Vice President and Principal Analyst

Constellation Research

Title: About Dion Hinchcliffe

Dion Hinchcliffe is an internationally recognized business strategist, bestselling author, enterprise architect, industry analyst, and noted keynote speaker. He is widely regarded as one of the most influential figures in digital strategy, the future of work, and enterprise IT. He works with the leadership teams of large enterprises as well as software vendors to raise the bar for the art-of-the-possible in their digital capabilities.

He is currently Vice President and Principal Analyst at Constellation Research. Dion is also currently an executive fellow at the Tuck School of Business Center for Digital Strategies. He is a globally recognized industry expert on the topics of digital transformation, digital workplace, enterprise collaboration, API…...

Read more

If one were to conduct an inventory of all the different digital technologies, platforms, services, channels, and devices that an organization uses -- and certainly most CIOs do this today -- it would come as a surprise to most. For the average organization, the numbers of items on that tech inventory would number in the hundreds, or even thousands in large organizations. And because nearly everything in business is becoming digitized, all while needing to be made more contextualized and personalized, a growing percentage of this technology has to work closely together to effectively solve business problems, meet customer needs, and create value. This imperaive, however, tends to tight coupling and combinatorial situations that are now reaching levels that are difficult for many organizations to realize and manage.

In short, complexity has become one of the leading challenges cited by executives when it comes to dealing with iT today. One strategy is simply to reduce the number of IT vendors being used (making them deal with making everything work together), and indeed, vendor consolization has been steadily rising. I've even explored recently the trend of unified software service providers as a distinct new trend to cope with this. But the strategy to export complexity to outside the organization tends to break down when a new digital solution or IT system has to be best-of-breed, such as when it runs the core business, providing differentiated capabilities, at least when compared to key competitors. That's because one generally can't consolidate leading edge solutions from a newer, often smaller, vendor as easily.

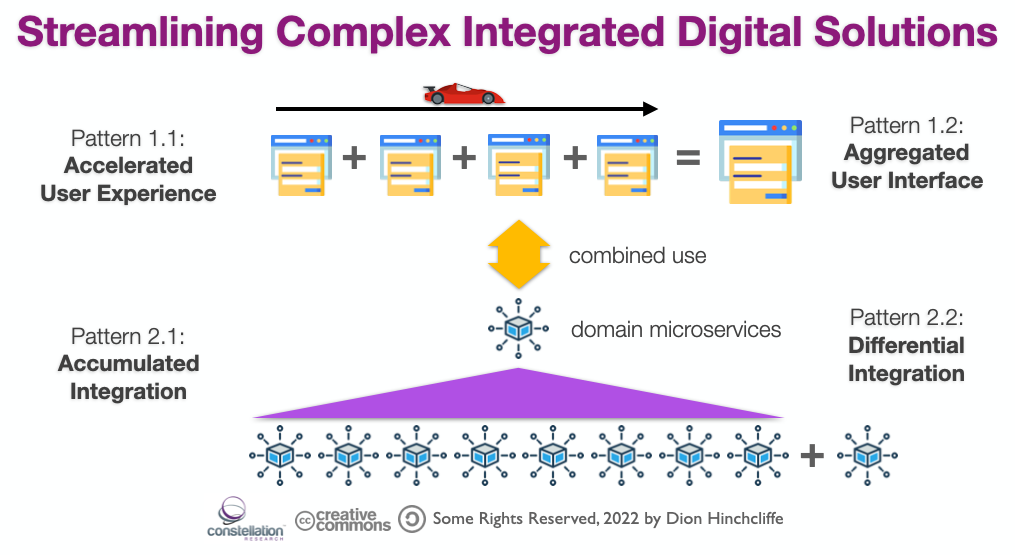

Instead, in today's world of hypercoverged IT services, new lightweight integration techniques, and new methods to accelerate or streamline user experience, my research shows that a new crop of vendors are using the compelling new design and architectural breakthroughs to collapse time to value, create operational simplicity with large numbers of simultaneously integrated systems, all while delivering high leverage in the user experience to make these many integrations perform significantly more useful work per given unit of user effort.

Reducing Digital Complexity Through Crux Efficiency

What appears to be happening is that in the competitive lab of the industry, certain tech developers are hitting upon highly effective approaches that address the very core of what is holding back organizations from tackling the next levels of complexity in their digital landscapes. The key obstacles: 1) The very high levels of integration required to deliver solutions that are much better than previous ones. 2) Overly complex user experiences that result from having so many underlying systems brought together. 3) The tediousness and time-consuming nature of the sophisticated user interfaces required to deliver on end-to-end digitized business processes. Usability has long been an adoption and efficiency barrier in enterprise, but it's often been unaddressed for a variety of reasons outside the scope of this discussion.

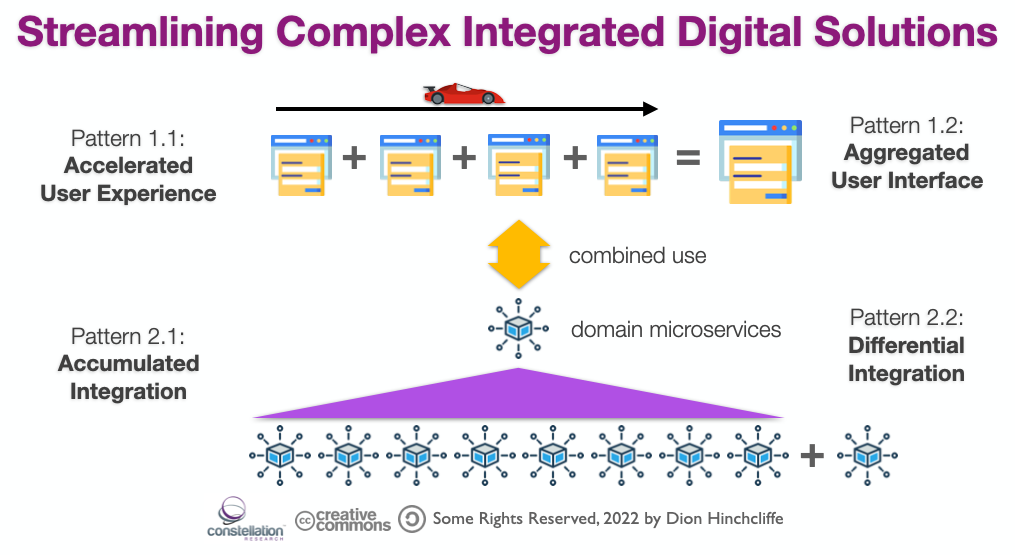

So, rather than barely achieve minimum acceptable levels of integration or sufficient level of usability, a new generation of solutions are emerging that go directly towards the core, or crux, of the problem: If integration is valuable, then we should do it often and have many of them, designed to be useful and efficient as possible. If today's digital processes, as represented in the user experience, are too cumbersome and lengthy, then ways should be found to make them dramatically more streamlined and efficient. As I examine more of this class of solution, I find that several central design patterns emerge consistently in their designs.

The Design Patterns of Highly Streamlined Digital Solutions

While my research shows that there are likely other patterns still to be uncovered, the patterns below appear frequently and at the very core of many of an emerging next-generation of highly streamlied and lower complexity (to the user) digital/IT solutions that have signifficantly higher levels of useful integration and effective usability. And therefore much higher user productivity and business impact.

Pattern 1.1: Accelerated User Experience

The hallmark of this pattern is a maximal reduction in the number of steps, context switches, and individual user actions to accomplish a goal. This can be achieved through automatic completion of fields for the user, offering up the most common and recently used entries to fields, and even asking the user for key bits of information and otherwise carrying the entire task out for the user on their behalf. Notably, this pattern is now being delivered as an entire product category in its own right now as in the form of digital adoption platforms, which seek to reduce the overall user burden of a digital system in every way possible. The essence here is to eliminate every source of friction to the user in carrying out a task to the fullest extent possible, converting their intention to business outcome with an absolute minimum of physical or mental effort, using automation as much as possible. My research shows that 5-to-1 and even 10-to-1 efficiencies in usage, and again, therefore productivity/business results are possible.

Pattern 1.2: Aggregated User Experience

More than just acceleration, highly streamlined IT aggregates underlying experiences into new, briefer, more succinct user experiences. Instead of using a Concur or Workday user experience directly to schedule travel or file expense reports, the streamlined solution might have it's own user experience that aggregates the underlying solution as an end-to-end travel experience. It would not expose the user to fields not relevant to the task, and it would collect the minimum amount of information from the user and instead do the work on its own to gather the information from underlying systems elsewhere (travel data in an airline app, client names from meeting calendars, dining expenses from a bank statement), without making the user go to different systems to collect and then enter contextual information manually into another system. This approach is endlessly adpatable to the majority of activities in digital employee experience, customer experience, and line of business processes. However, a lot of the value and the range of possibilities are determined by how good the integration is with other IT systems that relevant data is stored in. Which brings us to the next layer of highly complementary patterns.

Pattern 2.1: Accumulated Integration

When the value of integration is high and its combined cost/difficulty continues to decrease, far more contextually-aware solutions can be developed than previously, especially with the aggregated user experience pattern above. This is where the value of a solution based on a platform comes in, which systematically integrates other IT systems in a way that builds network effects. In fact, the realization is now that platforms that move the cost/difficulty/depth of integration out of individual solutions and down to the platform level allows solutions to be devleoped that already have, pre-integrated, dozens or even hundreds of other IT systems. We can see in the marketplace today particularly successful solutions that have high levels of 3rd party applications pre-integrated in a high quality way, such as what the popular collaboration service Slack has done for chat apps or Asana has provided with their work coordination solution. This accumulated integration continually raises the bar for an entire organization or even the broader industry, each time another application is integrated. The crux of this pattern is valuing, emphasizing, and amortizing many high quality integrations in large numbers. It's only then that combinatorial complexity can start to be converted into a more linear problem. The most successful new highly streamlined digital/IT solutions have large numbers of integrations out of the box (dozens to hundreds) and also make it easy, through low-code approaches, for new integrations to be added. Importantly, adding a new integration to the platform makes it available every other new solution built on it. This means that over time, integration complexity is systematically reduced.

Pattern 2.2: Differential Integration

Building on the accumulated integration, this pattern simply recognizes the value that occurs that if the previous pattern is fully realized, making it so that the next new solution developed on the platform requires the least amount of new, differential integration to achieve. In other words, if an organization has diligently added its proprietary and/or obscure systems as deep, quality integrations to the platform, that when a new solution is needed, the minimum possible amount of new integration must be developed. This is a significant force multiplier in time to value given that IT integration is still one of the hardest, complex, and higher risk part of any IT project or solution development effort. Aggressive pursuit of systematic integration pays off down the road, not at the first 10-20 integrations, but when a critical mass of applications are now available to easily build new contextual solutions.

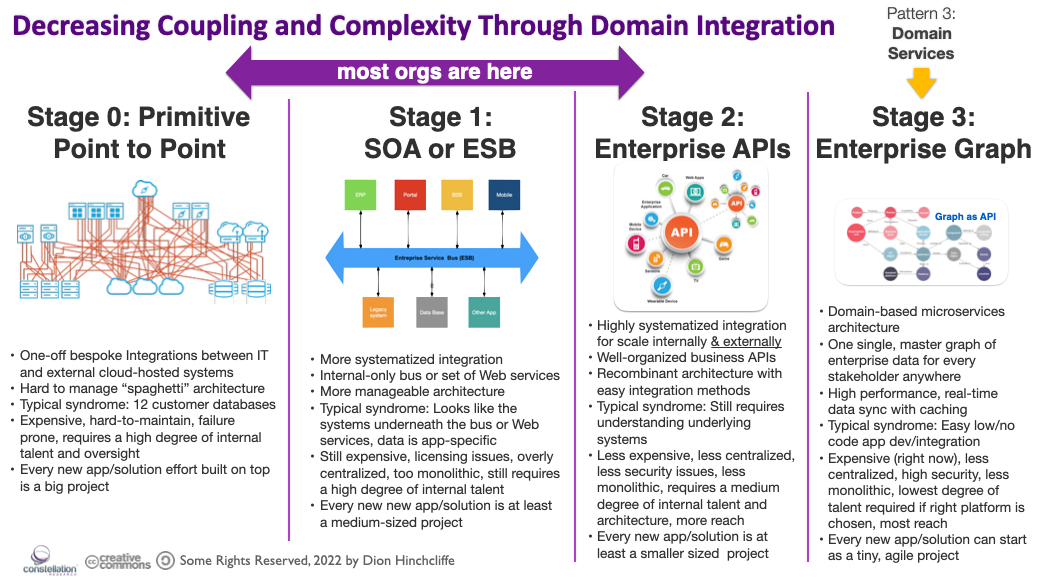

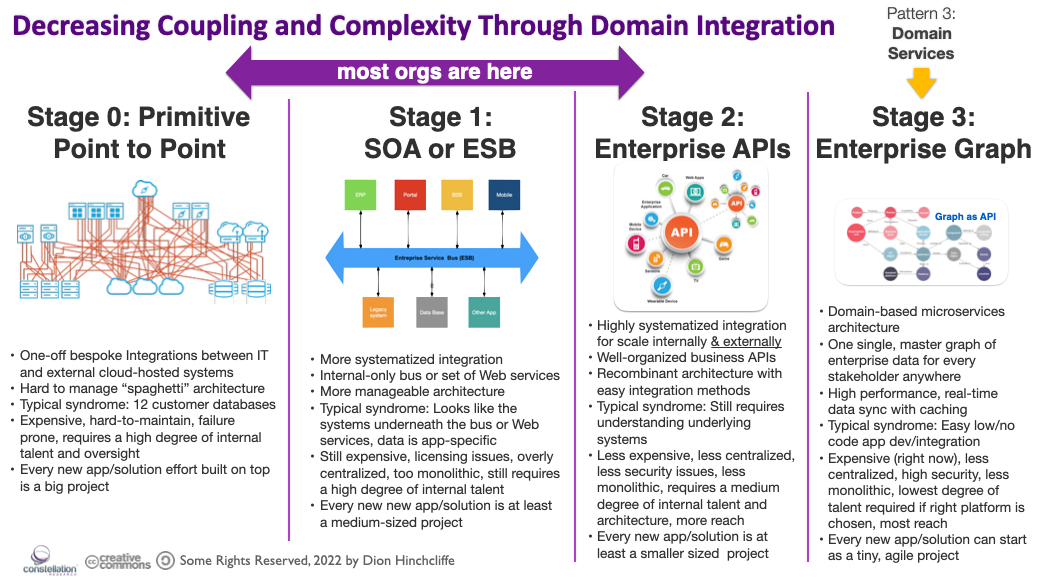

Pattern 3: Domain Services

The lesson in this pattern is that the patchwork of APIs and microservices accumulating in silos in organizations must come to an end and evolve to the next level of utility. A single, consistent (but eminently decentralized by its very nature) set of business-level domain services must become the norm. All of IT -- systems and people both -- must speak the same language. The business must speak it too. That means that the APIs must work as a coherent business graph at the domain level. I've been strongly suggesting for years that microservices have to become a core business strategy and common master artifact, and the time this has come, in particularly in the form of a fully consistent business graph. This will take years for most organization, but realizing it at the platform level is where it must happen, for the reasons above and more. Low code/no code, which can unleash an order of magnitude more productivity alone, outright demands domain services that anyone can consume. And doing this ensures that integrations can be used by anyone and that all such solutions are using the right master data, right guardrails, right compliance, and right security approaches in the most orderly, operation-friendly, manageable, and governable way possible.

An Example: Brightspot

As evidence that these types of highly streamlined new solutions are emerging, I would hold up Brightspot, an advanced content management platform that has been around for a few years now, but that has been steadily gaining marketshare and notable wins against much larger competitors because it so well embodies the design patterns above. It dramatically reduces complexity and increased user leverage throughout its user experience and its deeply integrated design. Brightspot is designed around the understanding that it's part of a much larger ecosystem and value chain, and must work contextually with it as closely as possible to make it as easy as it can for users to be effective in their work and in business outcomes.

Brightspot has many user experience accelerators, aggregated experiences, workflow guides, and other ways to ensure that a given business process is carried out as easily and quickly as possible. It does this by pursuing solid, deep, high quality integrations with common applications in their industry (advertising, analytics, DAM, search, social, images, transacation, etc.) to the fullest extent possible. if you're going to build on Brightspot, you can be confident that it will have the widest range of already-built integrations that will make creating business critical workflows and processes within it as simple and relevant as is possible.

Releated Research: How Brightspot Transformed Content Management in the Research Industry

I'll be exploring the capabilities of Brightspot and others in more detail for what these new highly streamlined platforms actually do to provide dramatically improved time-to-value, productivity, and efficiency in the entire development to operations to maintenance/evolution/innovation lifecycle. But the patterns themselves are clear. By understading how these approaches address the very crux of the problems in IT complexity that are still holding back most solutions from reaching new plateaus of productivity is an investment in time that I encourage solution architects, user experience designers, and business solution owners to make if they wish to tap into the next generation of what is possible today.

Additional Reading

To Strategically Scale Digital, Enterprises Must Have a Multicloud Experience Integration Stack <-- What a highly streamlined IT platform realization looks like

How Tailored Experiences Deliver Efficiency and Productivity

How Headless Revolutionized Content Management

The future of enterprise content is modular and headless | ZDNet

How CXOs Can Attain Minimum Viable Digital Experience for Customers, Employees, and Partners

Cloud Reaches an Inflection Point for the CIO in 2022

Future of Work

New C-Suite

Next-Generation Customer Experience

Tech Optimization

Innovation & Product-led Growth

ipaas

AI

Analytics

Automation

CX

EX

Employee Experience

HCM

Machine Learning

ML

SaaS

PaaS

Cloud

Digital Transformation

Enterprise Software

Enterprise IT

Leadership

HR

B2C

Chief People Officer

Chief Human Resources Officer

Chief Information Officer

Chief Customer Officer