What VMware customers are doing through the lens of Nutanix

If you want to know what VMware customers are plotting in the wake of Broadcom's acquisition it's worth checking out Nutanix's results, which are getting a gradual boost.

Not surprisingly, Nutanix's second quarter earnings conference call featured a heavy dose of VMware questions from Wall Street analysts. CEO Rajiv Ramaswami initially just mentioned VMware as an unnamed competitor, but analysts went right to the VMware between-the-lines benefit to Nutanix.

Ramaswami said VMware customers are rethinking overall strategies and looking toward other more automated options. "(VMware customers) were happy with the vendor prior, and now they don't feel happy. So, they got to look at an alternative. And we are a very solid infrastructure alternative," he said.

- VMware mansplains to customers about model changes, subscription pricing, account upheaval

- KKR buys VMware's EUC division from Broadcom for $4 billion

- Dell Technologies to exit commercial agreement with VMware

- Will VMware customers balk as Broadcom transitions them to subscriptions?

- BT150 CXO zeitgeist: AI trust, AI pilots to projects, VMware angst, projects ahead

First, the numbers.

Nutanix's second quarter earnings handily topped estimates with non-GAAP earnings of 46 cents a share on revenue of $565.2 million, up 16% from a year ago. Nutanix reported second-quarter net income of $32.8 million, or 13 cents a share.

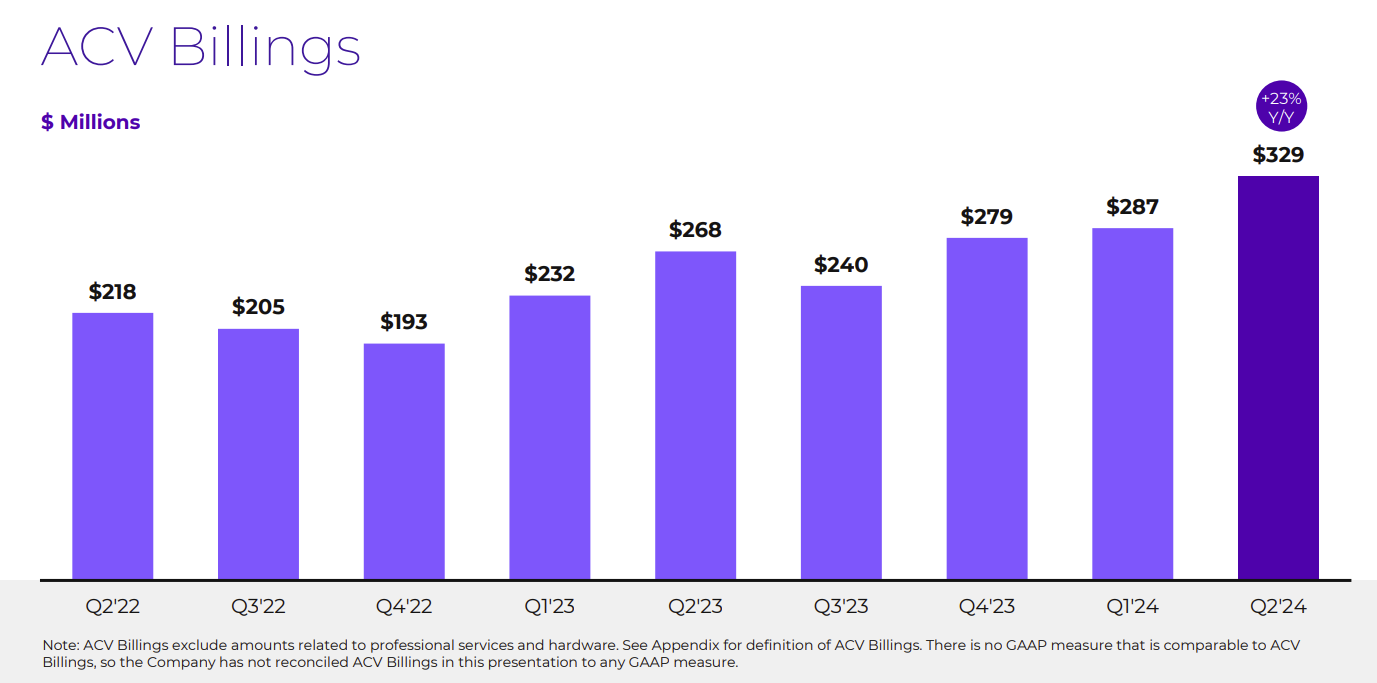

The company said annual contract value (ACV) billings were up 23% from a year ago in the second quarter with annual recurring revenue up 26%.

As for the outlook, Nutanix projected third quarter revenue of $510 million to $520 million and fiscal 2024 revenue of $2.12 billion to $2.15 billion.

Ramaswami noted a few wins and how Nutanix is landing larger deals. "A good example is a seven-figure win with a global EMEA based provider of automotive technology solutions. This new customer had an existing three tier footprint in need of a refresh but was frustrated by the recent price increases of their incumbent vendor and was also looking to have the flexibility to potentially move some of their footprint to the public cloud in future. They chose our Nutanix Cloud Platform, including our AHP hypervisor, as well as Nutanix Cloud Management, based on its superior TCO, built-in automation for infrastructure as a service," he said.

Constellation ShortListâ„¢ Next-Generation Computing Platforms

It doesn't take Sherlock Holmes to figure out that competitor given the multiple reports of VMware disgruntlement. Ramaswami also said a converged infrastructure partnership with Cisco was showing promise even though it's early. Nutanix CFO Rukmini Sivaraman said the company is "seeing a higher mix of larger deals in our pipeline" as well as new and expansion opportunities in an uncertain environment.

So, what are VMware customers thinking? Here's a distilled version of the lessons from Nutanix's second quarter conference call.

VMware customer migrations are likely to be a multi-year events. Ramaswami said the timing and magnitude of landing VMware's customers is unpredictable, but the "pipeline is quite substantial and growing." Ramaswami said:

"We expect contribution for the opportunity to build gradually, and here are the reasons. First is that many customers signed multi-year ELAs enterprise agreements with VMware prior to the deal closing for three to five years. That buys them some time to make decisions. The second is converting from VMware 3-tier accounts or legacy storage accounts, which is a good chunk of VMware footprint, in many cases requires a refresh of their storage and our servers. That could also impact the timing of the potential software purchases that they would make with us."

Larger customers have a lot of work to do to migrate away from VMware, but inertia isn't much of an option. Customization is also a factor since that can slow migration work.

Ramaswami said:

“One of the reasons we're seeing these large deals is because of course for a while we've been working on a portfolio, that product portfolio, which we think is ready for large scale enterprise deployments. And so, we have segmented our focus a bit further up the market in terms of our own sales for segmentation, and then on top of that, we've got the industry disruption with VMware where many large customers, of course, who are not necessarily engaged with us before are now engaging with us. So that's the reason why we're seeing more of these large deals in our pipeline."

The catch? Those large deals have a lot of variability on timing even as the pipeline builds. "It's a sea of engagement, when you have these types of deals between both companies, we are investing resources, customers investing a lot of resources as well, because there's a lot of testing certifications, go into contract negotiations, security audits, a whole bunch of things that get through this process," he said.

VMware Cloud Foundation is the target. Broadcom has focused VMware on its VMware Cloud Foundation business. That platform happens to be the one that lines up with what Nutanix offers. Ramaswami said:

"If you compare the full stack that Broadcom was offering with VMware Cloud Foundation, that, -- and our Nutanix cloud platform pretty much goes head-to-head against that, and we've got all the capabilities. That's a full stack that includes the hypervisor, a software defined storage, networking and management. So, we compare very well with that full stack and we're able to go to a very comparable offering."

VMware customers on lower-tier offerings, VMware Virtual Foundation (formerly vSphere) attached to legacy storage, will look at Nutanix as a broader transformation move. Ramaswami said:

"Customers are actually making a shift from a legacy architecture that say hypervisor plus external storage to a modern HCI (hyperconverged infrastructure) architecture that includes our hypervisor, but also the rest of our stack."

As a side note, this is where Dell's decision to terminate a commercial agreement with VMware may affect HCI decisions.

Broadcom's VMware purchase may be speeding up moves to HCI. Nutanix has put incentives in place for partners, advertising more to highlight its platform and helping customers with migrations.

Cisco is going to be Nutanix's BFF and help with migrations. It's early in the Cisco-Nutanix partnership, but Cisco's scale and market position can only help Nutanix. "There's a lot of cooperation happening between our sellers, and Cisco sellers in the field. So, all good, good omens at this point in time, but still very early," said Ramaswami.