How do you get to repeatable, analytical decision making? IT services and outsourcing firm Genpact helps companies bring automated, predictive systems into production so they can sense, act and respond in real-time.

“I've heard consultants suggest that business problems are an equation that can be solved, but it’s not as simple as doing the math,” said Paul Burton, senior VP of analytics and research, speaking at Genpact’s Analyst & Advisor Forum earlier this month. “I would go so far as to say, if all you’re doing is math, you’re probably not going to solve the problem, because point-in-time analyses don’t age very well.”

This is an important perspective to consider for any company striving to get to data-driven decision making. Amid all the talk about the new data sources, new big data platforms and new analytic tools and frameworks, we hear far too little about operationalizing these new types of analyses.

Burton uses the analogy of a simple straight ladder, akin to the tools and manual analyses companies might first try to get to the next level of insight. A next step might be to the stepladder stage, with, perhaps, a portfolio or predictive models and embedding of decision services into applications.

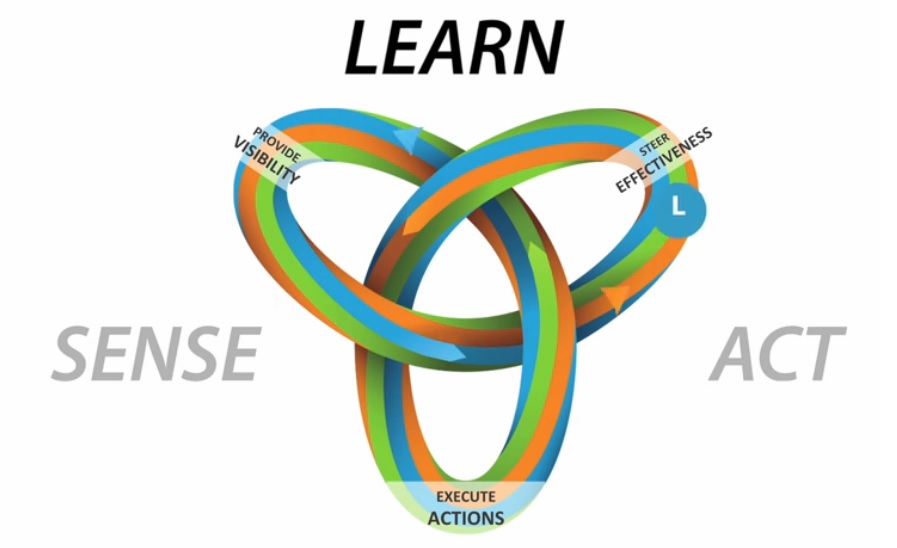

Genpact, a global IT services, outsourcing and strategy advisory and consulting firm, advocates an industrialized approach. Think of an escalator offering continuous operation and capable of bringing an end-to-end business system to the next level with stability, speed and scale. Genpact calls it Intelligent Operations. Key components include an automated layer that takes care of the managing and positioning of data and algorithmic analysis across multiple systems and disparate data sets. In a data-to-decisions context, the approach spans data capture, cleansing, analysis, model management, decision services, and round-trip feedback of operational performance data back into the next round of sensing and responding to the dynamic operational environment.

Genpact touts its Intelligent Operations approach, pictured above, as reimagining business processes with analytics and technology so they can be operationalized at scale.

Genpact applies this Intelligent Operations approach in nine industries: life sciences, retail and commercial banking, insurance, capital markets, consumer goods, healthcare, high-tech, and manufacturing. One of the fastest-growing areas of interest for the approach is in Internet of Things (IoT) applications, where there are built-in expectations for real-time operation at scale.

Duke Energy Renewables (Duke), one of Genpact’s IoT customers, is getting help moving beyond labor-intensive, manual methods to support predictive analysis. The company has wind and solar energy projects in 12 states, and Duke and Genpact are collaborating on optimizing power output and cutting long-term maintenance costs at 15 wind farms in the U.S. In all Duke Energy Renewables wind farms have 1,600 megawatts of capacity – enough to power half a million homes.

Most of Duke’s wind farms have dozens of turbines. The largest, in Sweetwater, TX, has 392 turbines. The equipment is supplied by seven different manufacturers, including GE, Siemens and Vestus. Most of these manufacturers offer monitoring software of their own, but because Duke uses a variety of turbines and because the equipment ranges in age, with many turbines coming off warranty, Duke is building its own, centralized monitoring systems for power optimization and predictive maintenance.

“We have good relationships with all of our suppliers, but we want our own view of the data so we can save money on parts replacement and maintenance,” said Duke Energy Renewables President, Greg Wolf, speaking at Genpact’s analyst event. “Our system gives us our own perspective on the data, operational conditions, and maintenance and parts planning.”

Rather than relying on a hodgepodge of OEM software, Duke is working with Genpact to build its own operational decisions into a centralized management system, working with the turbine manufacturers, wind farm operators, and weather experts. Duke is collecting more data than manufacturers call for on heat and vibration across its fleet of turbines because replacing gear boxes is expensive. By balancing power output against long-term wear and tear, Wolf says Duke is confident it can save as much as tens of thousands of dollars per year, per turbine by keeping units in service longer, avoiding unanticipated breakdowns, and reducing part and maintenance costs.

Taking a centralized approach, where the focus is on entire wind farms, rather than one turbine at a time, Duke wants to move to an automated, production-oriented approach, so it could no longer sustain what Wolf described as a “quasi-manual approach.” That’s where Genpact came in.

“We started the discussions with Genpact around data capture, data cleanup and how we're going to use the information,” said Wolf. “For us it was getting our engineers and operational folks out of the business of managing and scrubbing the data and into the role of analyzing and driving decisions.”

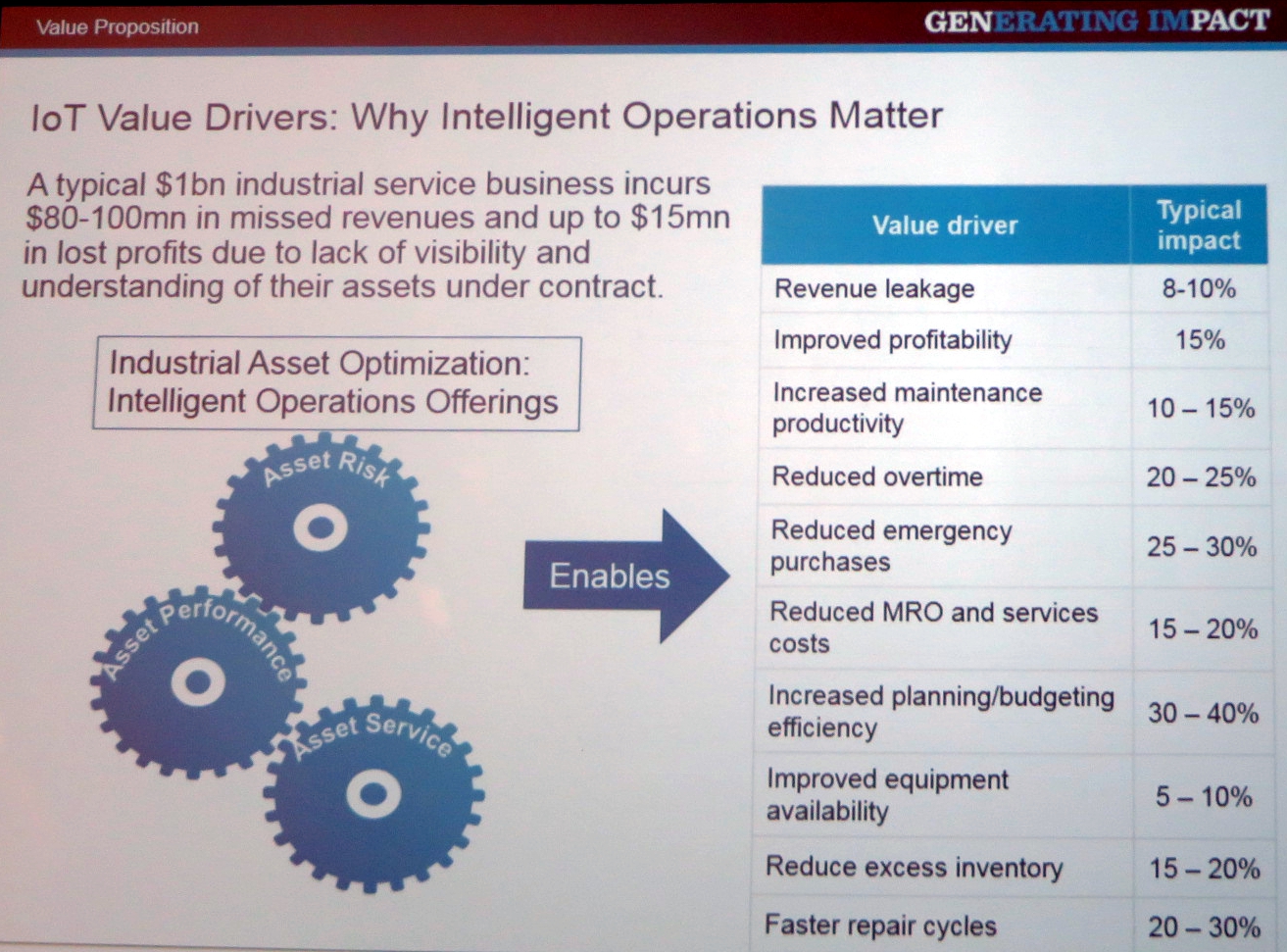

Genpact's take on potential value drivers in Internet of Things application scenarios.

MyPOV On The Need For Strategic Thinking

The IoT and SMAC (social, mobile, analytics, and cloud) trends and interest in innovation are driving many firms to become software companies. Duke Energy Renewables took the first step toward predictive maintenance, but it needed to scale up. Using a baseball analogy, Wolf says Duke is “in the fourth inning” of its wind farm project, and “Genpact is helping us to think through those next-level analytics we need to do drive better decisions,” he said.

When you talk to software vendors, whether database, big data platform, middleware, application, analytics, cloud, or, in Duke’s case, OEM equipment suppliers, you often get a piece-part view of what ultimately must be part of a larger, operational system spanning multiple systems and data sources. It’s in these cases where outfits like Genpact -- and competitors such as Accenture, TCS, Infosys, CapGemini and Wipro -- bring a broader view to the business problem.

In Genpact’s case about 60% of its work is in business process outsourcing, 20% in technology implementation services, 10% in business-process and systems design, and another 10% in data and analytics. This holistic capability and perspective comes into play in cases where business process need to be resigned and when systems need to be developed from scratch.

And when business process scale, scope, costs, and compensation models don’t make sense internally, Genpact can help companies run selected process as shared services, outsourced services or in a hybrid model. That, too, is beyond the scope of most tech vendors, but it’s an important option to consider when innovation and a reassessment of core competencies call for a change in approach.