The mass exodus from VMware following Broadcom wasn't a sprint as much as it was a walk. Nevertheless, earnings results from Nutanix and Pure Storage highlight VMware customers are taking a measured approach to leaving.

First, Nutanix reported better-than-expected fiscal third quarter results and raised its outlook. The company reported non-GAAP earnings of 42 cents a share on revenue of $639 million, up 22% from a year ago. Nutanix also raised its outlook and now projects fourth quarter revenue of $635 million to $645 million.

The big technology development in the quarter was Nutanix partnership with Dell Technologies. Nutanix is supporting external storage in a move that will broaden its reach and give enterprises more options to move to its virtualization platform. Nutanix on Dell PowerFlex became available the end of April. Typically, customers would consume Nutanix storage along with its hypervisor.

The Dell deal, coupled with a more mature Cisco partnership, and a new effort with Pure Storage gives Nutanix more enterprise heft and ability to target AI workloads. Nutanix's cloud platform will also support Google Cloud.

"We continue to focus on helping customers build apps and run them anywhere," said Nutanix CEO Rajiv Ramaswami. "Our largest wins in the quarter demonstrated our ability to land and expand within some of the largest and most demanding organizations in the world as they look to modernize their IT footprints, including adopting hybrid multi-cloud operating models and modern applications, as well as those looking for alternatives in the wake of industry M&A."

Previous Nutanix earnings calls didn't usually name VMware directly and alluded to migrations as moves from legacy providers or some not-so-vague reference. This conference call was more direct as analysts and Nutanix executives mentioned VMware 13 times. Nutanix is often coming into the enterprise as a second virtualization option and growing from there.

- What VMware customers are doing through the lens of Nutanix

- Nutanix product additions, partnerships designed to capitalize on VMware customer angst

- Nutanix winning deals vs. VMware, but Broadcom punching back with pricing

Ramaswami also said Nutanix is developing its Kubernetes efforts. Talking about Nutanix's .NEXT conference, which was recently held, Ramaswami noted that the company is building up its customer base that migrated from VMware.

"Our customers would like us to support every external storage array that's out there. They want to see how we can make migration as easy as possible for them. And there were many customers who talked about their migration experience moving from VMware to Nutanix at the conference," he said.

According to Ramaswami, VMware isn't using pricing as much to keep accounts. Nutanix is taking a more a la carte approach and VMware is selling a complete stack.

Nutanix stands to benefit as VMware customers that signed three-year deals prior to the Broadcom acquisition come up for renewal now.

"Some did three years, some did five years with VMware as soon as they heard about the acquisition or around the time the acquisition was announced or as it started getting to be closed," said Ramaswami. "All of those customers renewals are coming up now, let's say this year or next year."

He said the one bucket of VMware customers are planning to actively migrate. Other customers will probably have to renew with VMware, but are planning for it to be the last deal. Either way, Nutanix plans to play a long game.

VMware was also a topic on Pure Storage's earnings call. Pure Storage reported strong first quarter results with non-GAAP earnings of 29 cents a share compared to estimates of 25 cents a share. Revenue in the quarter was $778.5 million, which also topped estimates.

As for the outlook Pure Storage projected second quarter revenue of $845 million and annual revenue of $3.51 billion.

CEO Charlie Giancarlo noted that Pure Storage is benefiting from its storage software, flash-based systems and subscription model to manage data for AI workloads. "Modern AI environments require a wide variety of performance levels consistently delivered across tens of thousands of GPUs," said Giancarlo, who noted AI inference and retrieval augmented generation is benefiting Pure Storage. "Q1 was a strong quarter in our breadth of AI wins."

As for the VMware hook, Giancarlo said AI workloads are forcing enterprises to revisit virtualization strategies. He cited the Nutanix partnership as an important milestone.

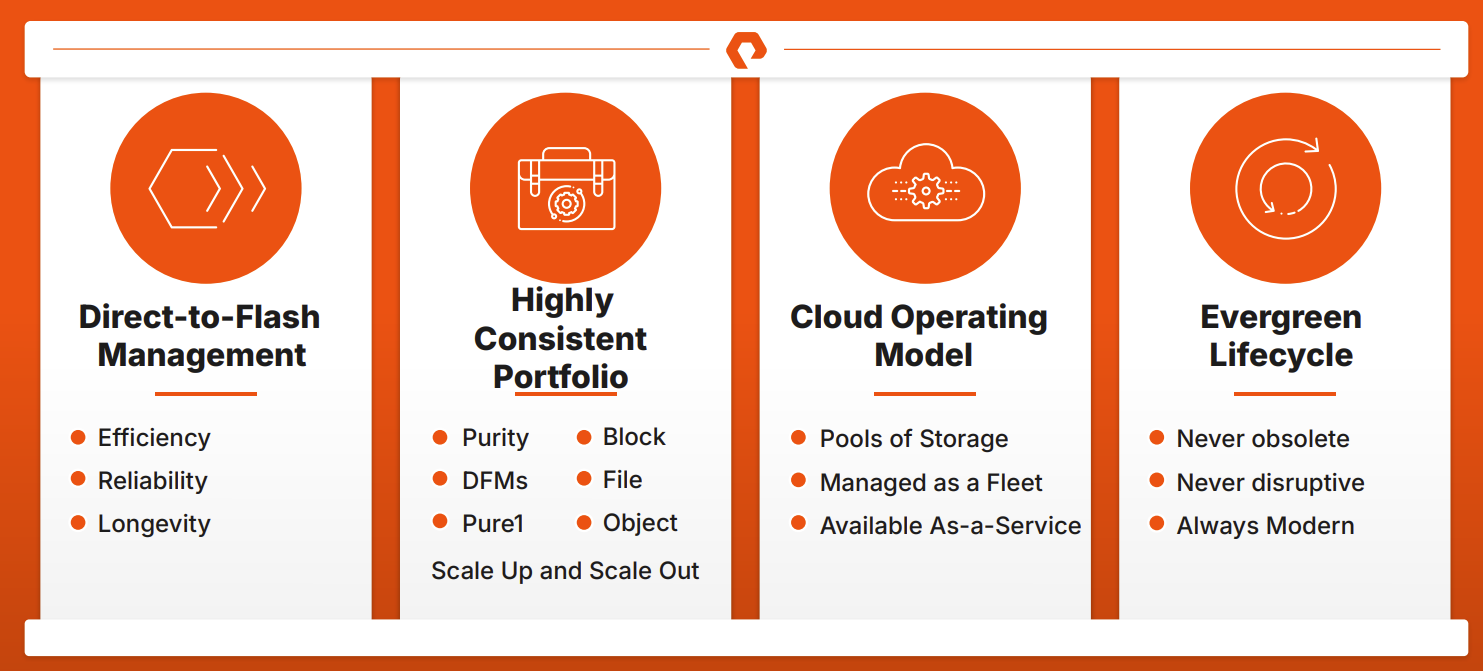

"This joint solution provides a modern, scalable, virtualized environment, which is purpose built for high demand data center scale workloads. Our partnership will deliver a high performance virtualized environment, providing Nutanix cloud infrastructure with Pure's enterprise data cloud using Pure FlashArray storage. We expect the solution to be generally available later this year," said Giancarlo.

Pure Storage landed multiple virtualization deals in the quarter with its Portworx offering that unifies container and virtual machine workloads.

The results from Nutanix and Pure Storage highlight the encroachment on VMware's customer base. Yes, Broadcom's VMware purchase was a financial win, but moves on perpetual licenses have rankled customers.

And the VMware angst also benefits smaller companies not just large vendors. Platform9 appears to be benefiting with private cloud migrations too.

- Platform9 launches community edition for Private Cloud Director

- HPE, Platform9 latest to target VMware customer angst

Platform9 recently penned an open letter to VMware customers about "sweeping changes in licensing and strategy, often at odds with what was to their benefit."

The bottom line: A big chunk of VMware's customer base is up for grabs and competitors are playing the long game to win them over.