Vice President and Principal Analyst

Constellation Research

Chirag Mehta is Vice President and Principal Analyst focusing on cybersecurity, next-gen application development, and product-led growth.

With over 25 years of experience, he has built, shipped, marketed, and sold successful enterprise SaaS products and solutions across startups, mid-size, and large companies. As a product leader overseeing engineering, product management, and design, he has consistently driven revenue growth and product innovation. He also held key leadership roles in product marketing, corporate strategy, ecosystem partnerships, and business development, leveraging his expertise to make a significant impact on various aspects of product success.

His holistic research approach on cybersecurity is grounded in the reality that as sophisticated AI-led attacks become…...

Read more

It’s Albert Einstein’s birthday today. Einstein would not have imagined 885 people dressing up as him to set a Guinness World Record, 145 years after he was born. Salesforce held a special event last week in San Francisco, during their developer-focused conference, TrailblazerDX, where Trailblazers dressed up as Einstein to break a Guinness World Record. During this conference, Salesforce announced their next-generation AI platform, Einstein 1 Studio. The energy on the show floor was palpable as hundreds of developers hurried from expert sessions to demo stations to the Hacker Camp. Thousands of other developers tuned in online to stream the conference programming.

Over the course of years, Salesforce has made many bold decisions to continue to reinvent itself. On its 25th anniversary this week, Salesforce once again reinvented itself by deciding to go all in with AI. When Parker Harris, co-founder of Salesforce, took the keynote stage to announce Einstein 1, he joked about him looking old. He was as energetic and beaming with enthusiasm as one can be. On a beach-themed stage, he even threw a beach ball to the next presenter after flawlessly pronouncing his name in single breath, Muralidhar Krishnaprasad, the engineering head of Data Cloud, who goes by MK. Parker also took the opportunity to remind the audience about Salesforce’s 1-1-1 model: donating 1% equity to charitable causes, 1% products to non-profits, and 1% of employees’ time in community service.

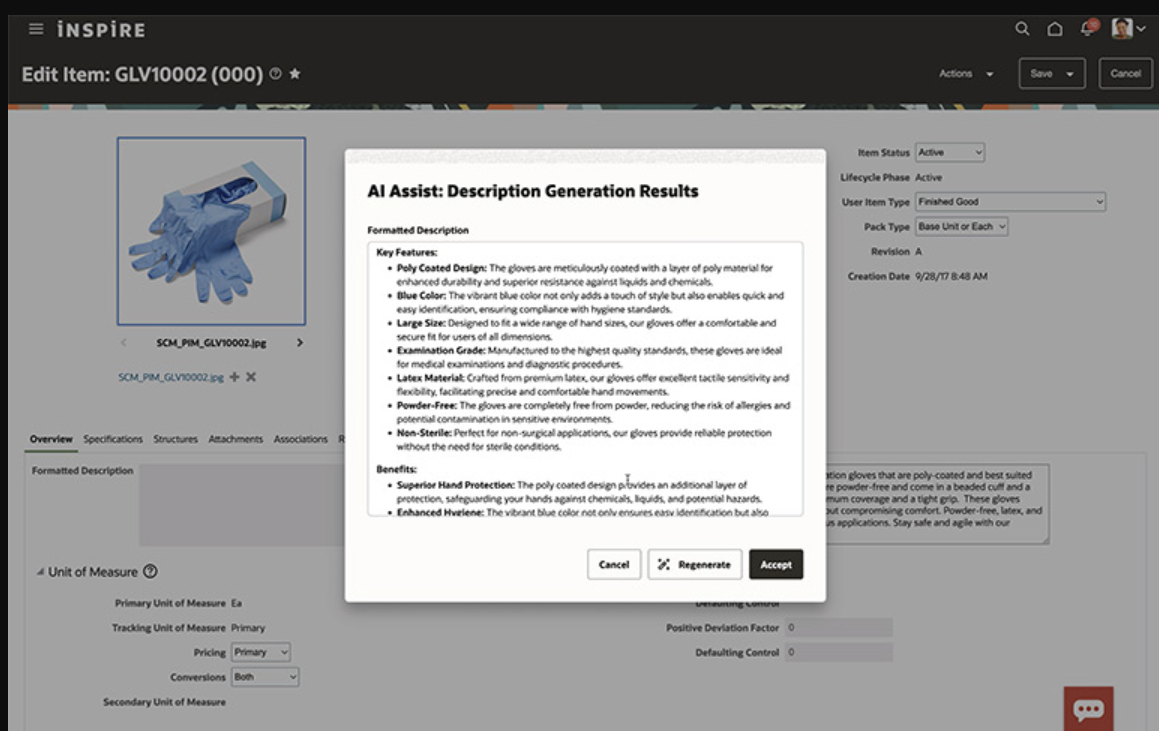

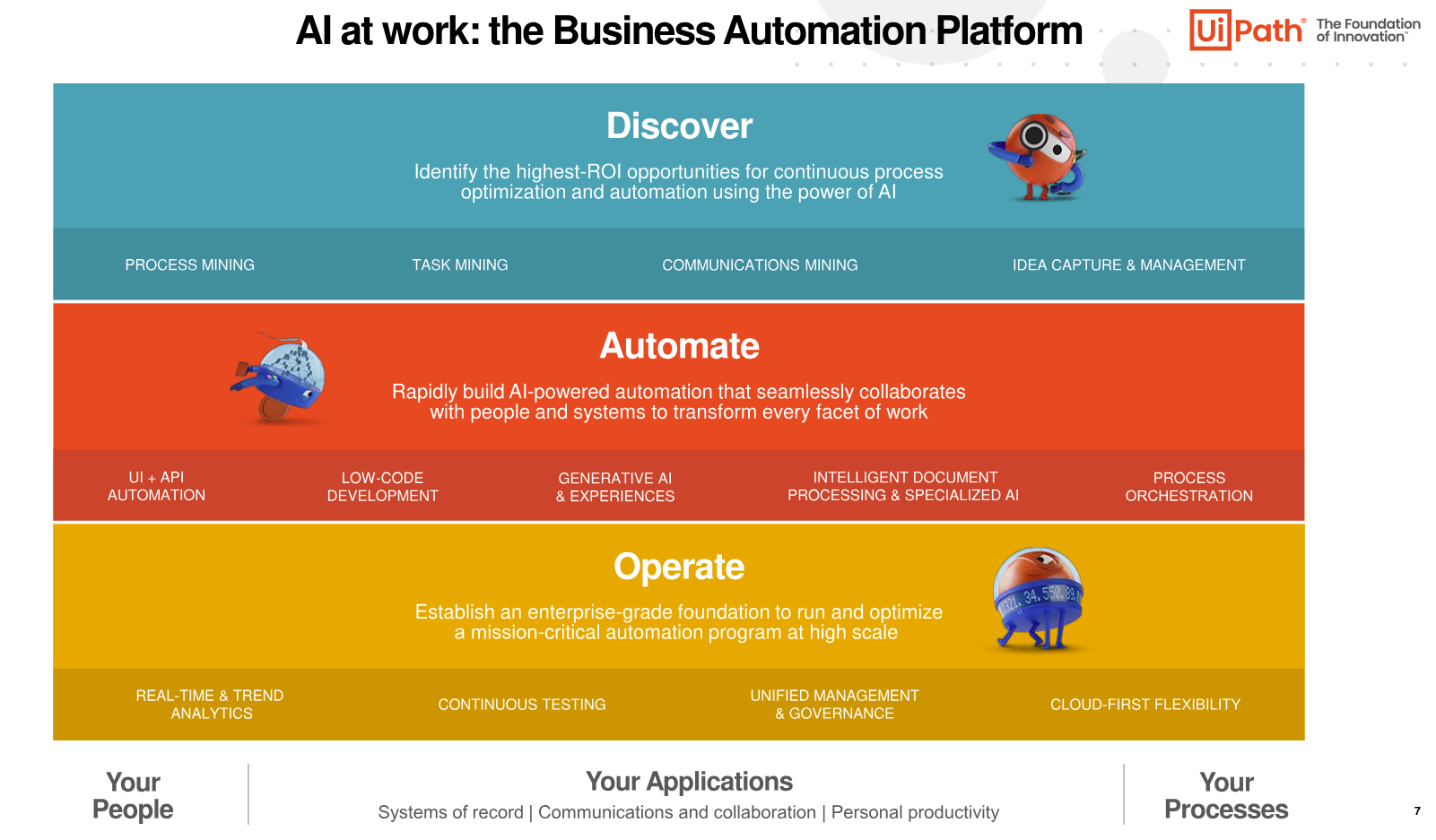

Einstein 1 Studio includes Prompt Builder, Copilot Builder, and Model Builder—three essential ingredients of a next-generation platform. Salesforce’s post captures details on these specific components. At high-level, the platform caters to developers who want to build AI-driven experiences that can leverage Salesforce metadata, customizable workflows, and underlying predictive and generative AI-models that are either trained inside Salesforce or elsewhere. These Salesforce developers also want to maximize code reuse and program a system using a natural language. The foundation of Salesforce’s big bet on AI is its fast-growing Data Cloud. MK talked up the role of Data Cloud in preventing hallucination and keeping Einstein 1 “grounded in trust.â€

My insights

With Einstein 1, Salesforce is in a unique position to serve customers in three important dimensions—use data to strengthen AI, provide a platform to build and extend product experiences, and provide first-party and third-party solutions. Salesforce has clearly demonstrated their intent to lead their platform with AI. They are also matching their intent with investment in various areas, products as well as the underlying platform.

As Salesforce blazes forward with Einstein 1, and as CxOs closely navigate this fast-moving chaotic domain to make informed decisions about their own investment in AI, here are a few things worth highlighting:

Ecosystem beyond Salesforce

Einstein 1 platform’s near-term roadmap is designed to help existing Salesforce customers to get the best out of their investment. There are many more prospects, however, who don’t use Salesforce today, their products or the platform. These prospects are exploring their next-gen platform choices that include platforms from hyperscalers, niche AI vendors, and select global service integrators (GSI). Many of these prospects have also invested in various copilots. While Einstein 1 can clearly compete to win, it’s unclear whether it is enough of a draw for these prospects to consider Salesforce. As copilots proliferate, customers want to avoid an interoperability nightmare. While most vendors do offer lower-level API integrations, lack of well-defined semantics and interfaces pose interoperability challenges for components that operate at higher levels.

And then there are large number of startups (ISVs) that have choices to make. Clara Shih, CEO of Salesforce AI, underscored the value proposition of Einstein 1 on why startups should consider building on Salesforce instead of investing their limited resources in building core AI components that Salesforce is heavily investing in. ISVs will continue to be the one of the biggest customers of any next-gen platform. If ISVs can get what they need from Salesforce, and if Salesforce can provide them effective distribution and commerce via AppExchange, there is an opportunity to enable a brand-new AI ecosystem.

Benchmarking next-gen platforms

While engineering and business efficiency gains from using a next-gen platform such as Einstein 1 are very real, the industry lacks KPI definitions and a benchmark to compare these platforms and measure ROI. It’s unclear what makes a copilot a great copilot or what makes a prompt designer a great prompt designer. Enterprise software vendors do use domain-specific KPIs such as time to close a ticket, increase in pipeline coverage etc., but IT leaders want to compare various platforms to better understand their ROI. While this is clearly not vaporware, IT leaders have been burnt before by making an early investment in technology they did not fully understand. There will always be a qualitative comparison, but a good set of KPIs ground everyone in facts. It’s time someone takes a lead to define what these KPIs could look like.

Bridging PX and DX

A promise of a next-gen platform—the one that goes beyond code reusability, productivity gains, and natural language driven development—is how fast one can go from an idea or a sketch to a working application with customer validation. AI can effectively help bridge the gap between product experience (PX) and developer experience (DX) with faster feedback loops. Finding the right problem to solve is equally, if not more, important than solving it efficiently. The last thing you want to use AI for is to increase the efficiency of solving a wrong problem. Salesforce’s Flow Builder is the closest to a visual representation of a working application but it’s not a prototyping tool. Salesforce and the rest of the industry have a unique opportunity to increase their focus upstream—investing in AI-driven declarative prototyping tools—to reap the benefits downstream, faster time to market and time to value.

Happy coding, or shall I say happy generating!

Tech Optimization

Chief Technology Officer