Oracle's Q1 better than expected and Ellison loves generative AI

Oracle reported better-than-expected first quarter results as the company's infrastructure-as-a-service business gains generative AI workloads.

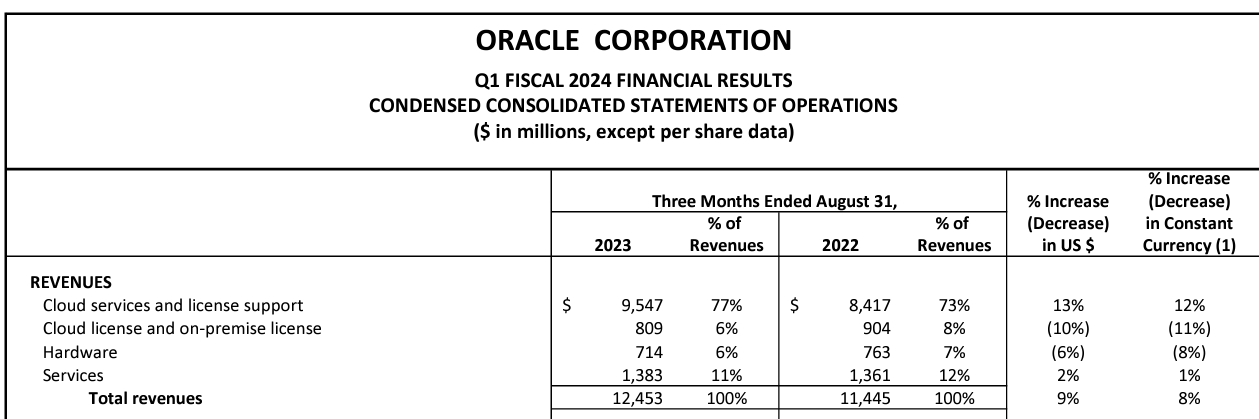

The company reported first quarter earnings of $2.4 billion, or 86 cents a share, on revenue of $12.45 billion, up 9% from a year ago. Non-GAAP earnings for the first quarter were $1.19 a share.

Wall Street was looking for Oracle to report first quarter earnings of $1.15 a share on revenue of $12.47 billion. Oracle's fourth quarter results shined due to cloud strength.

Oracle’s cloud revenue (IaaS and SaaS) was $4.6 billion, up 30% from a year ago. Of that cloud revenue, Oracle’s IaaS business had revenue of $1.5 billion in the first quarter, up 66% from a year earlier. Cloud application revenue in the first quarter was $3.1 billion, up 17% from a year earlier.

Research

- Oracle Writes the Next Chapter of Exadata With Exadata X10M

- Oracle’s Data Platform Gets an EPYC™ Boost

The ever-quotable Larry Ellison, CTO of Oracle, is clearly on the generative AI bandwagon. In a statement he said: "Is Generative AI the most important new computer technology ever? Maybe!†In 2008, Ellison panned cloud computing as the latest tech fashion trend but acknowledged that Oracle would make cloud announcements.

Today, Ellison is way faster to the generative AI mark and making cloud computing noise. Ellison said AI development companies have signed contracts to purchase more than $4 billion of capacity in Oracle’s Gen2 Cloud. “That's twice as much as we had booked at the end of Q4,†he said.

Oracle is grabbing generative AI workloads due to a tight partnership with Nvidia and its RDMA-connected superclusters. Oracle CEO Safra Catz said the recurring revenue stream from cloud generated $7 billion in operating cash flow in the first quarter.

Catz previewed Oracle Cloud World and said announcements would revolve around:

- Multi-cloud strategy.

- Analytics.

- Generative AI.

- Hardware and infrastructure advances.

- Customer stories and networking.

"Some of the customers you'll hear from are Nvidia, Uber, Cohere as well as partners such as VMware and Microsoft," said Catz. "There are a lot of discussions going on and you'll see announcements shortly." Indeed, Oracle's Ellison and Microsoft CEO Satya Nadella will have a joint announcement planned. The two companies have been ramping up connections between their clouds for joint customers.

Ellison added that the Microsoft partnership will expand collaboration and enable Azure customers to leverage Oracle cloud applications and databases.

Catz said Oracle has signed several deals for Oracle Cloud Infrastructure topping $1 billion. "My point here is that customer momentum is continuing to build. Our annual revenue growth will continue to accelerate going forward."

She added that Oracle saw strength in autonomous databases, cloud applications and cloud workloads. Catz added that Cerner and database migration to the cloud will also drive growth in the future.

"Our biggest challenge is building data centers as quickly as possible," said Catz, who noted Oracle is also migrating Cerner to the cloud.

Here's the outlook in US dollars for the second quarter. Total revenue including Cerner is expected to grow 5% to 7%. Total revenue growth excluding Cerner will be 8% to 10%. Total cloud revenue excluding Cerner is expected to grow from 29% to 31%. Non-GAAP EPS will be $1.27 to $1.31 including Cerner and $1.30 to $1.34. Catz's takeaway is the the Cerner integration is a headwind, but the core business is gaining momentum.

What spooked investors was the idea that Oracle would be funneling profits into capital expenses. Constellation Research analyst Holger Mueller said:

"Oracle did not deliver to expectations on the revenue side – and that is never a good thing. Traditional Q1 is weak for Oracle, due to summer and lack of potential Q4 closing incentives for both customers and sales processionals. But the cloud portfolio is growing, and Oracle is more profitable, growing generated cash flow and now putting $8B+ - more than 50% of generated cash flow – into CAPEX – for trailing last 4 quarters. Clearly, Larry Ellison and Safra Catz see a massive opportunity in AI and are walking the talk on the CAPEX side. Good to see all regions growing – which is not always the case in an Oracle Q1. Now it will be all to deliver to expectations in Q2. We will see."

Ellison said Elon Musk's X AI has signed a contract for workloads. He added that the Cerner unit is about to sign two big deals at $1 billion. Berkshire Hathaway's insurance units are also standardizing on Oracle Cloud ERP.

Select Constellation Research Shortlists that include Oracle

- Cloud-Based Planning and Performance Management

- Enterprise Application Platforms

- Enterprise Cloud Finance

- Global HCM Suites

- Global IaaS for NextGen Apps

- Healthcare ERP

- Next-Gen Databases: RDBMS for On-Premises

- Next-Generation Computing Platforms

- Product-Centric Cloud ERP

Here’s a breakdown of Oracle’s revenue in the first quarter.