CrowdStrike acquires Onum, reports strong Q2

CrowdStrike said it will acquire Onum, a company that specializes in real-time telemetry data pipelines, in a move that will bring more data into the cybersecurity vendor’s platform.

CEO George Kurtz said Onum “is both a pipeline and a filter, which will stream high-quality, filtered data directly into the platform to drive autonomous cybersecurity at scale.†Onum data will be folded into CrowdStrike’s Falcon Next-Gen SIEM.

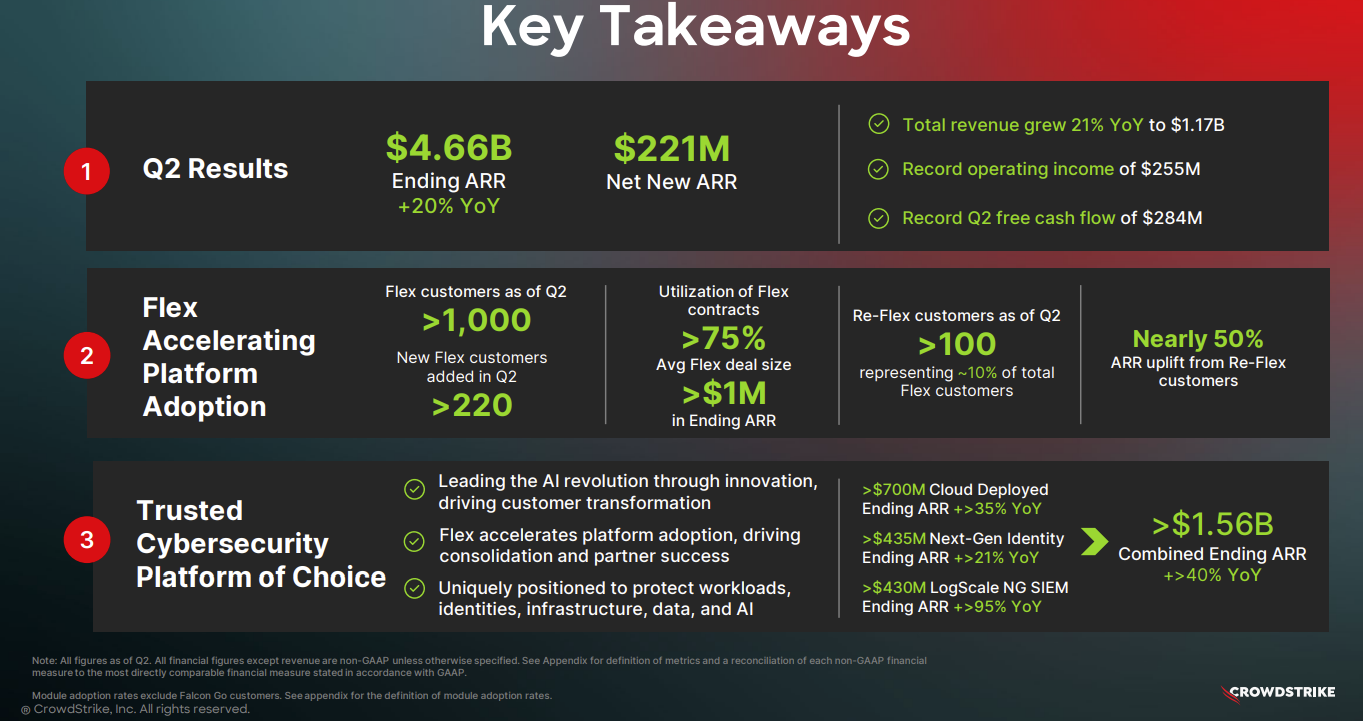

The company also reported second quarter results. CrowdStrike reported a second quarter net loss of $77.7 million, or 31 cents per share, on revenue of $1.17 billion, up 21% from a year ago. Non-GAAP earnings in the quarter checked in at 93 cents a share.

Wall Street was looking for second quarter non-GAAP earnings of 83 cents a share on revenue of $1.15 billion.

CrowdStrike’s quarter landed following a strong outlook from Palo Alto Networks, which also recently said it would acquire CyberArk for $25 billion.

As for the outlook, CrowdStrike projected third quarter revenue between $1.208 billion and $1.218 billion with non-GAAP earnings of 93 cents a share to 95 cents a share. For fiscal 2026, CrowdStrike is projecting revenue between $4.75 billion and $4.8 billion with non-GAAP earnings of $3.60 a share to $3.72 a share.

CrowdStrike CEO George Kurtz on a conference call said AI is complicating the cybersecurity landscape even as it leads to opportunities.

Kurtz said:

"In cybersecurity as well as the broader technology market, AI's impact is palpable. As organizations of all sizes embrace AI transformation, I hear several thematic concerns from executives and Boards. One, where is shadow AI emerging in my business? Two, how do I control what data enters AI systems? Three, how do I control what AI systems can do in my enterprise? Which ultimately leads to the focal question of four, how do I secure AI agents? AI has made the role of CISOs and CIOs more complicated than ever.

CrowdStrike's role in the agentic era is staying ahead of AI-armed threat actors to secure AI at every layer. Beginning with the AI model itself to the workloads and hosts on which they run to the actual human and agentic identities, to the end-user devices accessing these systems and applications."

Kurtz also outlined the reasoning behind the Onum purchase and the company's goal to use it to secure every stage of the AI life cycle.

"Onum will bring Falcon's AI-powered detections closer to third-party data sources in pipeline, starting analysis before data even enters the Falcon platform. Here's why Onum stood out to us. One, speed. Onum delivers 5x more events per second than its nearest competitor and processes data in real-time versus legacy batch and store methods. Two cost. Onum's smart filtering reduces data storage costs by 50%. Three, superior outcomes. Onum's real-time pipeline detection starts before data enters the Falcon platform, delivering up to 70% faster incident response with 40% less ingestion overhead."

Other takeaways from Kurtz:

- The company had more than 1,000 Falcon Flex customers with the average Flex customer representing more than $1 million of annual recurring revenue.

- "I think a big part of it is going to be the AI story of understanding how all these interdependencies work in the build environments, in code and obviously, in sort of these interactions with MCP-type services. So this is something that we continue to invest in this area."

- "Customers are in the early journey of how they leverage AI. And it's moving from, hey, this is really a cool technology to how do we implement it and implement it securely and do it in a way that actually accrues value back to the business. If we believe in AI, and we think there's going to be more AI in the future, in the next year, 3 or 5 years, then security is a necessity. You're not going to have more AI without security."