To Lead Post-Pandemic Recovery: Streamline, Monitor Intensely, Plan Targeted Actions

Prepare for intensive monitoring and analysis, continuous planning, and timely moves aimed at survival and recovery.

There’s no one-size-fits-all or silver-bullet approach to post-pandemic business recovery. The advice I share is to be agile and adaptive, monitoring market activity in a granular way and coming up with targeted action plans.

Constellation Research has been holding town-hall style meetings with CXOs to hear about their experiences, good ideas, and best practices for business recovery. We’ve also been sharing our “Post-Pandemic Playbook.†Playbook is an apt analogy, as organizations must anticipate many different possible scenarios and be ready with the right, situational game plan.

Here’s a quick rundown on what’s next and how to prepare.

When Will Businesses Reopen?

In the recovery, as in real estate, it’s all about location, location, location. Recovery won’t come nation by nation, region by region or even state by state. Think in terms of metro areas. Here in the Northeast, where I live, seven state governors are trying to coordinate their “road back†plans, and the rough idea is a color-coded red/yellow/green approach.

At this writing, most states remain in the red, lock-down phase, but the month of May will see rural areas and smaller cities in the northeast going to yellow status. The guideline for a status change in Pennsylvania, for example, is having 50 or fewer cases per 100,000 population for at least 14 days. Social distancing and wearing of masks will still prevail in public during the yellow phase, as will the closure of schools, restaurants, and entertainment venues. But all other businesses can reopen, so long as people keep their distance and gatherings of people are limited in keeping with the size of the facility.

Sustained declines in COVID-19 cases over time will determine when more densely populated urban areas will reopen and when the status goes from yellow to green. The ability to test, track and quarantine will be crucial. Expect something akin to this red/yellow/green approach to roll out globally and across the US. New York and New Jersey, where the pandemic hit first and worst in the US, will soon follow in the footsteps of Italy, Spain and other hard-hit areas that are now going into a yellow phase. The good news is that social distancing has worked well enough in some countries and in many parts of the US such that they’re already going to yellow or even green status, but let’s hope that that doesn’t lead to a resurgence in cases.

The task for businesses will be monitoring activity, market by market, to get a sense of the pace of recovery and to better predict what to expect as more and more markets reopen.

When Will Real Demand Return?

On this question, too, we’re likely to see drastic differences from industry to industry and customer to customer. Larger businesses are better positioned to absorb the shocks than small and midsized businesses, but don’t plan based on that generalization. Large consumer product goods companies, food suppliers and grocery chains, for example, are going to be in much better shape than large department store chains. In fact, some businesses have flourished during the shutdown. Kimberly Clark reported a 13% increase in tissue and toilet paper sales in the first quarter, while diapers and feminine hygiene product sales were up 6%. People were also hoarding snacks and beverages going into the lockdown, as evidenced by PepsiCo’s 7.7% increase in sales in the first quarter.

As all investors are warned, “past performance is no guarantee of future results.†Despite one great quarter, Kimberly Clark has pulled its guidance for 2020, perhaps anticipating that all those extreme hoarders will inevitably forego purchases in Q2. Conversely, some businesses that were forced to be closed may be greeted by pent-up-demand once business returns. It’s nice to be able to cite positive examples, but there’s no sugar coating the fact that we’re likely to see soft business-to-business and business-to-consumer demand in many segments given the spike in unemployment nationwide and globally.

Businesses must adapt, monitoring market conditions more granularly and frequently than ever before. Old customer segments, predictive models and even reports and dashboards may not be up to the task. Even if the business was satisfied with the data-to-decisions lifecycle before the crisis, it’s time to reassess, refresh and respond to the needs of today.

How Best to Prepare For Success?

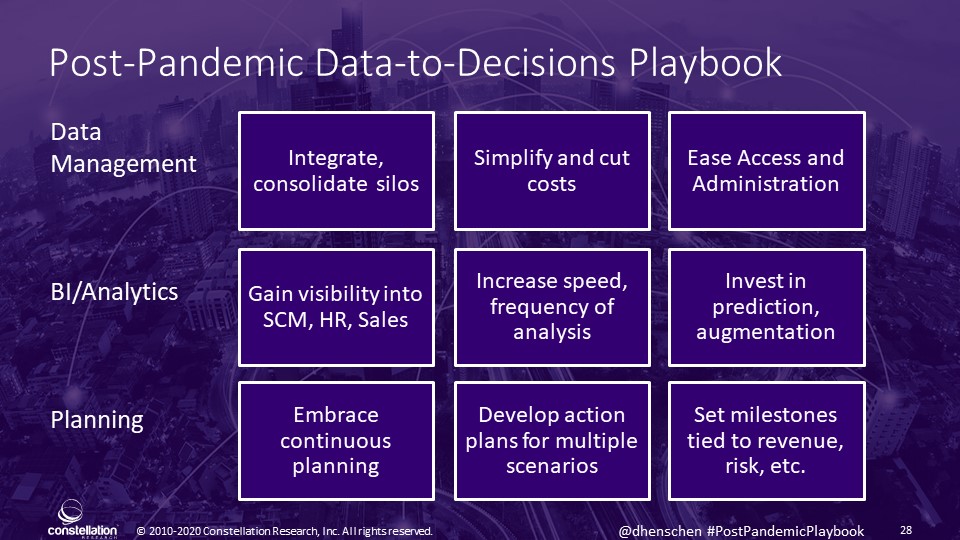

My Post-Pandemic Playbook highlights imperatives on three fronts:

Data Management:

- Integrate and consolidate: If you suffered from silos and disparate systems before the crisis, it’s really time to reassess the company-standard platforms of today and the future versus the dying legacy systems and failed experiments. Integrate and consolidate with the future in mind. You can let it ride if decommissioning will be costly, unless, of course, that means reupping on licenses and maintenance fees that aren’t returning value.

- Simplify and cut costs: The step above should help with simplification, but complexity and high total cost of ownership are the real enemies. In many cases, licenses may be only 10% of the total cost of ownership once you add all the costs of keeping something running. It’s time to renegotiate, looking for ways to turn shelfware and dying systems into something of value. Many vendors have cloud programs whereby on-premises licenses can be converted into cloud subscriptions, but be mindful of the cash flow implications.

- Ease data access and governance. Modern, machine-learning-assisted data catalogs, data-prep tools and data-governance platforms are making it easier to see what data is actually used and by whom. That makes it easier to share valuable data more broadly but with solid governance, security, and access controls. Augmented capabilities are faster, more consistent and more efficient than the old labor-intensive surveys and consulting projects.

BI & Analytics

- Gain visibility. It’s imperative to have fresh, accurate views into supply chains, human resources, and all aspects of sales, revenue and profitability. The value of historical reports and analyses has diminished while fresh, detailed insight into the very latest data is invaluable. To navigate you must be able to see resources, revenues, costs, and risks. Flying blind is not an option.

- Increase the frequency and speed of analysis. Plenty of executive crisis teams are operating in war-room-like atmospheres. They’re pouring over KPIs, and they want them daily or even inter-day. Can you support more frequent analysis and deliver insights sooner? Emerging augmented capabilities are helping to speed exploration and iterative analysis.

- Invest in prediction, augmentation. Are you looking for forward-looking insight? The old answer from BI and analytics vendors was support for “R, Python, and partners,†but that’s no longer enough. Emerging augmented features and deeper partner integrations are giving customers easier ways to deliver predictive capabilities. Augmented features are also helping to automate some data-prep, pipelining and modeling steps that used to require tedious and repetitive manual labor. Insight is valuable; foresight is gold.

Planning

- Embrace continuous planning. Once perceived by many as a nice-to-have ideal, continuous planning is now essential to survival and success. Successful firms are sharing KPIs and reviewing plans versus actuals daily, and they have mapped out multiple scenarios, anticipating down-side risks of varying severity. Beyond financial planning, manufacturers are doubling down on supply chain analysis amid disruptions and geographic risks. Essential businesses are doubling down on workforce planning to foresee payroll and staffing needs accounting for hazard pay, social distancing requirements, and extended sick leave.

- Develop action plans for multiple scenarios. Plans of action tied to each possible scenario are even more essential than envisioning what could happen. Companies are layering on cash-flow, days-sales-outstanding and revenue projections to understand implications such as compliance with loan covenants. Plan targeted, strategic actions that feed strenghts and salve weaknesses, rather than making ham-fisted, across-the-board cuts.

- Set milestone triggers tied to action plans. Don’t cross that bridge when you come to it. Set interim milestones around sales, revenue, cash positions, etc., that will trigger predefined actions that will help keep the organization out of trouble.

In short, data equals visibility and improved visibility drives better decisions. Getting the data-to-decisions lifecycle back on track is the first step toward recovery and, soon thereafter, competitive advantage.