Vice President & Principal Analyst

Constellation Research

About Liz Miller:

Liz Miller is Vice President and Principal Analyst at Constellation, focused on the org-wide team sport known as customer experience. While covering CX as an enterprise strategy, Miller spends time zeroing in on the functional demands of Marketing and Service and the evolving role of the Chief Marketing Officer, the rise of the Chief Experience Officer, the evolution of customer engagement, and the rising requirement for a new security posture that accounts for the threat to brand trust in this age of AI. With over 30 years of marketing experience, Miller offers strategic guidance on the leadership, business transformation, and technology requirements to deliver on today’s CX strategies. She has worked with global marketing organizations to transform…...

Read more

“Why can’t MARKETING speak in the language of the BUSINESS”

This has long been the lament shouted from the corporate hilltops as marketing metrics scrambled to find solid ground. In the early days of digital, the cadre of “descriptive metrics” like “views” and “clicks” sought to quantify value in a tit-for-tat “we paid x and got y that only we can understand and define” model that infuriated finance leaders.

But those early earnest desires to articulate impact veered off-course and remained in an odd and largely tactical state of vanity metrics that summarized what marketing could see in the rear-view mirror but did little to tie marketing action to revenue or start to forecast performance models let alone adequately plan for future growth.

Marketing metrics remained locked in a state of advertising-focused measures with a growth-driving mandate. In the financially-driven world of forecasts, annually recurring revenue, total addressable market and, dare I say, gross margins, Marketers were left filling slide after slide with likes, clicks, views, single points of attribution or loosely correlated multi-point attribution models in an attempt to bring analytics and business rigor to a land pock-marked by gut, intuition and tradition.

We have entered an age where the Chief Marketing Officer (CMO) has embraced the role of growth driver. CMOs want to quantify the impact marketing and engagement investments are making on top line acceleration while also mapping operational efficiencies driving down costs and reducing waste and obsolescence. The model has evolved from one of wanting to plan for media mix investments and instead to plan and track performance across the entirety of marketing’s strategy for growth, experience and engagement.

But interestingly, the dynamic between CMO and their finance colleague, the Chief Financial Officer, tends to be less formed and cemented than other relationships across the C-Suite. When asked by Constellation Research about key mandates and imperatives for marketing’s top role, only 2% pointed to fully aligning customer experience strategy plans with finance and operations roles[i].

This is what made Planful’s September 15, 2022 acquisition announcement to buy the marketing planning and budget analysis solution, Plannuh, so interesting.

The Deal

Let’s break down the nuts and bolts of the deal.

The Silicon Valley-based pioneer of financial performance management cloud software, Planful, acquired Plannuh, the brainchild of seasoned CMO Peter Mahoney, who in 2019 launched the company out of his own personal frustrations around marketing performance and reporting solutions. Plannuh focuses on what a CMO might expect from an MPM solution with agile planning, budgeting and performance tracking and management. But Plannuh takes the additional critical step of connecting these established marketing practices with financial outcomes.

As the story goes, Planful’s own Chief Marketing Officer, Rowan Tokin and Peter Mahoney, author of the book, The Next CMO: A Guide to Operational Marketing Excellence, were part of the Exit Five marketing community. Dave Gerhardt, the founder of Exit Five, introduced Tonkin and Mahoney given their backgrounds and mutual love for planning and financial performance management. Upon meeting, Tonkin knew Plannuh would be an easy, complimentary fit to the existing work he and the team were already doing with Planful at Planful.

While other tools have provided marketers with the campaign metrics to report on tactical outcomes and baseline budget tracking, with Plannuh, leaders are armed with deep financial intelligence across all marketing activities. Some highlights into capabilities include:

- Building marketing plans that consolidate goals, campaigns, budget, and performance metrics into one view for a more purposefully agile approach to marketing operations.

- AI-powered marketing budget and expense management automation.

- Easy import of budgets for full alignment and tracking across regions and functions, for an accurate and consolidated single view of marketing performance.

- Real-time calculation and visibility of business-based metrics including cost-per-outcome (CPO), return on investment (ROI), and lifetime value (LTV).

- Rapid deployment that has seen teams up and running within 3 weeks.

Financial details of the deal have not been disclosed. All of Plannuh’s employees join the Planful team, and the Plannuh application will be merged into the Planful platform. Existing Plannuh customers will not experience any disruption and can continue to use the solution as a standalone offering. Plannuh will also be available as part of the comprehensive Planful platform.

Constellation’s Take

On the surface, this is a great move for Marketing executives looking for some true planning firepower that extends beyond the traditional tactical and functionally focused strategy reporting CMOs have become comfortable utilizing. But dig a bit deeper and you find the really big news: that the capabilities represent a bridge between the strategic measurements of running a marketing organization and the tools required to truly run a modern growth machine. In terms of playing with our “alphabet soup”, it brings more financial planning management (FPM) to marketing performance management (MPM) at just the right time in business evolution.

Today’s CMO is laser focused on identifying, facilitating and empowering growth. Most of today’s broad marketing technology platforms come with natively built (or at minimum natively integrated) marketing analytics tools to help unify marketing campaign performance. And there are a growing number of business intelligence solutions on the market that empower marketers to interrogate engagement and campaign data very differently. But truth be told, few fully integrate into the CFOs vision of planning or forecasting…and this is where this combined vantage point of Plannuh and Planful come to play.

Marketing, for far too long, has tried the most ancient of tools to manage budgeting, planning and revenue-based strategy: spreadsheets. These endless line item ladened ledgers are weights around leaders looks to accelerate their decision velocity with forecasting that is more predictable and reliable. Guessing hasn’t gotten marketing very far when being asked to build a case for spend, let alone when forced to defend budgets. In as much as guessing isn’t a strategy, spreadsheets are not a plan.

Let’s also revisit a data point that may have been easy to skim past at the top of this post: when asked about top priorities, only 2% of marketing leaders had more closely aligning with finance on their dance card. Yet the overwhelming majority believe their top priority is to drive growth across existing market segments and customers. Yes…marketers believe their top job is to drive growth for their organizations, but they don’t intend to align with finance as part of that forward moving financial progression. Yes…it is easy to push this aside and say that marketing, like finance, have a length list of priorities and not everything can rank at the top of the list. Here’s the problem: something as important as CFO alignment shouldn’t be the priority that is listed dead last.

For any of this to truly work, it will require a shift in mindset (read: elimination of cynicism) on the part of the finance. Often seen by marketers as a roadblock-by-trade, finance has earned the reputation of naysayer of innovation, despite the mandate to serve more as protector of transformation. While leaders from IT, Digital, Commerce and even Marketing are charged with lofty, evolutionary and, yes, even “sexy” aspirations such as transformation, it is typically the finance leaders who must serve as the earth-bound anchor to those dreams. But today’s CFO can no longer just rely on serving as the data analyst that can outline what has happened to the bottom line of a business. Finance leaders are being asked to leverage data to answer the question of WHY and to deliver a business strategy that looks more creatively at HOW.

Now, more than ever, CMOs and CFOs are being asked similar questions and need to interrogate data and accelerate their capacity to make decisive decisions towards action. This will require common strategies and “north stars” for growth in margin and profit. It will require shared visibility that lends itself to collaboration and partnership instead of approvals and apologies. If the dynamic between CMO and CFO requires change, it also requires common tools, not just speaking a common language. It will require that both marketing and finance stop clinging to a raft of spreadsheets and instead evolve, perhaps, together.

For more about the acquisition, be sure to check out the official announcement here.

[i] Source: CMO 2022 Survey, Constellation Research, November 2022

Data to Decisions

Marketing Transformation

New C-Suite

Next-Generation Customer Experience

Chief Executive Officer

Chief Financial Officer

Chief Marketing Officer

Chief Revenue Officer

Chief Data Officer

One thing that was exactly as expected was the opening keynote from the familiar Hawaiian blessing to the star-studded special guests (let’s just get this out of the way…Nobody but NOBODY will ever say no to a Lenny Kravitz moment to start the day.) What stood out was the dynamic between the co-CEOs, Marc Benioff with his larger-than-life exuberance and Bret Taylor with his pragmatic, steadying presence.

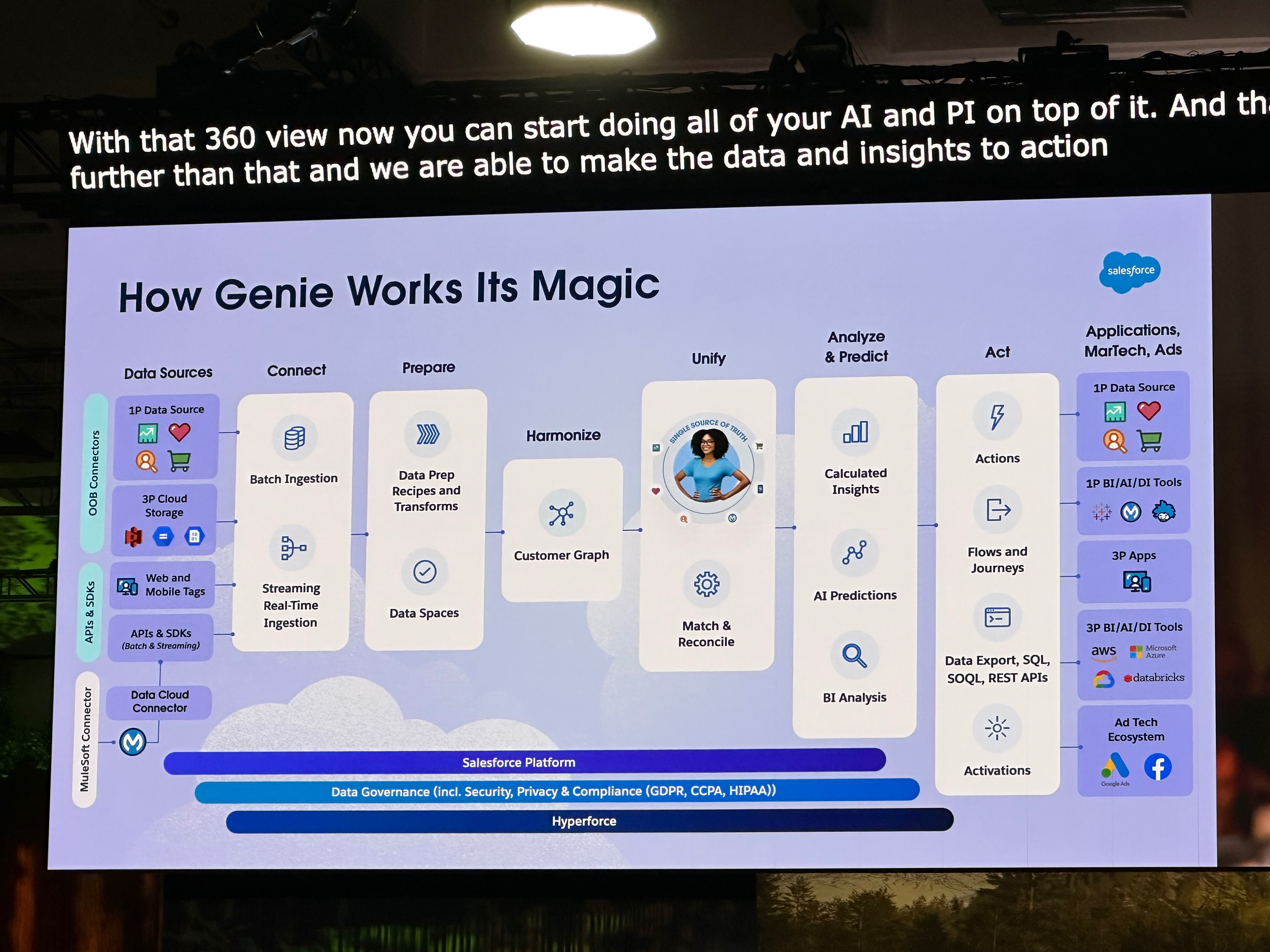

One thing that was exactly as expected was the opening keynote from the familiar Hawaiian blessing to the star-studded special guests (let’s just get this out of the way…Nobody but NOBODY will ever say no to a Lenny Kravitz moment to start the day.) What stood out was the dynamic between the co-CEOs, Marc Benioff with his larger-than-life exuberance and Bret Taylor with his pragmatic, steadying presence. What elicited cheers from the Dreamforce audience was Genie’s capacity to help normalize and harmonize data…cleaning up the pathways that turn random stacks of data into individual, more comprehensive and complete customer records. The reality of customer records is that for every one customer, there are 900+ systems that collect data from or about that customer. So instead of Liz…you have Lizx900. Personalization occurs by accident in this scenario. Thanks to Genie’s capacity to reconcile data and identifiers, the haze and exhaust surrounding a persona turns crystal clear and becomes a person that can be engaged with regardless of where that person has engaged.

What elicited cheers from the Dreamforce audience was Genie’s capacity to help normalize and harmonize data…cleaning up the pathways that turn random stacks of data into individual, more comprehensive and complete customer records. The reality of customer records is that for every one customer, there are 900+ systems that collect data from or about that customer. So instead of Liz…you have Lizx900. Personalization occurs by accident in this scenario. Thanks to Genie’s capacity to reconcile data and identifiers, the haze and exhaust surrounding a persona turns crystal clear and becomes a person that can be engaged with regardless of where that person has engaged.