Palo Alto Networks delivers strong Q4, outlook

Palo Alto Networks reported better-than-expected fourth quarter earnings and projected revenue growth of about 14% for the fiscal year ahead.

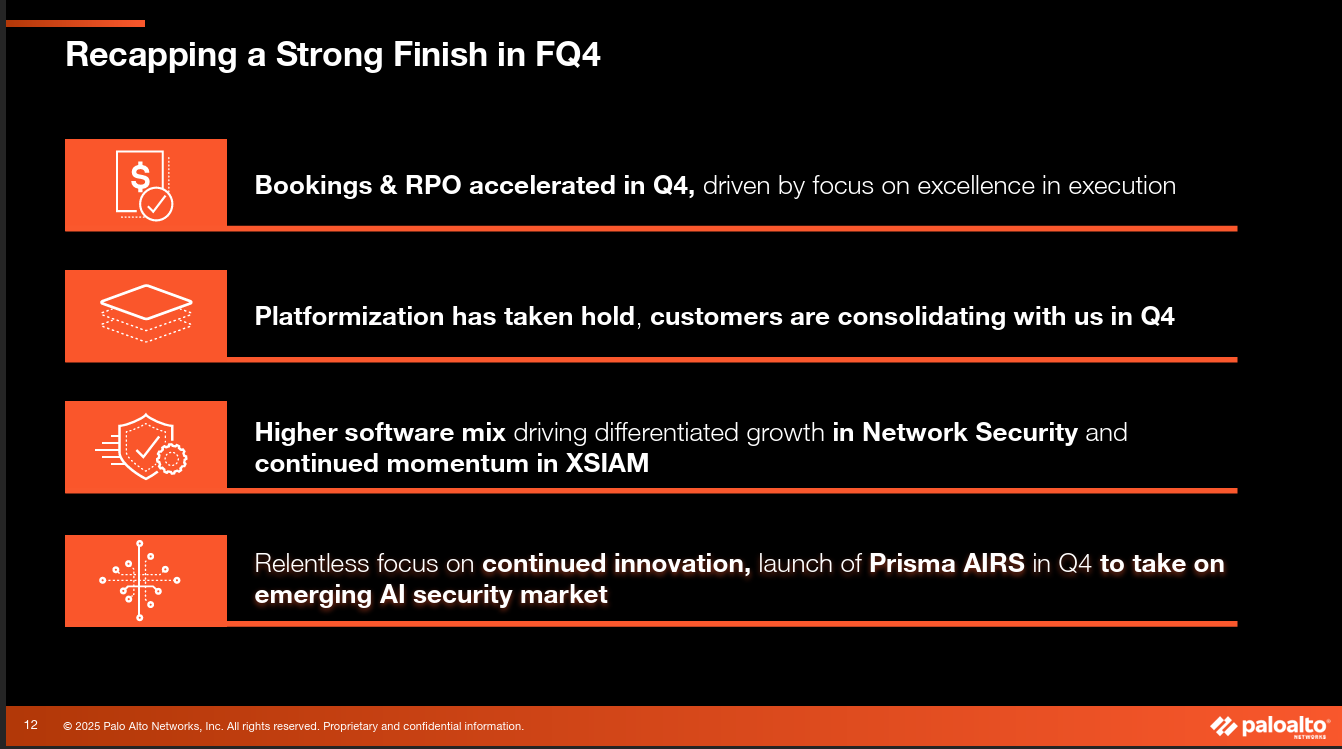

The cybersecurity company reported fourth quarter earnings of $253.8 million, or 36 cents a share, on revenue of $2.5 billion, up 16% from a year ago. Non-GAAP earnings for the quarter were 95 cents a share.

Wall Street was expecting Palo Alto Networks to report fourth quarter non-GAAP earnings of 88 cents a share on revenue of $2.5 billion.

For fiscal 2025, Palo Alto Networks reported earnings of $1.134 billion, or $1.60 a share, on revenue of $9.22 billion.

CEO Nikesh Arora said the company executed well in the fourth quarter and looking for platforms that "are designed to work in concert." Arora said remaining performance obligation (RPO) is accelerating into the new fiscal year and signaling growth.

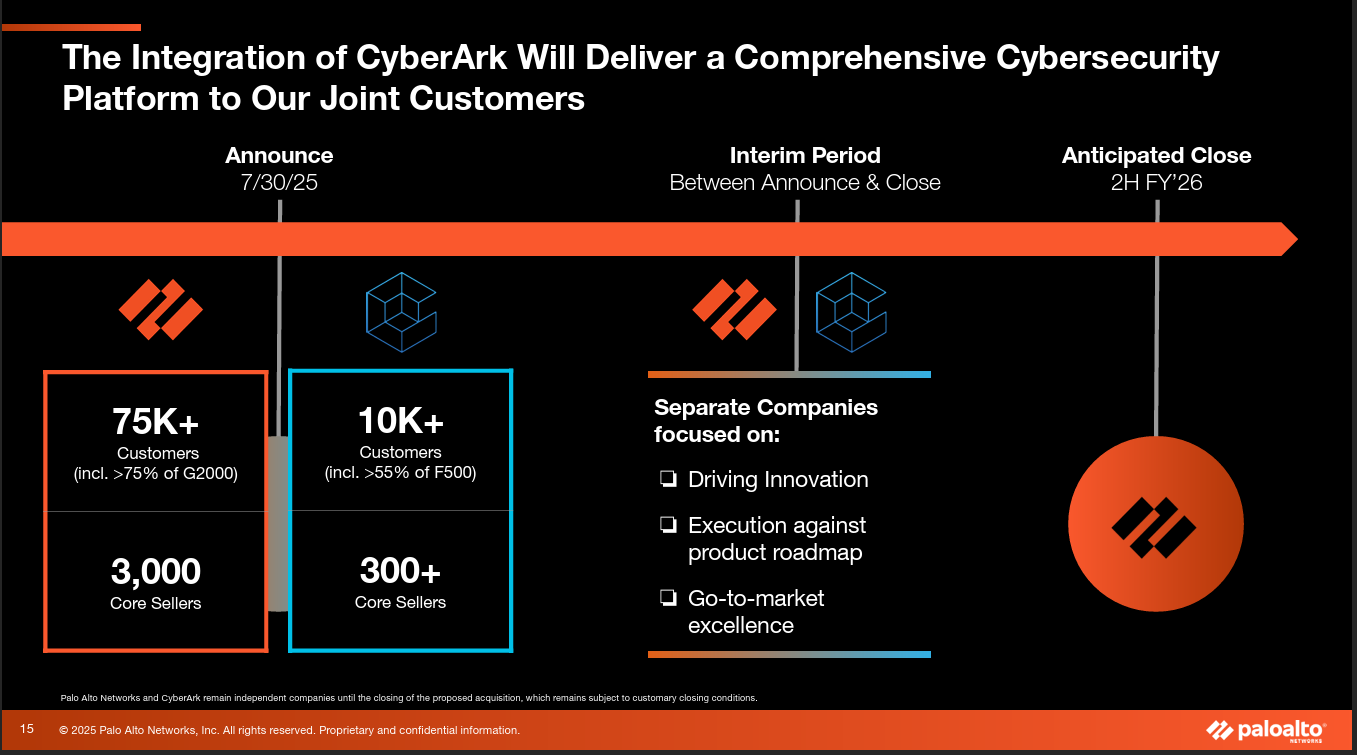

The company has been on a bit of a buying spree with the acquisition of CyberArk for $25 billion.

- Palo Alto Networks buys CyberArk in $25 billion bet on identity

- Palo Alto Networks acquires Protect AI, aims to secure AI ecosystems

Separately, Palo Alto Networks said that CTO Nir Zuk will retire. Lee Klarich, Chief Product Officer (CPO), will also take on the CTO role. Zuk founded the company in 2005.

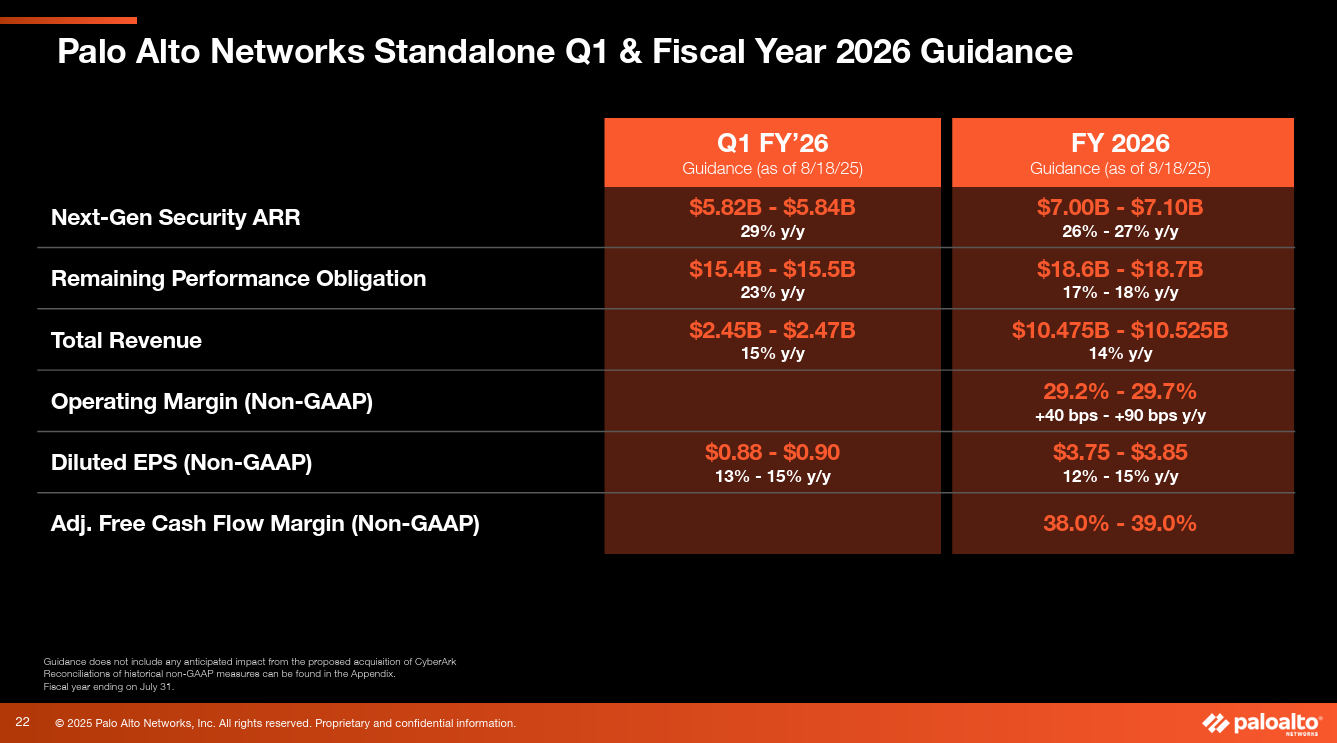

As for the outlook, Palo Alto Networks said first quarter revenue will be between $2.45 billion to $2.47 billion, up 15% with non-GAAP earnings of 88 cents a share to 90 cents a share. Remaining performance obligation is expected to be $15.4 billion to $15.5 billion, up 23% from a year ago.

For fiscal 2026, Palo Alto Networks projected revenue of $10.475 billion to $10.525 billion, up 14% from a year ago. Non-GAAP earnings for the fiscal year are expected to be $3.75 a share to $3.85 a share. Remaining performance obligation will be between $18.6 billion and $18.7 billion, up 17% to 18%.

Key points from Arora on the conference call:

- "The only way to get near real time is to have some consistency in your platform where data talks to each other and you're able to run agents on top of it. I can't run agents on top of disparate infrastructure. There's no agent out there that understands three different firewall vendors and infrastructure to SASE vendors, a browser vendor, and seven other vendors on top. Agenting is only going to make this worse, because there are agents that bad actors can deploy to try and reach it."

- "We expect our top line seasonality to continue to be second half and four weighted as we continue to compromise with our customers."

- "The reason we highlighted a $50 million ARR deal, that's a big number in technology, whether it's cybersecurity, anything else that tells it the art of the possible. If one was able to consolidate the entire security span of a large customer, you can get up to $50 million in ARR."

- "AI is going to act as an accelerant towards a desire to consolidate customers are beginning to feel the value of consolidated data, not just in security, in other areas, you can see."