Why customer satisfaction, CX shows diminishing returns

This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

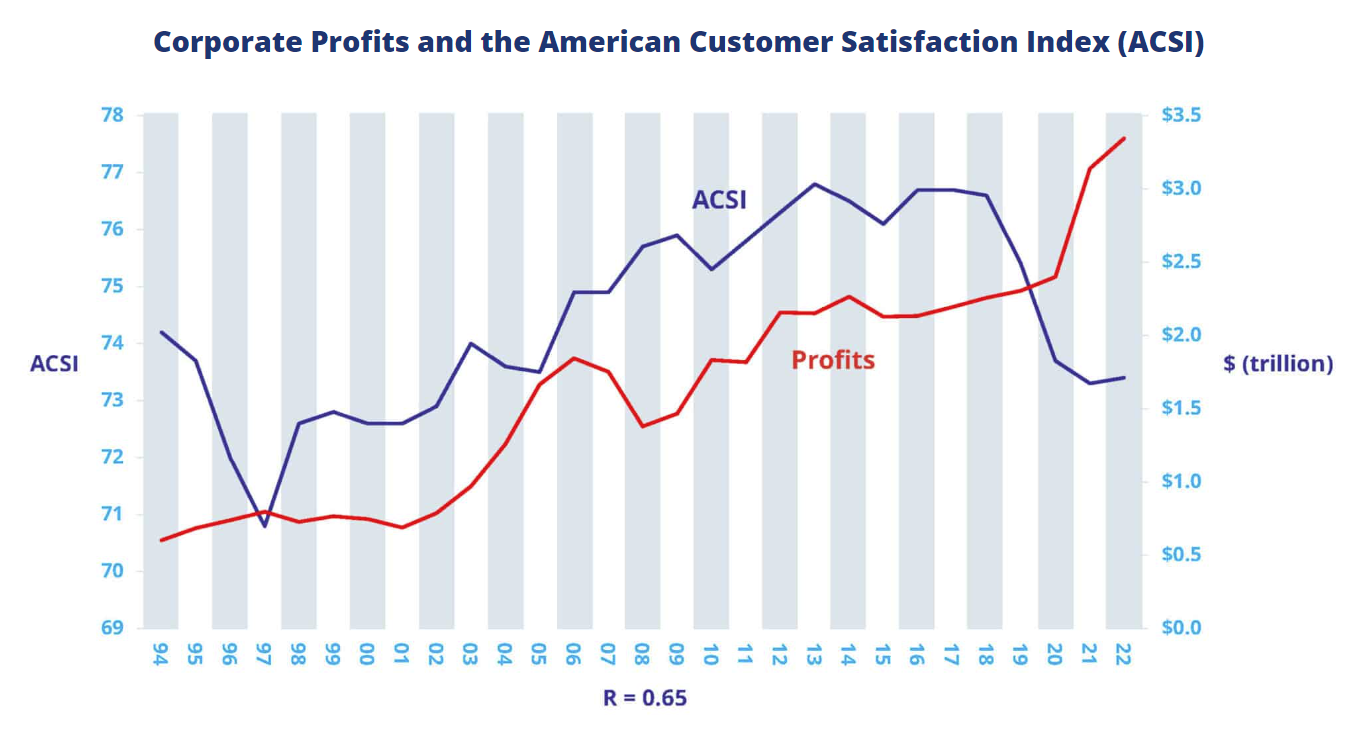

A good customer experience is supposed to lead to profits, revenue growth and stock market returns. But stock returns and customer satisfaction have become decoupled, according to the American Customer Satisfaction Index (ACSI).

Does this mean that you should ditch all those customer experience (CX) projects? Not quite. However, the most recent ACSI data does challenge CX conventional wisdom a bit.

The good news is that the ACSI rose to a record score of 77.8 on a 100-point scale. This surge in satisfaction can be attributed to a return to supply chain and labor shortage normalcy after the COVID-19 pandemic. In addition, consumer expectations have fallen and that has lowered the bar for companies.

Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (emeritus) of Business Administration at the University of Michigan, said the following in remarks that came with the latest data.

"There is one remaining economic anomaly. As evidence of a well-functioning economy, companies with superior customer satisfaction usually have superior stock returns. The relationship between strong customer satisfaction and positive abnormal stock returns has yet to recur. It is not that the stock returns on customer satisfaction have been weak, but they have not outperformed the market the way they did in the past."

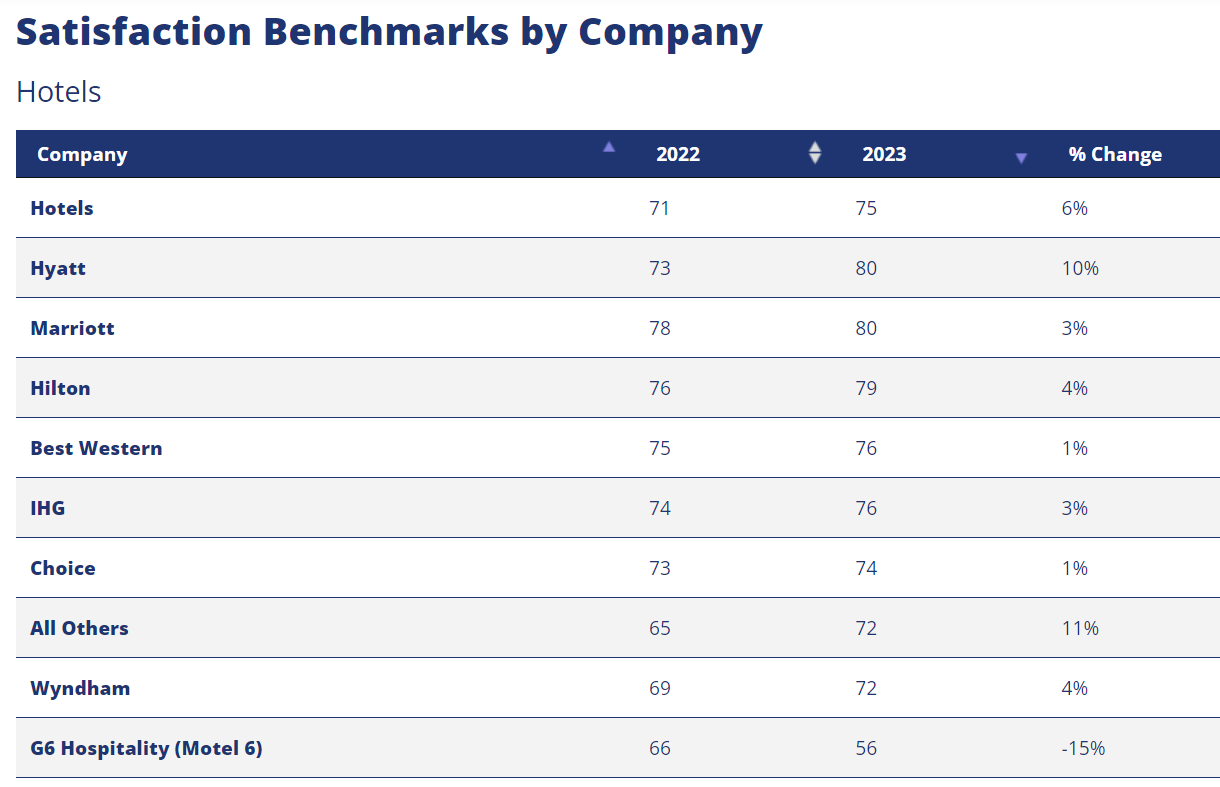

Indeed, some of the biggest gainers in the ACSI scores were Macy's, Hyatt Hotels, Amazon Prime Video and Avis Car Rentals. None of those companies have been stock market superstars. Historically speaking, ACSI scores at the company level have been correlated with higher profits, cash flow, stock returns, revenue growth, margins and market share.

Fornell had another takeaway that should make any CX pro cringe--the more data you collect on customers the less you seem to know. Fornell said:

"The steep decline in U.S. overall customer satisfaction is not just caused by COVID, shortages, and inflation. While these factors have exacerbated the problem, the weakness and subsequent deterioration in customer satisfaction began about a decade ago. It is not because of a lack of effort by business either. Companies collect much more data on their customers today than they did 10 years ago. Paradoxically, the more data companies collect about their customers, the less they seem to know about how to satisfy them. That’s because data and information are not the same thing. Customer survey data in particular contain a great deal of noise. For such data to become useful beyond descriptive statistics, filtration and calibration are paramount—something that is lacking in just about any analytics tool used by business today."

Should this data prove to be more than an anomaly, the implications on CX could be huge. To date, enterprises have assumed that improved customer experiences lead to better financial results. If that conventional wisdom doesn't hold up, CX will be under a lot of scrutiny.

ACSI in its analysis of ACSI scores as financial indicators said (emphasis mine):

"Recently, there have been economic anomalies affecting both the market and the economy. Inflation, in addition to product and labor shortages have led to declining customer satisfaction. Yet, despite high inflation, due to shortages, consumer demand has exceeded supply in many markets. When demand exceeds supply, customer satisfaction matters less and stock returns on customer satisfaction changed from positive to negative.

Nevertheless, several of the leading ACSI companies have held up reasonably well, but the S&P 500 has become less relevant as a benchmark."

It's too early for a definitive view on whether this decoupling between customer satisfaction and financial returns is permanent, but in the meantime, here are a few thoughts.

- The data on customer satisfaction is noisy due to the "shortage economy" and supply issues amid strong demand. There's a good chance that noisy data may be the norm given the supply chain is likely to be volatile for the foreseeable future.

- It's possible that multiple companies in any category have strong customer satisfaction scores. In that situation, a company is penalized for bad experiences, but not necessarily rewarded for good ones.

Let us take something like the ACSI scores for PCs. The major players have ACSI scores above 80 so there's little reward for outperformance.

Wireless carriers all have the same customer satisfaction scores.

In fact, many industry groups in the ACSI have similar customer satisfaction scores. In other words, the players are good enough.

- Like any big initiative there is a point of diminishing returns unless something is broken. Companies will aim for good-enough customer experiences given that going above and beyond may not pay off. In hotels, many of the competitors are in the same customer satisfaction ballpark. For instance, IHG may not pay up to go from 76 to 80 on its ACSI score. Motel 6 clearly has to invest after cratering.

More on CX:

- 5 takeaways for retail, marketers, CX from Adobe’s holiday 2023 data

- Enterprise technology customer success stories: Everything we learned from CXOs about AI, data, CX, transformation

- CR CX Convos: Intelligence and Context in Modern CX

- Customer experience vs. efficiency and cost cutting: Which one wins?

- Constellation ShortListâ„¢ Digital Experience (DX) Platforms

- Connecting Experiences From Employees to Customers

From our underwriter

Hitachi Vantara will host its latest Exchange event--Building a New Blueprint: How Data and AI Are Forming the Foundation for Innovation--in New York February 1. Hitachi Vantara executives along with executives from Verizon Business, Voya Financial and AllianceBerstein will talk data strategies and frameworks to set the stage for future innovation such as generative AI. Here's the agenda and what's on tap.

Next-Generation Customer Experience B2C CX