Teradata Transition to Cloud and Consulting Continues

Teradata simplifies pricing, executes on business consulting and hybrid cloud strategy. A look at next steps in the company’s ongoing transition.

“Business outcome led, technology enabled.” This was the theme at the May 8-10 Teradata Third-Party Influencers Summit in San Diego, and it reflected a two-to-one ratio of consulting-oriented presentations to technology updates.

Teradata has been expanding already robust consulting and implementation offerings in part because mass migrations to cloud computing and open-source big data platforms like Hadoop have reduced demand for Teradata’s on-premises racks and appliances for data warehousing. Even as data volumes have continued to grow exponentially, Teradata’s revenues have declined in recent years from a high of $2.7 billion in 2014 to $2.3 billion in 2016.

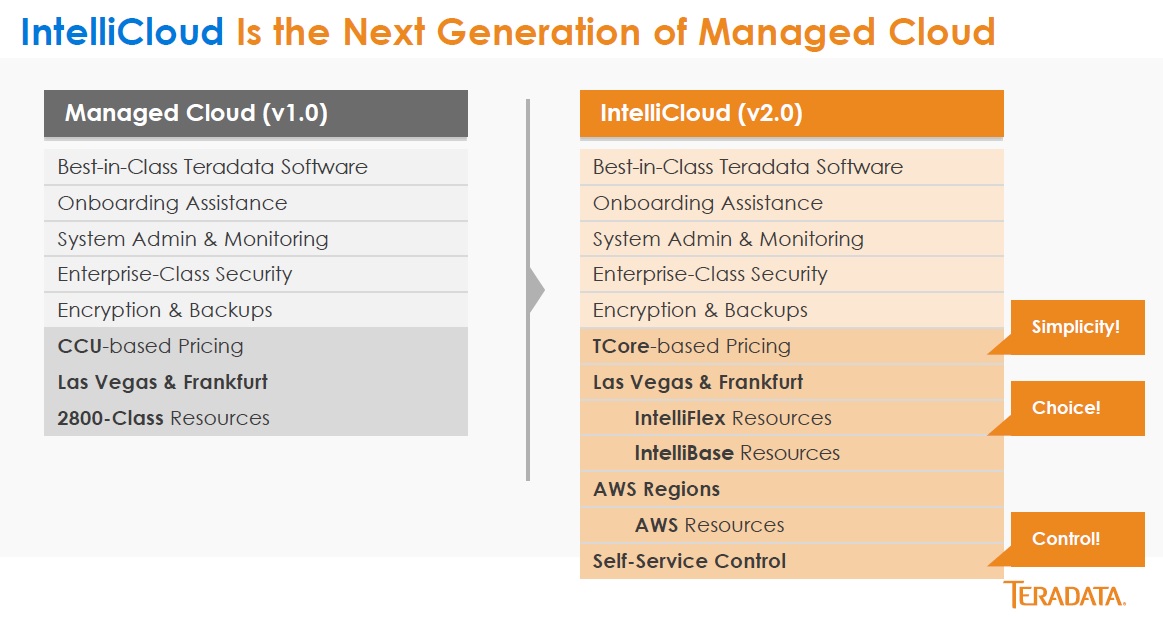

Teradata compared it's old (at left) and new (at right) pricing scheme and cloud managed

services options at its May Influencers Summit.

Last year’s Summit was held shortly after the company replaced its CEO, announced plans to sell off its Aprimo marketing business unit, and introduced a more aggressive path to cloud and consulting services. At this year’s Summit we learned that Teradata has not only executed on that strategy, it has gone further to transform itself by pursuing simplicity, flexibility and control in four areas:

Pricing: Responding to feedback that its licensing approach was too complex, with too many licensing models and too many a la carte options, Teradata has devised a consistent, subscription-based licensing approach that will apply on-premises or in private or public clouds. The model is based on two dimensions: T Cores and Tiers. T Cores measure compute cores and disk I/O, but there are discounts if you’re using less than maximum input/output capacity.

The four-tiers reflect how capacity is being used, ranging from the free Developer tier to progressively more feature-rich (and most costly) Base (simple production), Advanced (production with mixed workloads), and Enterprise (mission-critical, enterprise workloads) tiers. The pricing is designed to be simple, predictable and consistent, with no penalties for choosing or moving between on-premises, private cloud or public cloud deployment. What’s more, pricing is more aggressive, with the Base Tier taking on cloud rivals like Amazon Redshift.

Portfolio: Where Teradata previously offered as many as nine systems in its portfolio, in now offers just two. IntelliFlex, the company’s new flagship, separates storage and compute decisions to support multiple workloads within a single rack. Customers can add different types of storage and compute nodes, ranging from archival retrieval to the ultimate in in-memory query performance. Customers can also add capacity in smaller increments than previously available and they can quickly reconfigure as needs change.

IntelliBase is Teradata’s entry-level appliance. It costs approximately 15% more than commodity hardware. IntelliBase is designed for more balanced data warehouse workloads. IntelliBase is designed for more balanced data warehouse workloads. It is not as flexible as IntelliFlex, which can be reconfigured to address high I/O or high CPU requirements..

Cloud: Teradata has made over and recast its managed cloud services as IntelliCloud. The offering combines the new T-Core- and Tier-based pricing scheme with three flexible infrastructure options behind the cloud services. Teradata previously offered only appliance-grade (2800 series) capacity behind its services, but you can now choose IntelliFlex or IntelliBase as the platform for managed services in the Teradata Cloud, which has data centers in Las Vegas and Frankfurt. The third option is Teradata-managed services running on carefully selected infrastructure services in the Amazon cloud (and, later this year, the Microsoft’s Azure cloud). Consumption options are more elastic with the public cloud options, but it won’t be as performant as IntelliFlex-based capacity, and service-level agreements aren’t available because Teradata has no control over the infrastructure. The intent it to give customers choice, with a fourth choice being bring-your-own-license and managing Teradata Database on AWS or Azure yourself.

Consulting: Teradata has consolidated its growing consulting offerings under the Teradata Global Services umbrella, and it has formalized three service lines to avoid overlaps and confusion. Think Big Analytics, the big data consulting business Teradata acquired in 2014, continues as the business-outcome-focused unit, offering industry-focused expertise in data science, data visualization and big data solutions. Enterprise Data Consulting focuses on technology, offering expertise in architecture, data management, data governance, security and services. Customer Services helps customers get the most out of their systems and people, applying proactive and reactive expertise in systems and software management and change management.

MyPOV on Teradata’s Ongoing Transformation

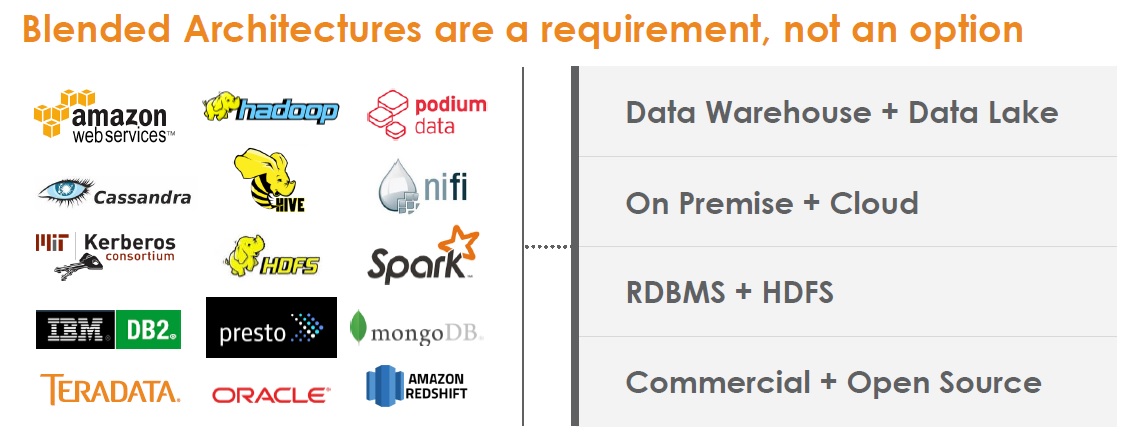

Disruptive market forces have dealt Teradata a tough hand to play. There’s clearly disillusionment with complex open source platforms like Hadoop these days, but that doesn’t mean we’re going back to Teradata’s heyday of enterprise data warehousing. Companies are still pursuing high-scale data lake approaches on low-cost, distributed platforms, whatever flavor prevails (whether that’s HDFS, objects stores like S3 and Azure Data Lake, or the next open source fad). Companies will also continue to rationalize their comparatively high-cost data warehousing infrastructure expenditures.

Teradata acknowledged last year that we’re in a “post-relational world,” but this year’s Summit shows signs that it’s truly adapting to a changed market. The company has not only delivered far more flexible hardware, it has gone further with the simplified, hybrid subscription-based pricing and more flexible cloud-deployment options.

Teradata is becoming more of a software and services company and less of a hardware vendor. That shift should eventually improve profitability, even if revenues continue to slide as deployments shift to the cloud.

Will customers trust Teradata to provide impartial, “business outcome led” consulting services? Customer Gerhard Kress said he chose Teradata in 2013 in large part because “the company understands that the world is a lot bigger than Teradata.” Director, Data Services at Siemens, Kress presented at the Summit on the train manufacturer’s global IoT deployment, and he noted that other vendors (mostly big platform vendors) asserted that they could address all challenges within their stacks. Teradata, meanwhile, suggested a heterogeneous approach reflecting technologies already in place at Siemens.

This “Blended Architecture” slide, from a Teradata Ecosystem Architecture Services presentation,

captures the vendor’s realistic sense of its place within enterprise environments.

Teradata has also become more realistic about its cloud ambitions. Two years ago Teradata talked about pursuing midsize businesses with the Teradata Database on AWS service. At this year’s Summit Teradata said it’s no longer pursuing that idea. Instead, executives said the company is focused on the needs of the 500 highest-scale and most sophisticated customers. That’s where Teradata’s technology really shines.

Teradata thrived in the past when it focused on delivering data-driven business outcomes at top of the market. It appears that focus is back.