Intuit’s bets on data, AI, AWS pay off ahead of generative AI transformation

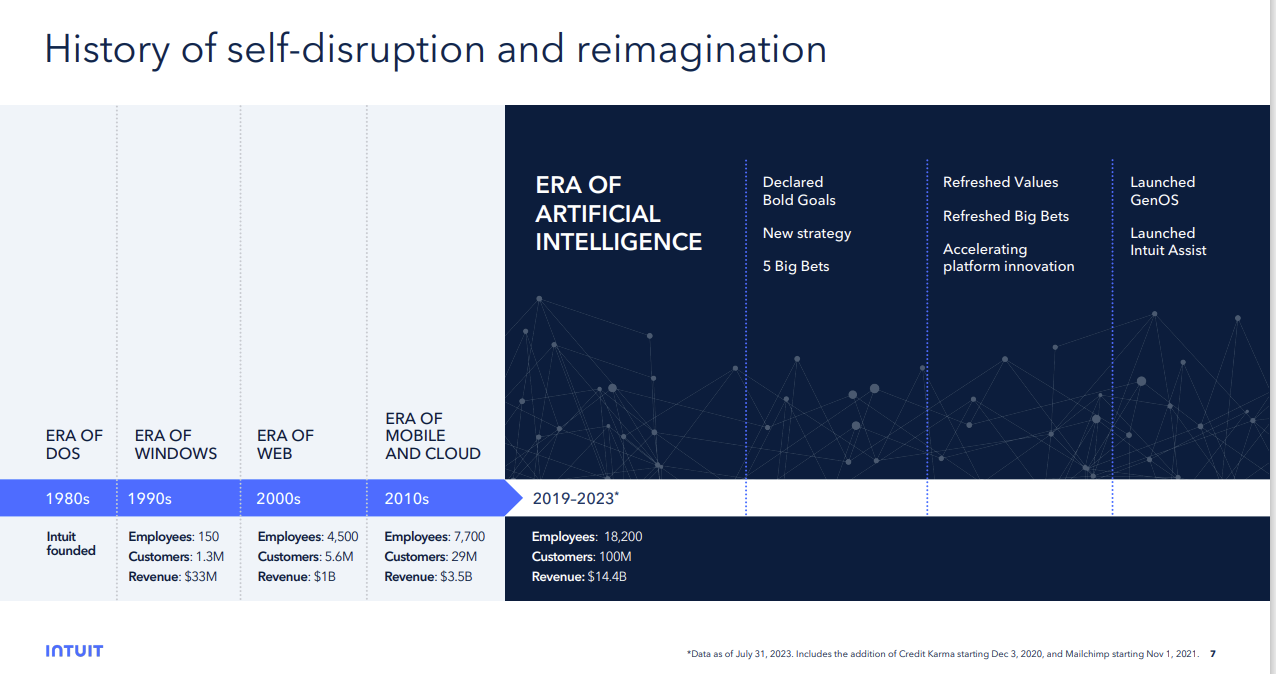

Intuit may be the best example of the need to have a data strategy before tackling generative AI. The company, which has had to adapt to technology and economic shifts for 40 years, realized five years ago that data and AI would be fundamental to its core mission.

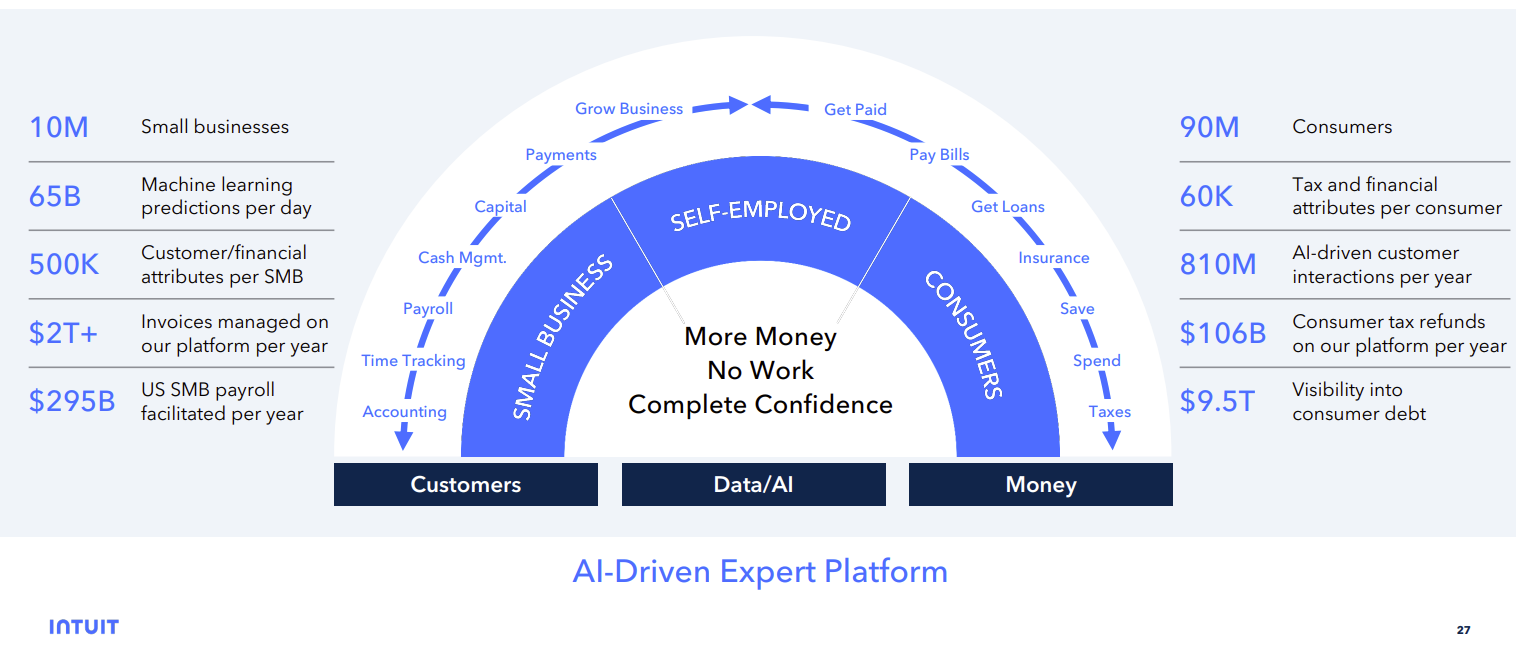

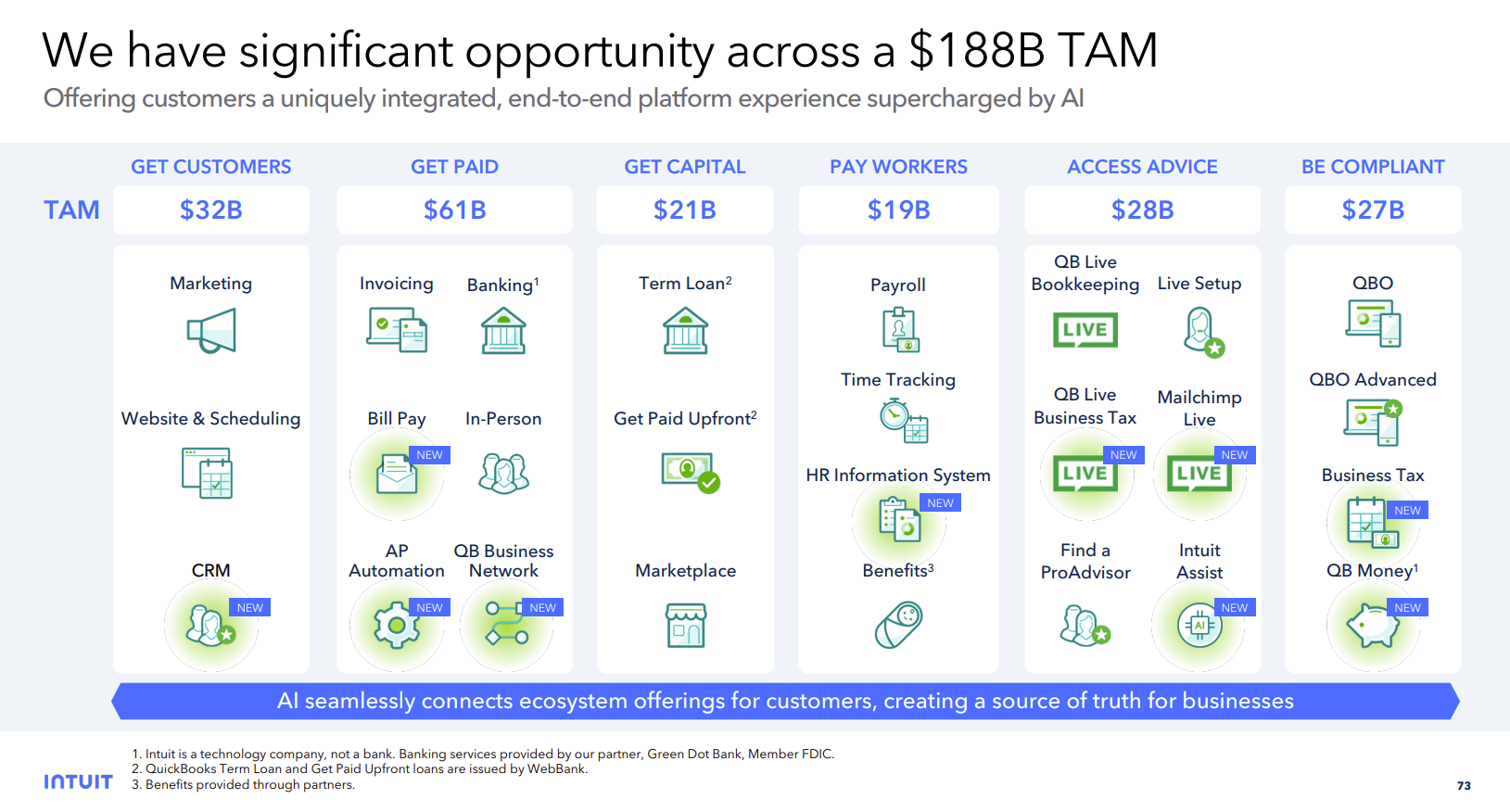

The company's mission, to power prosperity around the world, is a bet that it can create a platform that can help you grow your business, run it, manage cash flow and be compliant. Intuit's platform, which also serves as a gateway to human expertise, aims to conduct business with you and for you.

Get this customer story as a PDF

For fiscal 2023, Intuit reported revenue of $14.4 billion, up 13% from the previous year and up from $6.78 billion in 2019. Intuit acquired Credit Karma and Mailchimp in 2020 and 2021, respectively.

"In order to pull that off, we declared five years ago that data and AI was going to be fundamental," said Intuit CEO Sasan Goodarzi, speaking at a recent investor conference. "And everything starts with data. To create a future of done for you, you must have data. We have invested heavily in the last decade, but in the last five years, we really accelerated our investments in data and AI."

That decade period is also notable because Intuit's prescient bet on data lined up with a transformational move to go all-in on Amazon Web Services (AWS) for its infrastructure.

In 2013, Intuit decided to go all-in on AWS and has been a core reference customer ever since. Intuit, which has built a strategy that revolves around AI, data touch points and signals, machine learning and generative AI, is a key reference for AWS given the cloud race to host workloads.

Goodarzi said Intuit has 500,000 data points per small business. "We see all the money coming in, all of the money going out, all the transactions," he said. "We're not new to this game of AI, and particularly it was machine learning and knowledge engineering."

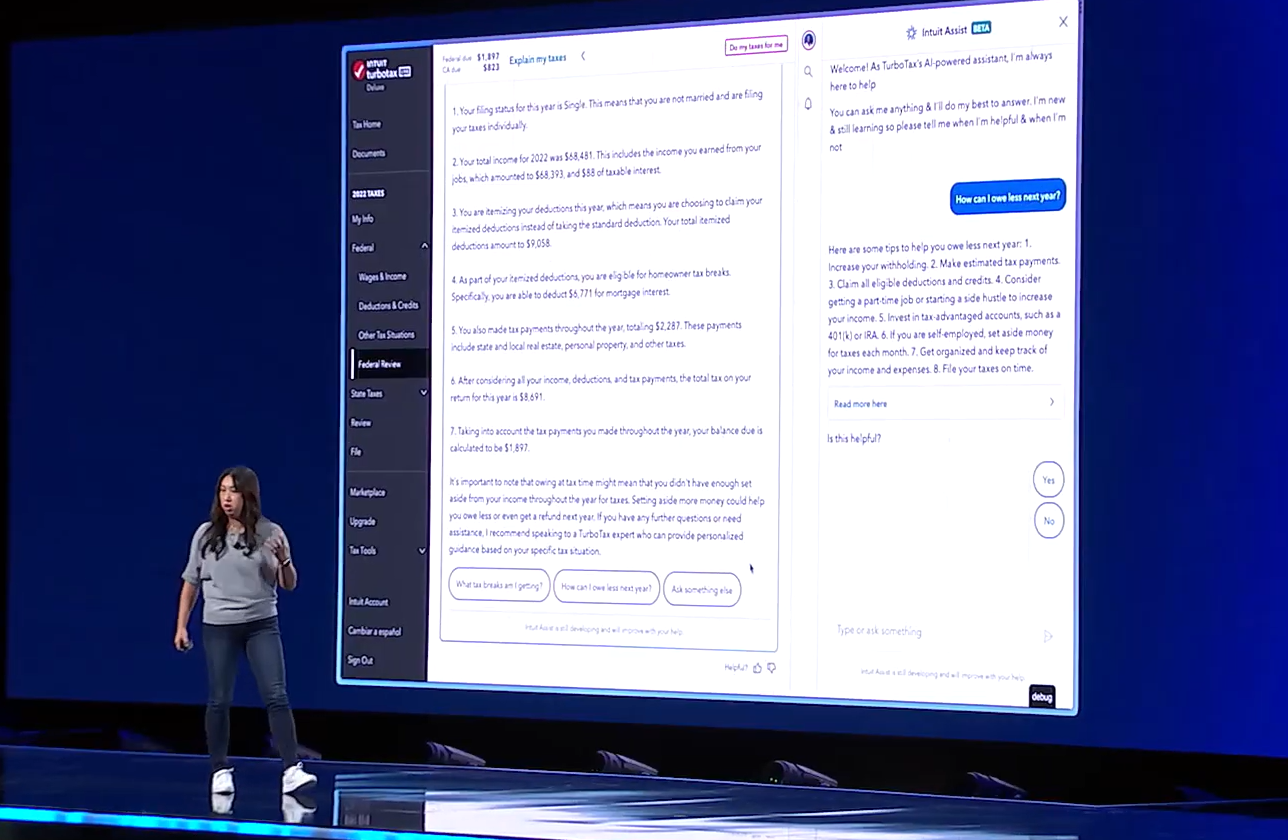

Now with generative AI, Intuit has launched Intuit Assist, a horizontal assistant that will operate across the company's product portfolio. Intuit wants to enable small businesses, which can have 10 to 100 employees, and increasingly mid-sized businesses.

"We're leveraging data and AI and now generative AI to really create a platform where we do the work with you and for you. You’re always in control. And human expertise is critical in what we do because we deal with people's money, whether it's a consumer or a small business," explained Goodarzi. "We have also created on our platform a virtual expert platform where there's always a gateway to human expertise, but that human is also AI-driven."

Intuit's generative AI turn

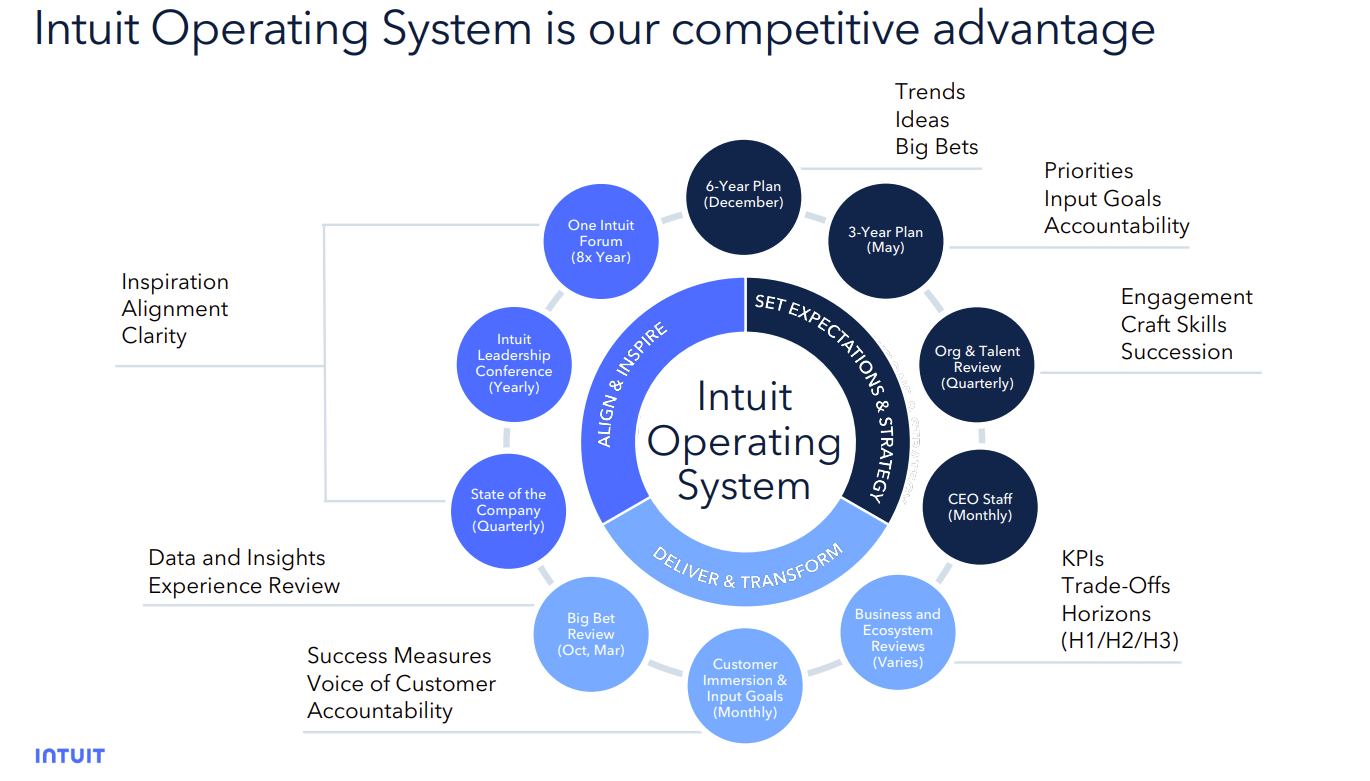

In September, Intuit updated its plans and goals through 2030. Five years before, Intuit said data and AI would be critical.

"We stood here more than five years ago and shared with you that our belief was that AI was going to be as revolutionary as electricity and the internet. We believe then and we believe now that it will ignite global innovation in ways that we could never imagine possible across every single industry," said Goodarzi.

Now it is time for Intuit to accelerate, said Goodarzi. "With the announcement of Intuit Assist, which is based on years of investment in data in AI and now particularly Gen AI. Intuit is about to paint its masterpiece for our customers and as we think about growth in the future," he said.

Intuit rolls out Intuit Assist generative AI across platform | Constellation ShortListâ„¢ B2C Marketing Automation for Small to Midsize Business

Intuit's 2025 goals are ambitious. It aims to double the household saving rate and improve the small-midsized business success rate by 10 points better than the industry average, grow to more than 200 million customers and accelerate revenue growth. Half of SMBs fail. In 2030, Intuit hopes to make the SMB success rate 20 points better than the industry average.

The big bets for Intuit revolve around speed to benefit, connecting people to experts, unlocking smart money decisions, driving SMB growth and disrupting the market.

Intuit estimates that its total addressable market tops $300 billion. Today, Intuit has about 5% of that market. Goodarzi said Intuit can grow its total market because it is not poaching customers from other vendors. SMB non-adoption--businesses using Google Sheets, paper, Microsoft Word and shoeboxes of invoices--is Intuit's biggest rival.

To get more of that market, Intuit Assist will need to play a big role. The horizontal generative AI assistant can drive customer growth, increase adoption of services, point customers to experts and leverage Intuit's data flywheel for new products.

- Intuit Assist is powered by GenOS, Intuit's generative operating system that enables the company to design, build and deploy experiences. GenOS, which is designed to use multiple large language models (LLMs), is comprised of the following parts:

- GenStudio, a developer environment to refine experiences, prompts, and code.

- GenRuntime, an intelligent layer that can access the right data and platform capabilities and choose LLMs in real time to orchestrate and execute personalized action plans for customers.

- GenUX, a library of consistent customer interfaces and flows for generative AI experiences.

- LLMs are designed to run with Intuit's own financial LLMs that are tuned to solve tax, accounting, personal finance and marketing issues.

Goodarzi noted that Intuit Assist's secret sauce isn't technology but data. "It sits on top of years of investment in data, years of investment in AI and all the ecosystem of apps that we now have to provide us the ability on behalf of our customers to do the work for them to help them grow their business to manage their cash flow to manage their employees to get their taxes done for them," he said.

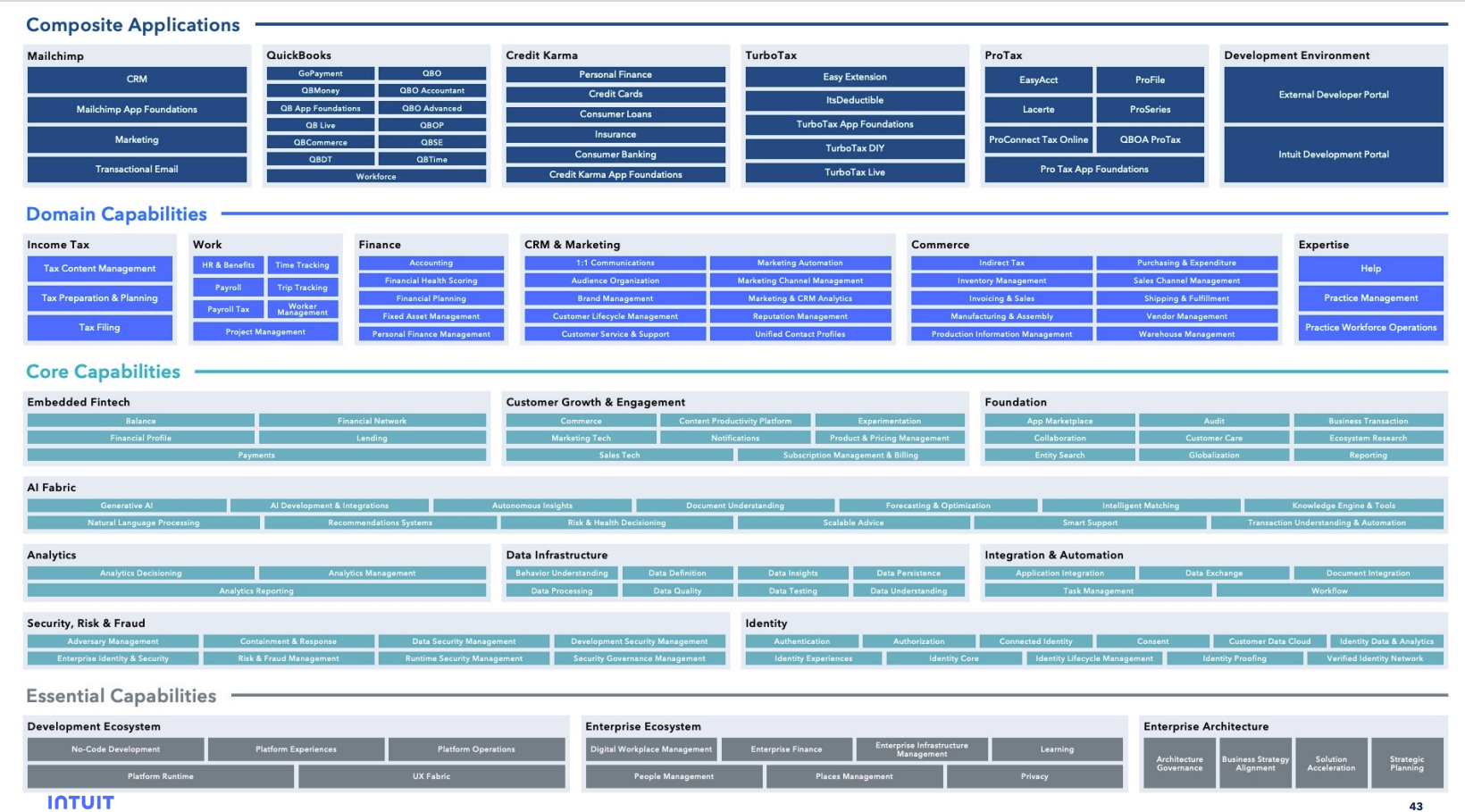

Intuit CTO Alex Balazs, speaking at the company's September Investor Day, said the company's platform is anchored in what it calls the city map.

"Our city map reflects the common architecture shared by all of our products, and it drives our platform vision it shows everything we're developing and plan to develop. It helps us to clarify what do we have, and what do we need to have to achieve our strategy," he said. "It helps to organize our teams and drive accountability and we move faster, the more we consume the capabilities of our platform. It's also important that it's not just a technical point of view. It also reflects our business capabilities to our business architecture."

The city map evolves based on what Intuit needs to meet customer needs, said Balazs.

For instance, Intuit recently elevated identity as a category as well as data integration and embedding fintech. This city map approach keeps Intuit's technology team on track and delivering experiences quickly.

"We've supercharged our platform at GenOS to rapidly create solutions for our customers’ most important financial needs powered by AI and generative AI," he said. "We create a differentiated value for our customers with both scale and speed."

The infrastructure behind Intuit's transformation

Nhung Ho, vice president of AI at Intuit, spoke during AWS re:Invent to outline the company's latest moves on the cloud provider.

"Intuit has built on AWS first from moving our applications onto the cloud to AI and machine learning with SageMaker and now in the era of generative AI with Bedrock," said Ho. "In 2019, we declared that we were going to be an AI driven expert platform. And by combining cutting edge AI with tax and  human expertise, we're delivering unparalleled experiences for our customers. Today, we've been able to achieve incredible scale of AWS running all of our data capabilities, as well as our data lake on AWS."

human expertise, we're delivering unparalleled experiences for our customers. Today, we've been able to achieve incredible scale of AWS running all of our data capabilities, as well as our data lake on AWS."

Ho (right) said the AWS infrastructure enables Intuit to make more than 65 billion machine learning predictions per day and analyze more than a half of a million data points for small business customers. Intuit also sees more than 810 million customer-backed AI interactions each day.

Because of those previous moves to AWS, Intuit has ensured it has good data governance and clean data. As numerous technology executives have said, there is no AI strategy without a data strategy.

For Intuit, the AWS infrastructure has enabled it to focus on applications, building prototypes and building out its generative AI operating system.

Ho said that Intuit has to anchor its generative AI strategy to accuracy, latency and cost. "The ability to use smaller, faster models allows us to realize significant latency gains and we're able to host these models on SageMaker," said Ho. "We also use third-party algorithms because the thing you have to really optimize for is the customer experience. Bedrock gives us the optionality with a wide range of models."

Intuit's inference infrastructure runs on AWS VPC so it can keep customer data separated, secure and private, said Ho. Intuit Assist is embedded across Intuit platforms ranging from TurboTax to QuickBooks to MailChimp and can tap into the data and knowledge based to answer questions and create experiences.

"You have to really invest in your underlying data because it's going to be the differentiator for every experience you build," said Ho. "You also need to build in horizontal solutions from day one. There is also no one size fits all LLM, so optionality is incredibly important."

Can Intuit move upstream?

Intuit is known for its base of consumer and SMB customers, the Goodarzi noted that the midmarket isn't out of reach.

"We have defined mid-market as 10 to 100 employees, I want to be clear that our stopping point is not 100. In fact, most companies don't even define 10 to 100 employees as mid-market. It's far greater than that. Our stopping point in the near term was 100. But our goal is to be able to serve mid-market customers that are in the 1,000s because this is a massive opportunity for the company," said Goodarzi.

The midmarket bet is that Intuit has a platform that can assist every customer’s job. The biggest difference between a company with 100 employees and 1,000 is scale.

Goodarzi said:

"We don't want to serve enterprises, but we have a platform that's easy to use and we can be very disruptive on price. We have a big opportunity to be disruptive and we have pricing power in the mid-market. It’s the same service, the same capabilities, just building them at scale.â€

Intuit has already been seeing progress in the midmarket, said Goodarzi, who noted there's a lot of white space in the market.

He said:

"What makes us very excited about this space is, there's an enormous gap in those that are between sort of 10 employees and 1,000 employees because in the past there's been players like us that can serve the low end. There have been big players, right, like the Oracles, the SAP can then serve enterprise, and this group in the middle, which is a massive market, has always had to make a choice. Do I pay a ton of money and use something that I don't really need, or do I keep screaming at Intuit to hurry up and create a platform that I can use?"