Zscaler reported better-than-expected fourth quarter results and delivered a strong outlook for the fiscal year ahead.

The security vendor reported a fourth quarter net loss of $17.6 million, or 11 cents a share, on revenue of $719.2 million, up 21% from a year ago. Non-GAAP earnings in the fourth quarter were 89 cents a share.

Wall Street was expecting Zscaler to report non-GAAP earnings of 80 cents a share on revenue of $707.14 million.

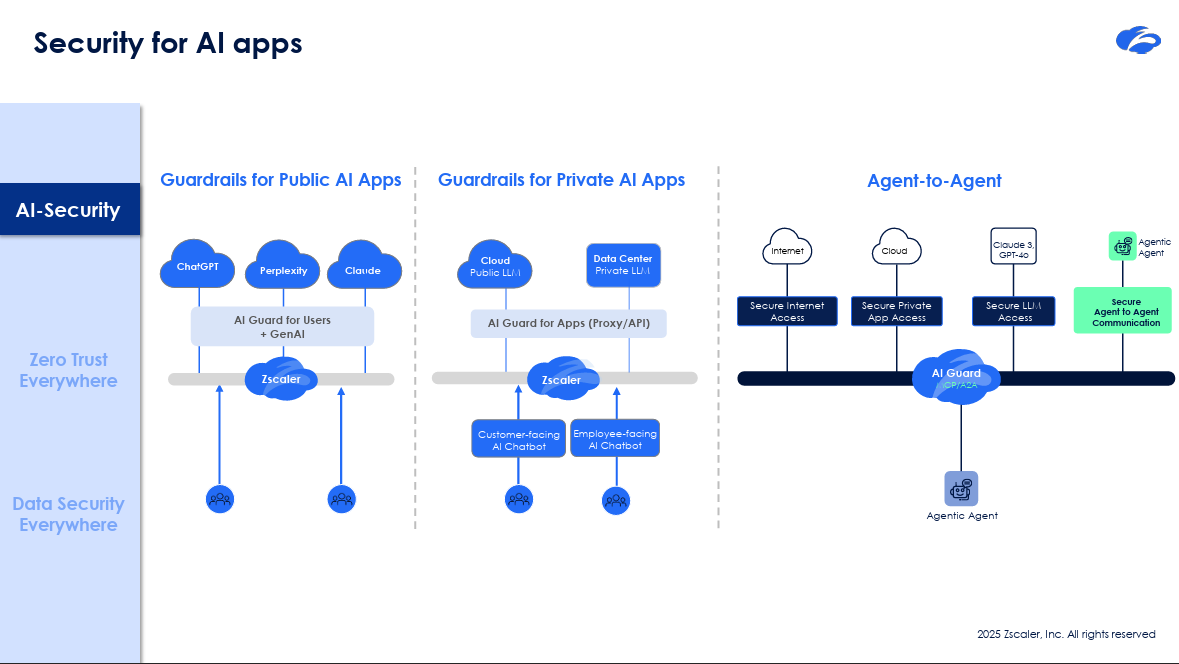

Jay Chaudhry, CEO of Zscaler, said the company topped $3 billion in annual recurring revenue with record operating margin. "We are rapidly expanding our AI security portfolio to address the emerging risks of AI models and applications," said Chaudhry.

Chaudhry added:

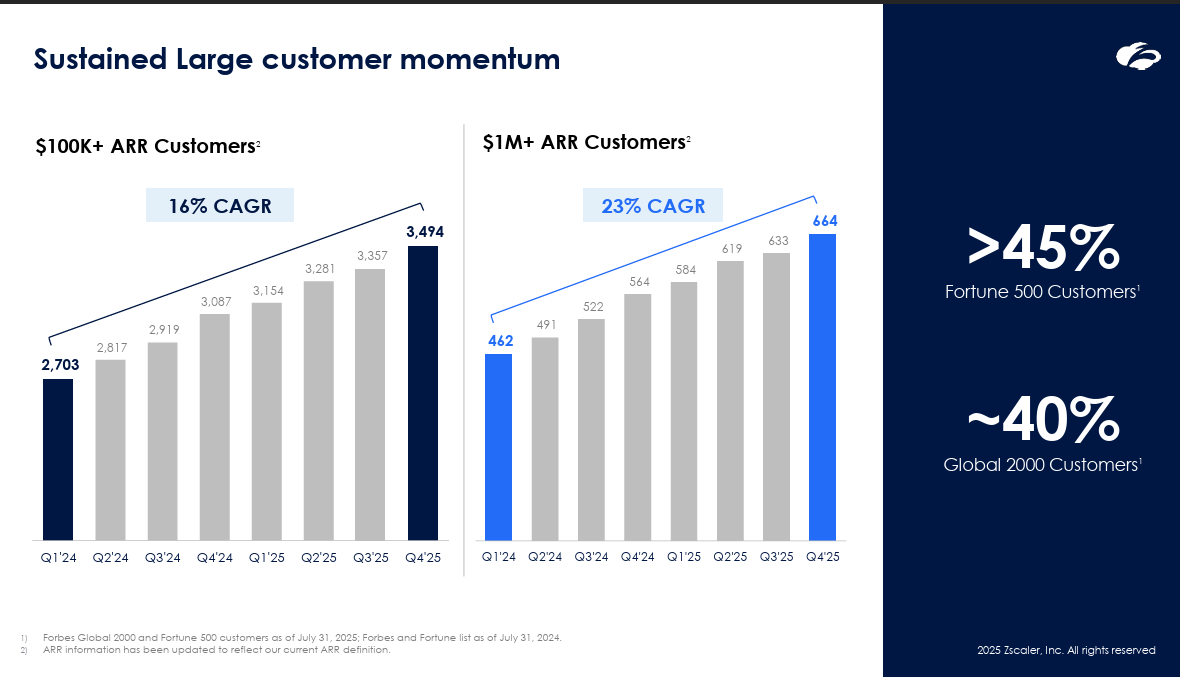

“We are seeing significant customer interest in our powerful AI security solutions, including our new AI Guard and GenAI security offerings. An increasing number of enterprises are choosing Zscaler because of our technology leadership and platform scale. I’m pleased to share that our platform now secures nearly 40% of the Global 2000 and over 45% of the Fortune 500 companies.”

Zscaler’s report landed after strong quarters from CrowdStrike, Palo Alto Networks and SentinelOne. Fortinet’s latest quarter was ahead of estimates, but the outlook was light due to the firewall refresh cycle.

For fiscal 2025, the company reported a net loss of $41.5 million, or 27 cents a share, on revenue of $2.67 billion, up 23% from a year ago. Non-GAAP earnings were $3.28 a share for the fiscal year.

As for the outlook, Zscaler projected first quarter non-GAAP earnings of 85 cents a share to 86 cents a share on revenue of $772 million to $774 million. For fiscal 2026, Zscaler projected non-GAAP earnings of $3.64 a share to $3.68 a share on revenue of $3.68 billion to $3.7 billion.

Zscaler’s plan is to grow via agentic security operations.