ServiceNow outlines generative AI roadmap, bring your own LLMs

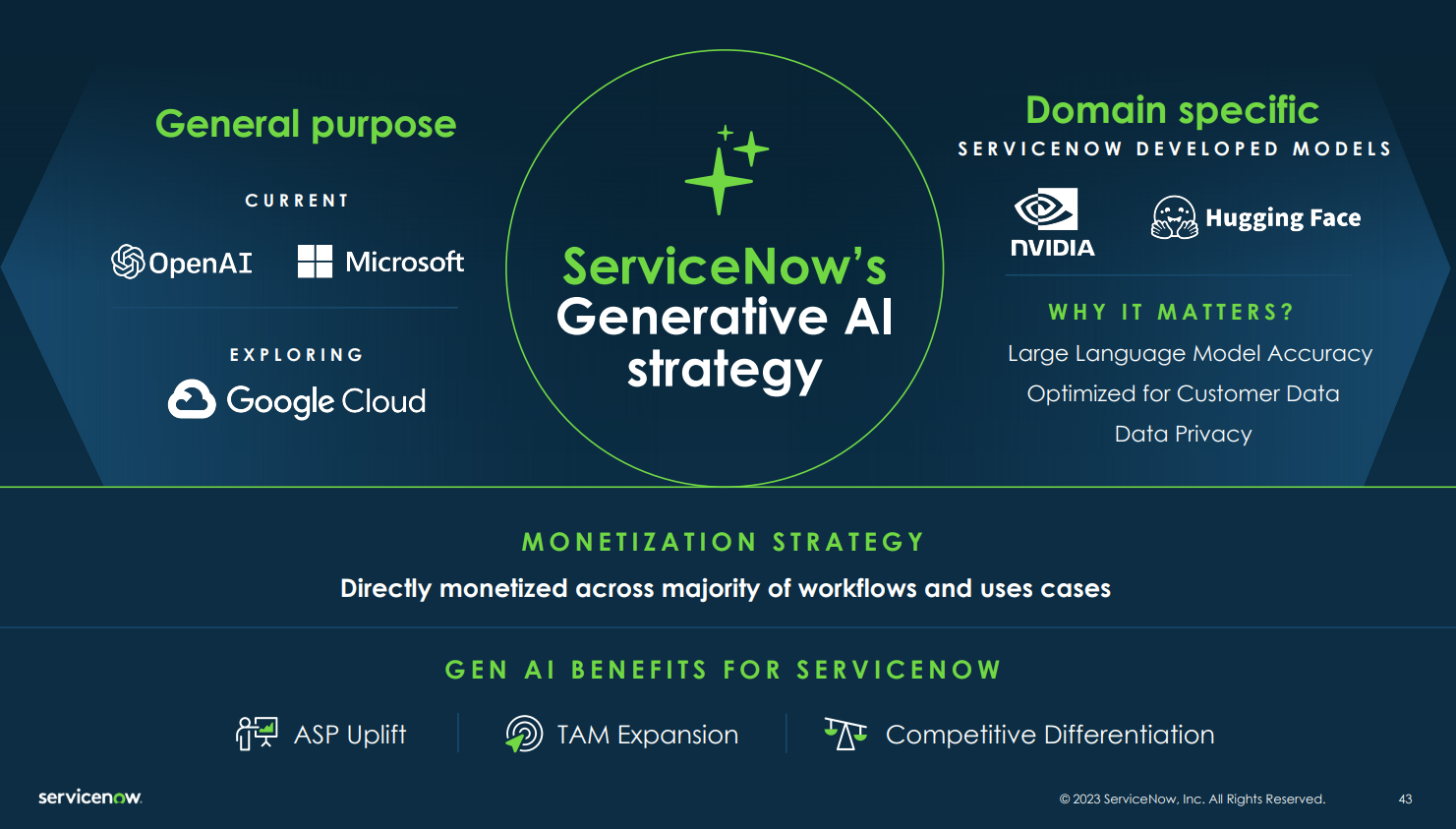

ServiceNow said customers will be able to bring their own large language models to its platform, but the real returns are likely to come from industry and customer specific generative AI models.

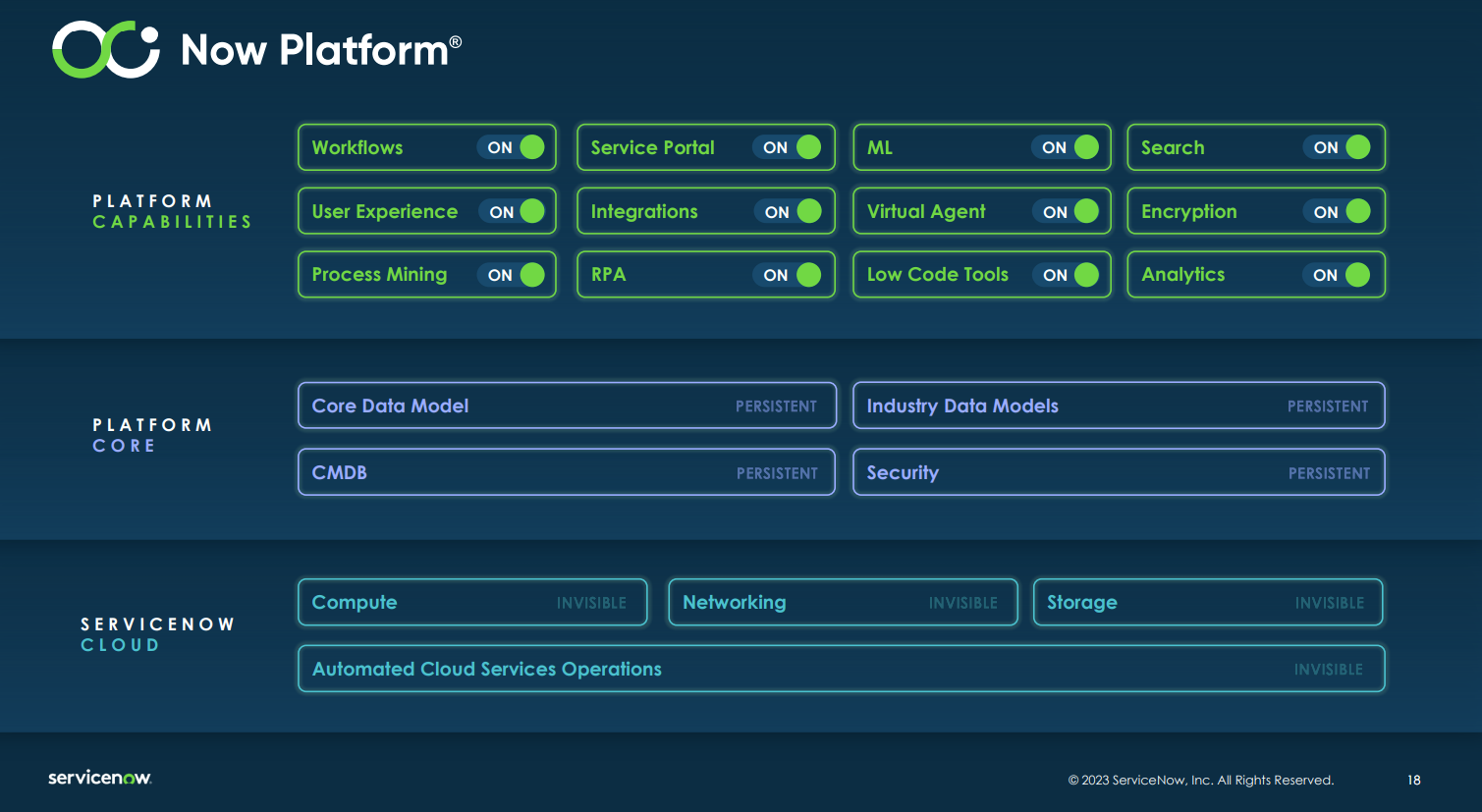

CJ Desai, ServiceNow's Chief Product Officer, outlined the company's platform roadmap. ServiceNow's latest Utah release is live now with Vancouver scheduled for September. A Washington DC release lands in 2024.

"GenAI is a catalyst for our platform. It's an augmentation of our platform that's good for our customers," said Desai, speaking at ServiceNow's Financial Analyst Day on Tuesday. "Customers can bring their own LLM and we will provide you with a connector just like we integrate with systems of record. The value for our customers is domain specific LLMs for our workflows and use cases." Indeed, ServiceNow said it would use Nvidia infrastructure to develop LLMs for its platform.

ServiceNow expands finance, supply chain process, workflow automation | ServiceNow Offers AI-Powered Service Operations for Modern ITOps

In September, ServiceNow's Vancouver release will include generative AI enhanced Virtual Agent Q&A experiences, summarized search results and accelerated configuration and extension tools. In 2024, the Washington DC release will include complete self-service, automated knowledge creation for agents and generative AI for admins and builders.

Desai said ServiceNow's platform capabilities built on its data model and code base speeds up innovation and enables the company to use generative AI throughout its portfolio. In addition, ServiceNow has invested in AI for years, often through acquisitions. ServiceNow has been expanding into new use cases, processes and industries such as financial services, telecom and media, manufacturing, public sector, healthcare and life sciences to increase its total addressable market.

ServiceNow CEO Bill McDermott said the company "is the center of the great reprioritization in the enterprise." McDermott said ServiceNow has evolved from mostly talking to CIOs to CEO-level conversations. "We're getting market pull from CEOs," said McDermott. "Just a few years ago they were trying to figure out what ServiceNow does. They want collaboration. They want integration. With AI, the IT strategy is the business strategy."

McDermott added that the company is landing more CEO conversations because enterprises are looking to consolidate tech vendors to take costs out. "Point solutions have gone out of favor and platforms, especially if cloud based, are ruling the day," he said.

Indeed, those CEO conversations are part of the reason why ServiceNow is focusing on finance and supply chain processes at Knowledge 2023. Those processes include a lot of manual work that generative AI can replace and automate. In addition, CEOs are looking to streamline ERP processes, but migrations take too long to truly transform to a clean core ERP instance.

ServiceNow is looking to transform and mitigate the risk with ERP migrations. Nevertheless, the company frequently noted that it is not replacing ERP but building a force multiplier to make systems of record more productive.

Other items of note from the Financial Analyst Day:

- ServiceNow operates its own data centers and has 34 globally to date.

- Executives demonstrated new workflows for finance and supply chain as well as generative AI capabilities.

- Once ITSM is live at an enterprise, additional ServiceNow applications deliver time to value faster with implementations that take anywhere from 8 weeks to 16 weeks.

- The company referenced an average selling price uplift as it sells more of the platform to enterprises. Desai said ServiceNow is delivering strong value.

- 66% of ServiceNow's existing customer base spent incremental dollars with the company in 2022.