Survive or thrive? The underlying conditions of the business matter more than business conditions. Get on with analysis and planning.

As we approach the summer of 2020, much of North America -- and the world -- is getting back to business. It’s clearly not business as usual, with continued social distancing and uneven, half-steps back to business. With recovery in mind, here are some of the latest points of advice from my Constellation Research “Post Pandemic Playbook” for data-to-decisions initiatives.

Underlying Conditions for Business

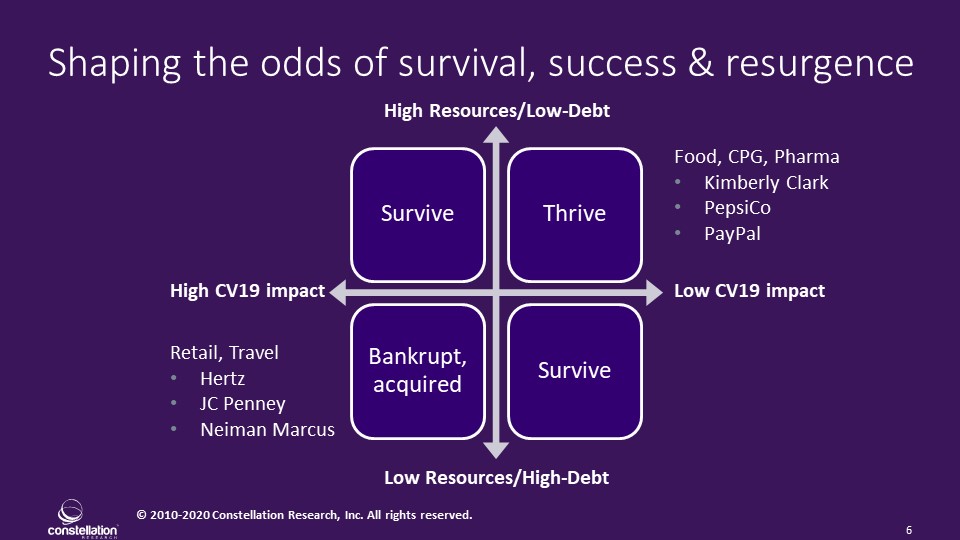

Just as certain underlying medical conditions make people more susceptible to COVID-19, certain underlying business conditions can make or break a company in a challenging economic climate. Being an analyst, I’ve come up with a two-by-two matrix (below) to explain. On the vertical axis are resources and debt, while the horizontal axis weighs the impact – lasting or not -- of the pandemic and lockdown.

Resources exist in many forms. Large companies, for example, are in a better position, generally, to absorb economic blows, than are small companies, but there’s much more to it than that. Other resources include access to capital, financial health, brand equity, large and sticky customer bases, business agility, and seasoned, innovative leadership. All these resources can be counted in an organization’s favor, and many small companies have more of them than troubled large companies.

High debt is always a millstone around a company’s neck, and if you compound that with a deep economic impact, as we’ve seen in travel and retail, the outcome is not good. Hertz, JC Penney, Niemen Marcus and J. Crew have been the headline bankruptcies in recent weeks, and what they all had in common was high debt levels and, in most cases, questionable management practices and strategies.

At the opposite extreme there are examples of companies that have seen less-damaging economic impact. Grocery stores and drug stores never closed during the crisis, so many food supply and consumer product goods (CPG) companies are doing reasonably well. In fact, some companies, like Kimberly Clark and PepsiCo, saw big sales increases in sales in the first quarter, due in part to consumers stockpiling (and hoarding) goods before the lockdown.

Kimberly Clark reported a 14% increase in paper product sales in Q1 while PepsiCo saw strong SuperBowl snack and beverage sales followed by consumer stockpiling that sent the company’s first-quarter sales up 7%. PayPal saw a 17% increase in new accounts and a 20% increase in payment transactions in the first quarter, as organizations and consumers sought alternative payment options amid the lockdown.

The point is that it’s hard to anticipate outcomes by industry. Instead, look at underlying health, agility and leadership by company. We’re likely to see strong, agile companies consolidating their positions and perhaps acquiring vulnerable rivals that lack resources or that are saddled with debt.

Move to Fine-Grained, Low-Latency Analysis

Even firms that discovered a silver lining in an otherwise dark cloud, like Kimberly Clark, have pulled their financial guidance for 2020 because uncertainty remains. This is one reason I’ve been advocating the adoption of more precise analyses driven by more granular, low-latency data. Timely, fine-grained insight will help organizations better understand big differences in business resumption within countries, states, cities, counties and even suburbs and exurbs. Aggregations at the level of global regions and regions within countries are less useful than they once were. Similarly, predictive models built on old data may need to be retrained or entirely rebuilt for today’s very different customer behaviors.

Demand-driven forecasting is nothing new, but it can make a significant difference when dealing with the rapidly shifting market conditions we’ve seen over the last couple of months. Heading into the lockdown in February, global systems integration and consulting firm Infosys helped a major CPG company to harness near-real time point-of-sale (POS) data, as well as weather, trade promotions and competitive data, to improve the accuracy and timeliness of demand forecasts. Previously the company relied on shipment data, which would have totally missed demand spikes experienced heading into the lockdown in mid-March.

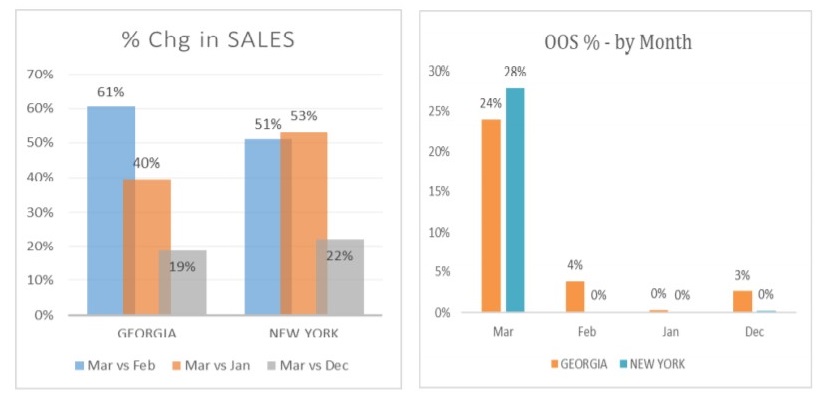

A CPG Pulse report on comparative "essential product" sales and out of stock (OOS) conditions in Georgia and New York in Q1 2020. Source: Infosys

POS-driven analyses of sales in New York State, for example, spotted panic buying setting in on March 12. Sales of the company’s products in the state increased 51% compared to the prior month. As a result, out-of-stock (OOS) conditions spiked by 28%. However, the early warning provided by timely analysis helped the CPG company stabilize the supply problems by March 17. Overall, the use of granular, store-by-store daily POS data has improved forecast accuracy by 70% to 85%. These forecasts are used to accelerate the delivery dates of firm orders, within the guidelines of service level agreements, to prevent stock-outs. The typical improvement across all states for the company has been a 2% increase in overall sales.

Adopt Continuous Planning

I’ve been writing about the need for frequent, iterative financial planning and analysis for years, but the need has been all the more acute in today’s climate. The leading firms I have encountered have stepped up from monthly to weekly or even daily planning to respond to changes in supply chains, sales, financial results, and human resources requirements. Cloud-based planning platforms make it far easier to support continuous and collaborative planning among finance and business leaders. But what if your organization is locked into antiquated, spreadsheet-based methods? Is it realistic to deploy a new platform in the middle of such a tumultuous period?

During last week’s Planful Virtual Tour, customer SmartyPants Vitamins presented on a focused, 20-day planning deployment that stayed on track amid the lockdown in March. SmartyPants has been an innovator and challenger in the vitamin category. It launched in 2011 with a single product: affordable children’s multi-vitamin gummies without artificial ingredients. The company subsequently branched out into gummy vitamins for adults and even pets, and in 2016 it surpassed $25 million in sales.

Early in the first quarter of 2020, the company decided on a phased deployment of the Planful, cloud-based planning platform rather than a big-bang deployment addressing the entire balance sheet. “We decided to focus on sales and trade spending, as opposed to the total balance sheet, because sales drives the rest of the organization and how we allocate spending,” explained Cheryl Chow, the company’s Senior Finance Manager. “Sales was already on a monthly cadence, and we needed something dynamic that could pull in actual results data and then reforecast the rest of the year quickly and at a very detailed level.”

Cheryl Chow, Senior Finance Manager at SmartyPants Vitamins, said the company's focused planning deployment went off as planned in March despite work-from-home challenges.

Little did the Marina Del Rey, CA-based company know that its March 2020 project would soon have to cope with that state’s pandemic lockdown. The switch to working from home definitely “added a level of complexity” to the project, said Chow, but the team managed to stick to its 20-business-day deployment schedule with some parallel execution of the four deployment steps: Step 1. Understand revenue drivers and templates and test modeling hierarchies; Step 2. Simultaneously import existing data into Planful, including historical actuals and the existing budget; Step 3. Build out and test reports and reconciling data disparities; Step 4. Roll out new planning and reporting capabilities to the sales team with thorough training.

The crisis confirmed that the decision to start with sales and trade-spend forecasting was the right approach. "Because we were doing this during a period of craziness with Coronavirus, our demand-planning team really needed weekly forecasts,” Chow explains. “They use details available in the sales and trade-spend forecasts to do demand planning because these are the drivers of the business, so it was clear it's what we needed to focus on in the first phase."

SmartyPants wrapped up forecasting sales and trade-spend for the full year and it has developed preliminary sales and trade-spend forecasts for 2021. The company has also moved into the second phase of its Planful deployment, addressing operating expenses.

“Just two months in we’re now wrapping up operating expense templates and starting forecasting for the rest of 2020 and preliminary 2021,” explained Chow. “That's a huge win because I don't want to have to manage dozens of spreadsheets from departments maintaining separate budgets and planning.”

In a planned third phase, set for the second half of 2020, SmartyPants will extend the platform to address cost of goods sold and the overall balance sheet.

In response to the many companies now desperate to get to faster and more agile planning, Planful has come up with fixed-cost, 30-day deployment offerings for specific financial planning and analysis use cases that are currently in high demand. These include cash-flow forecasting, workforce planning, monthly close and consolidation, and multi-dimensional ad hoc analysis. I’d expect other vendors to follow Planful’s approach of offering focused, fixed-cost, fixed-time deployments during this recovery period.

I’ve been around long enough to have seen tough economic conditions before, from the real estate collapse of 1987 to the dot-com bust of 2001 and the Great Recession of 2007. The agile and adaptive companies respond, rebound and lead the way back to better times.