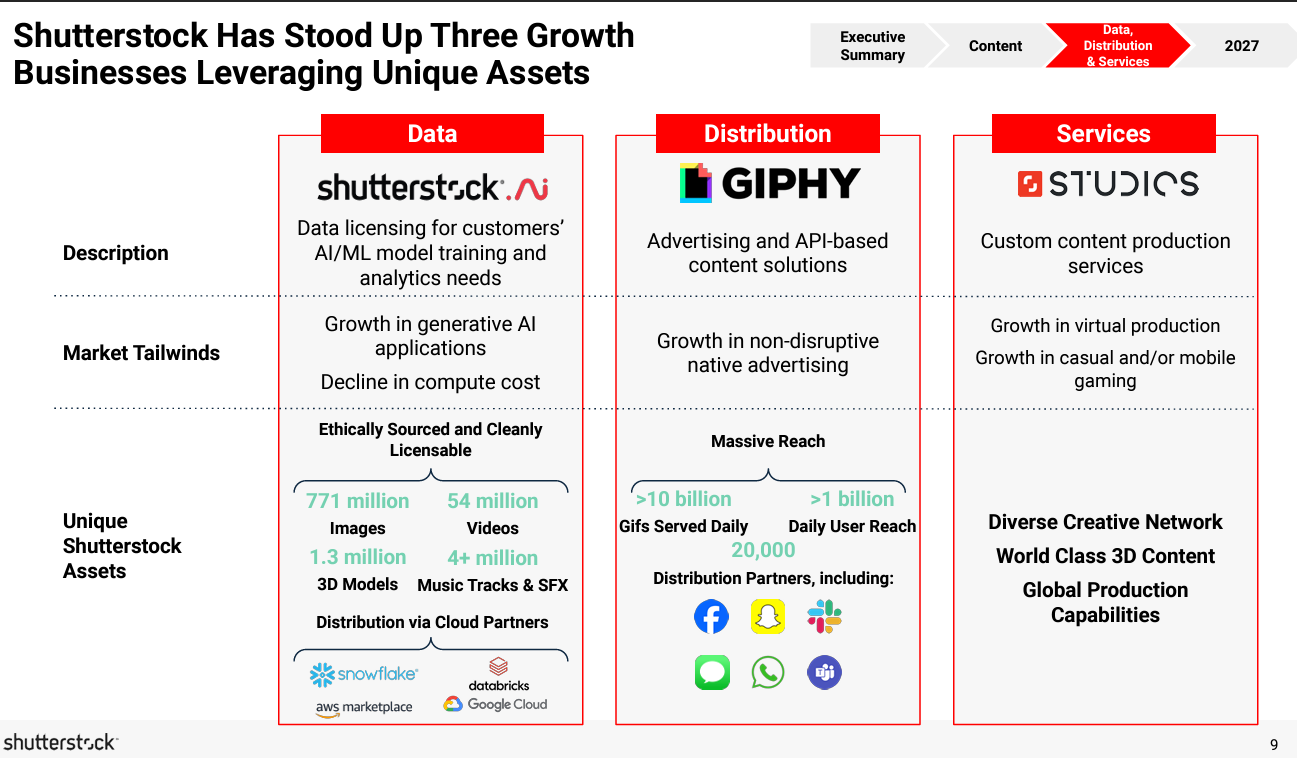

Shutterstock will bring its training data to Databricks, Snowflake, Amazon, Google Cloud

Shutterstock is best known as a stock image provider and owner of Giphy, but the money and margins may come from training data for model training.

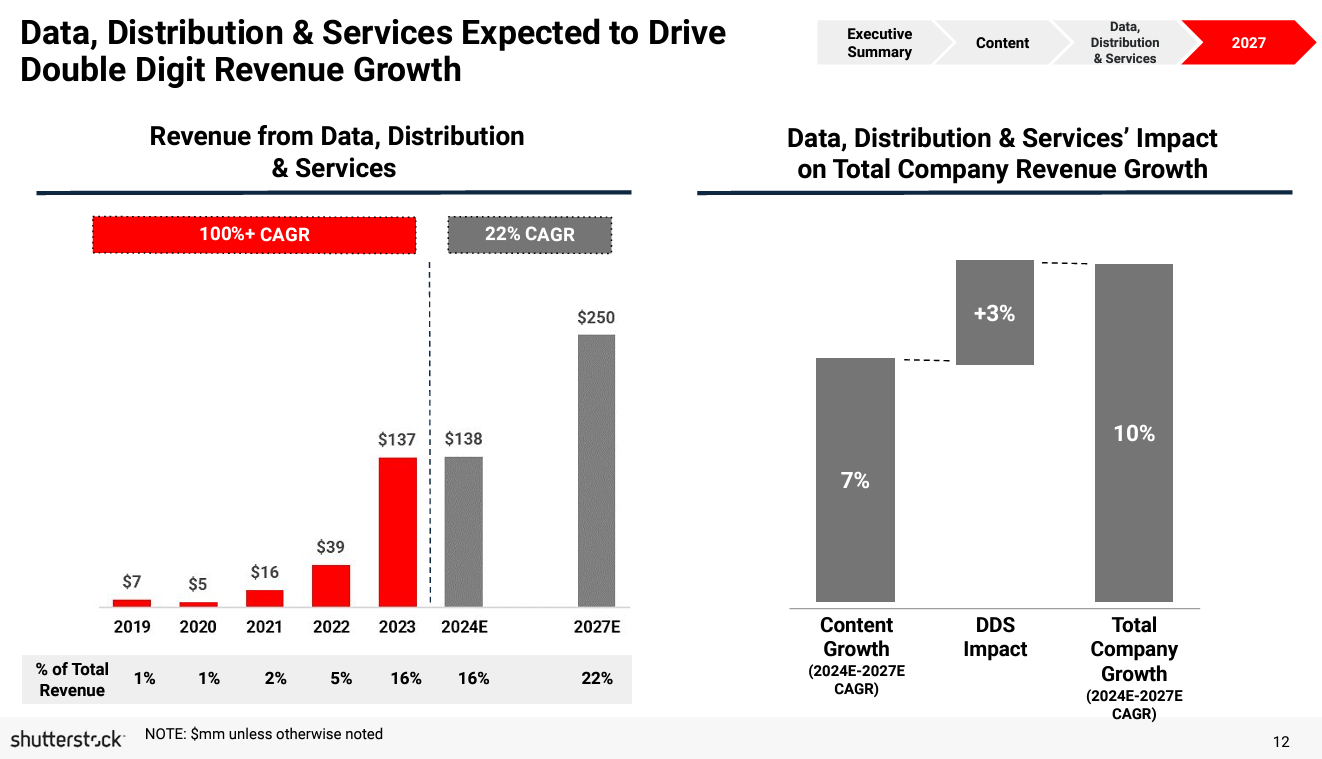

During the company’s fourth quarter earnings call, Shutterstock CEO Paul Hennessy said the company is looking beyond wholesale data deals with the likes of Meta and OpenAI to licensing data across marketplaces. Shutterstock sees the data business as something that can grow at a compound annual growth rate of 22% through 2030.

Hennessy said:

"As we look ahead, AI and machine learning model training will continue to be a growth opportunity, especially as we look to diversify our revenue base by targeting new buyers beyond the hyperscalers. In fact, we just won our first seven figure contract involving a venture backed startup in the generative AI ecosystem, and we feel there are much more such opportunities ahead. We'll also be expanding our delivery model by leveraging our cloud marketplace partners. This will allow us to go from being a wholesale provider of data to the likes of Meta and OpenAI to a retail provider of data to the hundreds of companies we believe are going to custom train their own models.

To that end, we are in the process of rolling out Shutterstock's training data onto data marketplaces of DataBricks, Snowflake, Amazon and Google Cloud."

Shutterstock's data business had revenue of $104 million in 2023. Today, Shutterstock has 10 anchor customers for training data, but thinks it can get to 150 over time.

"The data marketplaces of Snowflake, Databricks, AWS and Google are comparatively small but fast-growing businesses for these companies as their customers learn how to enrich and monetize their own data and models," said Doug Henschen, VP and Principal Analyst at Constellation Research. "Interest in GenAI will further accelerate the growth of these data marketplaces as companies start to build their own small and midsize models, including ones harnessing image data."

Giphy has a role in this generative AI play for Shutterstock because the content platform is connected with APIs. That know-how has given Shutterstock "API relationships" with major technology players. Shutterstock will invest in 2024 to build out its training data business.

Hennessey said the plan is to bring Shutterstock data to where the customers are. "Our customers don't naturally think of Shutterstock as a place to go for computer vision training data and training their generative AI models, but they do typically go to a DataBricks or a Snowflake or an AWS or GCS in order to acquire training data. This is also the natural compute environment for these customers," said Hennessey, who added that those partners will boost distribution without hurting margins.

"The way these distribution channels make money is not by taking a cut of the data sales, it's through the compute. And so they're looking forward to having our data on their ecosystems, so they can drive additional compute in the cloud," he said.

It remains to be seen how Shutterstock's training data business develops. Contracts can last years or be shorter depending on volume-based pricing.

Shutterstock reported 2023 revenue of $874.6 million, up 6% from a year ago, with net income of $110.3 million.