FinancialForce's Spring 2021 Release Shows Why Being Customer-Centric Pays

Bottom Line: Customer revenue lifecycles are the lifeblood of any services business, making FinancialForce's Spring 2021 release timely given the services-first revenue renaissance happening today.

The essence of an excellent services business is that it can consistently create expectations clients trust and the business regularly exceeds. Orchestrating the best people for a given project at the right time, tracking costs, revenue, and margin across all services revenue, including those associated with a client's assets, is very challenging. Customer revenue lifecycles are in the data, yet no one can get to them because they're hidden across multiple systems that aren't integrated. Knowing how efficient a services business is at turning customer engagement into cash is what everyone needs to know, but no one can find. The challenge is equally as daunting for long-established services providers and those rushing into new services businesses to redefine themselves in the hope of profits that are more consistent and fewer price wars.

How Much Is Customer Engagement Is Worth?

Services businesses face the paradox of exceeding client expectations with every engagement but not knowing if extra time, resources, and staff invested are paying off with more revenue and profit. FinancialForce's Spring 2021 release looks to solve this problem. What galvanizes the ERP, PSA, and platform announcements is a fresh intensity on customer centricity, both for the services business adopting the Spring 2021 release and the customers it's intended to serve.

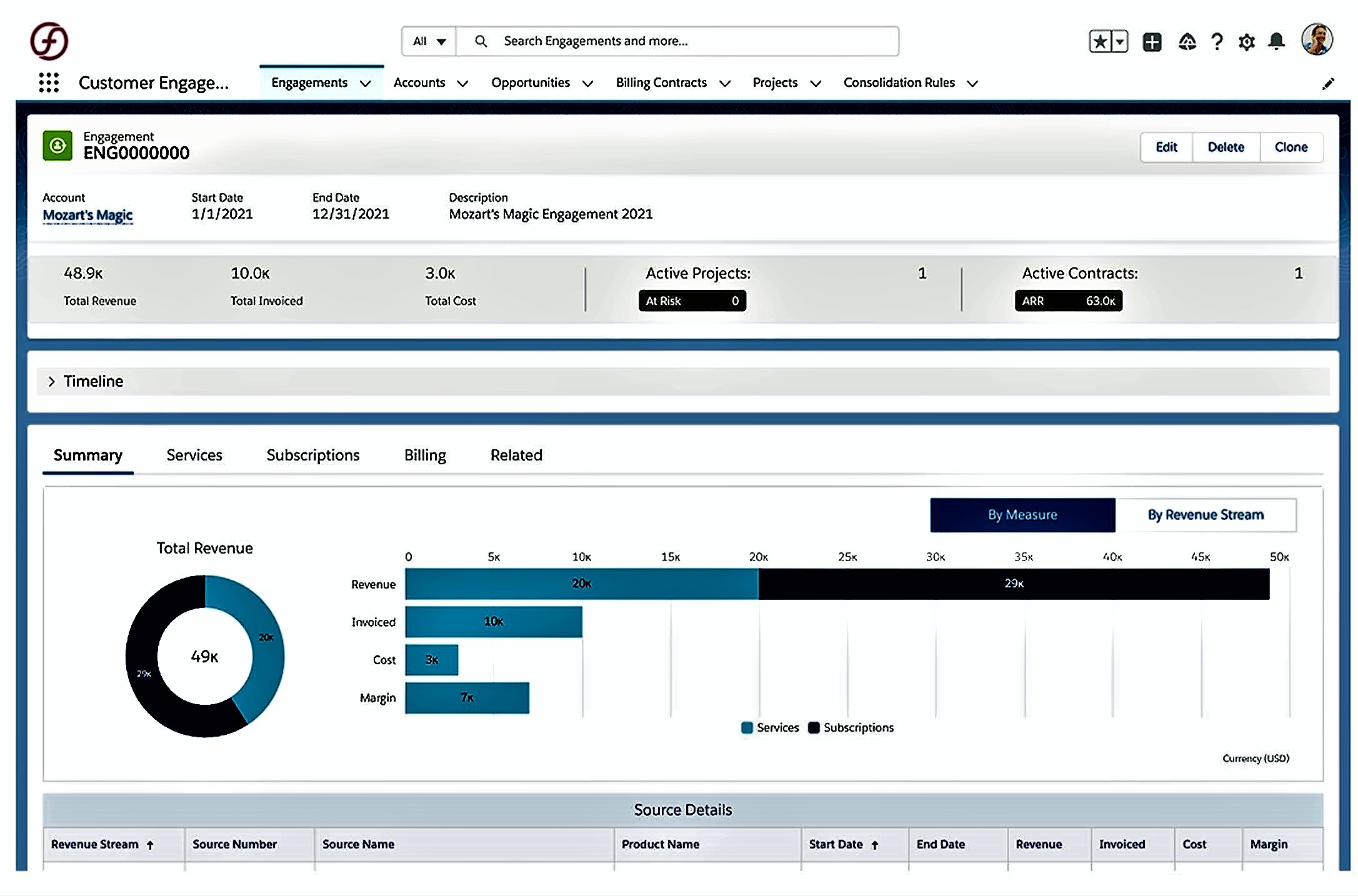

Knowing if and by how much a given customer engagement and its revenue lifecycle generate cash, and its potential is one of the core focus areas of the Spring 2021 release. It's badly needed as many services are flying blind today, overcommitting resources for little return and too often losing control of client engagement and paying the price in lost margin and profits. FinancialForce sees that pain and wants to alleviate it with better financial visibility on all aspects of customer services revenue. FinancialForce aims to provide customer-centric financial reporting down to the revenue stream and costing measure level.

Knowing every customer's impact on revenue and profitability from all revenue streams will make managing services engagements much more accurate, easier to manage, and more profitable.

Key Takeaways From The Spring 2021 Release

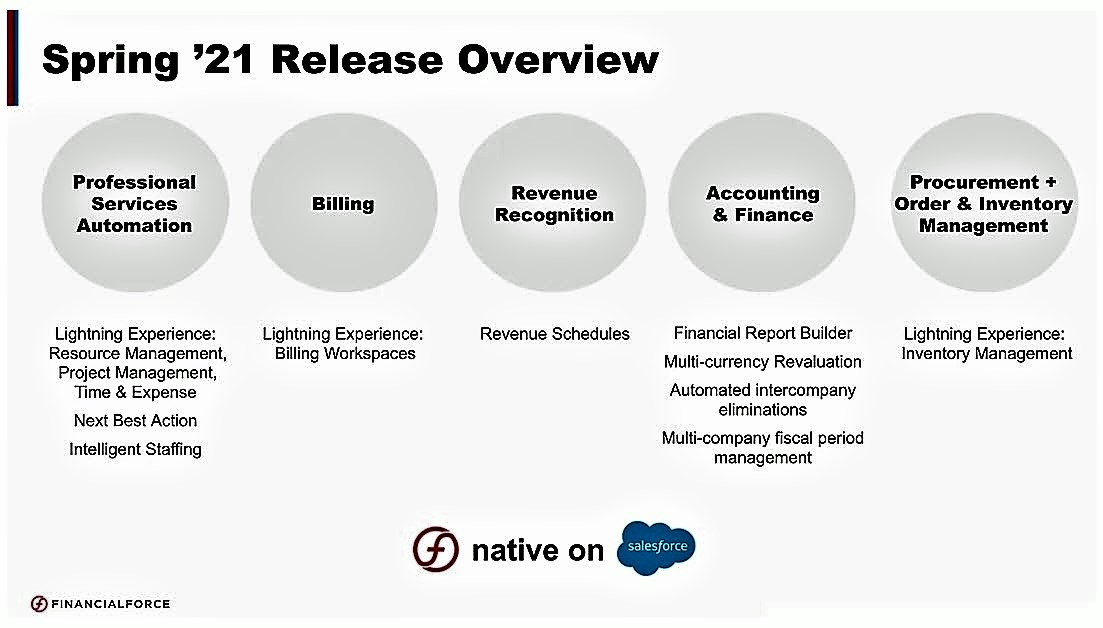

centricity seen through a financial lens is the cornerstone of FinancialForce's latest release. One of the primary goals of this release is to update more applications to Salesforce lightning to provide FinancialForce users with a more consistent user experience across all applications. Salesforce has been doubling down for years on Lightning and its user experience technologies, with FinancialForce reaping the benefits for over a decade. FinancialForce is transitioning their core Professional Services Automation (PSA), Billing, Accounting & Finance and Procurement, Order and Inventory Management to Lightning in this release in response to their customers wanting a consistent user experience across the entire FinancialForce suite of applications. The Spring 2021 release reflects how FinancialForce strives to provide a real-time understanding of customer lifetime value for their ERP and PSA customers.

Additional key takeaways include the following:

- FinancialForce sees reducing days to close as one of the highest priorities they need to address today. The majority of new feature announcements center on how the days to close cycles can be streamlined, especially across multi-company and multisite locations across geographic and currency-specific regions of the world. Multi-company currency revaluation will help FinancialForce customers who operate across multiple geographies that operate in different currencies and will be especially useful for those clients creating new global channels and considering foreign acquisitions. Further showing the high priority they are putting on reducing days to close, the Spring 2021 release also includes automated eliminations, multi-company period close for software closes, which are designed to temporarily close out a financial report and revenue schedules that can provide a future view in revenues – a key factor in knowing customer revenue lifecycles.

- New features and a new lightning interface for Accounting, Billing Central, and Inventory Management simplifies complex transactions for users. FinancialForce has one of the most customer-driven product management teams in enterprise software. The depth of features they have added to inventory management, transactional and reconciliation processes for accounting, drop-ship use cases, and enhancements for adding products to billing contracts show how much FinancialForce is listening to customers.

- AI-enhanced financial reporting that works with any Einstein data set. FinancialForce leads the Salesforce partner ecosystem when it comes to integrating Tableau CRM (formerly known as Einstein Analytics) into its platform. Now thirteen releases in, FinancialForce's Spring 2021 release reflects the intuitive, adaptive intelligence that the product management team aims to achieve by integrating Einstein into their financial reporting workflows.

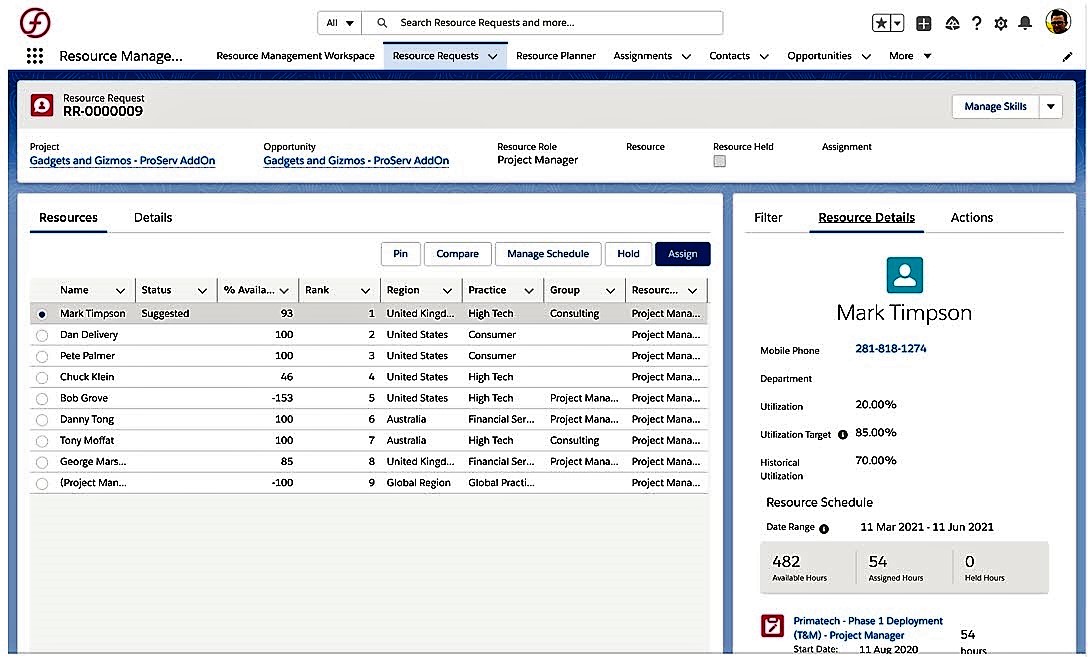

- Professional Services Automation (PSA) Applications Including Resource Management, Project Management, and Time & Expense upgraded to Lightning. Transitioning three of the core PSA applications to Lightning will help broaden adoption and make them easier to upsell and cross-sell across the FinancialForce customer base. It will also help existing customers using these applications get new employees up to speed faster on them, given how much more streamlined Lightning is as an interface compared to previous versions.

- Intelligent Staffing solves the complex challenges resource managers face when assigning the best possible associates to a given project. Designed to filter and intelligently rank potential resources based on region, practice, group skill sets, and availability, Intelligent Staffing is designed to get resource managers as close to an ideal match as possible for a given project's requirements. This is a much-welcomed new feature by FinancialForce customers who are large-scale services providers as they're facing the challenges of assigning the right person to the right project at the right time to ensure project success.

- Integration of Salesforce AI's Next Best Action (NBA) will raise the level of project expertise at scale across customers. Part of the customer centricity focus in Spring 2021 is focused on providing customers with new technologies and applications to share expertise and knowledge at scale. Next Best Action provides prescriptive guidance for the project manager and will see heavy use in new associate onboarding across services businesses and achieve greater corporate-wide learning at scale. This is consistent with the focus in the Spring 2021 release on bringing greater space and speed to mid-size and larger services customers.

Conclusion

FinancialForce defines customer engagement and centricity from a financial standpoint in the Spring 2021 release. Too often, services businesses commit to large-scale projects without a clear idea of the customer revenue lifecycle. With FinancialForce, they can stop and ask if the level of customer engagement they're committing to is worth it or not – and if it isn't, what needs to be done. FinancialForce is doubling down on user experience and accelerating time-to-close, two areas their customers want innovation to and look to them to deliver. Look for FinancialForce to scale out with more MuleSoft and Tableau integration scenarios, all aimed at capitalizing on their expertise developing on the Salesforce platform. There's a bigger challenge to customer engagement on the horizon, and that's providing a real-time view of financials across all customers with all available data across a business, making MuleSoft integration key to FinancialForce's future growth.